Tiny Ltd. (formerly, WeCommerce Holdings Ltd.)

(“Tiny” or “the “Company”) (TSXV: TINY)

(OTCQX: TNYZF), a leading technology holding company with a

strategy of acquiring majority stakes in businesses, today

announced the financial results for Tiny Ltd. for the three- and

nine-months ended September 30, 2023 (“Q3 2023” and “YTD Q3 2023”,

respectively). Currency amounts are expressed in Canadian dollars

unless otherwise noted.

Q3 2023 Financial Results

For the three-months ended

September 30,

For the nine-months

ended September 30,

2023

2022

2023

2022

Revenue

50,522,913

40,914,446

134,327,157

114,829,942

Operating income (loss)

(3,549,129)

8,347,486

(15,518,331)

24,222,904

Net income (loss)

(5,900,753)

1,724,415

24,111,068

8,098,727

EBITDA (1)

4,142,849

6,888,092

44,872,963

22,271,353

EBITDA % (1)

8%

17%

33%

19%

Adjusted EBITDA (1)

8,646,423

11,327,655

17,875,225

32,763,293

Adjusted EBITDA % (1)

17%

28%

13%

29%

Recurring revenue (1)

9,741,419

2,031,255

21,272,187

7,028,653

Recurring revenue % (1)

19%

5%

16%

6%

Cash provided by operating activities

451,830

8,676,531

(6,505,390)

19,172,355

Basic earnings/(loss) per share

(0.03)

0.02

0.15

0.09

Diluted earnings/(loss) per share

(0.03)

0.02

0.15

0.09

(1) Refer to Non-IFRS Measures for further

information

- Revenue in Q3 2023 was $50,522,913, an increase of $9,608,467

or 23% compared to Q3 2022.

- Management has added a new metric to identify revenues that are

stable and earned continuously: Recurring revenue (1). Recurring

revenue (1) in Q3 2023 was $9,741,419 and made up 19% of total

revenue, an increase of $7,710,165 or 14% of total revenue when

compared to Q3 2022.

- Net loss of $5,900,753 in Q3 2023 compared to net income of

$1,724,415 in Q3 2022. The biggest changes between Q3 2023 and Q3

2022 relates to depreciation and amortization, interest expense and

tax expenses that were incurred as a result of the WeCommerce

merger.

- Unrestricted cash on hand at September 30, 2023 was $22,643,639

compared to $31,201,836 on December 31, 2022. Total debt

outstanding at September 30, 2023 was $131,639,788 compared to

$69,793,864 on December 31, 2022. The increase in debt of

$61,845,924 is due to including WeCommerce.

- Total assets at September 30, 2023 were $414,995,956 compared

to $168,874,497 on December 31, 2022. Total intangibles and

goodwill increased by $10,895,892 and $6,446,514, respectively for

the quarter, as a result of the acquisition of Clean Canvas within

WeCommerce. Intangibles and goodwill increased over the year as a

result of acquiring $111.9 million in intangibles and $132.6

million in goodwill from the WeCommerce merger.

- Adjusted EBITDA(1) for Q3 2023 was $8,646,423 or 17% of

revenue, compared to $11,327,655 or 28% of revenue in Q3 2022.

Adjusted EBITDA increased by $2,230,379 from Q2 2023, which had

adjusted EBITDA of $6,416,044 or 14% of revenue.

Management Commentary

In an environment where corporate spending remains compressed,

the Company’s revenue is up sequentially and Adjusted EBITDA

margins expanding by approximately 400 basis points compared to

last quarter. Entering Q4, revenue will benefit from a full quarter

of Clean Canvas’ results, as well as partial quarters from Jagged

Pixel. We expect to see expenses benefit partially in Q4 from the

targeted efficiency initiatives we announced in October, with the

full run-rate savings expected to begin in Q1 of 2024.

As we approach year-end, our pipeline of opportunities continues

to expand. We see this as a perfect environment to continue adding

businesses to our portfolio that generate recurring revenue and

cash flow with a view to accelerating financial results as the

macro backdrop improves and generating long-term value for

shareholders.

Financial Statements

Tiny Ltd’s consolidated financial statements and Management’s

Discussion and Analysis (“MD&A”) for Q3 2023 are available on

SEDAR+ at https://www.sedarplus.ca/.

About Tiny

Tiny is a Canadian-based investment company focused primarily on

acquiring majority stakes in businesses that it expects to hold

over the long-term. The Company is structured to give maximum

flexibility to operating management teams by maintaining a focus at

the parent company level on only three areas: capital allocation,

management, and incentives. This structure enables each company to

run independently and focus on what they do best, within an

incentive structure that is designed to drive results for both the

operating business and ultimately for Tiny and its

shareholders.

