Steady Growth in Sales and Results

Confidence in Our Outlook

- First-half sales: €3,740m, +6.5% LFL1 and +3.6% on a

reported basis

- First-half Operating Result from Activity (ORfA): €244m,

+35.4%

- Operating margin up 1.5 pts to 6.5%

- Net profit: €100m, +31.6%

- Net financial debt as of 30 June 2024: €2,422m vs

€2,346m at end-June 2023

- Outlook for 2024:

- Organic sales growth of around 5%

- Operating margin confirmed close to 10%

Regulatory News:

Statement by Stanislas de Gramont, Chief

Executive Officer of Groupe SEB (Paris:SK)

“Our first-half performance is in line with our expectations,

with organic sales growth once again exceeding 5% in the second

quarter, in a slightly less favorable environment, coupled with a

marked increase in our operating margin.

Our Consumer business continued the trend of recent quarters,

driven by Europe and America. Our performance in Asia proved

resilient in a depressed market. This overall momentum was the

result of our long-term strategy focused on product innovation and

activating all distribution channels.

The Professional business posted a record first-half performance

in Coffee, characterized by sizeable deliveries from large deals,

particularly in China. We also continued to make headway in new

geographies and new customer segments and expanded our positions in

the professional culinary market with the acquisition of

Sofilac.

We remain confident in our ability to achieve an operating

margin close to 10% in 2024, with organic sales growth of around 5%

for the year.”

GENERAL COMMENTS ON GROUP SALES

In the first half of 2024, Groupe SEB generated sales of

€3,740m, up 6.5% LFL (+3.6% on a reported basis) versus 2023.

Currency fluctuations had a negative impact of €127m on first-half

sales, with a lesser effect in the second quarter (-€52m vs -€75m

in the first quarter).

Following first-quarter organic sales growth of 7.3%, the Group

posted further organic sales growth in the second quarter of 5.6%,

representing an increase of €101m. This was the fifth consecutive

quarter where organic growth exceeded 5%.

The Consumer business posted half-year sales of €3,246m,

an increase of 5.9% LFL and 2.2% on a reported basis. There was

virtually no difference in sales growth between the first and

second quarters, which recorded LFL growth of +5.8% and +5.9%

respectively. This good performance was driven by Europe (+8.6%

LFL) and the Americas (+12.9% LFL). Sales in Asia were resilient in

the first half of the year in a depressed market environment.

The Group continued to gain market share over the first half of

the year, thanks to product innovation, in flagship categories such

as oil-less fryers, versatile vacuum cleaners, cookware, linen care

and full auto coffee machines. Markets outside of Asia were

generally well oriented over the half-year. However, the situation

changed during the second quarter in some regions, marked by a

softening in consumption or slightly less favorable macroeconomic

conditions.

Sales in the Professional business rose 10.9% LFL (+13.8%

on a reported basis) based on high comps, having been favorably

impacted by the phasing of large deals, most notably in China. This

trend was also supported by a solid core business in Coffee in

Germany. The Group continued to expand and strengthen its foothold

in new geographies and new customer segments.

Growth in the Professional business slowed at the end of the

semester based on higher comps, due to the rollout of large deals

in 2023. The effect is expected to be more pronounced in the second

half of the year.

During the half-year, the Group continued its expansion into the

professional and semi-professional culinary markets with the

acquisition of the Sofilac Group, which owns the Charvet (high-end

professional cooking appliances) and Lacanche (high-end cooking

ranges) brands.

* the more recent acquisitions of Pacojet and Forge Adour will

be fully consolidated in H2 2023.

