Net of adjusting items, Second Quarter 2024 Net

Income of $3.14 per share(1)

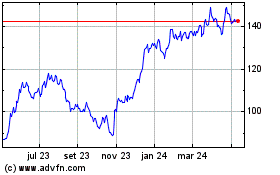

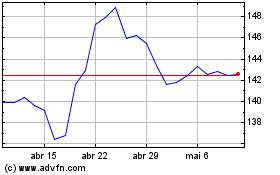

Capital One Financial Corporation (NYSE: COF) today announced

net income for the second quarter of 2024 of $597 million, or $1.38

per diluted common share, compared with net income of $1.3 billion,

or $3.13 per diluted common share in the first quarter of 2024, and

with net income of $1.4 billion, or $3.52 per diluted common share

in the second quarter of 2023. Adjusted net income(1) for the

second quarter of 2024 was $3.14 per diluted common share.

"We posted strong second quarter results while continuing to

lean into opportunities to grow and further strengthen our domestic

card and national consumer banking franchises," said Richard D.

Fairbank, Founder, Chairman, and Chief Executive Officer. "And

we’re “all in” and working hard to complete the Discover

acquisition, which will create a consumer banking and global

payments platform with the potential to enhance competition,

deliver compelling financial results, and create significant value

for merchants, small businesses, and consumers."

The quarter included the following adjusting items:

Pre-Tax

After-Tax Diluted EPS

(Dollars in millions, except per share data)

Impact

Impact

Allowance build for Walmart program

agreement loss sharing termination

$

826

$

1.63

Walmart program agreement termination

contra revenue impact

$

27

$

0.05

Discover integration expenses

$

31

$

0.06

FDIC special assessment

$

8

$

0.02

All comparisons below are for the second quarter of 2024

compared with the first quarter of 2024 unless otherwise noted.

Second Quarter 2024 Income Statement

Summary:

- Total net revenue increased 1 percent to $9.5 billion.

- Total non-interest expense decreased 4 percent to $4.9 billion:

- 5 percent increase in marketing.

- 6 percent decrease in operating expenses.

- Pre-provision earnings(2) increased 7 percent to $4.6

billion.

- Provision for credit losses increased $1.2 billion to $3.9

billion:

- Net charge-offs of $2.6 billion.

- $1.3 billion loan reserve build.

- Net interest margin of 6.70 percent, an increase of 1 basis

point.

- Efficiency ratio of 52.03 percent.

- Adjusted efficiency ratio(1) of 51.47 percent.

- Operating efficiency ratio of 40.84 percent.

- Adjusted operating efficiency ratio(1) of 40.31 percent.

Second Quarter 2024 Balance Sheet

Summary:

- Common equity Tier 1 capital ratio(3) under Basel III

Standardized Approach of 13.2 percent at June 30, 2024.

- Period-end loans held for investment in the quarter increased

$3.0 billion, or 1 percent, to $318.2 billion.

- Credit Card period-end loans increased $3.3 billion, or 2

percent, to $153.9 billion.

- Domestic Card period-end loans increased $3.2 billion, or 2

percent, to $147.1 billion.

- Consumer Banking period-end loans increased $564 million, or 1

percent, to $75.7 billion.

- Auto period-end loans increased $584 million, or 1 percent, to

$74.4 billion.

- Commercial Banking period-end loans decreased $833 million, or

1 percent, to $88.6 billion.

- Average loans held for investment in the quarter increased $274

million, or less than 1 percent, to $314.9 billion.

- Credit Card average loans increased $822 million, or 1 percent,

to $150.5 billion.

- Domestic Card average loans increased $857 million, or 1

percent, to $143.7 billion.

- Consumer Banking average loans increased $294 million, or less

than 1 percent, to $75.4 billion.

- Auto average loans increased $330 million, or less than 1%

percent, to $74.1 billion.

- Commercial Banking average loans decreased $842 million, or 1

percent, to $89.0 billion.

- Period-end total deposits increased $473 million, or less than

1 percent, to $351.4 billion, while average deposits increased $3.8

billion, or 1 percent, to $349.5 billion.

- Interest-bearing deposits rate paid increased 3 basis points to

3.56 percent.

Earnings Conference Call Webcast Information

The company will hold an earnings conference call on July 23,

2024 at 5:00 PM Eastern Time. The conference call will be

accessible through live webcast. Interested investors and other

individuals can access the webcast via the company’s home page

(www.capitalone.com). Under “About,” choose “Investors” to access

the Investor Center and view and/or download the earnings press

release, the financial supplement, including a reconciliation of

non-GAAP financial measures, and the earnings release presentation.

The replay of the webcast will be archived on the company’s website

through August 6, 2024 at 5:00 PM Eastern Time.

Forward-Looking Statements

Certain statements in this release may constitute

forward-looking statements, which involve a number of risks and

uncertainties. Forward-looking statements often use words such as

“will,” “anticipate,” “target,” “expect,” “think,” “estimate,”

“intend,” “plan,” “goal,” “believe,” “forecast,” “outlook” or other

words of similar meaning. Any forward-looking statements made by

Capital One or on its behalf speak only as of the date they are

made or as of the date indicated, and Capital One does not

undertake any obligation to update forward-looking statements as a

result of new information, future events or otherwise. Capital One

cautions readers that any forward-looking information is not a

guarantee of future performance and that actual results could

differ materially from those contained in the forward-looking

information due to a number of factors. For additional information

on factors that could materially influence forward-looking

statements included in this earnings press release, see the risk

factors set forth under “Part I—Item 1A. Risk Factors” in the

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the Securities and Exchange Commission (the “SEC”) and

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K

filed with the SEC.

About Capital One

Capital One Financial Corporation (www.capitalone.com) is a

financial holding company which, along with its subsidiaries, had

$351.4 billion in deposits and $480.0 billion in total assets as of

June 30, 2024. Headquartered in McLean, Virginia, Capital One

offers a broad spectrum of financial products and services to

consumers, small businesses and commercial clients through a

variety of channels. Capital One, N.A. has branches and Cafés

located primarily in New York, Louisiana, Texas, Maryland, Virginia

and the District of Columbia. A Fortune 500 company, Capital One

trades on the New York Stock Exchange under the symbol “COF” and is

included in the S&P 100 index.

(1) This is a non-GAAP measure. We believe non-GAAP measures

help investors and users of our financial information understand

the effect of adjusting items on our selected reported results and

provide alternate measurements of our performance, both in the

current period and across periods. See our Financial Supplement,

filed as Exhibit 99.2 to our Current Report on Form 8-K on July 23,

2024 with the SEC, “Table 15: Calculation of Regulatory Capital

Measures and Reconciliation of Non-GAAP Measures” for a

reconciliation and additional information on non-GAAP measures.

(2) Pre-provision earnings is a non-GAAP metric calculated based

on total net revenue less non-interest expense for the period.

Management believes that this financial metric is useful in

assessing the ability of a lending institution to generate income

in excess of its provision for credit losses. See our Financial

Supplement, filed as Exhibit 99.2 to our Current Report on Form 8-K

on July 23, 2024 with the SEC, “Table 15: Calculation of Regulatory

Capital Measures and Reconciliation of Non-GAAP Measures” for a

reconciliation and additional information on non-GAAP measures.

