US$33 million in non-dilutive financing to

ASCU

Global Mining and Innovation Industry

partner validates scalability of Cactus Project and Nuton’s

confidence in enhancing project economics

Arizona Sonoran Copper Company Inc. (TSX:ASCU |

OTCQX:ASCUF) (“ASCU” or the “Company”) is pleased

to announce today that it has entered into an option to joint

venture agreement with Nuton LLC (“Nuton”), a wholly-owned

subsidiary of Rio Tinto, to establish a strategic alliance for

deployment of the Nuton technologies at its Cactus Mine and the

Parks/Salyer Project (collectively, the “Cactus Project”),

in Arizona, USA. All dollar figures herein are in United States

dollars unless otherwise indicated.

Management will host an interactive webinar on Friday, December

15 at 9 am ET. Please register with

https://www.bigmarker.com/vid-conferences/ASCU-TownHallForum to

join.

Transaction Highlights

Creating a Straightforward Mechanism for Significant Project

Funding

- Endorses the Cactus Project through up to US$33 million in

non-dilutive financing

- Creates a straightforward mechanism for significant project

funding, designed to minimize ASCU’s future share of equity

contributions to capital costs

- Commitment from Nuton to support the creation of a funding

strategy for ASCU, which may include the provision of a completion

guarantee for the Cactus Project or a performance guarantee related

to the Nuton technologies

- Potential to improve per share returns to ASCU

shareholders

Reduction of Execution Risks

- Establishes a framework for a joint-venture partnership with

industry-leading technical and innovation leader to deliver

value-enhancing project economics

- Potential to significantly increase attributable copper

production per share

- Defines near-term project advancement strategy with the goal of

delivering an Integrated Nuton Case PFS (defined below) by December

31, 2024

- Preserves long-term optionality for ASCU and outlines a clear

path towards environmentally- friendly copper production in the

USA, with a focus on Nuton’s positive impact pillars: water,

energy, land, materials, and society

George Ogilvie, President and CEO of ASCU commented, “We

are delighted to announce this strategic joint venture transaction

with Nuton. We welcome the expertise and financial support as we

expand testing of Nuton’s heap leaching technologies, while

concurrently advancing ASCU’s projects. Nuton’s column test results

have demonstrated continued improvements in extraction rates from

both the primary and enriched mineral resources, resulting in

potentially more efficient operations. We look forward to advancing

into Phase 2 testing, which includes an expanded understanding of

the Nuton technologies’ economic benefits within a fully-integrated

pre-feasibility study, anticipated by the end of 2024.”

Mr. Ogilvie continued, “The proposed heap leach and SXEW

flowsheet utilizing Nuton is intended to build upon the strength of

our standalone base case, utilizing the same infrastructure proving

economies of scale. Nuton has indicated the potential to

significantly increase copper cathode output from our current 45-50

ktpa target which could materially enhance project economics.

Furthermore, we see this as a significant de-risking event for ASCU

shareholders with up to US$33 million in non-dilutive near-term

financing and the addition of a strong project partner for future

financing and development.”

Adam Burley, CEO of Nuton LLC commented, “We are pleased to be

advancing our strategic partnership with ASCU. Successful

deployment of Nuton Technologies at Cactus and Park/Salyer has the

potential to materially enhance the economic and environmental

performance of the projects.”

Transaction Details

ASCU has entered into an Option to Joint Venture Agreement (the

“Option Agreement”) with Nuton and two of ASCU’s

wholly-owned subsidiaries, Arizona Sonoran Copper Company (USA)

Inc. (“ASUSA”) and Cactus 110 LLC (“Cactus”),

pursuant to which ASUSA has granted Nuton the exclusive right and

option (the “Option”) to acquire between a 35.0% to 40.0%

interest in the Company’s Cactus Project on the terms and

conditions contained in the Option Agreement.