BREAKDOWN OF SALES BY REGION

Sales in €m

H1

2023

H1

2024

Change 2024/2023

As reported

LFL

EMEA

Western Europe

Other EMEA

1,489

1,029

460

1,555

1,030

525

+4.4%

+0.1%

+14.2%

+8.6%

-1.3%

+30.5%

AMERICAS

North America

South America

458

315

143

517

336

180

+12.8%

+6.9%

+25.9%

+12.9%

+5.6%

+29.1%

ASIA

China

Other countries

1,231

998

232

1,174

957

217

-4.6%

-4.1%

-6.4%

+0.0%

+0.0%

-0.1%

TOTAL Consumer

3,177

3,246

+2.2%

+5.9%

Professional

435

495

+13.8%

+10.9%

GROUPE SEB

3,612

3,740

+3.6%

+6.5%

Rounded figures in €m

% calculated on non-rounded

figures

COMMENTS ON CONSUMER SALES BY REGION

Sales in €m

H1

2023

H1

2024

Change 2024/2023

As reported

LFL

EMEA

Western Europe

Other EMEA

1,489

1,029

460

1,555

1,030

525

+4.4%

+0.1%

+14.2%

+8.6%

-1.3%

+30.5%

WESTERN EUROPE

In Western Europe, sales for the first half of the year

were down 1.3% LFL and almost unchanged on a reported basis

(+0.1%). Excluding the impact of loyalty programs – which were

significant last year in the first half – the region was up 1.5%

LFL. The second quarter saw a sequential improvement with positive

organic sales growth of 2.9%, excluding the impact of loyalty

programs.

In France, sales for the half-year were up by more than 7% LFL,

restated for the impact of the aforementioned loyalty programs, in

a Small Domestic Equipment (SDE) market that was relatively buoyant

from the start of the year. This increase in sales was mainly due

to the Group’s excellent results in categories that are driving

market growth, such as oil-less fryers, versatile vacuum cleaners

and full auto coffee machines.

After a first quarter that was almost unchanged, Germany posted

sales growth of around 6% in the second quarter, notably due to

commercial synergies following the reorganization of the SEB and

WMF teams, effective since the beginning of 2024. New products

listings and market share gains are noteworthy in cookware,

oil-less fryers, versatile vacuum cleaners, and full auto coffee

machines.

In other Western European countries, the positive trend

continued in the first half of the year. Sales were up sharply in

Belgium, where the Group enjoyed excellent commercial momentum in

all categories, as well as in Portugal and the Nordic countries. In

contrast, the SDE market in the United Kingdom remained in

decline.

OTHER EMEA COUNTRIES

Sales in other EMEA countries were up 31% LFL during the

first half of the year. Note that this growth was adversely

affected by major devaluations of the Turkish lira, Egyptian pound

and Russian ruble, with growth limited to 14% on a reported

basis.

In Central and Eastern Europe, the SDE markets once again

performed well. The Group accelerated its growth in some region’s

key countries, such as Poland, Czech Republic and Romania, despite

a fiercely competitive environment. The Group’s strong sales growth

in the region was primarily driven by electrical cooking, with the

success of oil-less fryers; floor care, with our renewed versatile

vacuum cleaner ranges; and beverages, with full auto coffee

machines.

In Turkey, the market continued to expand, despite being

significantly impacted by the persistent volatility of the

country’s currency. Group sales were well oriented, particularly in

cookware, floor care and linen care.

Lastly, the Group announced that it had entered a strategic

partnership with the Alesayi Group to strengthen its foothold in

Saudi Arabia and accelerate its sales development in this

high-potential market. The Alesayi Group has an extensive

distribution network that will ensure a strong visibility for the

Group’s products throughout the country.

Sales in €m

H1

2023

H1

2024

Change 2024/2023

As reported

LFL

AMERICAS

North America

South America

458

315

143

517

336

180

+12.8%

+6.9%

+25.9%

+12.9%

+5.6%

+29.1%

NORTH AMERICA

In North America, the Group maintained the growth rate

observed since the second half of 2023, with half-year sales up

5.6% LFL (+6.9% on a reported basis).

In the United States, higher sales in the first half of the year

were largely driven by cookware through its strong complementary

brands – T-Fal, All-Clad and Imusa – confirming the Group’s leading

position in this category, in a declining market. Linen care sales

are fairly stable. Retailers, especially online pure players,

remained cautious about their procurement policy in the first half

of the year.

In Mexico, the Group continued to enjoy strong sales momentum,

with organic sales growth again exceeding 10% for the half-year.

