Fiscal 2024 Q3 net sales of $996 million

compared to $1,023 million a year ago

Fiscal 2024 Q3 GAAP EPS of $1.19 vs. $1.25 a

year ago, Non-GAAP EPS of $1.32 vs. $1.40 a year ago

Maintains outlook for fiscal 2024 non-GAAP

EPS of $2.00 or better ($2.50 or better before the February 2024

stock dividend)

Central Garden & Pet Company (NASDAQ: CENT) (NASDAQ: CENTA)

(“Central”), a market leader in the Pet and Garden industries,

today announced financial results for its fiscal 2024 third quarter

ended June 29, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240807439810/en/

"We delivered a solid third quarter earnings performance,

recognizing that we had a record third quarter in 2023," said Beth

Springer, Interim CEO. "Our Cost and Simplicity program continues

to prove effective as evidenced in our improved gross margins.

Looking ahead, we remain committed to our long-term Central to Home

strategy."

Fiscal 2024 Third Quarter Financial Results

Net sales were $996 million compared to $1,023 million a year

ago, a decrease of 3%. Organic net sales also decreased 3%.

Gross profit was $317 million compared to $318 million a year

ago. Non-GAAP gross profit of $326 million was in line with the

prior year. Gross margin expanded by 70 basis points to 31.8%. On a

non-GAAP basis, gross margin expanded by 80 basis points to 32.7%

driven by Central's Cost and Simplicity program and moderating

inflation.

Operating income was $116 million compared to $123 million a

year ago, a decrease of 6%. Non-GAAP operating income was $127

million compared to $137 million in the prior year. Operating

margin was 11.6% compared to 12.0% a year ago. On a non-GAAP basis,

operating margin was 12.8% compared to 13.4% in the prior year.

Net interest expense was $10 million compared to $13 million a

year ago.

Net income was $80 million compared to $83 million in the prior

year, a decrease of 4%. Non-GAAP net income was $88 million

compared to $94 million a year ago. Earnings per share were $1.19

compared to $1.25 in the prior year, a decrease of $0.06. Non-GAAP

earnings per share were $1.32 compared to $1.40 a year ago.

Adjusted EBITDA was $156 million compared to $166 million a year

ago.

The effective tax rate was 24.0% compared to 24.4% in the prior

year.

Pet Segment Fiscal 2024 Third Quarter Results

Net sales for the Pet segment were $508 million compared to $503

million in the prior year, an increase of 1% driven by the recent

TDBBS acquisition and growth in consumable pet products. Organic

net sales decreased 2% excluding the impact of TDBBS.

Pet segment operating income was $83 million compared to $60

million a year ago, an increase of 39%. Operating margin expanded

by 450 basis points to 16.4% compared to 11.9% driven by improved

gross margin. Pet segment adjusted EBITDA was $94 million compared

to $84 million in the prior year.

Garden Segment Fiscal 2024 Third Quarter Results

Net sales for the Garden segment were $488 million compared to

$520 million a year ago, a decrease of 6%. Organic net sales

decreased 4% excluding the impact of the sale of the independent

garden channel distribution business.

Garden segment operating income was $63 million compared to $88

million in the prior year, a decrease of 29%. Non-GAAP operating

income was $74 million. Operating margin contracted 410 basis

points to 12.8% compared to 16.9%. On a non-GAAP basis, operating

margin contracted 180 basis points to 15.1% driven by lower sell

through in live plants. Garden segment adjusted EBITDA was $85

million compared to $99 million a year ago.

Liquidity and Debt

The cash balance at the end of the quarter was $570 million

compared to $333 million a year ago driven by earnings and

inventory reduction efforts over the last 12 months.

Cash provided by operations during the quarter was $286 million

compared to $325 million a year ago.

Total debt as of June 29, 2024, and June 24, 2023 was $1.2

billion. The gross leverage ratio, as defined in Central's credit

agreement, at the end of the third quarter was 3.0x compared to

3.1x at the end of the prior year quarter.

