Broadstone Net Lease Provides an Update on its Healthcare Portfolio Simplification Strategy and Schedules Second Quarter 2024 Earnings Release and Conference Call

02 Julho 2024 - 5:10PM

Business Wire

Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today provided an update on its

healthcare portfolio simplification strategy through June 30, 2024.

Additionally, the Company announced that it will release its

financial and operating results for the quarter ended June 30,

2024, after the market closes on Tuesday, July 30, 2024, and host

its earnings conference call and audio webcast on Wednesday, July

31, 2024, at 11:00 a.m. Eastern Time.

JULY 2024 HEALTHCARE PORTFOLIO SIMPLIFICATION STRATEGY

UPDATE

- Through June 30, 2024 and as previously reported, we have sold

38 clinically-oriented healthcare properties for gross proceeds of

$262.2 million at a weighted average capitalization rate of

7.84%.

- As of July 2, 2024, a third-party purchaser has completed due

diligence procedures with respect to the purchase of an additional

15 clinically-oriented healthcare properties from the Company

pursuant to a previously executed purchase and sale agreement (the

“Portfolio Sale”). The Company anticipates the Portfolio Sale

transaction will close in two separate tranches in July and October

2024 for gross proceeds of $80.3 million at a weighted average

capitalization rate of 7.96%. Based on ABR at the time of our

initial announcement of the healthcare portfolio simplification

strategy, the Portfolio Sale represents an additional 15% of our

planned healthcare simplification strategy, completing nearly all

previously planned healthcare dispositions for 2024.

- Following the closing of the Portfolio Sale, our healthcare

dispositions would total $342.5 million year-to-date at a weighted

average capitalization rate of 7.87%, which we anticipate will be

fully redeployed based on actual and committed investments. With

these sales and successful redeployment efforts completed to-date,

we anticipate a reduction in our healthcare exposure from 17.6% of

our ABR at the end of 2023 to 11.3%.

MANAGEMENT COMMENTARY

“This portfolio sale marks a significant milestone in our

healthcare portfolio simplification strategy, and once closed, will

complete a substantial majority of our planned healthcare

dispositions for 2024. I couldn’t be more pleased with the team’s

ability to execute on these sales and remain highly optimistic in

our ability to redeploy proceeds into high quality industrial,

retail, and restaurant assets,” said John Moragne, BNL’s Chief

Executive Officer.

Conference Call and Webcast Details

To access the live webcast, which will be available in

listen-only mode, please visit:

https://events.q4inc.com/attendee/782540478. If you prefer to

listen via phone, U.S. participants may dial: 1-833-470-1428 (toll

free) or 1-404-975-4839 (local), access code 639622. International

access numbers are viewable here:

https://www.netroadshow.com/events/global-numbers?confId=68100.

A replay of the conference call webcast will be available

approximately one hour after the conclusion of the live broadcast.

To listen to a replay of the call via the web, which will be

available for one year, please visit:

https://investors.bnl.broadstone.com.

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that

invests in primarily single-tenant commercial real estate

properties that are net leased on a long-term basis to a

diversified group of tenants. Utilizing an investment strategy

underpinned by strong fundamental credit analysis and prudent real

estate underwriting, as of May 31, 2024, BNL’s diversified

portfolio consisted of 774 individual net leased commercial

properties with 767 properties located in 44 U.S. states and seven

properties located in four Canadian provinces across the

industrial, restaurant, healthcare, retail, and office property

types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “outlook,” “potential,” “may,”

“will,” “should,” “could,” “seeks,” “approximately,” “projects,”

“predicts,” “expect,” “intends,” “anticipates,” “estimates,”

“plans,” “would be,” “believes,” “continues,” or the negative

version of these words or other comparable words. Forward-looking

statements, including our 2024 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company's Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, which was filed with the SEC on

February 22, 2024, which you are encouraged to read, and will be

available on the SEC’s website at www.sec.gov. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. The Company assumes no obligation to,

and does not currently intend to, update any forward-looking

statements after the date of this press release, whether as a

result of new information, future events, changes in assumptions,

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702469613/en/

Company Contact: Brent Maedl Director, Corporate Finance

& Investor Relations brent.maedl@broadstone.com

585.382.8507

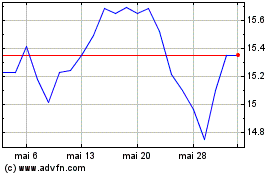

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025