(3) Regulatory capital metrics as of June 30, 2024 are

preliminary and therefore subject to change.

Capital One Financial

Corporation

Financial

Supplement(1)(2)

Second Quarter 2024

Table of Contents

Capital One Financial Corporation

Consolidated Results

Page

Table 1:

Financial Summary—Consolidated

1

Table 2:

Selected Metrics—Consolidated

3

Table 3:

Consolidated Statements of

Income

4

Table 4:

Consolidated Balance Sheets

6

Table 5:

Notes to Financial Summary, Selected

Metrics and Consolidated Financial Statements (Tables 1—4)

8

Table 6:

Average Balances, Net Interest Income

and Net Interest Margin

9

Table 7:

Loan Information and Performance

Statistics

10

Table 8:

Allowance for Credit Losses and Reserve

for Unfunded Lending Commitments Activity

12

Business Segment Results

Table 9:

Financial Summary—Business Segment

Results

13

Table 10:

Financial & Statistical

Summary—Credit Card Business

14

Table 11:

Financial & Statistical

Summary—Consumer Banking Business

16

Table 12:

Financial & Statistical

Summary—Commercial Banking Business

17

Table 13:

Financial & Statistical

Summary—Other and Total

18

Other

Table 14:

Notes to Net Interest Margin, Loan,

Allowance and Business Segment Disclosures (Tables 6—13)

19

Table 15:

Calculation of Regulatory Capital

Measures and Reconciliation of Non-GAAP Measures

20

____________ (1)

The information contained in this

Financial Supplement is preliminary and based on data available at

the time of the earnings presentation. Investors should refer to

our Quarterly Report on Form 10-Q for the period ended June 30,

2024 once it is filed with the Securities and Exchange

Commission.

(2)

This Financial Supplement includes

non-GAAP measures. We believe these non-GAAP measures are useful to

investors and users of our financial information as they provide an

alternate measurement of our performance and assist in assessing

our capital adequacy and the level of return generated. These

non-GAAP measures should not be viewed as a substitute for reported

results determined in accordance with generally accepted accounting

principles in the U.S. (“GAAP”), nor are they necessarily

comparable to non-GAAP measures that may be presented by other

companies. See “Table 15: Calculation of Regulatory Capital

Measures and Reconciliation of Non-GAAP Measures” for a

reconciliation of any non-GAAP financial measures.

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 1: Financial

Summary—Consolidated

2024 Q2

Six Months Ended June

30,

(Dollars in millions, except per share

data and as noted)

2024

2024

2023

2023

2023

2024

2023

2024 vs.

Q2

Q1

Q4

Q3

Q2

Q1

Q2

2024

2023

2023

Income Statement

Net interest income

$

7,546

$

7,488

$

7,519

$

7,423

$

7,113

1

%

6

%

$

15,034

$

14,299

5

%

Non-interest income

1,960

1,914

1,987

1,943

1,899

2

3

3,874

3,616

7

Total net revenue(1)

9,506

9,402

9,506

9,366

9,012

1

5

18,908

17,915

6

Provision for credit losses

3,909

2,683

2,857

2,284

2,490

46

57

6,592

5,285

25

Non-interest expense:

Marketing

1,064

1,010

1,254

972

886

5

20

2,074

1,783

16

Operating expense

3,882

4,127

4,463

3,888

3,908

(6

)

(1

)

8,009

7,956

1

Total non-interest expense

4,946

5,137

5,717

4,860

4,794

(4

)

3

10,083

9,739

4

Income from continuing operations before

income taxes

651

1,582

932

2,222

1,728

(59

)

(62

)

2,233

2,891

(23

)

Income tax provision

54

302

226

432

297

(82

)

(82

)

356

500

(29

)

Net income

597

1,280

706

1,790

1,431

(53

)

(58

)

1,877

2,391

(21

)

Dividends and undistributed earnings

allocated to participating securities(2)

(9

)

(23

)

(10

)

(28

)

(23

)

(61

)

(61

)

(32

)

(39

)

(18

)

Preferred stock dividends

(57

)

(57

)

(57

)

(57

)

(57

)

—

—

(114

)

(114

)

—

Net income available to common

stockholders

$

531

$

1,200

$

639

$

1,705

$

1,351

(56

)

(61

)

$

1,731

$

2,238

(23

)

Common Share Statistics

Basic earnings per common

share:(2)

Net income per basic common share

$

1.39

$

3.14

$

1.67

$

4.46

$

3.53

(56

)%

(61

)%

$

4.52

$

5.85

(23

)%

Diluted earnings per common

share:(2)

Net income per diluted common share

$

1.38

$

3.13

$

1.67

$

4.45

$

3.52

(56

)%

(61

)%

$

4.51

$

5.83

(23

)%

Weighted-average common shares

outstanding (in millions):

Basic

383.1

382.2

381.9

382.5

382.8

—

—

382.7

382.7

—

Diluted

383.9

383.4

382.8

383.3

383.7

—

—

383.7

383.8

—

Common shares outstanding (period-end, in

millions)

381.9

382.1

380.4

381.0

381.4

—

—

381.9

381.4

—

Dividends declared and paid per common

share

$

0.60

$

0.60

$

0.60

$

0.60

$

0.60

—

—

$

1.20

$

1.20

—

Tangible book value per common share

(period-end)(3)

99.28

98.67

99.78

87.97

90.07

1

%

10

%

99.28

90.07

10

%

2024 Q2

Six Months Ended June

30,

(Dollars in millions)

2024

2024

2023

2023

2023

2024

2023

2024 vs.

Q2

Q1

Q4

Q3

Q2

Q1

Q2

2024

2023

2023

Balance Sheet (Period-End)

Loans held for investment

$

318,186

$

315,154

$

320,472

$

314,780

$

311,323

1

%

2

%

$

318,186

$

311,323

2

%

Interest-earning assets

452,547

453,557

449,701

445,428

441,250

—

3

452,547

441,250

3

Total assets

480,018

481,720

478,464

471,435

467,800

—

3

480,018

467,800

3

Interest-bearing deposits

324,437

323,352

320,389

317,217

314,393

—

3

324,437

314,393

3

Total deposits

351,442

350,969

348,413

346,011

343,705

—

2

351,442

343,705

2

Borrowings

47,956

50,361

49,856

49,247

50,258

(5

)

(5

)

47,956

50,258

(5

)

Common equity

53,135

52,955

53,244

48,823

49,713

—

7

53,135

49,713

7

Total stockholders’ equity

57,981

57,801

58,089

53,668

54,559

—

6

57,981

54,559

6

Balance Sheet (Average

Balances)

Loans held for investment

$

314,888

$

314,614

$

315,890

$

312,759

$

309,655

—

2

%

$

314,751

$

308,711

2

%

Interest-earning assets

450,908

447,803

446,929

443,532

439,139

1

%

3

449,356

437,180

3

Total assets

477,285

474,995

472,594

469,860

466,652

—

2

476,140

464,459

3

Interest-bearing deposits

322,581

318,450

316,808

316,032

313,207

1

3

320,515

311,010

3

Total deposits

349,488

345,657

345,328

345,013

343,678

1

2

347,572

341,910

2

Borrowings

48,842

50,474

51,070

49,736

48,468

(3

)

1

49,658

48,243

3

Common equity

53,262

53,152

50,786

50,166

50,511

—

5

53,207

50,221

6

Total stockholders’ equity

58,107

57,998

55,632

55,012

55,357

—

5

58,052

55,066

5

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 2: Selected

Metrics—Consolidated

2024 Q2

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024

2024

2023

2023

2023

2024

2023

2024 vs.