The SDE market remained highly buoyant, and the Group continued to

expand in the country, gaining market shares in its core categories

(cookware and linen care) and successfully launching new ranges of

full auto coffee machines, thus consolidating its leadership

position. Fan sales also contributed to the Group’s excellent

performance in the first half of the year.

SOUTH AMERICA

In South America, sales for the half-year were up 29.1%

LFL (+25.9% on a reported basis, taking into account the impact of

the Argentinian peso), which confirmed the Group’s positive trend

in the region in recent quarters, despite a generally unfavorable

macroeconomic environment. This strong growth was driven most

notably by very high sales of fans caused by the “El Niño” climate

phenomenon.

Sales in Colombia once again rose sharply, driven by the success

of fan sales as well as by a good performance in cookware,

electrical cooking (oil-less fryers) and food preparation

(blenders). The Group strengthened its competitive positions in

this market and is gradually extending its category coverage (full

auto coffee machines and floor care).

In Brazil, the Group turned in a robust performance for the

half-year with organic sales growth of over 20%. These rising sales

reflect the dynamism of demand for fans, but also for other

categories such as beverages (single-serve coffee machines).

Sales in €m

H1

2023

H1

2024

Change 2024/2023

As reported

LFL

ASIA

China

Other countries

1,231

998

232

1,174

957

217

-4.6%

-4.1%

-6.4%

+0.0%

+0.0%

-0.1%

CHINA

Supor sales were stable LFL throughout the first half, as per

the first quarter, and were down 4% after taking into account the

depreciation of the yuan over the period.

In a declining market, this performance reflects the Group’s

continued gains in market shares, driven by ongoing innovation in

its core products. Rice cookers, kettles and electric pressure

cookers, for example, all reported growth over the half-year. This

outperformance applied to both offline networks and e-commerce

(including social media platforms).

At the same time, the Group continued to expand its offering

into new product categories (including outdoor, babycare, small

size household…).

While visibility was reduced overall, in an environment of muted

consumer spending and high promotional intensity, the second half

of the year is expected to be similar to the first, yielding to

stable or slightly growing organic sales for the full year.

OTHER ASIAN COUNTRIES

In other Asian countries, Group sales were fairly flat

LFL in the first half of the year and down 6.4% on a reported

basis, primarily due to the depreciation of the yen over the

period. Performances in the region varied from a country to

another.

In Japan, the persistent weakness of the yen weighed on the

Group’s business, which faces strong competition in its core

categories of cookware and electric pressure cookers. Overall, the

Group maintained its competitive positioning in an environment

where inflation weighs on consumer confidence.

The Group posted a positive performance in South Korea, despite

a similarly sluggish macroeconomic environment. Sales of cookware

and versatile vacuum cleaners were robust, helped by commercial

successes with our distributors.

Fans sales in Vietnam were very strong, giving rise to a

positive performance. The Group also reaped the benefits of its

growing presence among local retailers.

Lastly, in Australia, business grew throughout the half-year,

with a double-digit increase in sales LFL. These favorable results

were evenly spread across all product categories (electrical

cooking, cookware, linen care) and accompanied by numerous new

listings.

COMMENTS ON PROFESSIONAL BUSINESS

Sales in €m

H1

2023

H1

2024

Change 2024/2023

As reported

LFL

Professional

435

495

+13.8%

+10.9%

PROFESSIONAL

Sales in the Professional business totaled €495m for the

half-year, a rise of 10.9% LFL (+13.8% on a reported basis) on a

high comparison basis (+25% LFL in the first half of 2023).

The Coffee business posted a record half-year, driven by China,

which benefited from the large deals phasing. This good dynamic was

also supported through the half-year by solid core business in

Germany. In addition, the Group continued to develop its presence

in new markets, particularly Asia (including Malaysia and Taiwan),

Eastern Europe and Mexico, while extending its offering to new

customer segments, such as tea chains in China.

Given the delivery schedule for large deals in 2023 and 2024

(notably in China and the United States), the base effect, with its

already high comps in the second quarter, will become more

pronounced in the second half of the year.

