BlackRock to Acquire SpiderRock Advisors

08 Março 2024 - 12:39PM

Business Wire

Acquisition will expand BlackRock’s offerings

in personalized separately managed accounts

SMAs are one of the fastest growing product

segments in the U.S. wealth industry

BlackRock (NYSE: BLK) has agreed to acquire the remaining equity

interest in SpiderRock Advisors (“SRA”), a leading provider of

customized option overlay strategies in the U.S. wealth market.

This transaction expands on BlackRock’s minority investment in SRA

made in 2021 and reinforces BlackRock’s commitment to personalized

separately managed accounts (SMAs).

“By giving BlackRock more SMA capabilities, this acquisition

will enable us to meet growing demand from wealth managers for

personalized, tax-efficient portfolios. We look forward to fully

integrating SRA’s team and capabilities into our U.S. Wealth

Advisory business and to further expanding our offerings in SMA

solutions,” said Joe DeVico, Co-Head of BlackRock's U.S. Wealth

Advisory business.

SMAs are one of the fastest-growing product segments in the U.S.

wealth industry. They are expected to grow from $2.7 trillion in

AUM as of Q3 2023 to $4 trillion by 2026 according to Cerulli

Associates, fueled by a fundamental client need: the desire to

customize portfolios for unique tax, values-alignment, or

investment outcomes. Advances in technology have made it even

easier to access SMAs, and client demand for personalization

continues to grow.

“Each investor has unique circumstances inherent with a

concentrated stock position or existing SMA portfolio. SRA’s highly

complementary solutions can provide advisors with a comprehensive

suite of customization capabilities that help solve clients’ unique

challenges, such as income generation, downside protection, and

tax-efficiency through the use of options,” said, Eve Cout, Head of

Portfolio Design & Solutions pillar within BlackRock’s U.S.

Wealth Advisory business.

SRA managed approximately $4.8 billion in client assets as of

February 2024. The firm’s SMA strategies are focused on income and

risk management for single securities as well as diversified

portfolios using derivative overlay strategies, and are accessible

through RIAs, family offices, national broker/dealers and

institutional channels.

BlackRock is an industry leader in SMAs for U.S. wealth

management-focused intermediaries, managing $186 billion in SMAs as

of December 2023. The firm’s SMA franchise specializes in providing

customized strategies, including Aperio’s direct indexing

capability, actively managed fixed income, equity and multi-asset

strategies to meet the growing demand for personalization in the

marketplace.

“We are thrilled to fully join the BlackRock team, and to

broaden access to SpiderRock Advisors’ options management solutions

for both taxable and tax-exempt investors,” said Eric Metz,

President and Chief Investment Officer of SpiderRock Advisors.

“Innovative advisors and investors understand the value of options

in their portfolios to better manage risk as we navigate a

challenging capital markets landscape. We look forward to

benefiting from BlackRock’s global reach and deep industry

relationships as we seek to help more advisors deliver tailored

options strategies to empower their clients towards achieving their

after-tax investment goals.”

The transaction, expected to close in Q2 2024, is subject to

customary closing conditions. The financial impact of the

transaction is not material to BlackRock earnings. Financial terms

were not disclosed.

Jones Day acted as legal counsel for SpiderRock Advisors, LLC.

Kramer Levin Naftalis & Frankel LLP acted as legal counsel for

BlackRock.

About BlackRock BlackRock’s purpose is to help more and

more people experience financial well-being. As a fiduciary to

investors and a leading provider of financial technology, we help

millions of people build savings that serve them throughout their

lives by making investing easier and more affordable. For

additional information on BlackRock, please visit

www.blackrock.com/corporate

About SpiderRock Advisors SpiderRock Advisors, LLC is a

Chicago-based asset management firm focused on providing customized

option overlay strategies to investors. Combining technology with

comprehensive derivative management expertise, SpiderRock Advisors

is making it easy for financial advisors and institutions to add

option overlay strategies to their portfolios. SpiderRock Advisors

manages approximately $4.8 billion for firms in the RIAs, family

office, national broker/dealers and institutional channels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240308158161/en/

BlackRock Christa Zipf christa.zipf@blackrock.com

646-231-0013

SpiderRock Advisors Ray Hennessy, Vocatus LLC Mobile

973-527-1797 Email rh@vocatusllc.com

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

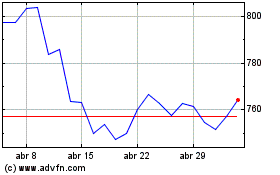

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024