Cost and Simplicity Program

Central continues to advance its multi-year Cost and Simplicity

program consisting of a pipeline of projects across procurement,

manufacturing, logistics, portfolio management and administrative

costs to simplify its business and improve efficiency across the

organization.

In the third quarter of fiscal 2024, Central began winding down

its pottery business.

As a result of Cost and Simplicity projects, Central incurred

$11.1 million of one-time costs largely related to the pottery

exit, including $8.6 million in cost of goods sold and $2.5 million

in selling, general and administrative costs, the majority of which

was non-cash.

Fiscal 2024 Guidance

Central continues to expect fiscal 2024 non-GAAP EPS to be $2.00

or better ($2.50 or better before the February 2024 stock dividend)

despite currently anticipating a one-time charge in the range of

$15-20 million in the fourth quarter. Given the recent significant

decrease in market prices for grass seed, Central determined in

August 2024 it will be necessary to write down the value of its

grass seed inventory.

This outlook reflects uncertain consumer demand and retailer

dynamics and an environment of macroeconomic and geopolitical

volatility. It excludes the impact of any restructuring activities

that may occur during the fourth quarter of fiscal 2024, including

projects under the Cost and Simplicity program or other one-time

non-recurring charges. Central now expects fiscal 2024 capital

spending to be approximately $60 million.

Conference Call

Central's senior management will hold a conference call today at

4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss its

fiscal 2024 third quarter results and provide a general business

update. The conference call and related materials can be accessed

at http://ir.central.com.

Alternatively, to listen to the call by telephone, dial (201)

689-8345 (domestic and international) using confirmation

#13746730.

About Central Garden & Pet

Central Garden & Pet Company (NASDAQ: CENT) (NASDAQ: CENTA)

understands home is central to life and has proudly nurtured happy

and healthy homes for over 40 years. With fiscal 2023 net sales of

$3.3 billion, Central is on a mission to lead the future of the Pet

and Garden industries. The Company’s innovative and trusted

products are dedicated to helping lawns grow greener, gardens bloom

bigger, pets live healthier, and communities grow stronger. Central

is home to a leading portfolio of more than 65 high-quality brands

including Amdro®, Aqueon®, Cadet®, Farnam®, Ferry-Morse®, Four

Paws®, Kaytee®, K&H®, Nylabone® and Pennington®, strong

manufacturing and distribution capabilities, and a passionate,

entrepreneurial growth culture. Central is based in Walnut Creek,

California, with 6,700 employees primarily across North America.

Visit www.central.com to learn more.

Safe Harbor Statement

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts, including statements concerning evolving

consumer demand and unfavorable retailer dynamics, the carryover

impact from pricing actions, productivity initiatives and estimated

capital spending, anticipated inventory write-down, and earnings

guidance for fiscal 2024, are forward-looking statements that are

subject to risks and uncertainties that could cause actual results

to differ materially from those set forth in or implied by

forward-looking statements. All forward-looking statements are

based upon Central's current expectations and various assumptions.

There are a number of risks and uncertainties that could cause

actual results to differ materially from the forward-looking

statements contained in this release including, but not limited to,

the following factors:

- impact of inflation and interest rates, and other adverse

macro-economic conditions;

- fluctuations in market prices for seeds and grains and other

raw materials, including the impact of the recent significant

decline in grass seed market prices on our inventory

valuation;

- our inability to pass through cost increases in a timely

manner;

- our ability to recruit and retain members of our management

team and employees, including a Chief Executive Officer, to support

our businesses;

- fluctuations in energy prices, fuel and related petrochemical

costs;

- declines in consumer spending and increased inventory risk

during economic downturns;

- reductions in demand for product categories that benefited from

the COVID-19 pandemic;

- adverse weather conditions;

- the success of our Central to Home strategy and our Cost and

Simplicity program;

- risks associated with our acquisition strategy, including our

ability to successfully integrate acquisitions and the impact of

purchase accounting on our financial results;