Lastly, an important milestone was reached during the half-year

with the acquisition of Sofilac2, which expanded our offering and

expertise in the professional culinary segment. In 2023, the

Sofilac Group generated sales of more than €60m in almost 45

countries.

OPERATING RESULT FROM ACTIVITY (ORfA)

In the first half of 2024, ORfA stood at €244m, a

rise of more than 35% from 2023. The figure includes a negative

currency effect of €73m and a positive scope effect of €2m. The

operating margin was 6.5% of sales, versus 5% the previous

year.

The change in ORfA compared with the first half of 2023 can

notably be explained by the following factors:

- a positive volume effect in both Consumer and

Professional;

- a positive mix effect bolstered by innovation in line with our

long-term strategy

- a reduction in cost of sales (FY effect of 2023 lower costs,

additional gains in 2024, better industrial absorption), allowing

to reinvest to support sales momentum;

- increase in growth drivers in line with sales to support

product development and marketing;

- slightly higher commercial expenses, reflecting ongoing dynamic

sales activation; and

- controlled administrative expenses.

It is reminded that the ORfA in the first half of the year is

not representative of the full year, given the seasonal nature of

the Group’s business.

OPERATING PROFIT AND NET PROFIT

At end-June 2024, Group operating profit amounted to

€210m, up 31% from €160m one year earlier. This result includes

a statutory and discretionary employee profit-sharing expense of

about €10m (€11m in the first half of 2023) and other income and

expenses of -€23m (mainly related to the reorganization in Germany

and restructuring costs in Brazil), versus -€9m in the first half

of 2023.

Net financial expense as of 30 June 2024 amounted to -€46m,

versus -€33m for the first half of 2023 in a context of increasing

average cost of Group debt, particularly following refinancings

carried out since the end of 2023.

The tax charge is -€39m, based on an estimated effective tax

rate of 24%, and after minority interests of -€24m. Profit

attributable to owners of the parent therefore totaled €100m in the

first half, compared with €76m at end-June 2023.

FINANCIAL STRUCTURE

As of 30 June 2024, consolidated equity stood at €3,328m,

down €133m versus end-2023, and up €174m versus 30 June 2023.

The Group’s net financial debt was €2,422m (including

€312m of IFRS 16 debt) as of 30 June 2024, up €76m versus 30 June

2023, and up €653m versus 31 December 2023. This increase compared

to end-2023 was primarily due to negative free cash flow of

€215m in the first half of 2024, which should be viewed against

the low point reached by the Group’s operating working capital

requirement at end-2023 (14.6% of sales versus 18.2% as of 30 June

2024). There were also non-recurring disbursements linked to the

Sofilac acquisition, the partnership in Saudi Arabia and the

strengthening of treasury shares.

The Group’s debt ratio (net financial debt/equity) as

of 30 June 2024 was 0.7x, stable compared to the same

date last year. The net financial debt/adjusted EBITDA ratio was

2.3x (2.1x excluding IFRS 16 and M&A), down compared to a

ratio of 2.7x as of 30 June 2023.

OUTLOOK

We anticipate organic sales growth of around 5% for the year. In

a macroeconomic and geopolitical environment characterized by low

visibility, we remain confident in our growth trajectory. In

comparison with 2023, this includes a more balanced growth between

the Consumer and Professional businesses.

The trend in our operating margin over the first half of the

year coupled with our expectations for the second half support our

ambition to achieve an operating margin close to 10% for the full

year 2024.

Groupe SEB’s company and consolidated financial statements as of

30 June 2024 were approved by the Board of Directors meeting held

on 24 July 2024

CONSOLIDATED INCOME STATEMENT

(€ million)

06/30/2024

6 months

06/30/2023

6 months

12/31/2023

12 months

Revenue

3,740.2

3,611.9

8,006.0

Operating expenses

(3,496.4)

(3,431.8)

(7,280.4)

OPERATING RESULT FROM ACTIVITY

243.8

180.1

725.6

Statutory and discretionary employee

profit-sharing

(10.4)

(11,0)

(23.8)

RECURRING OPERATING PROFIT

233.4

169.1

701.8

Other operating income and expense

(23.4)

(8.7)

