Broadstone Net Lease, Inc. (NYSE: BNL) (“BNL”, the “Company”,

“we”, “our”, or “us”), today announced its operating results for

the year and quarter ended December 31, 2023, and its healthcare

portfolio simplification strategy.

MANAGEMENT COMMENTARY

“I am incredibly proud of our 2023 results, which we were able

to deliver despite significant economic headwinds and capital

market volatility through the year. We thoughtfully navigated a

challenging environment by intentionally focusing on portfolio

composition and quality which we believe will be the catalyst for

increasing shareholder value as markets stabilize,” said John

Moragne, BNL’s Chief Executive Officer. “We employed a disciplined

and selective approach to all aspects of our investment cycle:

intentionally evading risk and creatively sourcing investment

opportunities that were created by the distressed lending

environment and complementary to our core competencies and asset

classes; maintaining a high quality portfolio of diversified

properties with strong operating metrics; pruning tenant credit

risk and lease rollover risk through selective dispositions with

attractive spreads to redeployment yields; and maintaining a

fortified investment grade balance sheet with low leverage at 5.0x,

no material debt maturities until 2026, and ample liquidity to

capitalize on additional investment opportunities. As a result, we

were able to achieve $1.41 per share of AFFO, in line with the

midpoint of our guidance range.”

FULL YEAR 2023 HIGHLIGHTS

INVESTMENT

ACTIVITY

- We completed investments totaling $165.6 million, including

$97.2 million in development fundings, $42.8 million in revenue

generating capital expenditures, and $25.6 million in new property

acquisitions. The revenue generating capital expenditures and new

property acquisitions had a weighted average initial cash

capitalization rate of 7.2%, lease term of 15.5 years, and annual

rent increase of 1.8%.

- In 2023 and through the date of this release, we sold 14

properties for gross proceeds of $200.1 million at a weighted

average cash capitalization rate of 6.0% on tenanted properties.

The gross proceeds represented a $35.0 million gain over original

purchase price.

- Subsequent to year-end, we invested an additional $12.3 million

in development fundings and $3.0 million in revenue generating

capital expenditures. As of the date of this release, we have $97.1

million of acquisitions under control, $98.9 million of commitments

to fund developments, and $6.8 million of commitments to fund

revenue generating capital expenditures with existing tenants.

- Subsequent to year end, we executed contracts to sell 37

clinical, surgical, and traditional medical office building (“MOB”)

properties for approximately $253.0 million at a weighted average

cash capitalization rate of 7.9%. The agreed upon sales price

represents a gain of $0.8 million over their original purchase

price. See Healthcare Portfolio Simplification Strategy section

below for additional information.

OPERATING

RESULTS

- Collected 99.8% of base rents due for the year for all

properties under lease.

- Portfolio was 99.4% leased based on rentable square footage,

with only two of our 796 properties vacant and not subject to a

lease at year end.

- Incurred $39.4 million of general and administrative expenses,

inclusive of $6.0 million of stock-based compensation and $1.6

million of severance and executive transition costs.

- Generated net income of $163.3 million, or $0.83 per

share.

- Generated adjusted funds from operations (“AFFO”) of $277.7

million, or $1.41 per share, in-line with the midpoint of our

guidance range.

CAPITAL MARKETS ACTIVITY

- Ended the year with total outstanding debt of $1.9 billion, Net

Debt of $1.9 billion, and a Net Debt to Annualized Adjusted

EBITDAre ratio (“Leverage Ratio”) of 5.0x.

- At December 31, 2023, had $909.6 million of capacity on our

Revolving Credit Facility.

- At December 31, 2023, had $145.4 million of capacity remaining

on our at-the-market common equity offering (“ATM Program”).

- On March 14, 2023, our board of directors approved a $150.0

million common stock repurchase program. We did not repurchase any

shares under the Repurchase Program during the year.

- Declared dividends of $1.12 in 2023, representing a 3.7%

increase over prior year.

- At its February 16, 2024, meeting, our Board of Directors

declared a quarterly dividend of $0.285 per common share and OP

Unit to holders of record as of March 29, 2024, payable on or

before April 15, 2024.

