Strong sequential improvement in sales in

Q4: -0.7 % 2023-24 COP margin guidance confirmed

- China: significant growth in Q4 sales, boosted by

positive phasing effects and good resilience of Rémy Martin CLUB in

a persistently complex market

- United States: continued destocking in Q4, amplified by

negative phasing effects

- EMEA: sequential improvement in Q4 sales, despite

contrasting market trends

- Travel Retail: strong rise in sales in Q4; full-year

sales above 2019-20 level

- Cost-cutting plan confirmed: €100m of cost savings

- 2023-24 COP margin objective confirmed: contained

decrease on an organic basis

Regulatory News:

Rémy Cointreau (Paris:RCO) reported 2023-24

sales of €1,194.1 million, down -19.2% on an organic basis1 (+16.2%

compared to 2019-20). On a reported basis, sales were down

-22.9%, including a negative currency effect of -3.7%, due

primarily to trends in the renminbi and the US dollar.

This performance includes a nearly flat sales performance in

Q4 2023-24 in organic terms (-0.7%), representing a +14.3% rise

compared to Q4 2019-20.

In FY 2023-24, APAC and EMEA regions grew by +2.0%

and +0.7%, respectively, demonstrating resilience in the face of

soft consumer trends. Following a decline in shipments in

Europe and China in Q3, the Group successfully

normalized stocks in Q4. By contrast, sales in the Americas

fell -39.6%, reflecting continued major destocking in an

environment marked by inflation, more intense promotions, and

strong post-Covid normalization of consumption.

Breakdown of sales by division:

€m

(April 2023 – March 2024)

FY 2023-24

FY 2022-23

Change as reported

Organic change

vs. FY 2022-23

vs. FY 2019-20

Cognac

778.6

1 100.0

-29.2%

-25.1%

+5.8 %

Liqueurs & Spirits

387.8

418.9

-7.4%

-4.6%

+47.4 %

Subtotal: Group Brands

1,166.5

1,518.9

-23.2%

-19.4%

+16.6 %

Partner Brands

27.7

29.6

-6.6%

-6.1%

+2.3 %

Total

1,194.1

1,548.5

-22.9%

-19.2%

+16.2 %

Cognac

The Cognac division saw Q4 sales rise +15.4% on an

organic basis, driven by a significant increase in China and, to a

lesser extent, growth in the EMEA region.

In the United States, sales were once again penalized by

an adverse environment and an intensely promotional market. In this

context, the Group faced continued deterioration in value

depletions2 and pursued destocking while maintaining a firm pricing

policy in keeping with its strategy of long-term value.

In China, the Group reported significant growth in a

persistently complex market. This excellent performance reflected

positive phasing effects and resilient underlying demand driven by

the success of the Rémy Martin CLUB brand and numerous marketing

and communications initiatives aimed at boosting sales during the

Chinese New Year. Major destocking carried out ahead of the Chinese

New Year allowed the Group to end the year with inventories at a

healthy level.

The EMEA region turned in a strong performance driven by

good momentum in the Africa/Middle East region and in Western

Europe.

Liqueurs & Spirits

Fourth-quarter sales of the Liqueurs & Spirits

division fell back by -27.0% on an organic basis, hit by negative

phasing effects in the United States, where the Group

deliberately opted to complete most of its shipments in the third

quarter. Underlying demand remained resilient despite a tough

market and high basis of comparison.

At the same time, the EMEA region reported a steep

improvement in sales backed by trends all of its geographies in a

market slowed by inflation and facing stepped-up promotional

activity.

Lastly, the APAC region recorded a decline in sales that

reflected a slowdown in whisky sales in China.

Partner Brands

Sales of Partner Brands eased by -1.1% on an organic

basis in the fourth quarter, hit by adverse trends in the Benelux

countries.