Q2

Q1

Q4

Q3

Q2

Q1

Q2

2024

2023

2023

Performance Metrics

Net interest income growth (period over

period)

1

%

—

1

%

4

%

(1

)%

**

**

5

%

11

%

**

Non-interest income growth (period over

period)

2

(4

)%

2

2

11

**

**

7

4

**

Total net revenue growth (period over

period)

1

(1

)

1

4

1

**

**

6

9

**

Total net revenue margin(4)

8.43

8.40

8.51

8.45

8.21

3

bps

22

bps

8.42

8.20

22

bps

Net interest margin(5)

6.70

6.69

6.73

6.69

6.48

1

22

6.69

6.54

15

Return on average assets

0.50

1.08

0.60

1.52

1.23

(58

)

(73

)

0.79

1.03

(24

)

Return on average tangible assets(6)

0.52

1.11

0.62

1.58

1.27

(59

)

(75

)

0.81

1.06

(25

)

Return on average common equity(7)

3.99

9.03

5.03

13.59

10.70

(504

)

(671

)

6.51

8.91

(240

)

Return on average tangible common

equity(8)

5.59

12.67

7.20

19.59

15.30

(708

)

(971

)

9.12

12.74

(362

)

Efficiency ratio(9)

52.03

54.64

60.14

51.89

53.20

(261

)

(117

)

53.33

54.36

(103

)

Operating efficiency ratio(10)

40.84

43.89

46.95

41.51

43.36

(305

)

(252

)

42.36

44.41

(205

)

Effective income tax rate for continuing

operations

8.3

19.1

24.2

19.4

17.2

(1,080

)

(890

)

15.9

17.3

(140

)

Employees (period-end, in thousands)

52.1

51.3

52.0

54.2

55.6

2

%

(6

)%

52.1

55.6

(6

)%

Credit Quality Metrics

Allowance for credit losses

$

16,649

$

15,380

$

15,296

$

14,955

$

14,646

8

%

14

%

$

16,649

$

14,646

14

%

Allowance coverage ratio

5.23

%

4.88

%

4.77

%

4.75

%

4.70

%

35

bps

53

bps

5.23

%

4.70

%

53

bps

Net charge-offs

$

2,644

$

2,616

$

2,533

$

1,999

$

2,185

1

%

21

%

$

5,260

$

3,882

35

%

Net charge-off rate(11)

3.36

%

3.33

%

3.21

%

2.56

%

2.82

%

3

bps

54

bps

3.34

%

2.52

%

82

bps

30+ day performing delinquency rate

3.36

3.40

3.71

3.42

3.08

(4

)

28

3.36

3.08

28

30+ day delinquency rate

3.63

3.67

3.99

3.71

3.36

(4

)

27

3.63

3.36

27

Capital Ratios(12)

Common equity Tier 1 capital

13.2

%

13.1

%

12.9

%

13.0

%

12.7

%

10

bps

50

bps

13.2

%

12.7

%

50

bps

Tier 1 capital

14.5

14.4

14.2

14.3

14.0

10

50

14.5

14.0

50

Total capital

16.3

16.3

16.0

16.2

16.0

—

30

16.3

16.0

30

Tier 1 leverage

11.3

11.3

11.2

11.2

11.0

—

30

11.3

11.0

30

Tangible common equity (“TCE”)(13)

8.2

8.1

8.2

7.3

7.6

10

60

8.2

7.6

60

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 3: Consolidated Statements of

Income

2024 Q2

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024

2024

2023

2023

2023

2024

2023

2024 vs.

Q2

Q1

Q4

Q3

Q2

Q1

Q2

2024

2023

2023

Interest income:

Loans, including loans held for sale

$

9,993

$

9,920

$

9,934

$

9,696

$

9,057

1

%

10

%

$

19,913

$

17,780

12

%

Investment securities

700

687

669

627

639

2

10

1,387

1,254

11

Other

587

570

542

550

470

3

25

1,157

886

31

Total interest income

11,280

11,177

11,145

10,873

10,166

1

11

22,457

19,920

13

Interest expense:

Deposits

2,874

2,812

2,745

2,611

2,277

2

26

5,686

4,133

38

Securitized debt obligations

258

261

263

249

236

(1

)

9

519

447

16

Senior and subordinated notes

591

606

608

579

528

(2

)

12

1,197

1,017

18

Other borrowings

11

10

10

11

12

10

(8

)

21

24

(13

)

Total interest expense

3,734

3,689

3,626

3,450

3,053

1

22

7,423

5,621

32

Net interest income

7,546

7,488

7,519

7,423

7,113

1

6

15,034

14,299

5

Provision for credit losses

3,909

2,683

2,857

2,284

2,490

46

57

6,592

5,285

25

Net interest income after provision for

credit losses

3,637

4,805

4,662

5,139

4,623

(24

)

(21

)

8,442

9,014

(6

)

Non-interest income:

Interchange fees, net

1,249

1,145

1,207

1,234

1,213

9

3

2,394

2,352

2

Service charges and other customer-related

fees

459

462

424

453

411

(1

)

12

921

790

17

Net securities gains (losses)

—

—

(34

)

—

—

—

—

—

—

—

Other

252

307

390

256

275

(18

)

(8

)

559

474

18

Total non-interest income

1,960

1,914

1,987

1,943

1,899

2

3

3,874

3,616

7

Non-interest expense:

Salaries and associate benefits

2,200

2,478

2,284

2,274

2,317

(11

)

(5

)

4,678

4,744

(1

)

Occupancy and equipment

551

554

628

518

506

(1

)

9

1,105

1,014

9

Marketing

1,064

1,010

1,254

972

886

5

20

2,074

1,783

16

Professional services

316

262

359

295

290

21

9

578

614

(6

)

Communications and data processing

355

351

345

344

344

1

3

706

694

2

Amortization of intangibles

19

19

22

24

22

—

(14

)

38

36

6

Other

441

463

825

433

429

(5

)

3

904

854

6

Total non-interest expense

4,946

5,137

5,717

4,860

4,794

(4

)

3

10,083

9,739

4

Income from continuing operations before

income taxes

651

1,582

932

2,222

1,728

(59

)

(62

)

2,233

2,891

(23

)

Income tax provision

54

302

226

432

297

(82

)

(82

)

356

500

(29

)

Net income

597

1,280

706

1,790

1,431

(53

)

(58

)

1,877

2,391

(21

)

Dividends and undistributed earnings

allocated to participating securities(2)

(9

)

(23

)

(10

)

(28

)

(23

)

(61

)

(61

)

(32

)

(39

)

(18

)

Preferred stock dividends

(57

)

(57

)

(57

)

(57

)

(57

)

—

—

(114

)

(114

)

—

Net income available to common

stockholders

$

531

$

1,200

$

639

$

1,705

$

1,351

(56

)

(61

)

$

1,731

$

2,238

(23

)

2024 Q2

Six Months Ended June

30,

2024

2024

2023

2023

2023

2024

2023

2024 vs.

