Emera Incorporated announces the closing of the offering of US$500 million Aggregate Principal Amount of Fixed-to-Fixed Reset Rate Junior Subordinated Notes

18 Junho 2024 - 12:27PM

Business Wire

Emera Incorporated (“Emera” or the “Company”) (TSX: EMA)

announced today that EUSHI Finance, Inc. (the “Issuer”) has

completed the sale of US$500,000,000 aggregate principal amount of

United States dollar denominated 7.625% fixed-to-fixed reset rate

junior subordinated notes due 2054 (the “U.S. Notes”), fully and

unconditionally guaranteed by Emera and Emera US Holdings Inc.

(“EUSHI and together with Emera, the “Guarantors”). EUSHI is a

direct and indirect wholly-owned subsidiary of Emera and the Issuer

is a direct, wholly-owned subsidiary of EUSHI. Morgan Stanley &

Co. LLC, MUFG Securities Americas Inc., RBC Capital Markets, LLC,

J.P. Morgan Securities LLC, Scotia Capital (USA) Inc., and Wells

Fargo Securities, LLC acted as joint book-running managers in

connection with the U.S. Notes offering. BMO Capital Markets Corp.,

BofA Securities, Inc., CIBC World Markets Corp., TD Securities

(USA) LLC, and Truist Securities, Inc. acted as co-managers.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any of the U.S. Notes and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such an offer, solicitation or sale would be unlawful.

The offering of the U.S. Notes and the related guarantees has

not been registered under the United States Securities Act of 1933,

as amended (the “Securities Act”) or any state securities laws and

the U.S. Notes and the related guarantees may not be offered or

sold in the United States absent a registration under the

Securities Act or an applicable exemption from registration

requirements. The U.S. Notes are being sold only to persons

reasonably believed to be “qualified institutional buyers” under

Rule 144A of the Securities Act and to non-U.S. persons under

Regulation S of the Securities Act. This press release is not an

offer of securities for sale in the United States. The U.S. Notes

have not been qualified by prospectus for public distribution under

the securities laws of any province or territory of Canada. The

U.S. Notes are not being, and may not be offered or sold, directly

or indirectly, in Canada or to any resident of Canada except under

exemptions from prospectus requirements of those securities laws,

and either by an appropriately registered dealer or in

circumstances where a dealer registration is not required. Until

such time as the U.S. Notes are registered, they will be subject to

certain restrictions on resale under the Securities Act.

The U.S. Notes will not be listed on any securities exchange,

and the Issuer and the Guarantors do not intend to arrange for the

U.S. Notes to be included on any quotation system.

Use of Proceeds

Emera intends to use the net proceeds from any offering of U.S.

Notes to finance the repayment of Emera US Finance LP’s (EUSFLP)

US$300 million 0.833% 2021 exchange notes (the “2021 Notes”) that

matured on June 15, 2024. Emera intends to use the remaining net

proceeds for general corporate purposes.

Forward Looking

Information

This news release contains forward-looking information within

the meaning of applicable securities laws with respect to, among

other things, the intended use of the net proceeds from the sale of

the U.S. Notes, and the entering into of a registration rights

agreement in connection with the offering of U.S. Notes. Undue

reliance should not be placed on this forward-looking information,

which applies only as of the date hereof. By its nature,

forward-looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. These statements

reflect Emera management’s current beliefs and are based on

information currently available to Emera management. There is a

risk that predictions, forecasts, conclusions and projections that

constitute forward-looking information will not prove to be

accurate, that Emera’s assumptions may not be correct and that

actual results may differ materially from such forward-looking

information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s

securities regulatory filings, including under the heading

“Business Risks and Risk Management” in Emera’s annual Management’s

Discussion and Analysis, and under the heading “Principal Risks and

Uncertainties” in the notes to Emera’s annual and interim financial

statements, which can be found on SEDAR+ at www.sedarplus.ca.

About Emera

Emera Inc. is a geographically diverse energy and services

company headquartered in Halifax, Nova Scotia, with approximately

$39 billion in assets and 2023 revenues of more than $7.6 billion.

The company primarily invests in regulated electricity generation

and electricity and gas transmission and distribution with a

strategic focus on transformation from high carbon to low carbon

energy sources. Emera has investments in Canada, the United States

and in three Caribbean countries. Emera’s common and preferred

shares are listed on the Toronto Stock Exchange and trade

respectively under the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C,

EMA.PR.E, EMA.PR.F, EMA.PR.H, EMA.PR.J and EMA PR.L. Depositary

receipts representing common shares of Emera are listed on the

Barbados Stock Exchange under the symbol EMABDR and on The Bahamas

International Securities Exchange under the symbol EMAB. Additional

information can be accessed at www.emera.com or at

www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240618459029/en/

Emera Inc. Investor

Relations Dave Bezanson, VP, Investor Relations &

Pensions 902-474-2126 dave.bezanson@emera.com

Media 902-222-2683

media@emera.com

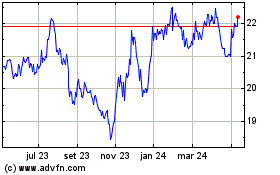

Emera (TSX:EMA.PR.H)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

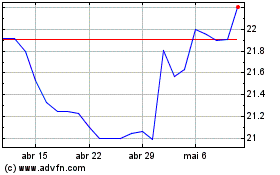

Emera (TSX:EMA.PR.H)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025