Tiny currently has three principle reporting segments: Digital

Services, which provides design, engineering, brand positioning and

marketing services to help companies of all sizes deliver premium

web and mobile products; E-Commerce Platform, which is home to a

complementary portfolio of recurring revenue software businesses

that support merchants, as well as digital themes businesses that

sell templates to Shopify merchants; and Creative Platform, which

is comprised primarily of Dribbble, the social network for

designers and digital creatives, as well as a premier online

marketplace for digital assets such as fonts and templates.

For more about Tiny, please visit www.tiny.com or refer to the

public disclosure documents available under Tiny’s SEDAR profile on

SEDAR at www.sedarplus.ca.

Non-IFRS Financial Measures

This news release makes to reference to certain non-IFRS

measures and ratios, hereafter, referred to as “non-IFRS measures”.

These measures are not recognised measures under IFRS, and do not

have a standardized meaning prescribed by IFRS and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the results of operations from management’s

perspective. Accordingly, these measures should not be considered

in isolation nor as a substitute for analysis of the financial

information reported under IFRS. The Company uses non-IFRS measures

including “EBITDA”, “EBITDA %”, “Adjusted EBITDA”, “Adjusted EBITDA

%” and “recurring revenue”. Management uses these non-IFRS measures

to facilitate operating performance comparisons from period to

period, to prepare annual operating budgets and forecasts and to

determine components of management compensation. As required by

Canadian securities laws, the Company defines and reconciles these

non-IFRS measures below:

EBITDA and EBITDA %

EBITDA is defined as earnings (net income or loss) before

finance costs, income taxes, depreciation and amortization. EBITDA

is reconciled to net income (loss) from the financial

statements.

EBITDA % ratio is determined by dividing EBITDA by total revenue

for the year.

EBITDA and EBITDA % is frequently used to assess profitability

before the impact of finance costs, income taxes, depreciation and

amortization. Management uses non-IFRS measures in order to

facilitate operating performance comparisons from period to period

and to prepare annual operating budgets. EBITDA and EBITDA % are

measures commonly reported and widely used as a valuation

metric.

Adjusted EBITDA and Adjusted EBITDA %

Adjusted EBITDA removes unusual, non-cash or non-operating items

from EBITDA such as listing expenses, acquisition costs,

restructuring charges, asset impairments, non-cash stock-based

compensation, fair value adjustments to contingent consideration

payable and foreign exchange gains and losses. The Company believes

adjusted EBITDA provides improved continuity with respect to the

comparison of its operating performance over a period of time.

Adjusted EBITDA is reconciled to net income (loss) from the

financial statements.

Adjusted EBITDA % is determined by dividing Adjusted EBITDA by

total revenue for the year.

Adjusted EBITDA and Adjusted EBITDA % is frequently used by

securities analysts and investors when evaluating a Company’s

ability to generate liquidity from the Company’s core operations.

It provides a consistent basis to evaluate profitability and

performance trends by excluding items that the Company does not

consider to be controllable activities for this purpose. Adjusted

EBITDA and EBITDA % are measures commonly reported and widely used

as a valuation metric.

Recurring Revenue

Recurring Revenue consists of revenues generated through

subscriptions that grant access to products and services with

recurring billing cycles. The subscriptions are recognized on an

overtime basis in accordance with IFRS 15.

Recurring Revenue is a part of total revenue disclosed in the

financial statements, as determined in accordance with IFRS 15.

Recurring Revenue represents revenues that are stable and the

Company expects to earn continuously. Recurring Revenue % is

determined by dividing Recurring Revenue by total revenue for the

year. Recurring Revenue is frequently used to determine any

indicators of future revenue growth and revenue trends. Recurring

Revenue and Recurring Revenue % are measures commonly reported and

widely used as a valuation metric.

NON-IFRS MEASURES RECONCILIATIONS EBITDA and Adjusted

EBITDA

For the three-months ended

September 30,

For the nine-months ended

September 30,

2023

2022

2023

2022

Net income (loss)

(5,900,753)

1,724,415

24,111,068

8,098,727

Income tax expense

(1,429,075)

3,096,455

(3,307,983)

9,239,646

Depreciation and amortization

8,906,495

1,148,139

18,109,110

3,407,062

Interest expense

2,566,182

919,083

5,960,768

1,525,918

EBITDA

4,142,849

6,888,092

44,872,963

22,271,353

EBITDA Adjustments

Gain on sale of intangibles

-

-

-

(2,808,336)

Share of loss from associate

-

1,981,352

1,379,679

7,522,652

Loss on disposal of subsidiary

163,366

-

163,366

-

Gain on step acquisition

-

-

(42,083,465)

-

Fair value (gain)/loss on investments

(1,776,782)

(213,299)

(4,023,712)

91,665

Fair value on contingent consideration

135,150

-

201,350

-

Business acquisition costs

100,359

1,012

2,977,695

112,249

Share based payments

657,107

713,476

3,965,405

2,758,922

Other expense(1)

2,664,567

839,480

2,118,582

552,602

Acquisition-related compensation

335,292

-

1,009,017

-

Non-recurring project costs(2)

277,456

-

277,457

807,653

Non-recurring professional fees(3)

363,062

1,117,542

3,482,919

1,454,503

Non-recurring severance expense

1,583,997

-

3,533,969

-

Adjusted EBITDA

8,646,423

11,327,655

17,875,225

32,763,293

(1) Other expenses / income relates to

COVID-19 related government assistance, gain/loss on FX and other

minor non-operating items

(2) Non-recurring project related to

advertising and promotion expense for a specific project that will

not continue in the future.

