SunLink Health Systems, Inc. (NYSE American: SSY) today

announced a loss from continuing operations of $652,000 (or a loss

of $0.09 per fully diluted share) for its fourth fiscal quarter

ended June 30, 2024 compared to a loss from continuing operations

of $1,021,000 (or a loss of $0.15 per fully diluted share) for the

fourth fiscal quarter ended June 30, 2023.

Earnings from discontinued operations were $4,940,000 (or

earnings of $0.70 per fully diluted share) for the fourth fiscal

quarter ended June 30, 2024 compared to a loss from discontinued

operations of $405,000 (or a loss of $0.06 per fully diluted share)

for the fourth fiscal quarter ended June 30, 2023. During the

quarter ended June 30, 2024, the Company’s indirect subsidiary,

Southern Health Corporation of Houston, Inc. (“Southern”) sold its

Trace Extended Care & Rehab senior care facility and related

real estate in Houston, Mississippi for net proceeds of $6,522,000

and recorded a gain on the sale of $5,584,000. Southern’s results

are included in discontinued operations for the year ended June 30,

2024.

Primarily as a result of the sale of Trace Extended Care &

Rehab, net income for the quarter ended June 30, 2024 was

$4,288,000 (or $0.61 per fully diluted share) compared to a net

loss of $1,426,000 (or a loss of $0.20 per fully diluted share) for

the quarter ended June 30, 2023.

On January 22, 2024, Southern reached revised agreements for the

sale of Trace Regional Hospital, a vacant medical office building

and three (3) patient clinics in Chickasaw County Mississippi,

(collectively “Trace Hospital Assets”) to Progressive Health of

Houston, LLC (“Progressive”) pursuant to which (i) Southern sold

certain personal and intangible property to Progressive for

$500,000 under to an asset purchase agreement (“Trace Hospital

Assets Sale"), (ii) entered into a six-month net lease of the real

property of the hospital, medical office building and the clinics

property (the "Trace Real Estate Lease") for $20,000 per month,

(iii) entered into a contract to sell the Trace Hospital real

estate (the "Trace Hospital Real Estate") to Progressive for

$2,000,000 and (iv) engaged Progressive under a management

agreement to manage the operations of Trace Hospital pending

receipt of certain regulatory approvals, which was received

February 29, 2024. The Company recorded a loss of $962,000 on the

Trace Hospital Assets sale during the year ended June 30, 2024,

which included sale expenses of $174,000. The completion of the

Trace Hospital Real Estate sale has been extended by mutual

agreement to October 4, 2024. As a result of the transactions

("Revised Agreement"), SunLink reported an impairment loss of

$1,974,000 at December 31, 2023 to reduce the net value of the

Trace Hospital Assets and Trace Hospital Real Estate to the

estimated sale proceeds under the Revised Agreement. An impairment

reserve of $1,695,000 remains at June 30, 2024 for the Trace

Hospital Real Estate. There can be no assurance the completion of

the sale of the Trace Hospital Assets Real Estate will be

achieved.

Consolidated net revenues for each of the fiscal quarters ended

June 30, 2024 and 2023 were $7,913,000 and $8,010,000,

respectively, which consists primarily of pharmacy net revenues.

Pharmacy net revenues for the quarter ended June 30, 2024 decreased

$97,000, or 1%, from the same period last year as a result of lower

pharmacy scripts dispensed. The quarter ended June 30, 2024

includes $34,000 of prior period sales tax credits relating to such

sales tax refund claims.

SunLink reported an operating loss for the quarter ended June

30, 2024 of $675,000 compared to an operating loss for the quarter

ended June 30, 2023 of $1,112,000. The decreased operating loss

this year compared to last year resulted primarily from increased

gross profit margin on pharmacy revenue.

SunLink reported a loss from continuing operations of $2,311,000

(or a loss of $0.33 per fully diluted share) for its twelve months

ended June 30, 2024 compared to earnings from continuing operations

of $198,000 (or $0.03 per fully diluted share) for the twelve

months ended June 30, 2023.

Earnings from discontinued operations were $784,000 (or $0.11

per fully diluted share) for the twelve months ended June 30, 2024

compared to a loss of $1,993,000 (or a loss of $0.28 per fully

diluted share) for the twelve months ended June 30, 2023, primarily

due to the Trace Hospital Assets and Trace Extended Care &

Rehab transactions and Trace Hospital Real Estate impairment charge

described above.

SunLink reported a net loss of $1,527,000 (or a loss of $0.22

per fully diluted share) for its twelve months ended June 30, 2024

compared to a net loss of $1,795,000 (or $0.26 per fully diluted

share) for the twelve months ended June 30, 2023.

Consolidated net revenues for each of the twelve months ended

June 30, 2024 and 2023 were $32,440,000 and $34,280,000,

respectively. Pharmacy net revenues for the twelve months ended

June 30, 2023 included $2,615,000 from the reversal of reserves for

certain sales taxes previously accrued. The Company determined

during that quarter that, based on discussions and correspondence

from taxing authorities and consultation with external legal

counsel, it was more likely than not that such accrued sales taxes

would not be payable. The twelve months ended June 30, 2024

includes $471,000 of prior period sales tax refunds. Excluding the

effect of the sales tax refunds and reversal of sales tax accruals,

net revenues decreased less than 1 % in the twelve months ended

June 30, 2024 compared to the prior year.

SunLink reported an operating loss for the twelve months ended

June 30, 2024 of $2,411,000 compared to operating profit for the

twelve months ended June 20, 2023 of $74,000. The operating profit

during the comparable twelve month period last year resulted

primarily from the reversal of accrued sales tax reserves.