(34.3)

OPERATING PROFIT

210.0

160.4

667.5

Finance costs

(30.0)

(16.5)

(42.9)

Other financial income and expense

(16.3)

(16.1)

(37.6)

PROFIT BEFORE TAX

163.7

127.8

587.0

Income tax expense

(39.3)

(30.7)

(147.6)

PROFIT FOR THE PERIOD

124.4

97.1

439.4

Non-controlling interests

(24.3)

(21.1)

(53.2)

PROFIT ATTRIBUTABLE TO OWNERS OF THE

PARENT

100.1

76.0

386.2

PROFIT ATTRIBUTABLE TO OWNERS OF THE

PARENT PER SHARE (in units)

Basic earnings per share

1.84

1.38

7.01

Diluted earnings per share

1.83

1.38

6.97

CONSOLIDATED BALANCE SHEET

ASSETS (in € million)

06/30/2024

06/30/2023

12/31/2023

Goodwill

1,865.5

1,757.6

1,868.4

Other intangible assets

1,360.6

1,303.0

1,347.5

Property, plant and equipment

1,216.0

1,295.0

1,292.2

Other investments

348.1

325.3

210.6

Other non-current financial assets

16.5

26.6

16.6

Deferred tax liabilities

199.4

152.0

151.6

Other non-current assets

66.6

66.3

65.5

Long-term derivative instruments -

assets

16.9

18.1

17.9

NON-CURRENT ASSETS

5,089.6

4,943.9

4,970.3

Inventories

1,690.9

1,625.2

1,474.8

Customers

923.4

788.8

1,018.0

Other receivables

173.5

175.8

185.0

Current tax assets

46.8

41.8

36.8

Short-term derivative instruments -

assets

48.2

51.2

40.8

Financial investments and other current

financial assets

38.6

58.3

94.7

Cash and cash equivalents

772.6

828.2

1,432.1

CURRENT ASSETS

3,694.0

3,569.3

4,282.2

TOTAL ASSETS

8,783.6

8,513.2

9,252.5

EQUITY & LIABILITIES (in €

million)

06/30/2024

06/30/2023

12/31/2023

Share capital

55.3

55.3

55.3

Reserves and retained earnings

3,137.1

2,895,0

3,170.8

Treasury stock

(100.0)

(27.7)

(27.7)

Equity attributable to owners of the

parent

3,092.4

2,922.6

3,198.4

Non-controlling interests

235.8

230.9

262.3

CONSOLIDATED SHAREHOLDERS’

EQUITY

3,328.2

3,153.5

3,460.7

Deferred tax liabilities

210.2

181.9

198.6

Employee benefits and other long-term

provisions

195.9

213.3

210.4

Long-term borrowings

1,636.0

1,405.8

1,890.4

Other non-current liabilities

78.9

57.2

58.9

Long-term derivative instruments -

liabilities

16.3

21.4

13.9

NON-CURRENT LIABILITIES

2,137.3

1,879.6

2,372.2

Employee benefits and other short-term

provisions

124.1

105,0

125.3

Suppliers

1,130.0

966.8

1,160.6

Other current liabilities

384.3

447.9

609.8

Current tax liabilities

53.4

45.4

58.8

Short-term derivative instruments -

liabilities

32.3

83.4

65.0

Short-term borrowings

1,594.1

1,831.6

1,400.1

CURRENT LIABILITIES

3,318.2

3,480.1

3,419.6

TOTAL CONSOLIDATED EQUITY AND

LIABILITIES

8,783.6

8,513.2

9,252.5

CASH FLOW STATEMENT

(€ million)

06/30/2024

06/30/2023

PROFIT ATTRIBUTABLE TO OWNERS OF THE

PARENT

100.1

76.0

Depreciation, amortization and impairment

losses

142.3

139.3

Change in provisions

(6.8)

(31.2)

Unrealized gains and losses on financial

instruments

(15.0)

17.4

Income and expenses related to stock

options and bonus shares

11.7

12.6

Gains and losses on disposals of

assets

0.6

1.5

Other

Non-controlling interests

24.3

21.1

Current and deferred taxes

39.3

30.7

Finance costs

30.0

16.5

CASH FLOW (1) (2)

