Defiance, a leader provider of options and income ETFs, today

announced the launch of TRES, the Defiance Treasury Alternative

Yield ETF (TRES). The fund will offer exposure to treasuries with

an options overlay intended to maximize yield. TRES will be

actively managed by Zega Financial. The ETF will seek to distribute

dividends monthly.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240125615551/en/

Defiance Expands ETF Option-Income

Offerings with the Treasury Alternative Yield ETF (TRES) (Graphic:

Business Wire)

Identifying that the options market typically misrepresents

expected moves in bond-based ETFs, Zega and Defiance aim to

capitalize on that mispricing of options and create a higher set of

returns than projected by options markets. The overlay, which will

primarily be net long volatility on the underlying ETFs, creates

participation on both bullish and bearish moves in selected

exchange-traded Treasury funds (“Treasury ETFs”). TRES will

additionally offset the time decay of long options with option

selling tactics to generate income, which may in turn be passed on

to investors.

“TRES brings together the stability and predictability of

short-term US treasuries, with a tactical options strategy that

aims to harvest the volatility of treasury-based ETFs,” said Jay

Pestrichelli, founder and CEO of Zega. “We’re excited to be

partnering our expertise in volatility with Defiance’s deep

experience in ETFs.”

Defiance’s suite of income-focused ETFs includes the 2023

launches of the first 0DTE Enhanced Income ETFs, JEPY, QQQY, and

IWMY.

Sylvia Jablonski, CEO at Defiance, added “We’re thrilled to be

expanding our suite of income focused ETFs that will help investors

face turbulent markets. With Zega and TRES, we’re providing an

investment strategy that will seek to allow investors to maximize

their yield with the security of treasuries.”

About Defiance ETFs

Founded in 2018, Defiance stands as a leading ETF sponsor

dedicated to income and thematic investing. Our actively managed

options ETFs are designed to enhance income while our suite of

first-mover thematic ETFs empower investors to express targeted

views on dynamic sectors leading the way in disruptive innovations,

including artificial intelligence, machine learning, quantum

computing, 5G, hydrogen energy, and electric vehicles.

Important Disclosures

TRES Disclosure: Defiance ETFs LLC is the ETF sponsor. The

Fund’s investment adviser is Toroso Investments, LLC (“Toroso” or

the “Adviser”). The investment sub-adviser is ZEGA Financial, LLC

(“ZEGA” or the “Sub-Adviser”).

Fund holdings and sector allocations are subject to change at

any time and should not be considered recommendations to buy or

sell any security.

The Funds' investment objectives, risks, charges, and expenses

must be considered carefully before investing. The prospectus

contain this and other important information about the investment

company. Please read carefully before investing. A hard copy of the

prospectuses can be requested by calling 833.333.9383.

Past performance is no guarantee of future results. High ratings

does not assure favorable performance.

Investing involves risk. Principal loss is possible. As an

ETF, the funds may trade at a premium or discount to NAV. Shares of

any ETF are bought and sold at market price (not NAV) and are not

individually redeemed from the Fund. A portfolio concentrated in a

single industry or country, may be subject to a higher degree of

risk.

There is no guarantee that the Fund’s investment strategy will

be properly implemented, and an investor may lose some or all of

its investment.

None of the Fund, the Trust, the Adviser, the Sub-Adviser, or

their respective affiliates makes any representation to you as to

the performance of the Index. THE FUND, TRUST, ADVISER, AND

SUB-ADVISER ARE NOT AFFILIATED WITH, NOR ENDORSED BY, THE

INDEX.

Liquidity Risk: Liquidity risk exists when particular

investments of the Fund would be difficult to purchase or sell,

possibly preventing the Fund from selling such illiquid securities

at an advantageous time or price, or possibly requiring the Fund to

dispose of other investments at unfavorable times or prices in

order to satisfy its obligations.

New Fund Risk: The Fund is a recently organized

management investment company with no operating history. As a

result, prospective investors do not have a track record or history

on which to base their investment decisions.