Q2

Q1

Q4

Q3

Q2

Q1

Q2

2024

2023

2023

Basic earnings per common

share:(2)

Net income per basic common share

$

1.39

$

3.14

$

1.67

$

4.46

$

3.53

(56

)%

(61

)%

$

4.52

$

5.85

(23

)%

Diluted earnings per common

share:(2)

Net income per diluted common share

$

1.38

$

3.13

$

1.67

$

4.45

$

3.52

(56

)%

(61

)%

$

4.51

$

5.83

(23

)%

Weighted-average common shares

outstanding (in millions):

Basic common shares

383.1

382.2

381.9

382.5

382.8

—

—

382.7

382.7

—

Diluted common shares

383.9

383.4

382.8

383.3

383.7

—

—

383.7

383.8

—

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 4: Consolidated Balance

Sheets

2024 Q2

2024

2024

2023

2023

2023

2024

2023

(Dollars in millions)

Q2

Q1

Q4

Q3

Q2

Q1

Q2

Assets:

Cash and cash equivalents:

Cash and due from banks

$

5,298

$

4,671

$

4,903

$

4,620

$

3,360

13

%

58

%

Interest-bearing deposits and other

short-term investments

40,116

46,357

38,394

40,249

38,236

(13

)

5

Total cash and cash equivalents

45,414

51,028

43,297

44,869

41,596

(11

)

9

Restricted cash for securitization

investors

2,415

474

458

435

452

**

**

Securities available for sale

79,250

78,398

79,117

74,837

78,412

1

1

Loans held for investment:

Unsecuritized loans held for

investment

289,124

285,577

289,229

284,953

280,933

1

3

Loans held in consolidated trusts

29,062

29,577

31,243

29,827

30,390

(2

)

(4

)

Total loans held for investment

318,186

315,154

320,472

314,780

311,323

1

2

Allowance for credit losses

(16,649

)

(15,380

)

(15,296

)

(14,955

)

(14,646

)

8

14

Net loans held for investment

301,537

299,774

305,176

299,825

296,677

1

2

Loans held for sale

808

1,631

854

742

1,211

(50

)

(33

)

Premises and equipment, net

4,396

4,366

4,375

4,378

4,359

1

1

Interest receivable

2,494

2,514

2,478

2,469

2,297

(1

)

9

Goodwill

15,062

15,062

15,065

15,048

15,060

—

—

Other assets

28,642

28,473

27,644

28,832

27,736

1

3

Total assets

$

480,018

$

481,720

$

478,464

$

471,435

$

467,800

—

3

2024 Q2

2024

2024

2023

2023

2023

2024

2023

(Dollars in millions)

Q2

Q1

Q4

Q3

Q2

Q1

Q2

Liabilities:

Interest payable

$

668

$

762

$

649

$

685

$

637

(12

)%

5

%

Deposits:

Non-interest-bearing deposits

27,005

27,617

28,024

28,794

29,312

(2

)

(8

)

Interest-bearing deposits

324,437

323,352

320,389

317,217

314,393

—

3

Total deposits

351,442

350,969

348,413

346,011

343,705

—

2

Securitized debt obligations

17,291

17,661

18,043

17,417

17,861

(2

)

(3

)

Other debt:

Federal funds purchased and securities

loaned or sold under agreements to repurchase

715

568

538

522

649

26

10

Senior and subordinated notes

29,925

32,108

31,248

31,283

31,627

(7

)

(5

)

Other borrowings

25

24

27

25

121

4

(79

)

Total other debt

30,665

32,700

31,813

31,830

32,397

(6

)

(5

)

Other liabilities

21,971

21,827

21,457

21,824

18,641

1

18

Total liabilities

422,037

423,919

420,375

417,767

413,241

—

2

Stockholders’ equity:

Preferred stock

0

0

0

0

0

—

—

Common stock

7

7

7

7

7

—

—

Additional paid-in capital, net

36,012

35,808

35,541

35,334

35,163

1

2

Retained earnings

62,211

61,905

60,945

60,529

59,028

—

5

Accumulated other comprehensive loss

(9,701

)

(9,534

)

(8,268

)

(12,224

)

(9,818

)

2

(1

)

Treasury stock, at cost

(30,548

)

(30,385

)

(30,136

)

(29,978

)

(29,821

)

1

2

Total stockholders’ equity

57,981

57,801

58,089

53,668

54,559

—

6

Total liabilities and stockholders’

equity

$

480,018

$

481,720

$

478,464

$

471,435

$

467,800

—

3

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 5: Notes to Financial Summary,

Selected Metrics and Consolidated Financial Statements (Tables

1—4)

(1)

Total net revenue was reduced by $649

million in Q2 2024, $630 million in Q1 2024, $566 million in Q4

2023, $449 million in Q3 2023 and $443 million in Q2 2023 for

credit card finance charges and fees charged-off as

uncollectible.

(2)

Dividends and undistributed earnings

allocated to participating securities and earnings per share are

computed independently for each period. Accordingly, the sum of

each quarterly amount may not agree to the year-to-date total. We

also provide adjusted diluted earnings per share, which is a

non-GAAP measure. See “Table 15: Calculation of Regulatory Capital

Measures and Reconciliation of Non-GAAP Measures” for additional

information on our non-GAAP measures.

(3)

Tangible book value per common share is a

non-GAAP measure calculated based on TCE divided by common shares

outstanding. See “Table 15: Calculation of Regulatory Capital

Measures and Reconciliation of Non-GAAP Measures” for additional

information on non-GAAP measures.

(4)

Total net revenue margin is calculated

based on annualized total net revenue for the period divided by

average interest-earning assets for the period.

(5)

Net interest margin is calculated based on

annualized net interest income for the period divided by average

interest-earning assets for the period.

(6)

Return on average tangible assets is a

non-GAAP measure calculated based on annualized income (loss) from

continuing operations, net of tax, for the period divided by

average tangible assets for the period. See “Table 15: Calculation

of Regulatory Capital Measures and Reconciliation of Non-GAAP

Measures” for additional information on non-GAAP measures.

(7)

Return on average common equity is

calculated based on annualized net income (loss) available to

common stockholders less annualized income (loss) from discontinued

operations, net of tax, for the period, divided by average common

equity. Our calculation of return on average common equity may not

be comparable to similarly-titled measures reported by other

companies.

(8)

Return on average tangible common equity

is a non-GAAP measure calculated based on annualized net income

(loss) available to common stockholders less annualized income

(loss) from discontinued operations, net of tax, for the period,

divided by average TCE. See “Table 15: Calculation of Regulatory

Capital Measures and Reconciliation of Non-GAAP Measures” for

additional information on non-GAAP measures.

