Clean Energy Fuels Corp. (NASDAQ: CLNE) (“Clean Energy” or the

“Company”) today announced its operating results for the second

quarter of 2024.

Financial Highlights

- Revenue of $98.0 million in Q2 2024 compared to $90.5 million

in Q2 2023.

- Net loss attributable to Clean Energy for Q2 2024 was $(16.3)

million, or $(0.07) per share, on a GAAP (as defined below) basis,

compared to $(16.3) million, or $(0.07) per share, for Q2

2023.

- Adjusted EBITDA (as defined below) was $18.9 million for Q2

2024, compared to $12.1 million for Q2 2023.

- Cash, Cash Equivalents (less restricted cash) and Short-Term

Investments totaled $249.3 million as of June 30, 2024.

- 2024 outlook:

- GAAP net loss of approximately $(91) million to $(81) million

(updated).

- Adjusted EBITDA of $62 million to $72 million (unchanged).

Operational and Strategic Highlights

- Renewable natural gas (“RNG”) gallons sold of 57.1 million

gallons in Q2 2024, a 2.6% decrease compared to Q2 2023.

- Joined forces with Maas Energy, the nation’s largest dairy

digester developer to build up to nine RNG production facilities

costing an estimated $130 million to build, totaling 35,000 cows

and making approximately 4 million gallons of RNG annually at

capacity.

- Completed construction on another dairy farm RNG project

totaling $22 million and 1,850 cows bringing the total number of

dairy farm RNG projects completed to six as of June 30, 2024.

Commentary by Andrew J. Littlefair, President and Chief

Executive Officer

“Building off a solid first quarter our second quarter was even

stronger, putting us in a healthy financial position at this

mid-point of 2024. The recurring daily fueling of RNG by our

customers within our extensive fueling network is driving our

results. After building out a network of over 600 RNG and CNG

fueling stations, fleets can easily access cleaner fueling

solutions. During the second quarter, we saw new stations opened

and additional RNG projects come online due to the great team here

at Clean Energy giving me reason to remain extremely enthusiastic

about RNG for transportation which is as exciting and relevant as

it ever has been.”

Summary and Review of Results

The Company’s revenue for the second quarter of 2024 was reduced

by $14.1 million of non-cash stock-based sales incentive

contra-revenue charges (“Amazon warrant charges”) relating to the

warrant issued to Amazon.com NV Investment Holdings LLC (the

“Amazon warrant”), compared to Amazon warrant charges of $13.9

million in the second quarter of 2023. Q2 2024 volume-related fuel

sales revenues of $57.4 million, net of the $14.1 million Amazon

warrant charge, were higher than the second quarter of 2023 by 7.7%

due to increased volumes of vehicle fueling at the Company’s

stations and increased bulk fuel sales into the marine sector, with

partial offsets due to lower underlying natural gas commodity costs

in Q2 2024 versus Q2 2023, and lower volumes of RNG fuel sold

outside the Company’s station network in Q2 2024 compared to Q2

2023. Revenue for the second quarter of 2024 also included an

unrealized gain of $0.1 million on commodity swap and customer

fueling contracts relating to the Company’s truck financing

program, compared to an unrealized gain of $3.6 million in the

second quarter of 2023. Q2 2024 renewable identification number

(“RIN”) and low carbon fuel standards (“LCFS”) revenues totaled

$13.9 million versus $7.9 million of RIN and LCFS revenues in the

second quarter of 2023, reflecting principally higher RIN credit

prices, greater number of LCFS credits being transacted in the

second quarter of 2024, and greater mix of low carbon intensity RNG

from dairies, partially offset by lower LCFS credit prices in the

second quarter of 2024. Q2 2024 includes $6.0 million of

alternative fuel excise tax credit (“AFTC”) revenue versus $5.1

million of AFTC in the second quarter of 2023. Q2 2024 station

construction revenues of $5.6 million versus $5.8 million of

station construction revenues in Q2 2023.

Net loss attributable to Clean Energy for the second quarter of

2024 had lower unrealized gain on derivative instruments relating

to the Company’s truck financing program when compared to Q2 2023.

Q2 2024 non-operating net interest expenses and losses from equity

method investments were higher than Q2 2023 primarily due to higher

outstanding indebtedness combined with higher amortization of debt

discount and issuance costs and expansion of our RNG investments,

respectively. Selling, general and administrative expenses were

lower in Q2 2024 by approximately $0.2 million mainly due to lower

stock-based compensation expense resulting from vesting of equity

awards granted in prior years.

Non-GAAP income (loss) per share (as defined below) for the

second quarter of 2024 was $0.01, compared to $(0.00) per share for

the second quarter of 2023.

Adjusted EBITDA (as defined below) was $18.9 million for the

second quarter of 2024, compared to $12.1 million for the second

quarter of 2023.