The Option Agreement provides for total funding of up to US$33

million in cash, comprised of the following:

- US$10 million payable by Nuton to ASUSA at signing of the

Option Agreement;

- Up to US$11 million available to be drawn by ASUSA in the form

of a pre-payment towards the Option Exercise Price (defined below)

to be used for certain land payments (the “Option Exercise Price

Pre-Payment Amount”); and

- Up to US$12 million payable to ASCU for funding costs

associated with continued Nuton test work required to produce the

Integrated Nuton Case PFS (defined below).

The parties have outlined a work program for the Nuton Case (as

defined below) to commence in Q1 2024, targeting delivery of the

Integrated Nuton Case PFS, by December 31, 2024. ASCU will continue

to act as operator of the Cactus Project. ASCU and Nuton will form

a Steering Committee, comprised of two members selected by ASCU and

two members selected by Nuton, to determine, among other things,

the detailed execution scope of the Integrated Nuton Case PFS.

Nuton will have the right to nominate one individual to ASCU’s

Technical & Sustainability Committee and will maintain its

observer rights provided under the Investor Rights Agreement dated

May 13, 2022, and as amended on February 9, 2023, between Nuton and

ASCU.

Should the following criteria be satisfied (the “Trigger

Events”), Nuton shall have the option to acquire between 37.5%

to 40.0% of the Cactus Project by payment of the Option Exercise

Price (defined below):

- the prefeasibility study prepared for the Cactus Project (the

“Integrated Nuton Case PFS”) indicates that the net present

value (the “NPV”) of the Cactus Project after applying the

Nuton technologies (the “Nuton Case”) is at least 1.39 times

the NPV of the Cactus Project without applying the Nuton

technologies (the “Standalone Case”);

- ASCU’s equity contribution to project capital costs under the

Nuton Case shall remain equal to or less than its equity

contribution to project capital costs under the Standalone Case

(assuming 50% of the Standalone Case capital costs are financed

with debt); and

- Nuton shall have made all payments required under the Option

Agreement.

Should the Mainspring Property, which is currently the subject

of exploration efforts, become material to ASCU and be incorporated

in a prefeasibility study in addition to the Cactus Project (the

“Standalone Case with Mainspring”) the Trigger Event (i)

above shall be as amended and Nuton shall have the option to

acquire between 35.0% to 40.0% of the Cactus Project (including the

Mainspring Property) by payment of the Option Exercise Price in the

event that the Nuton Case PFS with the Mainspring Property is at

least 1.20 times the NPV of the Standalone Case with

Mainspring.

Upon notice by ASCU to Nuton that the Trigger Events have been

met, the parties will determine the exercise price (the “Option

Exercise Price”) pursuant to mechanics outlined in the Option

Agreement and based on the product of (x) Nuton’s ownership

percentage in the Joint Venture Corporation (the “Initial Nuton

Ownership Percentage”), (y) the NPV of the Standalone Case (as

referenced in the Integrated Nuton Case PFS) and (z) a multiple of

0.65.

Following such determination, if Nuton elects to exercise its

option, Nuton will pay to ASUSA the Option Exercise Price net of

any Option Exercise Price Pre-Payment Amount plus accrued interest

at an annual rate equal to the Secured Overnight Financing Rate

plus 4.25% (“Interest”) within 30 days of a notice to

exercise.

The Initial Nuton Ownership Percentage in the case without the

Mainspring Property being incorporated in a prefeasibility study

will be equal to either:

- 37.5% if the NPV of the Nuton Case is 1.39 to 1.49 times the

NPV of the Standalone Case; or

- 40.0% if the NPV of the Nuton Case is at least 1.50 times the

NPV of the Standalone Case (each as referenced in the Integrated

Nuton Case PFS).

The Initial Nuton Ownership Percentage in the case with the

Mainspring Property being incorporated in a prefeasibility study

will be equal to:

- 35.0% if the NPV of the Nuton Case with Mainspring is 1.20 to

1.29 times the NPV of the Standalone Case with Mainspring;

- 37.5% if the NPV of the Nuton Case with Mainspring is 1.30 to

1.39 times the NPV of the Standalone Case with Mainspring; or

- 40.0% if the NPV of the Nuton Case with Mainspring is at least

1.40 times the NPV of the Standalone Case with Mainspring (each as

referenced in the Integrated Nuton Case PFS with Mainspring).