(9)

Efficiency ratio is calculated based on

total non-interest expense for the period divided by total net

revenue for the period. We also provide an adjusted efficiency

ratio, which is a non-GAAP measure. See “Table 15: Calculation of

Regulatory Capital Measures and Reconciliation of Non-GAAP

Measures” for additional information on our non-GAAP measures.

(10)

Operating efficiency ratio is calculated

based on operating expense for the period divided by total net

revenue for the period. We also provide an adjusted operating

efficiency ratio, which is a non-GAAP measure. See “Table 15:

Calculation of Regulatory Capital Measures and Reconciliation of

Non-GAAP Measures” for additional information on our non-GAAP

measures.

(11)

Net charge-off rate is calculated based on

annualized net charge-offs for the period divided by average loans

held for investment for the period.

(12)

Capital ratios as of the end of Q2 2024

are preliminary and therefore subject to change. See “Table 15:

Calculation of Regulatory Capital Measures and Reconciliation of

Non-GAAP Measures” for information on the calculation of each of

these ratios.

(13)

TCE ratio is a non-GAAP measure calculated

based on TCE divided by tangible assets. See “Table 15: Calculation

of Regulatory Capital Measures and Reconciliation of Non-GAAP

Measures” for additional information on non-GAAP measures.

**

Not meaningful.

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 6: Average Balances, Net Interest

Income and Net Interest Margin

2024 Q2

2024 Q1

2023 Q2

(Dollars in millions, except as noted)

Average Balance

Interest Income/

Expense

Yield/Rate(1)

Average Balance

Interest Income/

Expense

Yield/Rate(1)

Average Balance

Interest Income/

Expense

Yield/Rate(1)

Interest-earning assets:

Loans, including loans held for sale

$

315,823

$

9,993

12.66

%

$

315,563

$

9,920

12.57

%

$

310,335

$

9,057

11.67

%

Investment securities

89,501

700

3.13

88,581

687

3.10

89,994

639

2.84

Cash equivalents and other

45,584

587

5.16

43,659

570

5.21

38,810

470

4.84

Total interest-earning assets

$

450,908

$

11,280

10.01

$

447,803

$

11,177

9.98

$

439,139

$

10,166

9.26

Interest-bearing liabilities:

Interest-bearing deposits

$

322,581

$

2,874

3.56

$

318,450

$

2,812

3.53

$

313,207

$

2,277

2.91

Securitized debt obligations

17,452

258

5.91

17,836

261

5.85

17,771

236

5.31

Senior and subordinated notes

30,978

591

7.64

32,211

606

7.52

30,161

528

7.00

Other borrowings and liabilities(2)

2,502

11

1.73

2,373

10

1.78

2,419

12

1.95

Total interest-bearing liabilities

$

373,513

$

3,734

4.00

$

370,870

$

3,689

3.98

$

363,558

$

3,053

3.36

Net interest income/spread

$

7,546

6.01

$

7,488

6.00

$

7,113

5.90

Impact of non-interest-bearing funding

0.69

0.69

0.58

Net interest margin

6.70

%

6.69

%

6.48

%

Six Months Ended June

30,

2024

2023

(Dollars in millions, except as noted)

Average Balance

Interest Income/

Expense

Yield/Rate(1)

Average Balance

Interest Income/

Expense

Yield/Rate(1)

Interest-earning assets:

Loans, including loans held for sale

$

315,693

$

19,913

12.62

%

$

309,231

$

17,780

11.50

%

Investment securities

89,041

1,387

3.12

89,977

1,254

2.79

Cash equivalents and other

44,622

1,157

5.19

37,972

886

4.67

Total interest-earning assets

$

449,356

$

22,457

10.00

$

437,180

$

19,920

9.11

Interest-bearing liabilities:

Interest-bearing deposits

$

320,515

$

5,686

3.55

$

311,010

$

4,133

2.66

Securitized debt obligations

17,644

519

5.88

17,512

447

5.10

Senior and subordinated notes

31,594

1,197

7.58

30,149

1,017

6.75

Other borrowings and liabilities(2)

2,438

21

1.75

2,377

24

2.01

Total interest-bearing liabilities

$

372,191

$

7,423

3.99

$

361,048

$

5,621

3.11

Net interest income/spread

$

15,034

6.01

$

14,299

6.00

Impact of non-interest-bearing funding

0.68

0.54

Net interest margin

6.69

%

6.54

%

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 7: Loan Information and

Performance Statistics

2024 Q2

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024 Q2

2024 Q1

2023 Q4

2023 Q3

2023 Q2

2024 Q1

2023 Q2

2024

2023

2024 vs. 2023

Loans Held for Investment

(Period-End)

Credit card:

Domestic credit card

$

147,065

$

143,861

$

147,666

$

140,320

$

135,975

2

%

8

%

$

147,065

$

135,975

8

%

International card businesses

6,830

6,733

6,881

6,463

6,516

1

5

6,830

6,516

5

Total credit card

153,895

150,594

154,547

146,783

142,491

2

8

153,895

142,491

8

Consumer banking:

Auto

74,385

73,801

74,075

75,456

75,841

1

(2

)

74,385

75,841

(2

)

Retail banking

1,278

1,298

1,362

1,388

1,439

(2

)

(11

)

1,278

1,439

(11

)

Total consumer banking

75,663

75,099

75,437

76,844

77,280

1

(2

)

75,663

77,280

(2

)

Commercial banking:

Commercial and multifamily real estate

32,832

34,272

34,446

35,622

36,041

(4

)

(9

)

32,832

36,041

(9

)

Commercial and industrial

55,796

55,189

56,042

55,531

55,511

1

1

55,796

55,511

1

Total commercial banking

88,628

89,461

90,488

91,153

91,552

(1

)

(3

)

88,628

91,552

(3

)

Total loans held for investment

$

318,186

$

315,154

$

320,472

$

314,780

$

311,323

1

2

$

318,186

$

311,323

2

Loans Held for Investment

(Average)

Credit card:

Domestic credit card

$

143,744

$

142,887

$

142,112

$

137,500

$

132,505

1

%

8

%

$

143,316

$

130,544

10

%

International card businesses

6,723

6,758

6,515

6,549

6,257

(1

)

7

6,740

6,183

9

Total credit card

150,467

149,645

148,627

144,049

138,762

1

8

150,056

136,727

10

Consumer banking:

Auto

74,098

73,768

74,861

75,740

76,233

—

(3

)

73,933

76,846

(4

)

Retail banking

1,288

1,324

1,377

1,414

1,465

(3

)

(12

)

1,306

1,497

(13

)

Total consumer banking

75,386

75,092

76,238

77,154

77,698

—

(3

)

75,239

78,343

(4

)

Commercial banking:

Commercial and multifamily real estate

33,801

34,310

35,414

35,964

37,068

(1

)

(9

)

34,055

37,220

(9

)

Commercial and industrial

55,234

55,567

55,611

55,592

56,127

(1

)

(2

)

55,401

56,421

(2

)

Total commercial banking

89,035

89,877

91,025

91,556

93,195

(1

)

