Strong Signature Systems performance improves

second quarter results

Actions taken in the second quarter to reduce

costs and leverage productivity gains; executing against previously

communicated target of $7M-$9M in annualized cost savings by

2025

Full-year guidance lowered to $1.05 - $1.20 for

adjusted earnings per share, primarily due to continued demand

pressure in Recreational Vehicle, Marine, and Automotive

Aftermarket end markets

Myers Industries Inc. (NYSE: MYE), a leading manufacturer of a

wide range of polymer and metal products and distributor for tire,

wheel, and under-vehicle service industry, today announced results

for the second quarter ended June 30, 2024.

Second Quarter 2024 Financial

Highlights

- Net sales of $220.2 million compared with $208.5 million in the

prior-year period

- Net Income of $10.3 million, compared with $10.6 million in the

prior-year period

- Adjusted EBITDA of $38.9 million, compared with $24.7 million

in the prior-year period

- GAAP gross margin of 34.3%, up 150 basis points versus the

prior-year period

- Adjusted gross margin of 36.1%, up 320 basis points versus the

prior-year period

- GAAP net income per diluted share of $0.28 compared with $0.29

in the prior-year period

- Adjusted earnings per diluted share of $0.39 compared with

$0.35 in the prior-year period

- Cash flow provided by operations of $14.3 million and free cash

flow of $9.9 million

Myers Industries President and CEO Mike McGaugh commented, “Our

second-quarter results reflect the Company’s first full quarter

with Signature Systems. This business is benefiting from worldwide

investments in Infrastructure and helped drive both sequential and

year-over-year revenue growth and margin expansion. Signature’s

performance outpaced the demand headwinds in the Recreational

Vehicle (RV), Marine, and Automotive Aftermarket end markets.”

“We continue to focus on growing our Storage, Handling &

Protection portfolio, most notably our four power brands:

Akro-Mils, Buckhorn, Scepter, and Signature Systems. We believe our

increased participation in the Military and Infrastructure end

markets will provide meaningful growth for our Company over the

next several years.

At the same time, we are taking actions to reduce costs and

increase productivity in the Engineered Solutions and Automotive

Aftermarket portfolios. These actions include the consolidation of

three distribution centers in our Myers Tire Supply business, as

well as today’s announcement of the consolidation of our Atlantic,

Iowa, rotational molding facility into our other rotational molding

plants in Indiana. We are able to reduce our footprint and reduce

our cost structure, due to the productivity gains we’ve achieved.

We expect these closures to be completed in 2025 and deliver

approximately $5 million in cost savings in 2025 as well.

Our ongoing productivity-improvement and cost-reduction

initiatives will help us navigate the cyclical demand conditions in

the RV, Marine, and Automotive Aftermarket end markets while

positioning the Company favorably for when these conditions revert

to historical levels of demand.”

McGaugh concluded, “As a result of continued trough-like demand

conditions in these end markets, we believe it is prudent to lower

our full-year adjusted earnings per share guidance to a range of

$1.05 to $1.20.

Myers’ consistent and disciplined execution of our Three-Horizon

strategy and the expansion of our portfolio of branded products

enabled us to achieve the highest quarterly adjusted EBITDA margin

of the past decade. Despite the near-term demand softness in select

end markets, we remain excited about the ongoing transformation of

Myers Industries as we execute against our long-term strategy to

build a portfolio of businesses with high margin, branded products

that Move, Store, and Protect.”

Second Quarter 2024 Financial

Summary

Quarter Ended June 30,

(Dollars in thousands, except per share

data)

2024

2023

% Inc (Dec)

Net sales

$220,236

$208,453

5.7%

Gross profit

$75,517

$68,410

10.4%

Gross margin

34.3%

32.8%

Operating income

$23,728

$16,142

47.0%

Net income

$10,279

$10,605

(3.1)%

Net income per diluted share

$0.28

$0.29

(3.4)%

Adjusted operating income

$28,826

$19,027

51.5%

Adjusted net income

$14,561

$12,928

12.6%

Adjusted earnings per diluted share

$0.39

$0.35

11.4%

Adjusted EBITDA

$38,893

$24,704

57.4%

Net sales were $220.2 million, an increase of $11.8 million, or

5.7%, compared with $208.5 million for the second quarter of 2023.