FOURTH QUARTER 2023 HIGHLIGHTS

INVESTMENT ACTIVITY

- During the fourth quarter, we invested $64.1 million in three

industrial properties and two restaurant properties, including

$47.9 million in both new and existing development fundings and

$16.2 million in revenue generating capital expenditures. Revenue

generating capital expenditures had a weighted average initial cash

capitalization rate of 7.5%, lease term of 12.7 years, and annual

rent increase of 1.5%.

- During the fourth quarter, we sold five properties for gross

proceeds of $16.5 million at a weighted average cash capitalization

rate of 6.7%, representing a $5.3 million gain over their original

purchase price.

OPERATING

RESULTS

- Collected 99.2% of base rents due for the fourth quarter for

all properties subject to a lease. Outstanding base rents relate

solely to Green Valley Medical Center, whereby rents were scheduled

to commence in October 2023.

- Incurred $9.4 million of general and administrative expenses,

inclusive of $1.4 million of stock-based compensation and $0.2

million of severance and executive transition costs.

- Generated net income of $6.8 million, or $0.03 per diluted

share.

- Generated AFFO of $71.3 million, or $0.36 per share.

HEALTHCARE PORTFOLIO SIMPLIFICATION STRATEGY

Subsequent to quarter end, we made the strategic decision to

sell our clinically-oriented healthcare properties, furthering our

focus on core net lease assets in the industrial, retail, and

restaurant sectors. The assets identified for sale are not

customarily included in single tenant net lease portfolios and

include clinical, surgical, and traditional MOB properties. These

types of assets generally have shorter lease durations, greater

landlord responsibilities, longer potential downtime upon lease

maturity, and in some cases, greater potential challenges with

tenants. The characteristics of these assets can make them

attractive for a dedicated healthcare property investor and

manager, but those same characteristics can make them challenging

in the net lease space.

In total, we have identified 75 healthcare assets for sale that

account for approximately 11% of total annualized base rent (“ABR”)

with proceeds expected to be redeployed into our core industrial,

retail, and restaurant assets. On a proforma basis as of December

31, 2023, the sale of all clinically-oriented healthcare properties

will reduce our healthcare assets from 17.6% to 7.5% of our

portfolio based on ABR, and our scheduled healthcare lease

maturities through 2030 by 76.2%.

Of the properties identified for sale, we have executed

contracts on 37 healthcare properties for approximately $253.0

million at a weighted average cash capitalization rate of 7.9%,

representing a $0.8 million gain over original purchase price. The

properties represent approximately $19.9 million or 5.1% of our

December 31, 2023 ABR, 28.7% of our healthcare portfolio, and have

a weighted average remaining lease term of 4.7 years. We anticipate

the transactions will close during the first quarter of 2024. The

remaining healthcare properties identified for sale are in varying

stages of sales efforts.

Following the sales, the remaining assets in our healthcare

portfolio will consist of consumer-centric medical properties that

are customary for many publicly-traded net lease REITs, examples of

which include plasma, dialysis, and veterinary services; assets

with real estate fundamentals critical to the tenant’s business and

little to no regulatory risk. Refer to our fourth quarter 2023

investor presentation for more detailed information regarding our

healthcare portfolio simplification strategy.

As part of our healthcare portfolio simplification strategy, we

made the decision to sell Green Valley Medical Center after the

tenant failed to pay rent since October 2023 as the result of not

meeting certain operational thresholds, and we are actively

marketing the property through the date of this release. The

decision resulted in us recognizing approximately $26.4 million of

impairment during the quarter, and the tenant’s unpaid rents

represent the only outstanding rents of our 99.2% quarterly rent

collections. The tenant is responsible for all ongoing property

costs under the terms of the lease.

In reference to BNL’s healthcare portfolio simplification

strategy, John Moragne, BNL’s Chief Executive Officer, said, “As

I’ve highlighted in recent quarters, we continue to focus more

heavily on net lease industrial assets, while continuing to have

deep conviction in net lease retail and restaurant assets, and have

taken a hard look at property types that don’t fit within our

investment thesis, particularly clinical, surgical, and traditional

medical office building assets. Tenant bankruptcies, hands-on

property management, heavier landlord responsibilities and costs,

and messaging complexity in these properties has been an

unnecessary distraction from our otherwise prudent and successful

capital allocations. Our healthcare portfolio simplification

strategy is an extension of our focus on portfolio quality and

evolution, which we believe will result in meaningful value

creation for investors.”