COVID-19 Pandemic

The Company continues to experience adverse after-effects of the

COVID-19 pandemic in the quarter ended June 30, 2024 and believes

such effects will likely continue to affect its assets and

operations in the foreseeable future particularly from salaries and

wages pressure, workforce shortages, supply chain disruption and

broad inflationary pressures. Our ability to make estimates of any

such continuing effects on future revenues, expenses or changes in

accounting judgments that have had or are reasonably likely to have

a material effect on our financial statements is very limited,

depending as they do on the severity and length thereof; as well as

any further government actions and/or regulatory changes intended

to address such effects.

SunLink Health Systems, Inc. is the parent company of

subsidiaries that own and operate a pharmacy business and an

information technology business in the Southeast. For additional

information on SunLink Health Systems, Inc., please visit the

Company’s website.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 including, without limitation, statements regarding the

company’s business strategy. These forward-looking statements are

subject to certain risks, uncertainties, and other factors, which

could cause actual results, performance, and achievements to differ

materially from those anticipated. Certain of those risks,

uncertainties and other factors are disclosed in more detail in the

company’s Annual Report on Form 10-K for the year ended June 30,

2024 and other filings with the Securities and Exchange Commission

which can be located at www.sec.gov.

SUNLINK HEALTH SYSTEMS, INC. ANNOUNCES FISCAL 2024 FOURTH

QUARTER AND ANNUAL RESULTS Amounts in 000's, except per

share CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

Three Months Ended June 30, Twelve Months Ended June

30,

2024

2023

2024

2023

% of Net % of Net % of Net % of Net

Amount Revenues Amount Revenues Amount Revenues

Amount Revenues Net

revenues

$

7,913

100.0

%

$

8,010

100.0

%

$

32,440

100.0

%

$

34,280

100.0

%

Costs and Expenses: Cost of goods sold

4,382

55.4

%

4,929

61.5

%

18,253

56.3

%

18,571

54.2

%

Salaries, wages and benefits

2,624

33.2

%

2,609

32.6

%

10,561

32.6

%

10,156

29.6

%

Supplies

44

0.6

%

36

0.4

%

153

0.5

%

140

0.4

%

Purchased services

298

3.8

%

319

4.0

%

1,130

3.5

%

1,107

3.2

%

Other operating expenses

735

9.3

%

744

9.3

%

3,014

9.3

%

2,598

7.6

%

Rent and leases

92

1.2

%

96

1.2

%

367

1.1

%

372

1.1

%

Depreciation and amortization

413

5.2

%

389

4.9

%

1,373

4.2

%

1,262

3.7

%

Operating profit (loss)

(675

)

-8.5

%

(1,112

)

-13.9

%

(2,411

)

-7.4

%

74

0.2

%

Interest Income - net

23

0.3

%

74

0.9

%

93

0.3

%

87

0.3

%

Gain on sale of assets

0

0.0

%

17

0.2

%

2

0.0

%

30

0.1

%

Earnings (Loss) from Continuing Operations before Income

Taxes

(652

)

-8.2

%

(1,021

)

-12.7

%

(2,316

)

-7.1

%

191

0.6

%

Income Tax benefit

0

0.0

%

0

0.0

%

(5

)

0.0

%

(7

)

0.0

%

Earnings (Loss) from Continuing Operations

(652

)

-8.2

%

(1,021

)

-12.7

%

(2,311

)

-7.1

%

198

0.6

%

Earnings (Loss) from Discontinued Operations, net of tax

4,940

62.4

%

(405

)

-5.1

%

784

2.4

%

(1,993

)

-5.8

%

Net Loss

$

4,288

54.2

%

$

(1,426

)

-17.8

%

$

(1,527

)

-4.7

%

$

(1,795

)

-5.2

%

Earnings (Loss) Per Share from Continuing Operations: Basic

$

(0.09

)

$

(0.15

)

$

(0.33

)

$

0.03

Diluted

$

(0.09

)

$

(0.15

)

$

(0.33

)

$

0.03

Loss Per Share from Discontinued Operations: Basic

$

0.70

$

(0.06

)

$

0.11

$

(0.28

)

Diluted

$

0.70

$

(0.06

)

$

0.11

$

(0.28

)

Net Loss Per Share: Basic

$

0.61

$

(0.20

)

$

(0.22

)

$

(0.26

)

Diluted

$

0.61

$

(0.20

)

$

(0.22

)

$

(0.26

)

Weighted Average Common Shares Outstanding: Basic

7,041

7,032

7,038

7,019

Diluted

7,041

7,032

7,038

7,022

SUMMARY BALANCE SHEETS June 30, June

30,

2024

2023

ASSETS Cash and Cash Equivalents

$

7,170

$

4,486

Receivable - net

3,371

2,592

Current Assets Held for Sale

1,959

1,920

Other Current Assets

3,164

3,276

Property Plant and Equipment, net

2,809

2,717

Long-term Assets

2,139

8,277

$

20,612

$

23,268

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities

$

4,213

$

4,869

Noncurrent Liabilities

426

982

Shareholders' Equity

15,973

17,417

$

20,612

$

23,268

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930244290/en/

Robert M. Thornton, Jr. Chief Executive Officer

(770) 933-7004

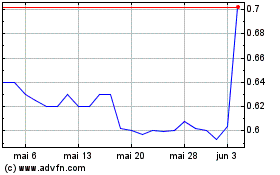

Sunlink Health Systems (AMEX:SSY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Sunlink Health Systems (AMEX:SSY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024