The increase in net sales was driven by contributions from the

recent acquisition of Signature Systems, partially offset by lower

pricing and volumes in both the Material Handling and Distribution

segments.

Gross profit increased $7.1 million, or 10.4%, to $75.5 million,

driven by performance at Signature Systems, favorable product mix

and lower material costs, partially offset by lower pricing and

volume, as well as adjusting items related to acquisition and

restructuring expenses. Gross margin improved 150 basis points to

34.3% compared with 32.8% for the second quarter of 2023. On an

adjusted basis, gross profit increased 320 basis points to 36.1%

from 32.9%. Selling, general and administrative expenses decreased

$0.7 million year-over-year, or 1.3%, to $51.7 million. SG&A as

a percentage of sales decreased to 23.5%, compared with 25.8% in

the first quarter of 2024 and 25.1% in the same period last year,

driven in part by lower incentive compensation accruals, reflecting

Myers’ full-year outlook and cost-saving initiatives. Net income

per diluted share was $0.28, compared with $0.29 for the second

quarter of 2023. Adjusted earnings per diluted share were $0.39,

compared with $0.35 for the second quarter of 2023.

Second Quarter 2024 Segment

Results

(Dollar amounts in the segment tables below are reported in

millions)

Material Handling

Net Sales

Op Income

Op Income Margin

Adj EBITDA

Adj EBITDA Margin

Q2 2024 Results

$166.0

$28.7

17.3%

$41.5

25.0%

Q2 2023 Results

$143.3

$24.8

17.3%

$29.9

20.8%

$ Increase (decrease) vs prior year

$22.7

$3.9

$11.6

% Increase (decrease) vs prior year

15.9%

15.6%

+0bps

39.0%

+420bps

Items in this table may not recalculate

due to rounding

Net sales for the Material Handling segment were $166.0 million,

an increase of $22.7 million, or 15.9%, compared with $143.3

million for the second quarter of 2023. Sales from the addition of

Signature Systems were partly offset by decreases, primarily in

Recreational Vehicle and Marine, but also Food & Beverage and

Consumer end markets.

Operating income increased 15.6% to $28.7 million, compared with

$24.8 million in the second quarter of 2023. Operating income

margin of 17.3% was flat compared with the second quarter of 2023.

Adjusted EBITDA increased 39.0% to $41.5 million, compared with

$29.9 million in the second quarter of 2023. SG&A expenses

increased year-over-year, primarily due to incremental SG&A

from Signature, partially offset by lower expenses for professional

services and incentive compensation. Adjusted EBITDA margin

improved by 420 basis points, primarily attributed to the Signature

acquisition, partially offset by lower sales volume and pricing in

the legacy business.

Distribution

Net Sales

Op Income

Op Income Margin

Adj EBITDA

Adj EBITDA Margin

Q2 2024 Results

$54.3

$2.2

4.0%

$3.8

6.9%

Q2 2023 Results

$65.2

$3.4

5.2%

$4.7

7.2%

$ Increase (decrease) vs prior year

($10.9)

($1.2)

($0.9)

% Increase (decrease) vs prior year

(16.7)%

(35.9)%

-120bps

(20.1)%

-30bps

Items in this table may not recalculate

due to rounding

Operating income decreased $1.2 million to $2.2 million,

compared with $3.4 million for the second quarter of 2023. Adjusted

EBITDA decreased 20.1% to $3.8 million, compared with $4.7 million

in the second quarter of 2023. The decrease in operating income and

adjusted EBITDA was primarily due to lower volume and pricing,

offset partially by favorable sales mix and material costs.

SG&A expenses decreased year-over-year, primarily due to lower

payroll costs and lower variable selling expenses. The Distribution

segment's operating income margin was 4.0% compared with 5.2% for

the second quarter of 2023. The Distribution segment’s adjusted

EBITDA margin was 6.9%, compared with 7.2% for the second quarter

of 2023. The Distribution Segment continues to implement pricing

and cost actions to counter cost inflation and improve margin.

Balance Sheet & Cash

Flow

As of June 30, 2024, the Company’s cash on hand totaled $37.3

million. Total debt as of June 30, 2024, was $409.0 million. Under

the terms of the Company’s loan agreement, its net leverage ratio

was 2.6x and it had $231.4 million of availability under its

revolving credit facility as of June 30, 2024. For the second

quarter of 2024, cash flow provided by operations was $14.3 million

and free cash flow was $9.9 million, compared with cash flow

provided by operations of $22.9 million and free cash flow of $16.7

million for the second quarter of 2023. The decrease in free cash

flow was driven primarily by increased interest expense and

investment in working capital, partially offset by contributions

from Signature. Capital expenditures for the second quarter of 2024

were $4.4 million, compared with $6.1 million for the second

quarter of 2023.