- material weaknesses relating to the internal controls of

recently acquired companies;

- seasonality and fluctuations in our operating results and cash

flow;

- supply shortages in pet birds, small animals and fish;

- dependence on a small number of customers for a significant

portion of our business;

- consolidation trends in the retail industry;

- risks associated with new product introductions, including the

risk that our new products will not produce sufficient sales to

recoup our investment;

- competition in our industries;

- continuing implementation of an enterprise resource planning

information technology system;

- potential environmental liabilities;

- risks associated with international sourcing;

- impacts of tariffs or a trade war;

- access to and cost of additional capital;

- potential goodwill or intangible asset impairment;

- our ability to remediate material weaknesses in our internal

control over financial reporting;

- our dependence upon our key executives;

- our ability to protect our trademarks and other proprietary

rights;

- litigation and product liability claims;

- regulatory issues;

- the impact of product recalls;

- potential costs and risks associated with actual or potential

cyberattacks;

- potential dilution from issuance of authorized shares;

- the voting power associated with our Class B stock; and

- the impact of new accounting regulations and the possibility

our effective tax rate will increase as a result of future changes

in the corporate tax rate or other tax law changes.

These risks and others are described in Central’s Securities and

Exchange Commission filings. Central undertakes no obligation to

publicly update these forward-looking statements to reflect new

information, subsequent events or otherwise. Central has not filed

its Form 10-Q for the fiscal quarter ended June 29, 2024, so all

financial results are preliminary and subject to change.

CENTRAL GARDEN & PET

COMPANY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share amounts, unaudited)

June 29, 2024

June 24, 2023

September 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

570,398

$

333,139

$

488,730

Restricted cash

13,980

13,542

14,143

Accounts receivable (less allowance for

credit losses and customer allowances of $24,838, $29,245 and

$25,797)

507,524

492,850

332,890

Inventories, net

784,775

865,496

838,188

Prepaid expenses and other

33,493

36,655

33,172

Total current assets

1,910,170

1,741,682

1,707,123

Plant, property and equipment, net

384,373

392,332

391,768

Goodwill

546,436

546,436

546,436

Other intangible assets, net

472,854

512,175

497,228

Operating lease right-of-use assets

188,506

172,379

173,540

Other assets

105,539

54,943

62,553

Total

$

3,607,878

$

3,419,947

$

3,378,648

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

191,041

$

198,406

$

190,902

Accrued expenses

276,751

247,517

216,241

Current lease liabilities

53,363

50,209

50,597

Current portion of long-term debt

290

255

247

Total current liabilities

521,445

496,387

457,987

Long-term debt

1,189,366

1,187,498

1,187,956

Long-term lease liabilities

151,038

132,419

135,621

Deferred income taxes and other long-term

obligations

150,249

156,537

144,271

Equity:

Common stock, $0.01 par value: 11,077,612,

11,098,584 and 11,077,612 shares outstanding at June 29, 2024, June

24, 2023 and September 30, 2023

111

111

111

Class A common stock, $0.01 par value:

54,719,533, 54,408,159 and 54,472,902 shares outstanding at June

29, 2024, June 24, 2023 and September 30, 2023

547

544

544

Class B stock, $0.01 par value: 1,602,374

shares outstanding at June 29, 2024, June 24, 2023 and September

30, 2023

16

16

16

Additional paid-in capital

595,646

588,597

594,282

Retained earnings

1,000,527

858,217

859,370

Accumulated other comprehensive loss

(3,199

)

(1,955

)

(2,970

)

Total Central Garden & Pet Company

shareholders’ equity

1,593,648

1,445,530

1,451,353

Noncontrolling interest

2,132

1,576

1,460

Total equity

1,595,780

1,447,106

1,452,813

Total

$

3,607,878

$

3,419,947

$

3,378,648

CENTRAL GARDEN & PET

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts, unaudited)