326.5

283.9

Change in inventories and work in

progress

(223.1)

32.6

Change in trade receivables

(88.0)

(50.3)

Change in trade payables

(24.7)

(27.2)

Change in other receivables and

payables

(14.8)

39.4

Income tax paid

(96.2)

(62.3)

Net interest paid

(30.0)

(16.5)

NET CASH FROM OPERATING

ACTIVITIES

(150.3)

199.6

Proceeds from disposals of assets

2.9

1.2

Purchases of property, plant and equipment

(2)

(60.7)

(63.7)

Purchases of software and other intangible

assets (2)

(20.5)

(18.0)

Purchases of financial assets

40.7

33.6

Acquisitions of subsidiaries, net of cash

acquired

(126.9)

(174.2)

NET CASH USED BY INVESTING

ACTIVITIES

(164.5)

(221.1)

Increase in borrowings (2)

1 023.4

782.8

Decrease in borrowings

(1 083.0)

(881.3)

Issue of share capital

Transactions between owners (3)

0.1

(30.7)

Change in treasury stock

(89.0)

(18.9)

Dividends paid, including to

non-controlling interests

(194.2)

(195.3)

NET CASH USED BY FINANCING

ACTIVITIES

(342.7)

(343.4)

Effect of changes in foreign exchange

rates

(2.0)

(43.9)

NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS

(659.5)

(408.8)

Cash and cash equivalents at beginning of

period

1 432.1

1 237.0

Cash and cash equivalents at end of

period

772.6

828.2

(1) Before net finance costs and income

taxes paid.

(2) Excluding IFRS 16 impact

(3) Including Supor share buyback of 0.1

million euros at end June 2024 (vs. 30.7 million euros at end June

2023 and 62.8 million euros at end December 2023)

APPENDIX

SALES BY REGION – 1ST QUARTER

Sales (€m)

Q1

2023

Q1

2024

Change 2024/2023

As reported

LFL

EMEA

Western Europe

Other EMEA

760

524

236

786

515

271

+3.4%

-1.8%

+14.9%

+8.0%

-3.1%

+32.9%

AMERICAS

North America

South America

212

143

69

246

155

90

+15.8%

+8.8%

+30.3%

+14.0%

+7.7%

+27.1%

ASIA

China

Other countries

640

527

113

603

498

106

-5.8%

-5.6%

-6.8%

+0.5%

+0.5%

+0.7%

TOTAL Consumer

1,613

1,635

+1.4%

+5.8%

Professional

209

258

+23.3%

+18.5%

GROUPE SEB

1,822

1,893

+3.9%

+7.3%

Rounded figures in €m

% calculated on non-rounded figures

SALES BY REGION – 2ND QUARTER

Sales (€m)

Q2

2023

Q2

2024

Change 2024/2023

As reported

LFL

EMEA

Western Europe

Other EMEA

729

505

224

769

515

254

+5.5%

+2.0%

+13.4%

+9.1%

+0.7%

+28.1%

AMERICAS

North America

South America

246

172

74

271

181

90

+10.2%

+5.3%

+21.7%

+12.0%

+3.8%

+31.0%

ASIA

China

Other countries

590

471

119

571

459

112

-3.3%

-2.6%

-6.1%

-0.6%

-0.6%

-0.8%

TOTAL Consumer

1,565

1,611

+2.9%

+5.9%

Professional

226

237

+5.0%

+3.9%

GROUPE SEB

1,790

1,847

+3.2%

+5.6%

Rounded figures in €m

% calculated on non-rounded figures

GLOSSARY

On a like-for-like basis (LFL) – Organic

The amounts and growth rates at constant exchange rates and

consolidation scope in a given year compared with the previous year

are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter)

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Operating Result from Activity (ORfA)

Operating Result from Activity (ORfA) is Groupe SEB’s main

performance indicator. It corresponds to sales minus operating

expenses, i.e. the cost of sales, innovation expenditure (R&D,

strategic marketing and design), advertising, operational marketing

as well as sales and marketing expenses. ORfA does not include

discretionary and non-discretionary profit-sharing or other

non-recurring operating income and expense.