ASCU shall hold the remaining equity interest in the Joint

Venture Corporation and continue to act as operator of the Cactus

Project.

Nuton will have the right to terminate the Option Agreement and

be repaid amounts paid by Nuton under the Option Agreement if there

is a change of control transaction in respect of ASCU during the

term of the Option Agreement.

In the event that Nuton exercises the Option, the parties will

either form a Delaware limited liability company or deem Cactus to

be the joint venture company for the Cactus Project (the “Joint

Venture Corporation”).

In the event the Triggers Events are not satisfied, ASCU

terminates the Option Agreement as a result of Nuton delaying its

approval of the Integrated Nuton Case PFS or Nuton elects not to

exercise the Option, then Nuton may elect to either be repaid the

Option Exercise Pre-Payment Amount, if any, advanced to ASUSA plus

Interest within 9 months or have ASUSA deliver to Nuton an

unsecured exchangeable debenture (the “Exchangeable

Debenture”) equal to the Option Exercise Price Pre-Payment

Amount, if any, advanced to ASUSA plus Interest (the “Principal

Amount”). If issued, the Exchangeable Debenture shall bear

Interest and will mature at the earlier of (i) two years from

issuance, and (ii) the date that is nine (9) months from the date

on which Nuton delivers a demand notice to ASUSA, which shall be no

later than nine (9) months prior to the date in (i). Nuton will

have the right to settle all or a portion of the outstanding

Principal Amount and Interest accrued thereon in common shares of

ASCU (the “Common Shares”) at a price per Common Share equal

to the volume weighted average trading price of the Common Shares

on the principal stock exchange on which such Common Shares are

listed for the five (5) consecutive trading days preceding the date

on which Nuton delivers a notice of exchange, after giving effect

to the prevailing Canadian dollar / U.S. dollar exchange rate,

provided that Nuton and its affiliates may not own or control more

than 19.9% of the then issued and outstanding Common Shares

following such exchange. The Exchangeable Debenture will also

contain certain pre-payment rights and resale notice rights in

favour of ASCU as well as other customary terms and conditions for

an agreement of this nature. The Toronto Stock Exchange has

conditionally approved for listing the Common Shares issuable upon

exchange of the Exchangeable Debenture, subject to the satisfaction

of certain customary listing conditions.

A copy of the Option Agreement will be available under ASCU’s

profile on SEDAR+ at www.sedarplus.ca. The summary of the Option

Agreement outlined above is qualified in its entirety by the full

text of the Option Agreement, and reference should be made to the

Option Agreement for its full terms and conditions.

Qualified Persons Statement

Technical aspects related to the metallurgical program of this

news release have been reviewed and verified by James L. Sorensen –

FAusIMM Reg. No. 221286 with Samuel Engineering, who is a qualified

person as defined by National Instrument 43-101– Standards of

Disclosure for Mineral Projects. The indicative metallurgical

information presented describes preliminary results from testing

that is currently in progress and subject to confirmation. Final

metallurgical performance estimates will require decommissioning of

the columns and analysis of the column residues.

Advisors

Scotiabank acted as financial advisor, and Bennett Jones LLP and

Davis Graham & Stubbs LLP acted as legal advisors, to ASCU.

Rothschild acted as financial advisor, and Torys LLP and Dorsey

& Whitney LLP acted as legal advisors, to Nuton.

About Arizona Sonoran Copper Company (www.arizonasonoran.com |

www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with

low operating costs and to develop the Cactus and Parks/Salyer

Projects that could generate robust returns for investors and

provide a long term sustainable and responsible operation for the

community and all stakeholders. The Company’s principal asset is a

100% interest in the Cactus Project (former ASARCO, Sacaton mine)

which is situated on private land in an infrastructure-rich area of

Arizona. Contiguous to the Cactus Project is the Company’s

100%-owned Parks/Salyer deposit that could allow for a phased

expansion of the Cactus Mine once it becomes a producing asset. The

Company is led by an executive management team and Board which have

a long-standing track record of successful project delivery in

North America complemented by global capital markets expertise.