In this press release, Clean Energy refers to various GAAP (U.S.

generally accepted accounting principles) and non-GAAP financial

measures. The non-GAAP financial measures may not be comparable to

similarly titled measures being used and disclosed by other

companies. Clean Energy believes that this non-GAAP information is

useful to an understanding of its operating results and the ongoing

performance of its business. Non-GAAP income (loss) per share and

Adjusted EBITDA are defined below and reconciled to GAAP net income

(loss) per share attributable to Clean Energy and GAAP net income

(loss) attributable to Clean Energy, respectively.

The table below shows GAAP and non-GAAP income (loss)

attributable to Clean Energy per share and also reconciles GAAP net

income (loss) attributable to Clean Energy to the non-GAAP net

income (loss) attributable to Clean Energy figure used in the

calculation of non-GAAP income (loss) per share:

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands, except share and per

share data)

2023

2024

2023

2024

Net loss attributable to Clean Energy

Fuels Corp.

$

(16,301

)

$

(16,293

)

$

(54,998

)

$

(34,736

)

Amazon warrant charges

13,922

14,079

27,652

26,976

Stock-based compensation

6,093

2,862

12,189

5,491

Loss (income) from Rimere equity method

investment

—

1,356

—

2,544

Loss (income) from SAFE&CEC S.r.l.

equity method investment

(193

)

847

253

1,868

Loss (gain) from change in fair value of

derivative instruments

(3,600

)

(61

)

(1,068

)

(1,683

)

Amortization of investment tax credit from

RNG equity method investments

—

(99

)

—

(99

)

Non-GAAP net income (loss) attributable to

Clean Energy Fuels Corp.

$

(79

)

$

2,691

$

(15,972

)

$

361

Diluted weighted-average common shares

outstanding

222,908,402

223,849,638

222,813,286

224,028,281

GAAP loss attributable to Clean Energy

Fuels Corp. per share

$

(0.07

)

$

(0.07

)

$

(0.25

)

$

(0.16

)

Non-GAAP income (loss) attributable to

Clean Energy Fuels Corp. per share

$

(0.00

)

$

0.01

$

(0.07

)

$

0.00

The table below shows Adjusted EBITDA and also reconciles this

figure to GAAP net loss attributable to Clean Energy:

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands)

2023

2024

2023

2024

Net loss attributable to Clean Energy

Fuels Corp.

$

(16,301

)

$

(16,293

)

$

(54,998

)

$

(34,736

)

Income tax expense (benefit)

(55

)

758

(119

)

580

Interest expense

4,365

7,921

8,719

15,683

Interest income

(2,766

)

(3,639

)

(5,483

)

(7,218

)

Depreciation and amortization

10,893

11,264

21,571

22,446

Amazon warrant charges

13,922

14,079

27,652

26,976

Stock-based compensation

6,093

2,862

12,189

5,491

Loss (income) from Rimere equity method

investment

—

1,356

—

2,544

Loss (income) from SAFE&CEC S.r.l.

equity method investment

(193

)

847

253

1,868

Loss (gain) from change in fair value of

derivative instruments

(3,600

)

(61

)

(1,068

)

(1,683

)

Depreciation and amortization from RNG

equity method investments

301

708

410

1,558

Interest expense from RNG equity method

investments

359

266

488

548

Interest income from RNG equity method

investments

(876

)

(1,023

)

(1,440

)

(2,206

)

Amortization of investment tax credit from

RNG equity method investments

—

(99

)

—

(99

)

Adjusted EBITDA

$

12,142

$

18,946

$

8,174

$

31,752

The tables below present a further breakdown of the above

consolidated Adjusted EBITDA:

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands)

2023

2024

2023

2024

Net loss attributable to fuel

distribution

$

(15,098

)

$

(12,693

)

$

(53,063

)

$

(27,943

)

Income tax expense (benefit)

(55

)

758

(119

)

580

Interest expense

4,365

7,921

8,719

15,683

Interest income

(2,766

)

(3,639

)

(5,483

)

(7,218

)

Depreciation and amortization

10,893

11,264

21,571

22,446

Amazon warrant charges

13,922

14,079

27,652

26,976

Stock-based compensation

6,093

2,862

12,189

5,491

Loss (income) from Rimere equity method

investment

—

1,356

—

2,544

Loss (income) from SAFE&CEC S.r.l.

equity method investment

(193

)

847

253

1,868

Loss (gain) from change in fair value of

derivative instruments

(3,600

)

(61

)

(1,068

)

(1,683

)

Adjusted EBITDA attributable to fuel

distribution

$

13,561

$

22,694

$

10,651

$

38,744

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands)

2023

2024

2023

2024

Net loss from RNG equity method

investments attributable to Clean Energy Fuels Corp.