SUMMARIZED FINANCIAL RESULTS

For the Year Ended

For the Three Months

Ended

(in thousands, except per share data)

December 31, 2023

December 31, 2022

December 31, 2023

September 30, 2023

December 31, 2022

Revenues

$

442,888

$

407,513

$

105,000

$

109,543

$

112,135

Net income, including non-controlling

interests

$

163,312

$

129,475

$

6,797

$

52,145

$

36,773

Net earnings per share - diluted

$

0.83

$

0.72

$

0.03

$

0.26

$

0.20

FFO

$

298,622

$

273,730

$

69,443

$

75,478

$

71,718

FFO per share

$

1.52

$

1.52

$

0.35

$

0.39

$

0.39

Core FFO

$

298,883

$

267,265

$

75,275

$

74,754

$

70,527

Core FFO per share

$

1.52

$

1.48

$

0.38

$

0.38

$

0.38

AFFO

$

277,725

$

252,173

$

71,278

$

69,958

$

65,585

AFFO per share

$

1.41

$

1.40

$

0.36

$

0.36

$

0.36

Diluted Weighted Average Shares

Outstanding

196,315

180,201

196,373

196,372

183,592

FFO, Core FFO, and AFFO are measures that are not calculated in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). See the Reconciliation of

Non-GAAP Measures later in this press release.

REAL ESTATE PORTFOLIO UPDATE

As of December 31, 2023, we owned a diversified portfolio of 796

individual net leased commercial properties with 789 properties

located in 44 U.S. states and seven properties located in four

Canadian provinces, comprising approximately 38.3 million rentable

square feet of operational space. As of December 31, 2023, all but

two of our properties were subject to a lease, and our properties

were occupied by 220 different commercial tenants, with no single

tenant accounting for more than 4.1% of ABR. Properties subject to

a lease represent 99.4% of our portfolio's rentable square footage.

The ABR weighted average lease term and ABR weighted average annual

minimum rent increase, pursuant to leases on properties in the

portfolio as of December 31, 2023, was 10.5 years and 2.0%,

respectively.

BALANCE SHEET AND CAPITAL MARKETS ACTIVITIES

As of December 31, 2023, we had total outstanding debt of $1.9

billion, Net Debt of $1.9 billion, and a Leverage Ratio of 5.0x. We

had $909.6 million of available capacity on our revolving credit

facility as of year end, and have no material debt maturities until

2026.

We did not raise any equity during the quarter and year, and had

approximately $145.4 million of capacity remaining on our ATM

Program as of December 31, 2023.

DISTRIBUTIONS

At its February 16, 2024, meeting, our board of directors

declared a quarterly dividend of $0.285 per common share and OP

Unit to holders of record as of March 29, 2024, payable on or

before April 15, 2024.

2024 GUIDANCE

For 2024, BNL expects to report AFFO of $1.41 per diluted

share.

The guidance is based on the following key assumptions:

(i)

investments in real estate properties between $350 million and

$700 million;

(ii)

dispositions of real estate properties between $300 million and

$500 million; and

(iii)

total cash general and administrative expenses between $32

million and $34 million.

Our per share results are sensitive to both the timing and

amount of real estate investments, property dispositions, and

capital markets activities that occur throughout the year.

The Company does not provide guidance for the most comparable

GAAP financial measure, net income, or a reconciliation of the

forward-looking non-GAAP financial measure of AFFO to net income

computed in accordance with GAAP, because it is unable to

reasonably predict, without unreasonable efforts, certain items

that would be contained in the GAAP measure, including items that

are not indicative of the Company’s ongoing operations, including,

without limitation, potential impairments of real estate assets,

net gain/loss on dispositions of real estate assets, changes in

allowance for credit losses, and stock-based compensation expense.

These items are uncertain, depend on various factors, and could

have a material impact on the Company’s GAAP results for the

guidance periods.

CONFERENCE CALL AND WEBCAST

The company will host its fourth quarter earnings conference

call and audio webcast on Thursday, February 22, 2024, at 11:00

a.m. Eastern Time.

To access the live webcast, which will be available in

listen-only mode, please visit:

https://events.q4inc.com/attendee/958546087. If you prefer to

listen via phone, U.S. participants may dial: 1-833-470-1428 (toll

free) or 1-404-975-4839 (local), access code 822981. International

access numbers are viewable here:

https://www.netroadshow.com/events/global-numbers?confId=59986.