Non-Diversification Risk: The Fund is classified as

“non-diversified,” which means the Fund may invest a larger

percentage of its assets in the securities of a smaller number of

issuers than a diversified fund. The Fund will generally have up to

15 credit spreads at any given time, with up to 25% exposure to a

single equity index credit spread. Investment in a limited number

of equity indexes exposes the Fund to greater market risk and

potential losses than if its assets were diversified among a

greater number of indexes.

Written Options Risk: The Fund will incur a loss as a

result of writing (selling) options (also referred to as a short

position) if the price of the written option instrument increases

in value between the date the Fund writes the option and the date

on which the Fund purchases an offsetting position. The Fund’s

losses are potentially large in a written put transaction and

potentially unlimited in a written call transaction.). Because of

the fund’s strategy of coupling written and purchased puts and call

options with the same expiration date and different strike prices,

the Fund expects that maximum potential loss for the Fund for any

given credit spread is equal to the difference between the strike

prices minus any net premium received. Nonetheless, because up to

100% of the Fund’s portfolio may be subject to this risk - the

value of an investment in the Fund – could decline significantly

and without warning, including to zero.

Fixed Income Securities Risk: The prices of fixed income

securities respond to economic developments, particularly interest

rate changes, as well as to changes in an issuer’s credit rating or

market perceptions about the creditworthiness of an issuer.

Generally fixed income securities decrease in value if interest

rates rise and increase in value if interest rates fall, and

longer-term and lower rated securities are more volatile than

shorter- term and higher rated securities.

Leveraging Risk: Derivative instruments held by the Fund

involve inherent leverage, whereby small cash deposits allow the

Fund to hold contracts with greater face value, which may magnify

the Fund’s gains or losses. Adverse changes in the value or level

of the underlying asset, reference rate or index can result in loss

of an amount substantially greater than the amount invested in the

derivative. In addition, the use of leverage may cause the Fund to

liquidate portfolio positions when it would not be advantageous to

do so in order to satisfy redemption obligations.

Derivatives Risk: Derivatives include instruments and

contracts that are based on and valued in relation to one or more

underlying securities, financial benchmarks, indices, or other

reference obligations or measures of value. Major types of

derivatives include options. Depending on how the Fund uses

derivatives and the relationship between the market value of the

derivative and the underlying instrument, the use of derivatives

could increase or decrease the Fund’s exposure to the risks of the

underlying instrument. Using derivatives can have a leveraging

effect if the Sub-Adviser is unable to set an appropriate spread

between two options held by the Fund and increase Fund volatility.

In that event, a small investment in derivatives could have a

potentially large impact on the Fund’s performance. Derivatives

transactions can be highly illiquid and difficult to unwind or

value, and changes in the value of a derivative held by the Fund

may not correlate with the value of the underlying instrument or

the Fund’s other investments. Many of the risks applicable to

trading the instruments underlying derivatives are also applicable

to derivatives trading. Financial reform laws have changed many

aspects of financial regulation applicable to derivatives. Once

implemented, new regulations, including margin, clearing, and trade

execution requirements, may make derivatives more costly, may limit

their availability, may present different risks or may otherwise

adversely affect the value or performance of these instruments. The

extent and impact of these regulations are not yet fully known and

may not be known for some time.

Diversification does not ensure a profit nor protect against

loss in a declining market.

Total return represents changes to the NAV and accounts for

distributions from the fund.

Median 30 Day Spread is a calculation of Fund’s median bid-ask

spread, expressed as a percentage rounded to the nearest hundredth,

computed by: identifying the Fund’s national best bid and national

best offer as of the end of each 10 second interval during each

trading day of the last 30 calendar days; dividing the difference

between each such bid and offer by the midpoint of the national

best bid and national best offer; and identifying the median of

those values.

Diversification does not ensure a profit nor protect against

loss in a declining market.

Commissions may be charged on trades.

TRES is distributed by Foreside Fund Services, LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240125615551/en/

Frank Taylor (646) 808-3647 defiance@dlpr.com

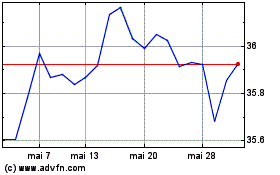

Ivz Ust Dist (LSE:TRES)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Ivz Ust Dist (LSE:TRES)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024