(4

)

89,456

93,641

(4

)

Total average loans held for

investment

$

314,888

$

314,614

$

315,890

$

312,759

$

309,655

—

2

$

314,751

$

308,711

2

2024 Q2

Six Months Ended June

30,

2024

2024

2023

2023

2023

2024

2023

2024

2023

2024 vs. 2023

Q2

Q1

Q4

Q3

Q2

Q1

Q2

Net Charge-Off (Recovery) Rates

Credit card:

Domestic credit card(3)(4)

6.05

%

5.94

%

5.35

%

4.40

%

4.38

%

11

bps

167

bps

5.99

%

4.21

%

178

bps

International card businesses

5.03

5.16

4.94

4.87

4.98

(13

)

5

5.10

4.77

33

Total credit card

6.00

5.90

5.33

4.42

4.41

10

159

5.95

4.24

171

Consumer banking:

Auto

1.81

1.99

2.19

1.77

1.40

(18

)

41

1.90

1.46

44

Retail banking

5.38

4.04

5.68

3.80

3.25

134

213

4.70

3.10

160

Total consumer banking

1.87

2.03

2.25

1.81

1.43

(16

)

44

1.95

1.50

45

Commercial banking:

Commercial and multifamily real estate

0.11

0.20

0.96

0.27

3.91

(9

)

(380

)

0.16

2.04

(188

)

Commercial and industrial

0.17

0.08

0.26

0.24

0.11

9

6

0.13

0.07

6

Total commercial banking

0.15

0.13

0.53

0.25

1.62

2

(147

)

0.14

0.85

(71

)

Total net charge-offs

3.36

3.33

3.21

2.56

2.82

3

54

3.34

2.52

82

30+ Day Performing Delinquency

Rates

Credit card:

Domestic credit card

4.14

%

4.48

%

4.61

%

4.31

%

3.74

%

(34)

bps

40

bps

4.14

%

3.74

%

40

bps

International card businesses

4.63

4.83

4.67

4.43

4.24

(20

)

39

4.63

4.24

39

Total credit card

4.16

4.50

4.61

4.32

3.77

(34

)

39

4.16

3.77

39

Consumer banking:

Auto

5.67

5.28

6.34

5.64

5.38

39

29

5.67

5.38

29

Retail banking

1.57

0.95

1.19

1.07

1.19

62

38

1.57

1.19

38

Total consumer banking

5.60

5.21

6.25

5.55

5.30

39

30

5.60

5.30

30

Nonperforming Loans and Nonperforming

Assets Rates(5)(6)

Credit card:

International card businesses

0.15

%

0.13

%

0.13

%

0.14

%

0.16

%

2

bps

(1)

bps

0.15

%

0.16

%

(1)

bps

Total credit card

0.01

0.01

0.01

0.01

0.01

—

—

0.01

0.01

—

Consumer banking:

Auto

0.88

0.79

0.96

0.85

0.77

9

11

0.88

0.77

11

Retail banking

2.81

3.21

3.36

3.28

2.99

(40

)

(18

)

2.81

2.99

(18

)

Total consumer banking

0.92

0.83

1.00

0.89

0.82

9

10

0.92

0.82

10

Commercial banking:

Commercial and multifamily real estate

1.28

1.58

1.23

1.29

1.15

(30

)

13

1.28

1.15

13

Commercial and industrial

1.56

1.10

0.60

0.65

0.71

46

85

1.56

0.71

85

Total commercial banking

1.46

1.28

0.84

0.90

0.89

18

57

1.46

0.89

57

Total nonperforming loans

0.63

0.57

0.48

0.48

0.47

6

16

0.63

0.47

16

Total nonperforming assets

0.64

0.58

0.50

0.50

0.48

6

16

0.64

0.48

16

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 8: Allowance for Credit Losses

and Reserve for Unfunded Lending Commitments Activity

Three Months Ended June 30,

2024

Credit Card

Consumer Banking

(Dollars in millions)

Domestic Card

International Card

Businesses

Total Credit Card

Auto

Retail Banking

Total Consumer Banking

Commercial Banking

Total

Allowance for credit losses:

Balance as of March 31, 2024

$

11,298

$

456

$

11,754

$

2,057

$

31

$

2,088

$

1,538

$

15,380

Charge-offs

(2,556

)

(130

)

(2,686

)

(615

)

(21

)

(636

)

(39

)

(3,361

)

Recoveries

383

45

428

280

3

283

6

717

Net charge-offs

(2,173

)

(85

)

(2,258

)

(335

)

(18

)

(353

)

(33

)

(2,644

)

Provision for credit losses

3,435

110

3,545

315

15

330

39

3,914

Allowance build (release) for credit

losses(7)

1,262

25

1,287

(20

)

(3

)

(23

)

6

1,270

Other changes(8)

—

(1

)

(1

)

—

—

—

—

(1

)

Balance as of June 30, 2024

12,560

480

13,040

2,037

28

2,065

1,544

16,649

Reserve for unfunded lending

commitments:

Balance as of March 31, 2024

—

—

—

—

—

—

134

134

Provision (benefit) for losses on unfunded

lending commitments

—

—

—

—

—

—

(5

)

(5

)

Balance as of June 30, 2024

—

—

—

—

—

—

129

129

Combined allowance and reserve as of

June 30, 2024

$

12,560

$

480

$

13,040

$

2,037

$

28

$

2,065

$

1,673

$

16,778

Six Months Ended June 30,

2024

Credit Card

Consumer Banking

(Dollars in millions)

Domestic Card

International Card

Businesses

Total Credit Card

Auto

Retail Banking

Total Consumer Banking

Commercial Banking

Total

Allowance for credit losses:

Balance as of December 31, 2023

$

11,261

$

448

$

11,709

$

2,002

$

40

$

2,042

$

1,545

$

15,296

Charge-offs

(5,008

)

(252

)

(5,260

)

(1,257

)

(39

)

(1,296

)

(78

)

(6,634

)

Recoveries

715

80

795

555

8

563

16

1,374

Net charge-offs

(4,293

)

(172

)

(4,465

)

(702

)

(31

)

(733

)

(62

)

(5,260

)

Provision for credit losses

5,592

212

5,804

737

19

756

61

6,621

Allowance build (release) for credit

losses(7)

1,299

40

1,339

35

(12

)

23

(1

)

1,361

Other changes(8)

—

(8

)

(8

)

—

—

—

—

(8

)

Balance as of June 30, 2024

12,560

480

13,040

2,037

28

2,065

1,544

16,649

Reserve for unfunded lending

commitments:

Balance as of December 31, 2023

—

—

—

—

—

—

158

158

Provision (benefit) for losses on unfunded

lending commitments

—

—

—

—

—

—

(29

)

(29

)

Balance as of June 30, 2024

—

—

—

—

—

—

129

129

Combined allowance and reserve as of

June 30, 2024

$

12,560

$

480

$

13,040

$

2,037

$

28

$

2,065

$

1,673

$

16,778

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 9: Financial Summary—Business

Segment Results

Three Months Ended June 30,

2024

Six Months Ended June 30,

2024

(Dollars in millions)