Three Months Ended

Nine Months Ended

June 29, 2024

June 24, 2023

June 29, 2024

June 24, 2023

Net sales

$

996,348

$

1,023,269

$

2,530,971

$

2,559,936

Cost of goods sold

679,290

705,217

1,756,188

1,810,547

Gross profit

317,058

318,052

774,783

749,389

Selling, general and administrative

expenses

201,122

195,222

556,988

548,112

Operating income

115,936

122,830

217,795

201,277

Interest expense

(14,720

)

(14,542

)

(43,412

)

(43,887

)

Interest income

4,504

1,408

12,016

2,287

Other income

225

853

1,047

3,147

Income before income taxes and

noncontrolling interest

105,945

110,549

187,446

162,824

Income tax expense

25,468

27,000

43,733

39,446

Income including noncontrolling

interest

80,477

83,549

143,713

123,378

Net income attributable to noncontrolling

interest

753

423

1,572

570

Net income attributable to Central Garden

& Pet Company

$

79,724

$

83,126

$

142,141

$

122,808

Net income per share attributable to

Central Garden & Pet Company:

Basic

$

1.21

$

1.27

$

2.17

$

1.87

Diluted

$

1.19

$

1.25

$

2.13

$

1.84

Weighted average shares used in the

computation of net income per share:

Basic

65,850

65,580

65,636

65,577

Diluted

66,945

66,725

66,848

66,832

CENTRAL GARDEN & PET

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands,

unaudited)

Nine Months Ended

June 29, 2024

June 24, 2023

Cash flows from operating activities:

Net income

$

143,713

$

123,378

Adjustments to reconcile net income to net

cash used by operating activities:

Depreciation and amortization

68,069

65,504

Amortization of deferred financing

costs

2,013

2,023

Non-cash lease expense

39,183

38,180

Stock-based compensation

15,138

20,632

Deferred income taxes

3,622

9,125

Facility closures and business exit

costs

16,385

13,923

Other operating activities

3,531

(450

)

Change in assets and liabilities

(excluding businesses acquired):

Accounts receivable

(169,867

)

(115,358

)

Inventories

58,705

69,610

Prepaid expenses and other assets

(383

)

6,530

Accounts payable

(2,968

)

(12,248

)

Accrued expenses

51,213

44,221

Other long-term obligations

2,352

(55

)

Operating lease liabilities

(38,902

)

(37,449

)

Net cash provided by operating

activities

191,804

227,566

Cash flows from investing activities:

Additions to plant, property and

equipment

(33,096

)

(40,850

)

Payments to acquire companies, net of cash

acquired

(59,818

)

—

Investments

(1,500

)

(500

)

Other investing activities

(175

)

(100

)

Net cash used in investing activities

(94,589

)

(41,450

)

Cash flows from financing activities:

Repayments of long-term debt

(289

)

(223

)

Borrowings under revolving line of

credit

—

48,000

Repayments under revolving line of

credit

—

(48,000

)

Repurchase of common stock, including

shares surrendered for tax withholding

(14,755

)

(33,409

)

Payment of contingent consideration

liability

(63

)

(33

)

Distribution to noncontrolling

interest

(900

)

—

Net cash used by financing activities

(16,007

)

(33,665

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

297

2,046

Net increase in cash, cash equivalents and

restricted cash

81,505

154,497

Cash, cash equivalents and restricted cash

at beginning of period

502,873

192,184

Cash, cash equivalents and restricted cash

at end of period

$

584,378

$

346,681

Supplemental information:

Cash paid for interest

$

48,853

$

49,419

Cash paid for income taxes

$

38,027

$

5,363

New operating lease right of use

assets

$

56,849

$

25,424

Use of Non-GAAP Financial Measures

We report our financial results in accordance with GAAP.