About Nuton

Nuton is an innovative venture that aims to help grow Rio

Tinto’s copper business. At the core of Nuton is a portfolio of

proprietary copper leach related technologies and capability - a

product of almost 30 years of research and development. Nuton

offers the potential to economically unlock copper from primary

sulfide resources worldwide through leaching, achieving

market-leading recovery rates, contributing to an increase in

copper production from copper bearing waste and tailings, and

achieving higher copper recoveries on oxide and transitional

material. One of the key differentiators of Nuton is the potential

to produce the world’s lowest carbon footprint copper while having

at least one Positive Impact at each of our deployment sites,

across our five pillars: water, energy, land, materials and

society.

Nuton™ Technologies

The Nuton™ technologies are proprietary Rio Tinto-developed

copper heap leach related processing and modelling technologies,

capability and intellectual property.

Forward-Looking Statements

This press release contains “forward-looking statements” and/or

“forward-looking information” (collectively, “forward-looking

statements”) within the meaning of applicable securities

legislation. All statements, other than statements of historical

fact, are forward-looking statements. Generally, forward-looking

statements can be identified by the use of forward-looking

terminology such as “plans”, “expect”, “is expected”, “in order

to”, “is focused on” (a future event), “estimates”, “intends”,

“anticipates”, “believes” or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, or the negative connotation thereof. In

particular, statements regarding ASCU’s future operations, future

exploration and development activities or other development plans

constitute forward-looking statements. By their nature, statements

referring to mineral reserves or mineral resources constitute

forward-looking statements. Forward-looking statements in this

press release include, but are not limited to statements with

respect to timing of completion of a fully-integrated

pre-feasibility study, potential project economic enhancements,

potential improvements to per share returns to ASCU shareholders,

potential increases to attributable copper production per share,

and timing of commencement of the work program for the Nuton

Case.

These forward-looking statements are based on ASCU’s current

beliefs as well as assumptions made by and information currently

available to it and involve inherent risks and uncertainties, both

general and specific.

Risks exist that forward-looking statements will not be achieved

due to a number of factors including, but not limited to,

developments in world commodity markets, changes in commodity

prices (particularly prices of copper), risks relating to

fluctuations in the Canadian dollar and other currencies relative

to the U.S. dollar, changes in exploration, development or mining

plans due to exploration results and changing budget priorities of

ASCU or its joint venture partners, the effects of competition in

the markets in which ASCU operates, the impact of the Nuton™

technologies on ASCU operations and cost relating to same, the

timing and ability for ASCU to prepare and complete the Integrated

Nuton Case PFS and the costs relating to same, the impact of

changes in the laws and regulations regulating mining exploration,

development, closure, judicial or regulatory judgments and legal

proceedings, operational and infrastructure risks and the

additional risks described in ASCU’s most recently filed Annual

Information Form, annual and interim MD&A, copies of which are

available on SEDAR+ (www.sedarplus.ca) under ASCU’s issuer profile.

ASCU’s anticipation of and success in managing the foregoing risks

could cause actual results to differ materially from what is

anticipated in such forward-looking statements.

Although management considers the assumptions contained in

forward-looking statements to be reasonable based on information

currently available to it, those assumptions may prove to be

incorrect. When making decisions with respect to ASCU, investors

and others should not place undue reliance on these statements and

should carefully consider the foregoing factors and other

uncertainties and potential events. Unless required by applicable

securities law, ASCU does not undertake to update any

forward-looking statement that is made herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231214242279/en/

For more information

Alison Dwoskin, Director, Investor Relations 647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director 416-723-0458

gogilvie@arizonasonoran.com

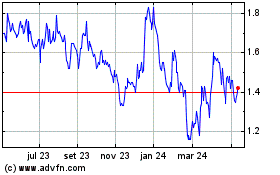

Arizona Sonoran Copper (TSX:ASCU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

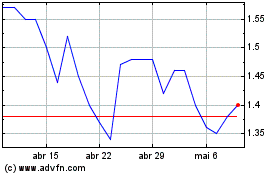

Arizona Sonoran Copper (TSX:ASCU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025