Credit Card

Consumer Banking

Commercial Banking(9)

Other(9)

Total

Credit Card

Consumer Banking

Commercial Banking(9)

Other(9)

Total

Net interest income (loss)

$

5,294

$

2,025

$

609

$

(382

)

$

7,546

$

10,566

$

4,036

$

1,208

$

(776

)

$

15,034

Non-interest income

1,506

172

271

11

1,960

2,982

331

552

9

3,874

Total net revenue (loss)

6,800

2,197

880

(371

)

9,506

13,548

4,367

1,760

(767

)

18,908

Provision for credit losses

3,545

330

34

—

3,909

5,804

756

32

—

6,592

Non-interest expense

3,134

1,250

483

79

4,946

6,363

2,496

998

226

10,083

Income (loss) from continuing operations

before income taxes

121

617

363

(450

)

651

1,381

1,115

730

(993

)

2,233

Income tax provision (benefit)

30

146

85

(207

)

54

329

263

172

(408

)

356

Income (loss) from continuing operations,

net of tax

$

91

$

471

$

278

$

(243

)

$

597

$

1,052

$

852

$

558

$

(585

)

$

1,877

Three Months Ended March 31,

2024

(Dollars in millions)

Credit Card

Consumer Banking

Commercial Banking(9)

Other(9)

Total

Net interest income (loss)

$

5,272

$

2,011

$

599

$

(394

)

$

7,488

Non-interest income (loss)

1,476

159

281

(2

)

1,914

Total net revenue (loss)

6,748

2,170

880

(396

)

9,402

Provision (benefit) for credit losses

2,259

426

(2

)

—

2,683

Non-interest expense

3,229

1,246

515

147

5,137

Income (loss) from continuing operations

before income taxes

1,260

498

367

(543

)

1,582

Income tax provision (benefit)

299

117

87

(201

)

302

Income (loss) from continuing operations,

net of tax

$

961

$

381

$

280

$

(342

)

$

1,280

Three Months Ended June 30,

2023

Six Months Ended June 30,

2023

(Dollars in millions)

Credit Card

Consumer Banking

Commercial Banking(9)

Other(9)

Total

Credit Card

Consumer Banking

Commercial Banking(9)

Other(9)

Total

Net interest income (loss)

$

4,727

$

2,269

$

632

$

(515

)

$

7,113

$

9,384

$

4,629

$

1,280

$

(994

)

$

14,299

Non-interest income (loss)

1,499

149

257

(6

)

1,899

2,862

284

469

1

3,616

Total net revenue (loss)

6,226

2,418

889

(521

)

9,012

12,246

4,913

1,749

(993

)

17,915

Provision for credit losses

2,084

259

146

1

2,490

4,345

534

405

1

5,285

Non-interest expense

3,020

1,231

482

61

4,794

6,058

2,514

1,012

155

9,739

Income (loss) from continuing operations

before income taxes

1,122

928

261

(583

)

1,728

1,843

1,865

332

(1,149

)

2,891

Income tax provision (benefit)

265

219

61

(248

)

297

437

440

78

(455

)

500

Income (loss) from continuing operations,

net of tax

$

857

$

709

$

200

$

(335

)

$

1,431

$

1,406

$

1,425

$

254

$

(694

)

$

2,391

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 10: Financial & Statistical

Summary—Credit Card Business

2024 Q2 vs.

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024 Q2

2024 Q1

2023 Q4

2023 Q3

2023 Q2

2024 Q1

2023 Q2

2024

2023

2024 vs. 2023

Credit Card

Earnings:

Net interest income

$

5,294

$

5,272

$

5,231

$

5,114

$

4,727

—

12

%

$

10,566

$

9,384

13

%

Non-interest income

1,506

1,476

1,565

1,513

1,499

2

%

—

2,982

2,862

4

Total net revenue

6,800

6,748

6,796

6,627

6,226

1

9

13,548

12,246

11

Provision for credit losses

3,545

2,259

2,353

1,953

2,084

57

70

5,804

4,345

34

Non-interest expense

3,134

3,229

3,417

3,015

3,020

(3

)

4

6,363

6,058

5

Income from continuing operations before

income taxes

121

1,260

1,026

1,659

1,122

(90

)

(89

)

1,381

1,843

(25

)

Income tax provision

30

299

241

393

265

(90

)

(89

)

329

437

(25

)

Income from continuing operations, net of

tax

$

91

$

961

$

785

$

1,266

$

857

(91

)

(89

)

$

1,052

$

1,406

(25

)

Selected performance metrics:

Period-end loans held for investment

$

153,895

$

150,594

$

154,547

$

146,783

$

142,491

2

8

$

153,895

$

142,491

8

Average loans held for investment

150,467

149,645

148,627

144,049

138,762

1

8

150,056

136,727

10

Average yield on loans outstanding(1)

18.79

%

18.84

%

18.96

%

19.02

%

18.17

%

(5)

bps

62

bps

18.82

%

18.07

%

75

bps

Total net revenue margin(10)

18.03

17.99

18.24

18.40

17.95

4

8

18.01

17.91

10

Net charge-off rate

6.00

5.90

5.33

4.42

4.41

10

159

5.95

4.24

171

30+ day performing delinquency rate

4.16

4.50

4.61

4.32

3.77

(34

)

39

4.16

3.77

39

30+ day delinquency rate

4.17

4.50

4.62

4.32

3.77

(33

)

40

4.17

3.77

40

Nonperforming loan rate(5)

0.01

0.01

0.01

0.01

0.01

—

—

0.01

0.01

—

Purchase volume(11)

$

165,143

$

150,171

$

162,055

$

158,640

$

157,937

10

%

5

%

$

315,314

$

299,595

5

%

2024 Q2 vs.

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024 Q2

2024 Q1

2023 Q4

2023 Q3

2023 Q2

2024 Q1

2023 Q2

2024

2023

2024 vs. 2023

Domestic Card

Earnings:

Net interest income

$

5,001

$

4,972

$

4,940

$

4,827

$

4,453

1

%

12

%

$

9,973

$

8,843

13

%

Non-interest income

1,440

1,411

1,498

1,445

1,431

2

1

2,851

2,729

4

Total net revenue(12)

6,441

6,383

6,438

6,272

5,884

1

9

12,824

11,572

11

Provision for credit losses

3,435

2,157

2,238

1,861

1,995

59

72

5,592

4,169

34

Non-interest expense

2,946

3,025

3,186

2,810

2,805

(3

)

5

5,971

5,652

6

Income from continuing operations before

income taxes

60

1,201

1,014

1,601

1,084

(95

)

(94

)

1,261

1,751

(28

)

Income tax provision

15

283

239

378

256

(95

)

(94

)

298

413

(28

)

Income from continuing operations, net of

tax

$

45

$

918

$

775

$

1,223

$

828

(95

)

(95

)

$

963

$

1,338

(28

)

Selected performance metrics:

Period-end loans held for investment

$

147,065

$

143,861

$

147,666

$

140,320

$

135,975

2

8

$

147,065

$

135,975

8

Average loans held for investment

143,744

142,887

142,112

137,500

132,505

1

8

143,316

130,544

10

Average yield on loans outstanding(1)