Adjusted EBITDA

Adjusted EBITDA is equal to Operating Result From Activity minus

discretionary and non-discretionary profit-sharing, to which are

added operating depreciation and amortization.

Free cash flow

Free cash flow corresponds to adjusted EBITDA, after accounting

for the change in the operating capital requirement, recurring

investments (CAPEX), taxes and financial expense, as well as other

non-operational items.

Net financial debt

This term refers to all recurring and non-recurring financial

debt minus cash and cash equivalents, as well as derivative

instruments linked to Group financing. It also includes debt from

application of the IFRS 16 standard “Lease contracts” in addition

to short-term investments with no risk of a substantial change in

value but with maturities of over three months.

Loyalty program (LP)

These programs, run by distribution retailers, consist in

offering promotional offers on a product category to loyal

consumers who have made a series of purchases within a short period

of time. These promotional programs allow distributors to boost

footfall in their stores and our consumers to access our products

at preferential prices.

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

climate, demand in the Group’s large markets and the impact of new

product launches by competitors. As a result of these

uncertainties, Groupe SEB cannot be held liable for potential

variance on its current forecasts, which result from unexpected

events or unforeseeable developments. The factors which could

considerably influence Groupe SEB’s economic and financial result

are presented in the Annual Financial Report and Universal

Registration Document filed with the Autorité des Marchés

Financiers, the French financial markets authority. This document

may contain individually rounded data. The arithmetical

calculations based on rounded data may present some differences

with the aggregates or subtotals reported.

Conference with management on July 24 at

6:00 p.m. CET

Click here to access the webcast live

(in English only)

Replay available on our website on July 24 at

www.groupeseb.com

or CONNECT as from 5:50pm and dial: From

France: +33 (0) 1 7037 7166 – Password: SEB From abroad: +44 (0) 33

0551 0200 – Password: SEB From the United States: +1 786 697 3501 –

Password: SEB

The Q&A session will be accessible via the

webcast (written questions) or the conference call (oral

questions)

Next key dates - 2024

October 24 | after market

closes

9-month 2024 sales and financial

data

December 12 |

ESG Investor Day

Find us on www.groupeseb.com

World reference in small domestic equipment and professional

coffee machines, Groupe SEB operates with a unique portfolio of 40

top brands (including Tefal, Seb, Rowenta, Moulinex, Krups,

Lagostina, All-Clad, WMF, Emsa, Supor), marketed through

multi-format retailing. Selling more than 400 million products a

year, it deploys a long-term strategy focused on innovation,

international development, competitiveness, and client service.

Present in over 150 countries, Groupe SEB generated sales €8

billion in 2023 and has more than 31,000 employees worldwide.

1 On a like-for-like basis (= organic) 2 Sofilac

will be consolidated starting from the third quarter, incorporating

the activity from April 4 to September 30.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724280387/en/

Investor/Analyst Relations

Groupe SEB Financial Communication and IR

Dept

Raphaël Hoffstetter Guillaume Baron

comfin@groupeseb.com Tel. +33 (0) 4 72 18 16

04

Media Relations

Groupe SEB Corporate Communication Dept

Cathy Pianon Marie Leroy

presse@groupeseb.com

Tel. + 33 (0) 6 33 13 02 00 Tel. + 33 (0) 6 76

98 87 53

Image Sept Caroline Simon Claire

Doligez Isabelle Dunoyer de Segonzac

caroline.simon@image7.fr cdoligez@image7.fr

isegonzac@image7.fr

Phone +33 (0) 1 53 70 74 70

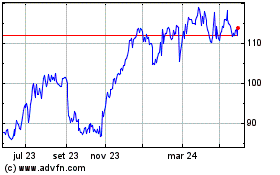

SEB (EU:SK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

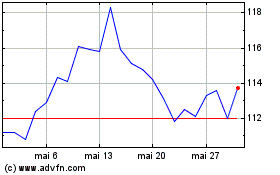

SEB (EU:SK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024