Morgan Stanley Private Credit Leads $220 Million Recapitalization for Grass Valley

21 Março 2024 - 10:00AM

Business Wire

Recapitalization will accelerate growth and lead the

reimagination of workflow for media technology provider after a

promising 2023

Morgan Stanley Private Credit (“MSPC”) announced today that

several of its investment funds have led a $220 million

recapitalization for Grass Valley, a leading media technology

company that provides end-to-end solutions for the live media and

entertainment industry. This strategic transaction will strengthen

the company’s balance sheet and further accelerate investments in

software and integrated hardware solutions as part of one of the

most advanced cloud-native media platforms in the industry.

Grass Valley is helping to lead the future of live production

solutions by enabling streamlined workflows through the Grass

Valley Media Universe (GVMU), which includes the AMPP SaaS

Platform, an open ecosystem delivering significant advantages with

flexibility across on-prem, hybrid or cloud native deployment

models. With this recapitalization, Grass Valley will accelerate

its investment across the combined GVMU integrated hardware and

software solutions, enabled by AMPP, further extending its

leadership across live, networking, content production, and playout

workflows.

“We are pleased to be Grass Valley’s financing partner and

support the company in its next phase of growth,” said Peter Ma,

Managing Director, Morgan Stanley Private Credit. “This debt

investment is an example of our ability to provide a flexible

capital solution tailored to meet Grass Valley’s needs, positioning

the business for significant future success.”

Commenting on the investment, Grass Valley’s Chairman and CEO,

Louis Hernandez Jr., said: “This recapitalization serves to

accelerate Grass Valley’s growth coming out of a successful 2023.

We had our strongest year since 2020 for live production and

networking infrastructure hardware. Earnings increased over 100%,

revenues nearly doubled thanks to a significant increase in

recurring revenue with AMPP, and we hired hundreds of employees

globally. This investment will accelerate Grass Valley’s innovation

across their entire portfolio during an industry-wide transition

period, particularly in the AMPP ecosystem.”

About Grass Valley

Grass Valley is the leading media technology provider for the

media and entertainment industry. Trusted by the world’s top media

brands, Grass Valley is empowering content producers to deliver

great live experiences through best-in-class hardware and software

solutions that improve efficiency and reduce costs. Supporting

customers across the globe, Grass Valley is at the forefront of

groundbreaking media innovation and continues to create the future

of live media production. Headquartered in Montreal, Grass Valley

has been engaged in the media technology business for over 60

years. For more information about Grass Valley, go to

grassvalley.com.

About Morgan Stanley Private Credit

Morgan Stanley Private Credit, part of Morgan Stanley Investment

Management, is a private credit platform focused on direct lending

and opportunistic private credit investment in North America and

Western Europe. The Morgan Stanley Private Credit team invests

across the capital structure, including senior secured term loans,

unitranche loans, junior debt, structured equity and common equity

co-investments. For further information, please visit the website:

morganstanley.com/im/private-credit

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240320372548/en/

Morgan Stanley: Alyson Barnes (212) 762-0514

mediainquiries@morganstanley.com Grass Valley: Bénédicte Fauveau

benedicte.fauveau@grassvalley.com

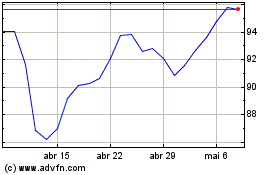

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

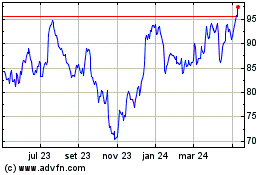

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024