2024 Outlook

Based on current exchange rates, market outlook and business

forecast, the Company is providing the following outlook for fiscal

2024:

- Net sales growth of 5% to 10%

- Net income per diluted share in the range of $0.76 to

$0.91

- Adjusted earnings per diluted share in the range of $1.05 to

$1.20

- Capital expenditures in the range of $30 million to $35

million

- Effective tax rate to approximate 26%

Myers will continue to monitor market conditions and provide

updates throughout the year.

Conference Call Details

The Company will host an earnings conference call and webcast

for investors and analysts on Thursday, August 1, 2024, at 8:30

a.m. ET. The call is anticipated to last less than one hour and may

be accessed using the following online participation registration

link:

https://www.netroadshow.com/events/login?show=ca1ab624&confId=68382.

Upon registering, each participant will be provided with call

details and a registrant ID. Reminders will also be sent to

registered participants via email. Alternatively, the conference

call will be available via a live webcast. To access the live

webcast or a replay, visit the Company's website

www.myersindustries.com and click on the Investor Relations tab. An

archived replay of the call will also be available on the site

shortly after the event. To listen to the telephone replay, callers

should dial: (U.S. Local) 1-929-458-6194 or (U.S. Toll-Free)

1-866-813-9403 Access Code: 408754.

Use of Non-GAAP Financial Measures

The Company uses certain non-GAAP measures in this release.

Adjusted gross profit, adjusted gross margin, adjusted operating

income (loss), adjusted operating income margin, adjusted earnings

before interest, taxes, depreciation and amortization (EBITDA),

adjusted EBITDA margin, adjusted net income, adjusted earnings per

diluted share (adjusted EPS), and free cash flow are non-GAAP

financial measures and are intended to serve as a supplement to

results provided in accordance with accounting principles generally

accepted in the United States. Myers Industries believes that such

information provides an additional measurement and consistent

historical comparison of the Company’s performance. A

reconciliation of the non-GAAP financial measures to the most

directly comparable GAAP measures is available in this news

release.

About Myers Industries

Myers Industries Inc., based in Akron, Ohio, is a manufacturer

of sustainable plastic and metal products for industrial,

agricultural, automotive, commercial, and consumer markets. The

Company is also the largest distributor of tools, equipment and

supplies for the tire, wheel, and under-vehicle service industry in

the United States. Visit www.myersindustries.com to learn more.

Caution on Forward-Looking

Statements

Statements in this release include “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995, including

information regarding the Company’s financial outlook, future

plans, objectives, business prospects and anticipated financial

performance. Forward-looking statements can be identified by words

such as “will,” “believe,” “anticipate,” “expect,” “estimate,”

“intend,” “plan,” or variations of these words, or similar

expressions. These forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on the Company’s current beliefs, expectations

and assumptions regarding the future of our business, future plans

and strategies, projections, anticipated events and trends, the

economy and other future conditions. Because forward-looking

statements relate to the future, these statements inherently

involve a wide range of inherent uncertainties, risks and changes

in circumstances that are difficult to predict and many of which

are outside of our control. The Company’s actual actions, results,

and financial condition may differ materially from what is

expressed or implied by the forward-looking statements.

Specific factors that could cause such a difference on our

business, financial position, results of operations and/or

liquidity include, without limitation, raw material availability,

increases in raw material costs, or other production costs; risks

associated with our strategic growth initiatives or the failure to

achieve the anticipated benefits of such initiatives; unanticipated

downturn in business relationships with customers or their

purchases; competitive pressures on sales and pricing; changes in

the markets for the Company’s business segments; changes in trends

and demands in the markets in which the Company competes;

operational problems at our manufacturing facilities or unexpected

failures at those facilities; future economic and financial

conditions in the United States and around the world; inability of

the Company to meet future capital requirements; claims, litigation

and regulatory actions against the Company; changes in laws and

regulations affecting the Company; unforeseen events, including

natural disasters, unusual or severe weather events and patterns,

public health crises, geopolitical crises, and other catastrophic

events; and other risks and uncertainties detailed from time to

time in the Company’s filings with the SEC, including without

limitation, the risk factors disclosed in Item 1A, “Risk Factors,”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023. Given these factors, as well as other variables

that may affect our operating results, readers should not rely on

forward-looking statements, assume that past financial performance

will be a reliable indicator of future performance, nor use

historical trends to anticipate results or trends in future

periods. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

thereof. The Company expressly disclaims any obligation or

intention to provide updates to the forward-looking statements and

the estimates and assumptions associated with them.