18.73

%

18.76

%

18.88

%

18.96

%

18.07

%

(3)

bps

66

bps

18.75

%

17.98

%

77

bps

Total net revenue margin(10)(12)

17.87

17.82

18.07

18.24

17.76

5

11

17.85

17.73

12

Net charge-off rate(3)(4)

6.05

5.94

5.35

4.40

4.38

11

167

5.99

4.21

178

30+ day performing delinquency rate

4.14

4.48

4.61

4.31

3.74

(34

)

40

4.14

3.74

40

Purchase volume(11)

$

161,370

$

146,696

$

158,290

$

154,880

$

154,184

10

%

5

%

$

308,066

$

292,494

5

%

Refreshed FICO scores:(13)

Greater than 660

69

%

68

%

68

%

69

%

69

%

1

—

69

%

69

%

—

660 or below

31

32

32

31

31

(1

)

—

31

31

—

Total

100

%

100

%

100

%

100

%

100

%

100

%

100

%

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 11: Financial & Statistical

Summary—Consumer Banking Business

2024 Q2 vs.

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024 Q2

2024 Q1

2023 Q4

2023 Q3

2023 Q2

2024 Q1

2023 Q2

2024

2023

2024 vs. 2023

Consumer Banking

Earnings:

Net interest income

$

2,025

$

2,011

$

1,951

$

2,133

$

2,269

1

%

(11

)%

$

4,036

$

4,629

(13

)%

Non-interest income

172

159

163

142

149

8

15

331

284

17

Total net revenue

2,197

2,170

2,114

2,275

2,418

1

(9

)

4,367

4,913

(11

)

Provision for credit losses

330

426

422

213

259

(23

)

27

756

534

42

Non-interest expense

1,250

1,246

1,402

1,262

1,231

—

2

2,496

2,514

(1

)

Income from continuing operations before

income taxes

617

498

290

800

928

24

(34

)

1,115

1,865

(40

)

Income tax provision

146

117

68

189

219

25

(33

)

263

440

(40

)

Income from continuing operations, net of

tax

$

471

$

381

$

222

$

611

$

709

24

(34

)

$

852

$

1,425

(40

)

Selected performance metrics:

Period-end loans held for investment

$

75,663

$

75,099

$

75,437

$

76,844

$

77,280

1

(2

)

$

75,663

$

77,280

(2

)

Average loans held for investment

75,386

75,092

76,238

77,154

77,698

—

(3

)

75,239

78,343

(4

)

Average yield on loans held for

investment(1)

8.54

%

8.33

%

8.17

%

7.97

%

7.65

%

21

bps

89

bps

8.44

%

7.52

%

92

bps

Auto loan originations

$

8,463

$

7,522

$

6,157

$

7,452

$

7,160

13

%

18

%

$

15,985

$

13,371

20

%

Period-end deposits

305,422

300,806

296,171

290,789

286,174

2

7

305,422

286,174

7

Average deposits

300,794

294,448

291,486

287,457

285,647

2

5

297,621

282,229

5

Average deposits interest rate

3.22

%

3.15

%

3.06

%

2.85

%

2.46

%

7

bps

76

bps

3.19

%

2.21

%

98

bps

Net charge-off rate

1.87

2.03

2.25

1.81

1.43

(16

)

44

1.95

1.50

45

30+ day performing delinquency rate

5.60

5.21

6.25

5.55

5.30

39

30

5.60

5.30

30

30+ day delinquency rate

6.35

5.86

7.08

6.27

5.95

49

40

6.35

5.95

40

Nonperforming loan rate(5)

0.92

0.83

1.00

0.89

0.82

9

10

0.92

0.82

10

Nonperforming asset rate(6)

0.99

0.91

1.09

0.96

0.88

8

11

0.99

0.88

11

Auto—At origination FICO

scores:(14)

Greater than 660

53

%

53

%

53

%

52

%

52

%

—

1

%

53

%

52

%

1

%

621 - 660

20

20

20

20

20

—

—

20

20

—

620 or below

27

27

27

28

28

—

(1

)

27

28

(1

)

Total

100

%

100

%

100

%

100

%

100

%

100

%

100

%

CAPITAL ONE FINANCIAL CORPORATION

(COF)

Table 12: Financial & Statistical

Summary—Commercial Banking Business

2024 Q2 vs.

Six Months Ended June

30,

(Dollars in millions, except as noted)

2024 Q2

2024 Q1

2023 Q4

2023 Q3

2023 Q2

2024 Q1

2023 Q2

2024

2023

2024 vs. 2023

Commercial Banking

Earnings:

Net interest income

$

609

$

599

$

617

$

621

$

632

2

%

(4

)%

$

1,208

$

1,280

(6

)%

Non-interest income

271

281

245

288

257

(4

)

5

552

469

18

Total net revenue(9)

880

880

862

909

889

—

(1

)

1,760

1,749

1

Provision (benefit) for credit losses

34

(2

)

84

116

146

**

(77

)

32

405

(92

)

Non-interest expense

483

515

487

512

482

(6

)

—

998

1,012

(1

)

Income from continuing operations before

income taxes

363

367

291

281

261

(1

)

39

730

332

120

Income tax provision

85

87

68

67

61

(2

)

39

172

78

121

Income from continuing operations, net of

tax

$

278

$

280

$

223

$

214

$

200

(1

)

39

$

558

$

254

120

Selected performance metrics:

Period-end loans held for investment

$

88,628

$

89,461

$

90,488

$

91,153

$

91,552

(1

)

(3

)

$

88,628

$

91,552

(3

)

Average loans held for investment

89,035

89,877

91,025

91,556

93,195

(1

)

(4

)

89,456

93,641

(4

)

Average yield on loans held for

investment(1)(9)

7.23

%

7.14

%

7.24

%

7.16

%

6.75

%

9

bps

48

bps

7.18

%

6.53

%

65

bps

Period-end deposits

$

29,210

$

31,082

$

32,712

$

36,035

$

36,793

(6

)%

(21

)%

$

29,210

$

36,793

(21

)%

Average deposits

30,810

31,844

34,525

37,279

37,960

(3

)

(19

)

31,327

38,945

(20

)

Average deposits interest rate

2.55

%

2.65

%

2.79

%

2.93

%

2.68

%

(10)

bps

(13)

bps

2.60

%

2.51

%

9

bps

Net charge-off rate

0.15

0.13

0.53

0.25

1.62

2

(147

)

0.14

0.85

(71

)

Nonperforming loan rate(5)

1.46

1.28

0.84

0.90

0.89

18

57

1.46

0.89

57

Nonperforming asset rate(6)

1.46

1.28

0.84

0.90

0.89

18

57

1.46

0.89

57

Risk category:(15)

Noncriticized

$

79,695

$

80,804

$

81,758

$

82,968

$

84,583

(1

)%

(6

)%

$

79,695

$

84,583

(6

)%

Criticized performing

7,639

7,509

7,969

7,363

6,158

2

24

7,639

6,158

24

Criticized nonperforming

1,294

1,148

761

822

811

13

60

1,294

811

60