A replay of the conference call webcast will be available

approximately one hour after the conclusion of the live broadcast.

To listen to a replay of the call via the web, which will be

available for one year, please visit:

https://investors.bnl.broadstone.com.

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that

invests in primarily single-tenant commercial real estate

properties that are net leased on a long-term basis to a

diversified group of tenants. Utilizing an investment strategy

underpinned by strong fundamental credit analysis and prudent real

estate underwriting, as of December 31, 2023, BNL’s diversified

portfolio consisted of 796 individual net leased commercial

properties with 789 properties located in 44 U.S. states and seven

properties located in four Canadian provinces across the

industrial, healthcare, restaurant, retail, and office property

types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “outlook,” “potential,” “may,”

“will,” “should,” “could,” “seeks,” “approximately,” “projects,”

“predicts,” “expect,” “intends,” “anticipates,” “estimates,”

“plans,” “would be,” “believes,” “continues,” or the negative

version of these words or other comparable words. Forward-looking

statements, including our 2023 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company's Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, which BNL expects to file with the

SEC on February 22, 2024, which you are encouraged to read, and

will be available on the SEC’s website at www.sec.gov. Should one

or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. The Company assumes no

obligation to, and does not currently intend to, update any

forward-looking statements after the date of this press release,

whether as a result of new information, future events, changes in

assumptions, or otherwise.

Notice Regarding Non-GAAP Financial Measures

In addition to our reported results and net earnings per diluted

share, which are financial measures presented in accordance with

GAAP, this press release contains and may refer to certain non-GAAP

financial measures, including Funds from Operations (“FFO”), Core

Funds From Operations (“Core FFO”), Adjusted Funds from Operations

(“AFFO”), Net Debt, and Net Debt to Annualized Adjusted EBITDAre.

We believe the use of FFO, Core FFO, and AFFO are useful to

investors because they are widely accepted industry measures used

by analysts and investors to compare the operating performance of

REITs. FFO, Core FFO, and AFFO should not be considered

alternatives to net income as a performance measure or to cash

flows from operations, as reported on our statement of cash flows,

or as a liquidity measure, and should be considered in addition to,

and not in lieu of, GAAP financial measures. We believe presenting

Net Debt to Annualized Adjusted EBITDAre is useful to investors

because it provides information about gross debt less cash and cash

equivalents, which could be used to repay debt, compared to our

performance as measured using Annualized Adjusted EBITDAre. You

should not consider our Annualized Adjusted EBITDAre as an

alternative to net income or cash flows from operating activities

determined in accordance with GAAP. A reconciliation of non-GAAP

measures to the most directly comparable GAAP financial measure and

statements of why management believes these measures are useful to

investors are included below.

Broadstone Net Lease, Inc. and

Subsidiaries

Consolidated Balance Sheets

(in thousands, except per share

amounts)

December 31, 2023

December 31, 2022

Assets

Accounted for using the operating

method:

Land

$

748,529

$

768,667

Land improvements

328,746

340,385

Buildings and improvements

3,803,156

3,888,756

Equipment

8,265

10,422

Total accounted for using the operating

method

4,888,696

5,008,230

Less accumulated depreciation

(626,597

)

(533,965

)

Accounted for using the operating method,

net

4,262,099

4,474,265

Accounted for using the direct financing

method

26,643

27,045

Accounted for using the sales-type

method

572

571

Property under development

94,964

—

Investment in rental property, net

4,384,278

4,501,881

Cash and cash equivalents

19,494

21,789

Accrued rental income

152,724

135,666

Tenant and other receivables, net

1,487

1,349

Prepaid expenses and other assets

36,661

64,180

Interest rate swap, assets

46,096

63,390

Goodwill

339,769

339,769

Intangible lease assets, net

288,226

329,585

Total assets

$

5,268,735

$

5,457,609

Liabilities and equity

Unsecured revolving credit facility

$

90,434

$

197,322

Mortgages, net

79,068

86,602

Unsecured term loans, net

895,947

894,692

Senior unsecured notes, net

845,309

844,555

Accounts payable and other liabilities

47,534

47,547

Dividends payable

56,869

54,460

Accrued interest payable

5,702

7,071

Intangible lease liabilities, net

53,531

62,855

Total liabilities

2,074,394

2,195,104

Commitments and contingencies

Equity

Broadstone Net Lease, Inc. equity:

Preferred stock, $0.001 par value; 20,000

shares authorized, no shares issued or outstanding

—

—

Common stock, $0.00025 par value; 500,000

shares authorized, 187,614 and 186,114 shares issued and

outstanding at December 31, 2023 and 2022, respectively

47

47

Additional paid-in capital

3,440,639

3,419,395

Cumulative distributions in excess of

retained earnings

(440,731

)

(386,049

)

Accumulated other comprehensive income

49,286

59,525

Total Broadstone Net Lease, Inc.

equity

3,049,241

3,092,918

Non-controlling interests

145,100

169,587

Total equity

3,194,341

3,262,505

Total liabilities and equity

$

5,268,735

$

5,457,609

Broadstone Net Lease, Inc. and

Subsidiaries

Consolidated Statements of Income

and Comprehensive Income

(in thousands, except per share

amounts)

(Unaudited)

For the Three Months

Ended

For the Year Ended

December 31, 2023

September 30, 2023

December 31, 2023

December 31, 2022

Revenues

Lease revenues, net

$

105,000

$

109,543

$

442,888

$

407,513

Operating expenses

Depreciation and amortization

39,278

38,533

158,626

154,807

Property and operating expense

5,995

5,707

22,576

21,773

General and administrative

9,383

10,143

39,425

37,375

Provision for impairment of investment in

rental properties

29,801

—

31,274

5,535

Total operating expenses

84,457

54,383

251,901

219,490

Other (expenses) income

Interest income

141

127

512

44

Interest expense

(18,972

)

(19,665

)

(80,053

)

(78,652

)

Gain on sale of real estate

6,270

15,163

54,310

15,953

Income taxes

268

(104

)

(763

)

(1,275

)

Other (expenses) income

(1,453

)

1,464

(1,681

)

5,382

Net income

6,797

52,145

163,312

129,475

Net income attributable to non-controlling

interests

(319

)

(2,463

)

(7,834

)

(7,360

)

Net income attributable to Broadstone

Net Lease, Inc.

$

6,478

$

49,682

$

155,478

$

122,115

Weighted average number of common

shares outstanding

Basic

186,829

186,766

186,617

169,840

Diluted

196,373

196,372

196,315

180,201

Net earnings per common share

Basic

$

0.03

$

0.27

$

0.83

$

0.72

Diluted

$

0.03

$

0.26

$

0.83

$

0.72

Comprehensive income

Net income

$

6,797

$

52,145

$

163,312

$

129,475

Other comprehensive income

Change in fair value of interest rate

swaps

(32,989

)

13,943

(17,293

)

90,560

Realized loss on interest rate swaps

317

522

1,883

2,514

Comprehensive (loss) income

(25,875

)

66,610

147,902

222,549

Comprehensive loss (income) attributable

to non-controlling interests

1,215

(3,147

)

(7,070

)

(12,700

)

Comprehensive (loss) income attributable

to Broadstone Net Lease, Inc.

$

(24,660

)

$

63,463

$

140,832

$

209,849

Reconciliation of Non-GAAP Measures

The following is a reconciliation of net income to FFO, Core

FFO, and AFFO for the three months ended December 31, 2023 and

September 30, 2023 and for the year ended December 31, 2023 and

2022. Also presented is the weighted average number of shares of

our common stock and OP Units used for the diluted per share

computation:

For the Three Months

Ended

For the Year Ended

(in thousands, except per share data)

December 31, 2023

September 30, 2023

December 31, 2023

December 31, 2022

Net income

$

6,797

$

52,145

$

163,312

$

129,475

Real property depreciation and

amortization

39,115

38,496

158,346

154,673

Gain on sale of real estate

(6,270

)

(15,163

)

(54,310

)

(15,953

)

Provision for impairment on investment in

rental properties

29,801

—

31,274

5,535

FFO

$

69,443

$

75,478

$

298,622

$

273,730

Net write-offs of accrued rental

income

4,161

—

4,458

1,326

Lease termination fees

—

—

(7,500

)

(2,469

)

Cost of debt extinguishment

—

—

—

(341

)

Gain on insurance recoveries

—

—

3

308

Severance and executive transition

costs

218

740

1,622

401

Other expenses (income)(1)