However, to supplement the financial results prepared in accordance

with GAAP, we use non-GAAP financial measures including non-GAAP

net income and diluted net income per share, non-GAAP operating

income, adjusted EBITDA and organic net sales. Management uses

these non-GAAP financial measures that exclude the impact of

specific items (described below) in making financial, operating and

planning decisions and in evaluating our performance. Also,

Management believes that these non-GAAP financial measures may be

useful to investors in their assessment of our ongoing operating

performance and provide additional meaningful comparisons between

current results and results in prior operating periods. While

Management believes that non-GAAP measures are useful supplemental

information, such adjusted results are not intended to replace our

GAAP financial results and should be read in conjunction with those

GAAP results.

Adjusted EBITDA is defined by us as income before income tax,

net other expense, net interest expense and depreciation and

amortization and stock-based compensation expense (or operating

income plus depreciation and amortization expense and stock-based

compensation expense). Adjusted EBITDA further excludes one-time

charges related to facility closures. We present adjusted EBITDA

because we believe that adjusted EBITDA is a useful supplemental

measure in evaluating the cash flows and performance of our

business and provides greater transparency into our results of

operations. Adjusted EBITDA is used by our management to perform

such evaluations. Adjusted EBITDA should not be considered in

isolation or as a substitute for cash flow from operations, income

from operations or other income statement measures prepared in

accordance with GAAP. We believe that adjusted EBITDA is frequently

used by investors, securities analysts and other interested parties

in their evaluation of companies, many of which present adjusted

EBITDA when reporting their results. Other companies may calculate

adjusted EBITDA differently and it may not be comparable.

The reconciliations of these non-GAAP measures to the most

directly comparable financial measures calculated and presented in

accordance with GAAP are shown in the tables below.

Non-GAAP financial measures reflect adjustments based on the

following items:

- Facility closures and business exit: we have excluded the

charges related to our decision to exit the pottery business and

the closure of distribution and manufacturing facilities as they

represent infrequent transactions that impact the comparability

between operating periods. They exclude the impact of the

expenditures related to the Cost and Simplicity program we have

embarked on to improve our future operations. We believe these

exclusions supplement the GAAP information with a measure that may

be useful to investors in assessing the sustainability of our

operating performance.

From time to time in the future, there may be other items that

we may exclude if we believe that doing so is consistent with the

goal of providing useful supplemental information to investors and

management.

- During the third quarter of fiscal 2024, we recognized

incremental expense of $11.1 million in the consolidated statement

of operations, from the decision to exit the pottery business, the

closure of a live goods distribution facility in Delaware and the

relocation of our grass seed research facility.

- During the second quarter of fiscal 2024, we recognized

incremental expense of $5.3 million in the consolidated statement

of operations, from the closure of a manufacturing facility in

Chico, California and the consolidation of our Southeast

distribution network.

- During the third quarter of fiscal 2023, we recognized

incremental expense of $13.9 million in the consolidated statement

of operations, from the closure of a leased manufacturing and

distribution pet bedding facility in Athens, Texas.

Net Income and Diluted Net Income Per

Share Reconciliation

GAAP to Non-GAAP

Reconciliation Three Months Ended

GAAP to Non-GAAP

Reconciliation Nine Months Ended

June 29, 2024

June 24, 2023

June 29, 2024

June 24, 2023

(in thousands, except per

share amounts)

GAAP net income attributable to Central

Garden & Pet Company

$

79,724

$

83,126

$

142,141

$

122,808

Facility closures & business exit

(1)

11,115

(3)

13,921

(1) (2)

16,385

(3)

13,921

Tax effect of facility closures &

business exit

(2,590

)

(3,373

)

(3,823

)

(3,373

)

Non-GAAP net income attributable to

Central Garden & Pet Company

$

88,249

$

93,674

$

154,703

$

133,356

GAAP diluted net income per share

$

1.19

$

1.25

$

2.13

$

1.84

Non-GAAP diluted net income per share

$

1.32

$

1.40

$

2.31

$

2.00

Shares used in GAAP and non-GAAP diluted

net earnings per share calculation

66,945

66,725

66,848

66,832

Operating Income Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 29,

2024

Nine Months Ended June 29,

2024

GAAP

Facility Closure & Business Exit

(1)(2)