M-INV

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in thousands, except

share and per share data)

Quarter Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net sales

$

220,236

$

208,453

$

427,338

$

424,192

Cost of sales

144,719

140,043

287,552

284,717

Gross profit

75,517

68,410

139,786

139,475

Selling, general and administrative

expenses

51,661

52,351

105,118

104,432

(Gain) loss on disposal of fixed

assets

128

(83

)

61

(56

)

Operating income (loss)

23,728

16,142

34,607

35,099

Interest expense, net

9,006

1,790

15,085

3,436

Income (loss) before income

taxes

14,722

14,352

19,522

31,663

Income tax expense (benefit)

4,443

3,747

5,740

8,082

Net income (loss)

$

10,279

$

10,605

$

13,782

$

23,581

Net income (loss) per common

share:

Basic

$

0.28

$

0.29

$

0.37

$

0.64

Diluted

$

0.28

$

0.29

$

0.37

$

0.64

Weighted average common shares

outstanding:

Basic

37,179,658

36,761,916

37,043,913

36,663,345

Diluted

37,312,394

36,892,177

37,257,302

36,874,084

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

(Dollars in thousands)

June 30, 2024

December 31, 2023

Assets

Current Assets

Cash

$

37,345

$

30,290

Trade accounts receivable, net

129,775

113,907

Other accounts receivable, net

9,050

14,726

Inventories, net

105,796

90,844

Other current assets

13,577

6,854

Total Current Assets

295,543

256,621

Property, plant, & equipment, net

135,251

107,933

Right of use asset - operating leases

31,751

27,989

Goodwill and intangible assets, net

474,685

140,521

Deferred income taxes

209

209

Other assets

14,194

8,358

Total Assets

$

951,633

$

541,631

Liabilities & Shareholders'

Equity

Current Liabilities

Accounts payable

$

93,097

$

79,050

Accrued expenses

44,137

53,523

Operating lease liability - short-term

6,223

5,943

Finance lease liability - short-term

609

593

Long-term debt - current portion

19,603

25,998

Total Current Liabilities

163,669

165,107

Long-term debt

380,450

31,989

Operating lease liability - long-term

25,003

22,352

Finance lease liability - long-term

8,306

8,615

Other liabilities

17,543

12,108

Deferred income taxes

62,110

8,660

Total Shareholders' Equity

294,552

292,800

Total Liabilities & Shareholders'

Equity

$

951,633

$

541,631

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

Quarter Ended June 30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash Flows From Operating

Activities

Net income

$

10,279

$

10,605

$

13,782

$

23,581

Adjustments to reconcile net income to net

cash provided by (used for) operating activities

Depreciation and amortization

10,067

5,677

18,564

11,295

Amortization of deferred financing

costs

544

78

775

156

Amortization of acquisition-related

inventory step-up

1,342

—

4,457

—

Non-cash stock-based compensation

expense

(135

)

2,488

547

4,392

(Gain) loss on disposal of fixed

assets

128

(83

)

61

(56

)

Other

170

3,319

164

2,492

Cash flows provided by (used for) working

capital

Accounts receivable - trade and other,

net

248

11,915

8,212

15,096

Inventories

(2,145

)

4,048

(1,959

)

(4,730

)

Prepaid expenses and other current

assets

(5,528

)

(5,048

)

(4,643

)

(3,828

)

Accounts payable and accrued expenses

(623

)

(10,147

)

(5,343

)

240

Net cash provided by (used for) operating

activities

14,347

22,852

34,617

48,638

Cash Flows From Investing

Activities

Capital expenditures

(4,417

)

(6,125

)

(10,124

)

(15,216

)

Acquisition of business, net of cash

acquired

578

—

(348,312

)

(160

)

Proceeds from sale of property, plant, and

equipment

9

109

84

142

Net cash provided by (used for) investing

activities

(3,830

)

