Alliance Resource Partners, L.P. Announces Pricing of $400 Million Private Offering of Senior Notes

29 Maio 2024 - 5:47PM

Business Wire

Alliance Resource Partners, L.P. (NASDAQ: ARLP) (“ARLP”)

announced today that Alliance Resource Operating Partners, L.P.

(“AROP”), the intermediate partnership of ARLP, and Alliance

Resource Finance Corporation, AROP’s wholly owned subsidiary,

priced the previously announced private placement of $400 million

in aggregate principal amount of 8.625% senior unsecured notes due

2029 (the “New Notes”). The New Notes will be issued at par. The

offering is expected to close on or about June 12, 2024, subject to

customary closing conditions.

AROP expects to use a portion of the net proceeds from the

offering of the New Notes to fund the redemption of its outstanding

7.5% Senior Notes due 2025 (the “2025 Notes”) and the remaining for

general corporate purposes. On May 29, 2024, AROP delivered a

conditional notice of redemption, subject to consummation of the

offering of the New Notes, for all of the outstanding 2025 Notes.

The redemption price for the 2025 Notes is 100% of the principal

amount of the 2025 Notes outstanding, plus accrued and unpaid

interest to the redemption date, which is expected to be June 28,

2024. This communication shall not constitute a notice of

redemption under the indenture governing the 2025 Notes.

The New Notes have not been, and will not be, registered under

the Securities Act of 1933, as amended (the “Securities Act”), or

under the securities laws of any other jurisdiction. Thus, the New

Notes may be offered only in transactions that are exempt from

registration under the Securities Act and applicable state

securities laws. The New Notes are offered only to qualified

institutional buyers under Rule 144A and to persons outside the

United States under Regulation S of the Securities Act. The New

Notes will not be listed on any securities exchange or automated

quotation system.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the New Notes, nor shall there be

any sale of the New Notes in any state or jurisdiction in which

such an offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the

largest coal producer in the eastern United States, supplying

reliable, affordable energy domestically and internationally to

major utilities, metallurgical and industrial users. ARLP also

generates operating and royalty income from mineral interests it

owns in strategic coal and oil & gas producing regions in the

United States. In addition, ARLP is evolving and positioning itself

as a reliable energy partner for the future by pursuing

opportunities that support the advancement of energy and related

infrastructure.

Cautionary Note Concerning Forward-Looking Statements

Certain statements and information in this news release

constitute “forward-looking statements,” including statements

regarding the intended use of proceeds. The words “believe,”

“expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,”

“would,” “could” or other similar expressions are intended to

identify forward-looking statements, which are generally not

historical in nature. These forward-looking statements represent

ARLP’s expectations or beliefs concerning future events, and it is

possible that the results described in this news release will not

be achieved. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside of

ARLP’s control, which could cause actual results to differ

materially from the results discussed in the forward-looking

statements. Any forward-looking statement speaks only as of the

date on which it is made, and, except as required by law, ARLP does

not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. New factors emerge from time to time,

and it is not possible for ARLP to predict all such factors. When

considering these forward-looking statements, you should keep in

mind the risk factors and other cautionary statements found in

ARLP’s filings with the Securities and Exchange Commission (“SEC”),

including, but not limited to, ARLP’s Annual Report on Form 10-K

for the year ended December 31, 2023, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. The risk factors and other

factors noted in ARLP’s SEC filings could cause actual results to

differ materially from those contained in any forward-looking

statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529737881/en/

Investor Relations Contact:

Cary P. Marshall Senior Vice President and Chief Financial

Officer 918-295-7673 investorrelations@arlp.com

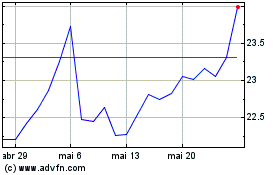

Alliance Resource Partners (NASDAQ:ARLP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

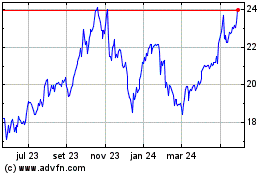

Alliance Resource Partners (NASDAQ:ARLP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025