SunLink Health Systems, Inc. (NYSE American: SSY) today

announced a loss from continuing operations of $407,000 (or a loss

of $0.06 per fully diluted share) for its second fiscal quarter

ended December 31, 2023 compared to earnings from continuing

operations of $2,277,000 (or $0.32 per fully diluted share) for the

second fiscal quarter ended December 31, 2022.

Net loss for the quarter ended December 31, 2023 was $3,075,000

(or a loss of $0.44 per fully diluted share) compared to net

earnings of $1,951,000 (or $0.28 per fully diluted share) for the

quarter ended December 31, 2022. The net loss for the quarter

included a loss from discontinued operations of $2,668,000 (or a

loss of $0.38 per fully diluted share), which includes an

impairment charge of $1,974,000 on the sale of Trace Regional

Hospital, a vacant medical office building and three (3) patient

clinics (“Trace”) discussed below, for the quarter ended December

31, 2023 compared to a loss from discontinued operations of

$326,000 (or a loss of $0.05 per fully diluted share) for the

quarter ended December 31, 2022, substantially all of which relates

to Trace’s results.

On January 22, 2024, the Company's indirect subsidiary, Southern

Health Corporation of Houston, Inc. (“Southern”), reached revised

agreements for the sale of Trace Regional Hospital, a vacant

medical office building and three (3) patient clinics in Chickasaw

County, MS, (collectively “Trace”) to Progressive Health of

Houston, LLC (“Progressive”). Pursuant to the revised agreements,

Southern sold certain personal and intangible property to

Progressive for $500,000 pursuant to an asset purchase agreement

(“Sale”), entered into a six-month net lease of certain hospital

real property for $20,000 per month, and engaged Progressive under

a management agreement to manage the operations of Trace until

receipt of certain regulatory approvals. Pursuant to the revised

agreements, Southern’s agreement with Progressive dated November

10, 2023, was terminated. Southern also entered into a real estate

purchase agreement with Progressive under which Progressive is to

purchase certain real estate of Trace for $2,000,000 by July 31,

2024. As a result of the transactions, in the quarter ended

December 31, 2023 SunLink reported an impairment charge of

$1,974,000 to write down the net assets being sold pursuant to the

asset purchase agreement and the real estate purchase agreement.

The Company is currently marketing for sale its Trace Extended Care

& Rehabilitation, a skilled care nursing facility adjacent to

the campus of Trace, which Southern retained. The results for Trace

and Trace Extended Care are included in discontinued operations for

the current fiscal year, and prior period financial information has

been restated to include them in discontinued operations. There can

be no assurance the Trace transactions will be completed or that

Trace Extended Care will be sold.

Consolidated net revenues for each fiscal quarters ended

December 31, 2023 and 2022 were $8,510,000 and $10,640,000.

Pharmacy net revenues for the quarter ended December 31, 2022

included $2,615,000 from the reversal of reserves for certain sales

taxes previously accrued. The Company determined during that

quarter that, based on discussions and correspondence from taxing

authorities and consultation with external legal counsel, it was

more likely than not that such accrued sales taxes would not be

payable. The quarter ended December 31, 2023 includes $59 of prior

period sales tax credits relating to such sales tax refund

claims.

SunLink reported an operating loss for the quarter ended

December 31, 2023 of $433,000 compared to an operating profit for

the quarter ended December 31, 2022 of $2,270,000. The operating

profit last year resulted primarily from the reversal of accrued

sales tax reserves.

SunLink reported a loss from continuing operations of $835,000

(or a loss of $0.12 per fully diluted share) for its six months

ended December 31, 2023 compared to earnings from continuing

operations of $1,672,000 (or $0.24 per fully diluted share) for the

six months ended December 31, 2023. Net loss for the six months

ended December 31, 2023 was $4,419,000 (or a loss of $0.63 per

fully diluted share) compared to net earnings of $393,000 (or $0.06

per fully diluted share) for the six months ended December 31,

2022. The net loss for the six months ended December 31, 2023

included a loss from discontinued operations of $3,584,000 (or a

loss of $0.51 per fully diluted share), compared to a loss from

discontinued operations of $1,279 (or a loss of $0.18 per fully

diluted share) for the six months ended December 31, 2022.

Consolidated net revenues for each of the six months ended

December 31, 2023 and 2022 were $17,065,000 and $18,089,000,

respectively. Pharmacy net revenues for the six months ended

December 31, 2022 included $2,615,000 from the reversal of reserves

for certain sales taxes previously accrued. The six months ended

December 31, 2023 includes $380 of prior period sales tax refunds.

Excluding the effect of the sales tax refunds and reversal of sales

tax accruals, net revenues increased 7% in the six months ended

December 31, 2023 compared to the prior year due primarily to

increased volume of Retail and Institutional pharmacy scripts

filled.

SunLink reported an operating loss for the six months ended

December 31, 2023 of $883,000 compared to an operating profit for

the six months ended December 31, 2022 of $1,653,000. The operating

profit during the comparable six month period last year resulted

primarily from the reversal of accrued sales tax reserves.