(6,016

)

(358,352

)

(15,234

)

Cash Flows From Financing

Activities

Net borrowings (repayments) from revolving

credit facility

4,000

(9,800

)

(7,000

)

(15,000

)

Proceeds from Term Loan A

—

—

400,000

—

Repayments of Term Loan A

(5,000

)

—

(5,000

)

—

Repayments of senior unsecured notes

—

—

(38,000

)

—

Payments on finance lease

(149

)

(129

)

(292

)

(258

)

Cash dividends paid

(5,022

)

(5,022

)

(10,367

)

(10,296

)

Proceeds from issuance of common stock

350

437

2,758

1,569

Shares withheld for employee taxes on

equity awards

(100

)

(34

)

(1,974

)

(2,033

)

Deferred financing fees

—

—

(9,172

)

—

Net cash provided by (used for) financing

activities

(5,921

)

(14,548

)

330,953

(26,018

)

Foreign exchange rate effect on cash

19

163

(163

)

167

Net increase (decrease) in cash

4,615

2,451

7,055

7,553

Beginning Cash

32,730

28,241

30,290

23,139

Ending Cash

$

37,345

$

30,692

$

37,345

$

30,692

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME

AND EBITDA (UNAUDITED)

(Dollars in thousands)

Quarter Ended June 30,

2024

Material Handling

Distribution

Segment Total

Corporate & Other

Total

Net sales

$

166,008

$

54,265

$

220,273

$

(37

)

$

220,236

Net income

10,279

Net income margin

4.7

%

Gross profit

75,517

Add: Restructuring expenses and other

adjustments

2,711

Add: Acquisition-related inventory

step-up

1,342

Adjusted gross profit

79,570

Gross margin as adjusted

36.1

%

Operating income (loss)

28,701

2,179

30,880

(7,152

)

23,728

Operating income margin

17.3

%

4.0

%

14.0

%

n/a

10.8

%

Add: Restructuring expenses and other

adjustments

2,223

755

2,978

—

2,978

Add: Acquisition and integration costs

207

—

207

471

678

Add: Acquisition-related inventory

step-up

1,342

—

1,342

—

1,342

Add: Environmental reserves, net(2)

—

—

—

100

100

Adjusted operating income (loss)(1)

32,473

2,934

35,407

(6,581

)

28,826

Adjusted operating income margin

19.6

%

5.4

%

16.1

%

n/a

13.1

%

Add: Depreciation and amortization

9,023

830

9,853

214

10,067

Adjusted EBITDA

$

41,496

$

3,764

$

45,260

$

(6,367

)

$

38,893

Adjusted EBITDA margin

25.0

%

6.9

%

20.5

%

n/a

17.7

%

(1) Includes gross profit adjustments of

$4,053 and SG&A adjustments of $1,045

(2) Includes environmental charges of $800

net of probable insurance recoveries of $700

Quarter Ended June 30,

2023

Material Handling

Distribution

Segment Total

Corporate & Other

Total

Net sales

$

143,295

$

65,173

$

208,468

$

(15

)

$

208,453

Net income

10,605

Net income margin

5.1

%

Gross profit

68,410

Add: Restructuring expenses and other

adjustments

180

Adjusted gross profit

68,590

Gross margin as adjusted

32.9

%

Operating income (loss)

24,828

3,398

28,226

(12,084

)

16,142

Operating income margin

17.3

%

5.2

%

13.5

%

n/a

7.7

%

Add: Restructuring expenses and other

adjustments

275

—

275

—

275

Add: Acquisition and integration costs

—

111

111

—

111

Add: Executive severance costs

—

410

410

289

699

Add: Environmental reserves, net(2)

—

—

—

1,800

1,800

Adjusted operating income (loss)(1)

25,103

3,919

29,022

(9,995

)

19,027

Adjusted operating income margin

17.5

%

6.0

%

13.9

%

n/a

9.1

%

Add: Depreciation and amortization

4,755

790

5,545

132

5,677

Adjusted EBITDA

$

29,858

$

4,709

$

34,567

$

(9,863

)

$

24,704

Adjusted EBITDA margin

20.8

%

7.2

%

16.6

%

n/a

11.9

%

(1) Includes gross profit adjustments of

$180 and SG&A adjustments of $2,705

(2) Includes environmental charges of

$1,900 net of probable insurance recoveries of $100

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME

AND EBITDA (UNAUDITED)