1,453

(1,464

)

1,678

(5,690

)

Core FFO

$

75,275

$

74,754

$

298,883

$

267,265

Straight-line rent adjustment

(5,404

)

(6,785

)

(26,736

)

(21,900

)

Adjustment to provision for credit

losses

—

—

(10

)

(5

)

Amortization of debt issuance costs

983

983

3,938

3,692

Amortization of net mortgage premiums

—

—

(78

)

(104

)

Loss on interest rate swaps and other

non-cash interest expense

319

522

1,884

2,514

Amortization of lease intangibles

(1,014

)

(1,056

)

(5,846

)

(4,809

)

Stock-based compensation

1,401

1,540

5,972

5,316

Deferred taxes

(282

)

—

(282

)

204

AFFO

$

71,278

$

69,958

$

277,725

$

251,969

Diluted WASO(2)

196,373

196,372

196,315

180,201

Net earnings per diluted share(3)

$

0.03

$

0.26

$

0.83

$

0.72

FFO per share(3)

0.35

0.39

1.52

1.52

Core FFO per share(3)

0.38

0.38

1.52

1.48

AFFO per share(3)

0.36

0.36

1.41

1.40

1

Amount includes $1.5 million and $(1.4)

million of unrealized foreign exchange loss (gain) for the three

months ended December 31, 2023 and September 30, 2023,

respectively, and $1.7 and $(5.6) million of unrealized foreign

exchange loss (gain) for the year ended December 31, 2023 and 2022,

primarily associated with our Canadian dollar denominated revolving

borrowings.

2

Excludes 493,524 and 506,172 weighted

average shares of unvested restricted common stock for the three

months ended December 31, 2023 and September 30, 2023,

respectively. Excludes 492,046 and 396,383 weighted average shares

of unvested restricted common stock for the year ended December 31,

2023 and 2022, respectively.

3

Excludes $0.1 million from the numerator

for the three months ended December 31, 2023 and September 30,

2023, respectively, and $0.5 million and $0.4 million from the

numerator for the year ended December 31, 2023 and 2022,

respectively, related to dividends paid or declared on shares of

unvested restricted common stock.

Our reported results and net earnings per diluted share are

presented in accordance with GAAP. We also disclose FFO, Core FFO,

and AFFO, each of which are non-GAAP measures. We believe the use

of FFO, Core FFO, and AFFO are useful to investors because they are

widely accepted industry measures used by analysts and investors to

compare the operating performance of REITs. FFO, Core FFO, and AFFO

should not be considered alternatives to net income as a

performance measure or to cash flows from operations, as reported

on our statement of cash flows, or as a liquidity measure and

should be considered in addition to, and not in lieu of, GAAP

financial measures.

We compute FFO in accordance with the standards established by

the Board of Governors of Nareit, the worldwide representative

voice for REITs and publicly traded real estate companies with an

interest in the U.S. real estate and capital markets. Nareit

defines FFO as GAAP net income or loss adjusted to exclude net

gains (losses) from sales of certain depreciated real estate

assets, depreciation and amortization expense from real estate

assets, and impairment charges related to certain previously

depreciated real estate assets. FFO is used by management,

investors, and analysts to facilitate meaningful comparisons of

operating performance between periods and among our peers,

primarily because it excludes the effect of real estate

depreciation and amortization and net gains (losses) on sales,

which are based on historical costs and implicitly assume that the

value of real estate diminishes predictably over time, rather than

fluctuating based on existing market conditions.

We compute Core FFO by adjusting FFO, as defined by Nareit, to

exclude certain GAAP income and expense amounts that we believe are

infrequently recurring, unusual in nature, or not related to its

core real estate operations, including write-offs or recoveries of

accrued rental income, lease termination fees, gain on insurance

recoveries, cost of debt extinguishments, unrealized and realized

gains or losses on foreign currency transactions, severance and

executive transition costs, and other extraordinary items.

Exclusion of these items from similar FFO-type metrics is common

within the equity REIT industry, and management believes that

presentation of Core FFO provides investors with a metric to assist

in their evaluation of our operating performance across multiple

periods and in comparison to the operating performance of our

peers, because it removes the effect of unusual items that are not

expected to impact our operating performance on an ongoing

basis.