COVID-19 Pandemic

The Company continued to experience adverse after-effects of the

COVID-19 pandemic in the quarter ended December 31, 2023 and

believes such effects will likely continue to affect its assets and

operations in the foreseeable future particularly from salaries and

wages pressure, workforce shortages, supply chain disruption and

broad inflationary pressures. Our ability to make estimates of any

such continuing effects on future revenues, expenses or changes in

accounting judgments that have had or are reasonably likely to have

a material effect on our financial statements is very limited,

depending as they do on the severity and length thereof; as well as

any further government actions and/or regulatory changes intended

to address such effects.

SunLink Health Systems, Inc. is the parent company of

subsidiaries that own and operate a pharmacy business and an

information technology business in the Southeast. For additional

information on SunLink Health Systems, Inc., please visit the

Company’s website.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 including, without limitation, statements regarding the

company’s business strategy. These forward-looking statements are

subject to certain risks, uncertainties, and other factors, which

could cause actual results, performance, and achievements to differ

materially from those anticipated. Certain of those risks,

uncertainties and other factors are disclosed in more detail in the

company’s Annual Report on Form 10-K for the year ended June 30,

2023 and other filings with the Securities and Exchange Commission

which can be located at www.sec.gov.

SUNLINK HEALTH SYSTEMS, INC. ANNOUNCES FISCAL 2024 SECOND

QUARTER RESULTS Amounts in 000's, except per share

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

Three Months Ended December 31, Six Months Ended December

31,

2023

2022

2023

2022

% of Net % of Net % of Net % of Net

Amount Revenues Amount Revenues

Amount Revenues Amount Revenues Net

revenues

$

8,510

100.0

%

$

10,640

100.0

%

$

17,065

100.0

%

$

18,089

100.0

%

Costs and Expenses: Cost of goods sold

4,761

55.9

%

4,518

42.5

%

9,532

55.9

%

8,887

49.1

%

Salaries, wages and benefits

2,668

31.4

%

2,481

23.3

%

5,285

31.0

%

5,004

27.7

%

Supplies

39

0.5

%

35

0.3

%

73

0.4

%

65

0.4

%

Purchased services

281

3.3

%

236

2.2

%

567

3.3

%

486

2.7

%

Other operating expenses

784

9.2

%

720

6.8

%

1,690

9.9

%

1,253

6.9

%

Rent and leases

92

1.1

%

92

0.9

%

183

1.1

%

184

1.0

%

Depreciation and amortization

318

3.7

%

288

2.7

%

618

3.6

%

557

3.1

%

Operating profit (loss)

(433

)

-5.1

%

2,270

21.3

%

(883

)

-5.2

%

1,653

9.1

%

Interest Income - net

29

0.3

%

5

0.0

%

51

0.3

%

5

0.0

%

Gain on sale of assets

0

0.0

%

1

0.0

%

2

0.0

%

13

0.1

%

Earnings (Loss) from Continuing Operations before Income

Taxes

(404

)

-4.7

%

2,276

21.4

%

(830

)

-4.9

%

1,671

9.2

%

Income Tax (benefit) expense

3

0.0

%

(1

)

0.0

%

5

0.0

%

(1

)

0.0

%

Earnings (Loss) from Continuing Operations

(407

)

-4.8

%

2,277

21.4

%

(835

)

-4.9

%

1,672

9.2

%

Loss from Discontinued Operations, net of tax

(2,668

)

-31.4

%

(326

)

-3.1

%

(3,584

)

-21.0

%

(1,279

)

-7.1

%

Net Earnings (Loss)

$

(3,075

)

-36.1

%

$

1,951

18.3

%

$

(4,419

)

-25.9

%

$

393

2.2

%

Earnings (Loss) Per Share from Continuing Operations:

Basic

$

(0.06

)

$

0.32

$

(0.12

)

$

0.24

Diluted

$

(0.06

)

$

0.32

$

(0.12

)

$

0.24

Earnings (Loss) Per Share from Discontinued Operations: Basic

$

(0.38

)

$

(0.05

)

$

(0.51

)

$

(0.18

)

Diluted

$

(0.38

)

$

(0.05

)

$

(0.51

)

$

(0.18

)

Net Earnings (Loss) Per Share: Basic

$

(0.44

)

$

0.28

$

(0.63

)

$

0.06

Diluted

$

(0.44

)

$

0.28

$

(0.63

)

$

0.06

Weighted Average Common Shares Outstanding: Basic

7,040

7,031

7,039

7,007

Diluted

7,040

7,033

7,039

7,010

SUMMARY BALANCE SHEETS December 31,

June 30,

2023

2023

ASSETS Cash and Cash Equivalents

$

2,055

$

4,486

Receivable - net

3,061

2,592

Current Assets Held for Sale

5,328

1,920

Other Current Assets

3,266

3,276

Property Plant and Equipment, net

2,921

2,717

Long-term Assets

2,156

8,277

$

18,787

$

23,268

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities

$

5,228

$

4,869

Noncurrent Liabilities

555

982

Shareholders' Equity

13,004

17,417

$

18,787

$

23,268

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213146430/en/

Robert M. Thornton, Jr. Chief Executive Officer

(770) 933-7004

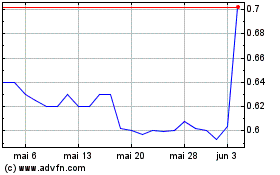

Sunlink Health Systems (AMEX:SSY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Sunlink Health Systems (AMEX:SSY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025