(Dollars in thousands)

Six Months Ended June 30,

2024

Material Handling

Distribution

Segment Total

Corporate & Other

Total

Net sales

$

318,233

$

109,159

$

427,392

$

(54

)

$

427,338

Net income

13,782

Net income margin

3.2

%

Gross profit

139,786

Add: Restructuring expenses and other

adjustments

2,952

Add: Acquisition-related inventory

step-up

4,457

Adjusted gross profit

147,195

Gross margin as adjusted

34.4

%

Operating income (loss)

50,957

2,784

53,741

(19,134

)

34,607

Operating income margin

16.0

%

2.6

%

12.6

%

n/a

8.1

%

Add: Restructuring expenses and other

adjustments

2,464

755

3,219

—

3,219

Add: Acquisition and integration costs

305

—

305

3,783

4,088

Add: Acquisition-related inventory

step-up

4,457

—

4,457

—

4,457

Less: Insurance recovery of legal fees

(702

)

—

(702

)

—

(702

)

Less: Environmental reserves, net(2)

—

—

—

(200

)

(200

)

Adjusted operating income (loss)(1)

57,481

3,539

61,020

(15,551

)

45,469

Adjusted operating income margin

18.1

%

3.2

%

14.3

%

n/a

10.6

%

Add: Depreciation and amortization

16,548

1,603

18,151

413

18,564

Adjusted EBITDA

$

74,029

$

5,142

$

79,171

$

(15,138

)

$

64,033

Adjusted EBITDA margin

23.3

%

4.7

%

18.5

%

n/a

15.0

%

(1) Includes gross profit adjustments of

$7,409 and SG&A adjustments of $3,453

(2) Includes environmental charges of $800

net of probable insurance recoveries of $1,000

Six Months Ended June 30,

2023

Material Handling

Distribution

Segment Total

Corporate & Other

Total

Net sales

$

295,857

$

128,358

$

424,215

$

(23

)

$

424,192

Net income

23,581

Net income margin

5.6

%

Gross profit

139,475

Add: Restructuring expenses and other

adjustments

282

Adjusted gross profit

139,757

Gross margin as adjusted

32.9

%

Operating income (loss)

50,179

5,635

55,814

(20,715

)

35,099

Operating income margin

17.0

%

4.4

%

13.2

%

n/a

8.3

%

Add: Restructuring expenses and other

adjustments

696

179

875

10

885

Add: Acquisition and integration costs

—

220

220

126

346

Add: Executive severance costs

—

410

410

289

699

Add: Environmental reserves, net(2)

—

—

—

2,300

2,300

Adjusted operating income (loss)(1)

50,875

6,444

57,319

(17,990

)

39,329

Adjusted operating income margin

17.2

%

5.0

%

13.5

%

n/a

9.3

%

Add: Depreciation and amortization

9,354

1,663

11,017

278

11,295

Adjusted EBITDA

$

60,229

$

8,107

$

68,336

$

(17,712

)

$

50,624

Adjusted EBITDA margin

20.4

%

6.3

%

16.1

%

n/a

11.9

%

(1) Includes gross profit adjustments of

$282 and SG&A adjustments of $3,948

(2) Includes environmental charges of

$3,500 net of probable insurance recoveries of $1,200

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED OPERATING INCOME,

ADJUSTED EBITDA AND FREE CASH FLOW (UNAUDITED)

(Dollars in thousands)

Quarter Ended June 30,

Six Months Ended June

30,

2024

2023

2024

2023

Adjusted operating income (loss)

reconciliation:

Operating income (loss)

$

23,728

$

16,142

$

34,607

$

35,099

Restructuring expenses and other

adjustments

2,978

275

3,219

885

Acquisition and integration costs

678

111

4,088

346

Acquisition-related inventory step-up

1,342

—

4,457

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

—

699

—

699

Environmental reserves, net

100

1,800

(200

)

2,300

Adjusted operating income (loss)

$

28,826

$

19,027

$

45,469

$

39,329

Adjusted EBITDA reconciliation:

Net income (loss)

$

10,279

$

10,605

$

13,782

$

23,581

Income tax expense (benefit)

4,443

3,747

5,740

8,082

Interest expense, net

9,006

1,790

15,085

3,436

Operating income (loss)