We compute AFFO by adjusting Core FFO for certain non-cash

revenues and expenses, including straight-line rents, amortization

of lease intangibles, adjustment to provision for credit losses,

amortization of debt issuance costs, amortization of net mortgage

premiums, (gain) loss on interest rate swaps and other non-cash

interest expense, deferred taxes, stock-based compensation, and

other specified non-cash items. We believe that excluding such

items assists management and investors in distinguishing whether

changes in our operations are due to growth or decline of

operations at our properties or from other factors. We use AFFO as

a measure of our performance when we formulate corporate goals, and

is a factor in determining management compensation. We believe that

AFFO is a useful supplemental measure for investors to consider

because it will help them to better assess our operating

performance without the distortions created by non-cash revenues or

expenses.

Specific to our adjustment for straight-line rents, our leases

include cash rents that increase over the term of the lease to

compensate us for anticipated increases in market rental rates over

time. Our leases do not include significant front-loading or

back-loading of payments, or significant rent-free periods.

Therefore, we find it useful to evaluate rent on a contractual

basis as it allows for comparison of existing rental rates to

market rental rates.

FFO, Core FFO, and AFFO may not be comparable to similarly

titled measures employed by other REITs, and comparisons of our

FFO, Core FFO, and AFFO with the same or similar measures disclosed

by other REITs may not be meaningful.

Neither the SEC nor any other regulatory body has passed

judgment on the acceptability of the adjustments to FFO that we use

to calculate Core FFO and AFFO. In the future, the SEC, Nareit or

another regulatory body may decide to standardize the allowable

adjustments across the REIT industry and in response to such

standardization we may have to adjust our calculation and

characterization of Core FFO and AFFO accordingly.

The following is a reconciliation of net income to EBITDA,

EBITDAre, and Adjusted EBITDAre, debt to Net Debt and Net Debt to

Annualized Adjusted EBITDAre as of and for the three months ended

December 31, 2023, September 30, 2023, and December 31, 2022:

For the Three Months

Ended

(in thousands)

December 31, 2023

September 30, 2023

December 31, 2022

Net income

$

6,797

$

52,145

$

36,773

Depreciation and amortization

39,278

38,533

45,606

Interest expense

18,972

19,665

23,773

Income taxes

(268

)

104

105

EBITDA

$

64,779

$

110,447

$

106,257

Provision for impairment of investment in

rental properties

29,801

—

—

Gain on sale of real estate

(6,270

)

(15,163

)

(10,625

)

EBITDAre

$

88,310

$

95,284

$

95,632

Adjustment for current quarter investment

activity (1)

153

26

1,283

Adjustment for current quarter disposition

activity (2)

(156

)

(400

)

(440

)

Adjustment to exclude non-recurring and

other expenses (income) (3)

128

740

—

Adjustment to exclude net write-offs of

accrued rental income

4,161

—

—

Adjustment to exclude gain on insurance

recoveries

—

—

(341

)

Adjustment to exclude realized /

unrealized foreign exchange (gain) loss

1,453

(1,433

)

796

Adjustment to exclude cost of debt

extinguishments

—

—

77

Adjustment to exclude lease termination

fees

—

—

(1,678

)

Adjusted EBITDAre

$

94,049

$

94,217

$

95,329

Annualized EBITDAre

$

353,240

$

381,136

$

382,528

Annualized Adjusted EBITDAre

$

376,196

$

376,868

$

381,316

1

Reflects an adjustment to give effect to

all investments during the quarter as if they had been made as of

the beginning of the quarter.

2

Reflects an adjustment to give effect to

all dispositions during the quarter as if they had been sold as of

the beginning of the quarter.

3

Amount includes $0.2 million of employee

severance and executive transition costs and ($0.1) million of

forfeited stock-based compensation for the three months ended

December 31, 2023 and $0.7 million of employee severance and

executive transition costs during the three months ended September

30, 2023.