(3) Non-recurring professional fees

relates to legal fees for the go-public transaction and

amalgamation with WeCommerce

EBITDA % and Adjusted EBITDA %

For the three-months ended

September 30,

For the nine-months

ended September 30,

2023

2022

2023

2022

EBITDA

4,142,849

6,888,092

44,872,963

22,271,353

Revenue

50,522,913

40,914,446

134,327,157

114,829,942

EBITDA %

8%

17%

33%

19%

Adjusted EBITDA

8,646,423

11,327,655

17,875,225

32,763,293

Revenue

50,522,913

40,914,446

134,327,157

114,829,942

Adjusted EBITDA %

17%

28%

13%

29%

Recurring Revenue

For the three-months ended

September 30,

For the nine-months

ended September 30,

2023

2022

2023

2022

Recurring revenues

9,741,419

2,031,255

21,272,187

7,028,653

Non-recurring revenues

40,781,494

38,883,191

113,054,970

107,801,289

Total revenue

50,522,913

40,914,446

134,327,157

114,829,942

Recurring revenue % of total

revenue

19%

5%

16%

6%

Cautionary Note Regarding Forward-Looking Information

This news release contains certain forward-looking statements

and forward-looking information within the meaning of Canadian

securities law. Such forward-looking statements and information

include, but are not limited to, statements or information with

respect to: requirements for additional capital and future

financing; estimated future working capital, funds available, uses

of funds, future capital expenditures and other expenses for

specific operations and intellectual property protection; industry

demand; ability to attract and retain employees, consultants or

advisors with specialized skills and knowledge; anticipated joint

development programs; incurrence of costs; competitive conditions;

general economic conditions; anticipated revenue growth; growth

strategy; and scalability of developed technology.

Forward-looking statements and information are frequently

characterized by words such as “plan”, “project”, “intend”,

“believe”, “anticipate”, “estimate”, “expect” and other similar

words, or statements that certain events or conditions “may” or

“will” occur. Although the Company’s management believes that the

assumptions made and the expectations represented by such statement

or information are reasonable, there can be no assurance that a

forward-looking statement or information referenced herein will

prove to be accurate. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

statements. Factors that could cause actual results to differ

materially from those in forward-looking statements include risks

relating to reliance on the Shopify platform; the Company’s limited

operating history; reliance on management and key employees;

conflicts of interest in relation to the Company’s officers,

directors, and consultants; additional financing requirements;

resale of Common Shares in the publicly- traded market; market

price fluctuations for the Common Shares; global financial

conditions; management of growth; risks associated with the

Company’s strategy of growth through acquisitions; tax risks;

currency fluctuations; competitive markets; uncertainty and adverse

changes in the economy; unsustainability of the Company’s rapid

growth and inability to attract new customers, retain revenue from

existing merchants, and increase sales to both new and existing

customers; adverse effects on the Company’s revenue growth and

profitability due to the inability to attract new customers or sell

additional products to existing customers; the successful

integration of the Company with Tiny Capital; future results of

operations being harmed due to declines in recurring revenue or

contracts not being renewed; security and privacy breaches; changes

in client demand; challenges to the protection of intellectual

property; infringement of intellectual property; ineffective

operations through mobile devices, which are increasingly being

used to conduct commerce; and risks associated with internal

controls over financial reporting. The Company undertakes no

obligation to update forward-looking statements and information if

circumstances or management’s estimates should change except as

required by law. The reader is cautioned not to place undue

reliance on forward-looking statements and information. More

detailed information about potential factors that could affect

results is included in the documents that may be filed from time to

time with the Canadian securities regulatory authorities by the

Company.

For a more detailed discussion of certain of these risk factors,

see the Company's most recent MD&A described in the “Risk

Factors” as well as the list of risk factors in the Company’s

management information circular dated March 6, 2023 available on

SEDAR at sedarplus.ca under the Company’s profile.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

SOURCE: TINY LTD.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231116403910/en/

David Charron Chief Financial Officer Phone: 416-418-3881 Email:

david@tiny.com

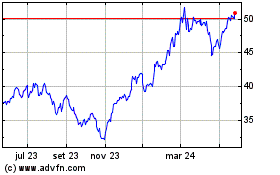

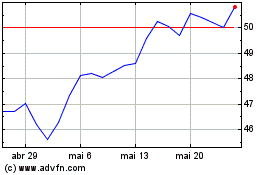

Proshares Nanotechnology... (AMEX:TINY)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Proshares Nanotechnology... (AMEX:TINY)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025