23,728

16,142

34,607

35,099

Depreciation and amortization

10,067

5,677

18,564

11,295

Restructuring expenses and other

adjustments

2,978

275

3,219

885

Acquisition and integration costs

678

111

4,088

346

Acquisition-related inventory step-up

1,342

—

4,457

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

—

699

—

699

Environmental reserves, net

100

1,800

(200

)

2,300

Adjusted EBITDA

$

38,893

$

24,704

$

64,033

$

50,624

Free cash flow reconciliation:

Net cash provided by (used for) operating

activities

$

14,347

$

22,852

$

34,617

$

48,638

Capital expenditures

(4,417

)

(6,125

)

(10,124

)

(15,216

)

Free cash flow

$

9,930

$

16,727

$

24,493

$

33,422

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED NET INCOME AND

ADJUSTED EARNINGS PER DILUTED SHARE (UNAUDITED)

(Dollars in thousands, except

per share data)

Quarter Ended June 30,

Six Months Ended June

30,

2024

2023

2024

2023

Adjusted net income (loss)

reconciliation:

Net income (loss)

$

10,279

$

10,605

$

13,782

$

23,581

Income tax expense (benefit)

4,443

3,747

5,740

8,082

Income (loss) before income taxes

14,722

14,352

19,522

31,663

Restructuring expenses and other

adjustments

2,978

275

3,219

885

Acquisition and integration costs

678

111

4,088

346

Acquisition-related inventory step-up

1,342

—

4,457

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

—

699

—

699

Environmental reserves, net

100

1,800

(200

)

2,300

Adjusted income (loss) before income

taxes

19,820

17,237

30,384

35,893

Income tax expense, as adjusted (1)

(5,259

)

(4,309

)

(7,900

)

(8,973

)

Adjusted net income (loss)

$

14,561

$

12,928

$

22,484

$

26,920

Adjusted earnings per diluted share

reconciliation:

Net income (loss) per common diluted

share

$

0.28

$

0.29

$

0.37

$

0.64

Restructuring expenses and other

adjustments

0.08

0.00

0.09

0.02

Acquisition and integration costs

0.02

0.00

0.11

0.01

Acquisition-related inventory step-up

0.04

—

0.12

—

Insurance recovery of legal fees

—

—

(0.02

)

—

Executive severance costs

—

0.02

—

0.02

Environmental reserves, net

0.00

0.05

(0.01

)

0.06

Adjusted effective income tax rate

impact

(0.03

)

(0.01

)

(0.06

)

(0.02

)

Adjusted earnings per diluted share(2)

$

0.39

$

0.35

$

0.60

$

0.73

Items in this table may not recalculate

due to rounding

(1) Income taxes are calculated using the

normalized effective tax rate for each year. The rate used in 2024

is 26% and in 2023 is 25%.

(2) Adjusted earnings per diluted share is

calculated using the weighted average common shares outstanding for

the respective period.

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GUIDANCE FOR FULL YEAR

ADJUSTED EARNINGS PER DILUTED SHARE

(UNAUDITED)

Full Year 2024

Guidance

Low

High

GAAP diluted net income per common

share

$

0.76

$

0.91

Add: Net restructuring expenses and other

adjustments

0.14

0.14

Add: Acquisition and integration costs

(3)

0.25

0.25

Less: Insurance recovery of legal fees

(0.02

)

(0.02

)

Less: Environmental reserves, net

(0.01

)

(0.01

)

Less: Adjusted effective income tax rate

impact (1)

(0.07

)

(0.07

)

Adjusted earnings per diluted share

(2)

$

1.05

$

1.20

(1) Income taxes are calculated using the

normalized effective tax rate for each year. The rate used in 2024

is 26%.

(2) Adjusted earnings per diluted share is

calculated using the weighted average common shares

outstanding.

(3) Includes acquisition-related inventory

step-up costs

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801624582/en/

Meghan Beringer, Senior Director Investor Relations,

252-536-5651

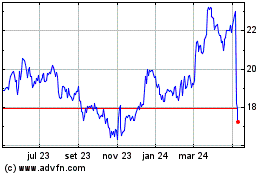

Myers Industries (NYSE:MYE)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

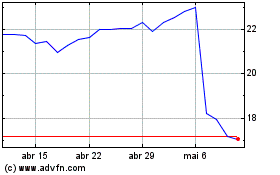

Myers Industries (NYSE:MYE)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024