(in thousands)

December 31, 2023

September 30, 2023

December 31, 2022

Debt

Unsecured revolving credit facility

$

90,434

$

74,060

$

197,322

Unsecured term loans, net

895,947

895,633

894,692

Senior unsecured notes, net

845,309

845,121

844,555

Mortgages, net

79,068

79,613

86,602

Debt issuance costs

8,848

9,360

10,905

Gross Debt

1,919,606

1,903,787

2,034,076

Cash and cash equivalents

(19,494

)

(35,061

)

(21,789

)

Restricted cash

(1,138

)

(15,436

)

(38,251

)

Net Debt

$

1,898,974

$

1,853,290

$

1,974,036

Net Debt to Annualized EBITDAre

5.4x

4.9x

5.2x

Net Debt to Annualized Adjusted

EBITDAre

5.0x

4.9x

5.2x

We define Net Debt as gross debt (total reported debt plus debt

issuance costs) less cash and cash equivalents and restricted cash.

We believe that the presentation of Net Debt to Annualized EBITDAre

and Net Debt to Annualized Adjusted EBITDAre is useful to investors

and analysts because these ratios provide information about gross

debt less cash and cash equivalents, which could be used to repay

debt, compared to our performance as measured using EBITDAre.

We compute EBITDA as earnings before interest, income taxes and

depreciation and amortization. EBITDA is a measure commonly used in

our industry. We believe that this ratio provides investors and

analysts with a measure of our performance that includes our

operating results unaffected by the differences in capital

structures, capital investment cycles and useful life of related

assets compared to other companies in our industry. We compute

EBITDAre in accordance with the definition adopted by Nareit, as

EBITDA excluding gains (losses) from the sales of depreciable

property and provisions for impairment on investment in real

estate. We believe EBITDA and EBITDAre are useful to investors and

analysts because they provide important supplemental information

about our operating performance exclusive of certain non-cash and

other costs. EBITDA and EBITDAre are not measures of financial

performance under GAAP, and our EBITDA and EBITDAre may not be

comparable to similarly titled measures of other companies. You

should not consider our EBITDA and EBITDAre as alternatives to net

income or cash flows from operating activities determined in

accordance with GAAP.

We are focused on a disciplined and targeted investment

strategy, together with active asset management that includes

selective sales of properties. We manage our leverage profile using

a ratio of Net Debt to Annualized Adjusted EBITDAre, discussed

below, which we believe is a useful measure of our ability to repay

debt and a relative measure of leverage, and is used in

communications with our lenders and rating agencies regarding our

credit rating. As we fund new investments using our unsecured

revolving credit facility, our leverage profile and Net Debt will

be immediately impacted by current quarter investments. However,

the full benefit of EBITDAre from new investments will not be

received in the same quarter in which the properties are acquired.

Additionally, EBITDAre for the quarter includes amounts generated

by properties that have been sold during the quarter. Accordingly,

the variability in EBITDAre caused by the timing of our investments

and dispositions can temporarily distort our leverage ratios. We

adjust EBITDAre (“Adjusted EBITDAre”) for the most recently

completed quarter (i) to recalculate as if all investments and

dispositions had occurred at the beginning of the quarter, (ii) to

exclude certain GAAP income and expense amounts that are either

non-cash, such as cost of debt extinguishments, realized or

unrealized gains and losses on foreign currency transactions, or

gains on insurance recoveries, or that we believe are one time, or

unusual in nature because they relate to unique circumstances or

transactions that had not previously occurred and which we do not

anticipate occurring in the future, and (iii) to eliminate the

impact of lease termination fees and other items, that are not a

result of normal operations. While investments in property

developments have an immediate impact to Net Debt, we do not make

an adjustment to EBITDAre until the quarter in which the lease

commences. We then annualize quarterly Adjusted EBITDAre by

multiplying it by four (“Annualized Adjusted EBITDAre”). You should

not unduly rely on this measure as it is based on assumptions and

estimates that may prove to be inaccurate. Our actual reported

EBITDAre for future periods may be significantly different from our

Annualized Adjusted EBITDAre. Adjusted EBITDAre and Annualized

Adjusted EBITDAre are not measurements of performance under GAAP,

and our Adjusted EBITDAre and Annualized Adjusted EBITDAre may not

be comparable to similarly titled measures of other companies. You

should not consider our Adjusted EBITDAre and Annualized Adjusted

EBITDAre as alternatives to net income or cash flows from operating

activities determined in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221682114/en/

Company: Brent Maedl Director, Corporate Finance &

Investor Relations brent.maedl@broadstone.com 585.382.8507

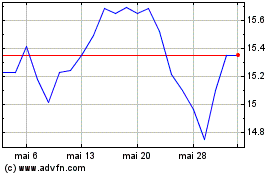

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025