Non-GAAP

GAAP

Facility Closure & Business Exit

(1)(2)

Non-GAAP

(in thousands)

Net sales

$

996,348

$

—

$

996,348

$

2,530,971

$

—

$

2,530,971

Cost of goods sold and occupancy

679,290

8,613

670,677

1,756,188

11,140

1,745,048

Gross profit

$

317,058

$

(8,613

)

$

325,671

$

774,783

$

(11,140

)

$

785,923

Selling, general and administrative

expenses

201,122

2,502

198,620

556,988

5,245

551,743

Income from operations

$

115,936

$

(11,115

)

$

127,051

$

217,795

$

(16,385

)

$

234,180

Operating Income Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 24,

2023

Nine Months Ended June 24,

2023

GAAP

Facility closure (3)

Non-GAAP

GAAP

Facility closure (3)

Non-GAAP

(in thousands)

Net sales

$

1,023,269

$

—

$

1,023,269

$

2,559,936

$

—

$

2,559,936

Cost of goods sold and occupancy

705,217

8,010

697,207

1,810,547

8,010

1,802,537

Gross profit

$

318,052

$

(8,010

)

$

326,062

$

749,389

$

(8,010

)

$

757,399

Selling, general and administrative

expenses

195,222

5,911

189,311

548,112

5,911

542,201

Income from operations

$

122,830

$

(13,921

)

$

136,751

$

201,277

$

(13,921

)

$

215,198

Pet Segment Operating Income

Reconciliation

GAAP to Non-GAAP

Reconciliation Three Months Ended

GAAP to Non-GAAP

Reconciliation Nine Months Ended

June 29, 2024

June 24, 2023

June 29, 2024

June 24, 2023

(in thousands)

GAAP operating income

$

83,068

$

59,969

$

189,115

$

154,779

Facility closure

(3)

—

13,921

—

13,921

Non-GAAP operating income

$

83,068

$

73,890

$

189,115

$

168,700

GAAP operating margin

16.4

%

11.9

%

13.5

%

11.1

%

Non-GAAP operating margin

16.4

%

14.7

%

13.5

%

12.1

%

Garden Segment Operating Income

Reconciliation

GAAP to Non-GAAP

Reconciliation Three Months Ended

GAAP to Non-GAAP

Reconciliation Nine Months Ended

June 29, 2024

June 24, 2023

June 29, 2024

June 24, 2023

(in thousands)

GAAP operating income

$

62,519

$

88,088

$

110,699

$

126,887

Facility closure & business exit

(1)

11,115

—

(1) (2)

16,385

—

Non-GAAP operating income

$

73,634

$

88,088

$

127,084

$

126,887

GAAP operating margin

12.8

%

16.9

%

9.8

%

10.9

%

Non-GAAP operating margin

15.1

%

16.9

%

11.2

%

10.9

%

Organic Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 29,

2024

Nine Months Ended June 29,

2024

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Q3 FY 24

$

996.3

$

15.8

$

980.5

$

2,531.0

$

48.4

$

2,482.6

Q3 FY 23

1,023.3

13.0

1,010.3

2,559.9

44.4

2,515.5

$ decrease

$

(27.0

)

$

(29.8

)

$

(28.9

)

$

(32.9

)

% decrease

(2.6

)%

(2.9

)%

(1.1

)%

(1.3

)%

Organic Pet Segment Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 29,

2024

Nine Months Ended June 29,

2024

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Q3 FY 24

$

508.0

$

15.8

$

492.2

$

1,397.5

$

48.4

$

1,349.1

Q3 FY 23

503.3

—

503.3

1,394.3

—

1,394.3

$ increase (decrease)

$

4.7

$

(11.1

)

$

3.2

$

(45.2

)

% increase (decrease)

0.9

%

(2.2

)%

0.2

%

(3.2

)%

Organic Garden Segment Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 29,

2024

Nine Months Ended June 29,

2024

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Q3 FY 24

$

488.3

$

—

$

488.3

$

1,133.5

$

—

$

1,133.5

Q3 FY 23

520.0

13.0

507.0

1,165.6

44.4

1,121.2

$ increase (decrease)