2023-24 full-year COP margin guidance

confirmed

In 2023-24 Rémy Cointreau protected its profitability and

investment capacity through tight cost controls, while continuing

to roll out its medium-term plan. To this end, it:

- maintained a strict and uncompromising pricing policy

- protected its gross margin in a persistently inflationary

environment

- selectively reduced its marketing and communications spend,

particularly for the Cognac division

- significantly reduced other operating costs

As a result, in 2023-24 Rémy Cointreau expects to see a

contained organic decrease in COP margin thanks to deployment of a

major cost-cutting plan, estimated at around €100 million in

savings this year (including €25 million already achieved in the

first half)

The Group now anticipates that unfavourable exchange

rates will cut Current Operating Profit by between -€7m and

-€10m in 2023-24 (versus -€10m and -€15m previously).

About Rémy Cointreau

All around the world, there are clients seeking exceptional

experiences; clients for whom a wide range of terroirs means a

variety of flavors. Their exacting standards are proportional to

our expertise – the finely-honed skills that we pass down from

generation to generation. The time these clients devote to drinking

our products is a tribute to all those who have worked to develop

them. It is for these Men and Women that Rémy Cointreau, a

family-owned French Group, protects its terroirs, cultivates

exceptional multi-centenary spirits and undertakes to preserve

their eternal modernity. The Group’s portfolio includes 14 singular

brands, such as the Rémy Martin and Louis XIII cognacs, and

Cointreau liqueur. Rémy Cointreau has a single ambition: becoming

the world leader in exceptional spirits. To this end, it relies on

the commitment and creativity of its 2,021 employees and on its

distribution subsidiaries established in the Group’s strategic

markets. Rémy Cointreau is listed on Euronext Paris.

A conference call with investors and analysts will be held today

by CFO Luca Marotta, from 9:00 am (Paris time). Related slides will

also be available on the website (www.remy-cointreau.com) in the

Finance section.

Appendices

Q1 2023-24 sales (April-June 2023)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

155.1

-6.6

-

161.6

292.3

-46.9%

-44.7%

Liqueurs & Spirits

95.0

-2.2

-

97.2

109.7

-13.5%

-11.4%

Subtotal: Group Brands

250.0

-8.8

-

258.8

402.0

-37.8%

-35.6%

Partner Brands

7.5

-0.1

-

7.6

7.9

-5.4%

-4.6%

Total

257.5

-8.9

-

266.4

409.9

-37.2%

-35.0%

Q2 2023-24 sales (July-September 2023)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

261.0

-23.1

-

284.1

345.9

-24.5%

-17.8%

Liqueurs & Spirits

111.7

-5.7

-

117.4

104.7

+6.7%

+12.1%

Subtotal: Group Brands

372.7

-28.8

-

401.6

450.6

-17.3%

-10.9%

Partner Brands

6.4

0.0

-

6.5

6.6

-2.3%

-1.6%

Total

379.2

-28.9

-

408.0

457.2

-17.1%

-10.8%

H1 2023-24 sales (April-September 2023)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

416.1

-29.7

-

445.8

638.1

-34.8%

-30.1%

Liqueurs & Spirits

206.7

-7.9

-

214.6

214.5

-3.6%

+0.1%

Subtotal: Group Brands

622.7

-37.7

-

660.4

852.6

-27.0%

-22.5%

Partner Brands

14.0

-0.1

-

14.1

14.5

-4.0%

-3.2%

Total

636.7

-37.8

-

674.5

867.1

-26.6%

-22.2%

Q3 2023-24 sales (October-December 2023)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

197.1

-10.4

-

207.5

314.0

-37.2%

-33.9%

Liqueurs & Spirits

114.6

-4.4

-

119.0

114.1

+0.4%

+4.3%

Subtotal: Group Brands

311.8

-14.7

-

326.5

428.1

-27.2%

-23.7%

Partner Brands

8.1

0.0

-

8.2

9.5

-14.0%

-13.5%

Total

319.9

-14.8

-

334.7

437.6

-26.9%

-23.5%

9M 2023-24 sales (April-December 2023)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

613.2

-40.1

-

653.3

952.1

-35.6%

-31.4%

Liqueurs & Spirits

321.3

-12.3

-

333.6

328.6

-2.2%

+1.5%

Subtotal: Group Brands

934.5

-52.4

-

986.9

1 280.7

-27.0%

-22.9%

Partner Brands

22.1

-0.2

-

22.2

24.0

-7.9%

-7.3%

Total

956.6

-52.6

-

1 009.2

1 304.7

-26.7%

-22.7%

Q4 2023-24 sales (January-March 2024)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported

Change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

165.4

-5.2

-

170.6

147.9

+11.9%

+15.4%

Liqueurs & Spirits

66.5

+0.6

-

66.0

90.3

-26.3%

-27.0%

Subtotal: Group Brands

232.0

-4.6

-

236.6

238.2

-2.6%

-0.7%

Partner Brands

5.6

0.0

-

5.6

5.6

-1.0%

-1.1%

Total

237.5

-4.6

-

242.1

243.8

-2.6%

-0.7%

H2 2023-24 sales (October 2023-March 2024)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported

Change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

362.6

-15.5

-

378.1

461.8

-21.5%

-18.1%

Liqueurs & Spirits

181.1

-3.8

-

185.0

204.4

-11.4%

-9.5%

Subtotal: Group Brands

543.7

-19.4

-

563.1

666.3

-18.4%

-15.5%

Partner Brands

13.7

0.0

-

13.7

15.1

-9.1%

-8.9%

Total

557.4

-19.4

-

576.8

681.4

-18.2%

-15.3%

Full year 2023-24 Sales (April 2023-March 2024)

€m

Reported

23-24

Forex

23-24

Scope 23-24

Organic

23-24

Reported

22-23

Reported

Change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

778.6

-45.3

-

823.9

1 100.0

-29.2%

-25.1%

Liqueurs & Spirits

387.8

-11.7

-

399.6

418.9

-7.4%

-4.6%

Subtotal: Group Brands

1 166.5

-57.0

-

1 223.5

1 518.9

-23.2%

-19.4%

Partner Brands

27.7

-0.1

-

27.8

29.6

-6.6%

-6.1%

Total

1 194.1

-57.2

-

1 251.3

1 548.5

-22.9%

-19.2%

Regulated information in connection with this

press release can be found at www.remy-cointreau.com

Definitions of

alternative performance indicators

Rémy Cointreau’s management process is based on the following

alternative performance indicators, selected for planning and

reporting purposes. The Group’s management considers that these

indicators provide users of the financial statements with useful

additional information to help them understand its performance.

These indicators should be considered as supplementing those

including in the consolidated financial statements and resulting

movements.

Organic sales growth:

Organic growth excludes the impact of exchange rate

fluctuations, acquisitions and disposals.

The impact of exchange rate fluctuations is calculated by

converting sales for the current financial year using average

exchange rates from the prior financial year.

For current-year acquisitions, sales of acquired entities are

not included in organic growth calculations. For prior-year

acquisitions, sales of acquired entities are included in the

previous financial year but are only included in current-year

organic growth with effect from the actual date of acquisition.

For significant disposals, data is post-application of IFRS 5

(which reclassifies entities disposed of under “Net earnings from

discontinued operations” for the current and prior financial year).

It thus focuses on Group performance common to both financial

years, over which local management has more direct influence.

___________________________________ 1 All references to “on an

organic basis” in this press release refer to sales growth at

constant currency and consolidation scope 2 Wholesalers’ sales to

retailers

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425227579/en/

Investor relations: Célia d’Everlange /

investor-relations@remy-cointreau.com Media relations:

Mélissa Lévine / press@remy-cointreau.com

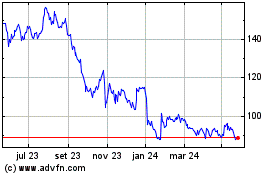

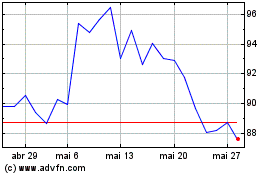

Remy Cointreau (EU:RCO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Remy Cointreau (EU:RCO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025