$

(31.7

)

$

(18.7

)

$

(32.1

)

$

12.3

% increase (decrease)

(6.1

)%

(3.7

)%

(2.8

)%

1.1

%

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 29,

2024

Pet

Garden

Corporate

Total

(in thousands)

Net income attributable to Central Garden

& Pet Company

$

—

$

—

$

—

$

79,724

Interest expense, net

—

—

—

10,216

Other income

—

—

—

(225

)

Income tax expense

—

—

—

25,468

Net income attributable to noncontrolling

interest

—

—

—

753

Income (loss) from operations

$

83,068

$

62,519

$

(29,651

)

$

115,936

Depreciation & amortization

10,979

11,008

725

22,712

Noncash stock-based compensation

—

—

6,211

6,211

Facility closures & business exit

(1)

—

11,115

—

11,115

Adjusted EBITDA

$

94,047

$

84,642

$

(22,715

)

$

155,974

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended June 24,

2023

Pet

Garden

Corporate

Total

(in thousands)

Net income attributable to Central Garden

& Pet Company

$

—

$

—

$

—

$

83,126

Interest expense, net

—

—

—

13,134

Other income

—

—

—

(853

)

Income tax expense

—

—

—

27,000

Net income attributable to noncontrolling

interest

—

—

—

423

Income (loss) from operations

$

59,969

$

88,088

$

(25,227

)

$

122,830

Depreciation & amortization

10,060

10,823

818

21,701

Noncash stock-based compensation

—

—

7,305

7,305

Facility closure

(3)

13,921

—

—

13,921

Adjusted EBITDA

$

83,950

$

98,911

$

(17,104

)

$

165,757

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Nine Months Ended June 29,

2024

Pet

Garden

Corporate

Total

(in thousands)

Net income attributable to Central Garden

& Pet Company

$

—

$

—

$

—

$

142,141

Interest expense, net

—

—

—

31,396

Other income

—

—

—

(1,047

)

Income tax expense

—

—

—

43,733

Net income attributable to noncontrolling

interest

—

—

—

1,572

Income (loss) from operations

$

189,115

$

110,699

$

(82,019

)

$

217,795

Depreciation & amortization

32,901

33,028

2,140

68,069

Noncash stock-based compensation

—

—

15,138

15,138

Facility closures & business exit

(1) (2)

—

16,385

—

16,385

Adjusted EBITDA

$

222,016

$

160,112

$

(64,741

)

$

317,387

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Nine Months Ended June 24,

2023

Pet

Garden

Corporate

Total

(in thousands)

Net income attributable to Central Garden

& Pet Company

$

—

$

—

$

—

$

122,808

Interest expense, net

—

—

—

41,600

Other income

—

—

—

(3,147

)

Income tax expense

—

—

—

39,446

Net income attributable to noncontrolling

interest

—

—

—

570

Income (loss) from operations

$

154,779

$

126,887

$

(80,389

)

$

201,277

Depreciation & amortization

30,647

32,483

2,374

65,504

Noncash stock-based compensation

—

—

20,632

20,632

Facility closure

(3)

13,921

—

—

13,921

Adjusted EBITDA

$

199,347

$

159,370

$

(57,383

)

$

301,334

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807439810/en/

Investor/Media Contact Friederike Edelmann VP, Investor

Relations & Corporate Sustainability (925) 412-6726

fedelmann@central.com

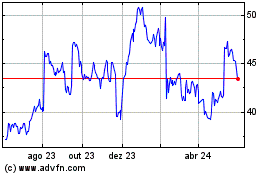

Central Garden and Pet (NASDAQ:CENT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

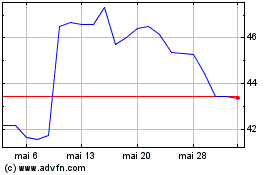

Central Garden and Pet (NASDAQ:CENT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024