$

(1,203

)

$

(3,600

)

$

(1,935

)

$

(6,793

)

Depreciation and amortization from RNG

equity method investments

301

708

410

1,558

Interest expense from RNG equity method

investments

359

266

488

548

Interest income from RNG equity method

investments

(876

)

(1,023

)

(1,440

)

(2,206

)

Amortization of investment tax credit from

RNG equity method investments

—

(99

)

—

(99

)

Adjusted EBITDA of RNG equity method

investments attributable to Clean Energy Fuels Corp.

$

(1,419

)

$

(3,748

)

$

(2,477

)

$

(6,992

)

Fuel and Service Volume

The following tables present, for the three and six months ended

June 30, 2023 and 2024, (1) the amount of total fuel volume the

Company sold to customers with particular focus on RNG volume as a

subset of total fuel volume and (2) operation and maintenance

(“O&M”) services volume dispensed at facilities the Company

does not own but at which it provides O&M services on a

per-gallon or fixed fee basis. Certain gallons are included in both

fuel and service volumes when the Company sells fuel (product

revenue) to a customer and provides maintenance services (service

revenue) to the same customer.

Three Months Ended

Six Months Ended

Fuel volume, GGEs(1) sold (in

millions),

June 30,

June 30,

correlating to total volume-related

product revenue

2023

2024

2023

2024

RNG

58.6

57.1

112.0

115.1

Conventional natural gas

14.1

13.3

29.5

30.3

Total fuel volume

72.7

70.4

141.5

145.4

Three Months Ended

Six Months Ended

O&M services volume, GGEs(1)

serviced (in millions),

June 30,

June 30,

correlating to volume-related O&M

services revenue

2023

2024

2023

2024

O&M services volume

65.9

67.9

125.5

133.3

______________________ (1)

The Company calculates one gasoline gallon

equivalent (“GGE”) to equal 125,000 British Thermal Units (“BTUs”),

and, as such, one million BTUs (“MMBTU”) equal eight GGEs.

Sources of Revenue

The following table shows the Company’s sources of revenue for

the three and six months ended June 30, 2023 and 2024:

Three Months Ended

Six Months Ended

June 30,

June 30,

Revenue (in millions)

2023

2024

2023

2024

Product revenue:

Volume-related (1)

Fuel sales(2) (4)

$

53.3

$

57.4

$

160.2

$

125.6

Change in fair value of derivative

instruments(3)

3.6

0.1

1.1

1.7

RIN Credits

5.4

9.5

9.9

18.3

LCFS Credits

2.4

4.4

4.7

4.2

AFTC

5.1

6.0

9.6

11.4

Total volume-related product revenue

69.8

77.4

185.5

161.2

Station construction sales

5.8

5.6

9.9

11.2

Total product revenue

75.6

83.0

195.4

172.4

Service revenue:

Volume-related, O&M services

13.9

14.5

25.9

28.2

Other services

1.0

0.5

1.4

1.1

Total service revenue

14.9

15.0

27.3

29.3

Total revenue

$

90.5

$

98.0

$

222.7

$

201.7

____________________ (1)

The Company’s volume-related product

revenue primarily consists of sales of RNG and conventional natural

gas, in the form of CNG and LNG, and sales of RINs and LCFS Credits

in addition to changes in fair value of our derivative

instruments.

(2)

Includes $13.9 million and $27.7 million

of Amazon warrant non-cash stock-based sales incentive

contra-revenue charges for the three and six months ended June 30,

2023, respectively. Includes $14.1 million and $27.0 million of

Amazon warrant non-cash stock-based sales incentive contra-revenue

charges for the three and six months ended June 30, 2024,

respectively.

(3)

The change in fair value of unsettled

derivative instruments is related to the Company’s commodity swap

and customer fueling contracts. The amounts are classified as

revenue because the Company’s commodity swap contracts are used to

economically offset the risk associated with the diesel-to-natural

gas price spread resulting from customer fueling contracts under

the Company’s truck financing program.

(4)

Includes net settlement of the Company’s

commodity swap derivative instruments. For the three and six months

ended June 30, 2023, net settlement payments recognized in fuel

revenue were $1.4 million and $1.0 million, respectively. For the

three and six months ended June 30, 2024, net settlement payments

recognized in fuel revenue were $0.9 million and $2.4 million,

respectively.

2024 Outlook

Our GAAP net loss for 2024 is expected to range from

approximately $(91) million to $(81) million, assuming no

unrealized gains or losses on commodity swap and customer contracts

relating to the Company’s truck financing program and including

Amazon warrant charges estimated to be approximately $63 million.

Changes in diesel and natural gas market conditions resulting in

unrealized gains or losses on the Company’s commodity swap and

customer fueling contracts relating to the Company’s truck

financing program, and significant variations in the vesting of the

Amazon warrant could significantly affect the Company’s estimated

GAAP net loss for 2024. Adjusted EBITDA for 2024 is estimated to

range from approximately $62 million to $72 million. These

expectations exclude the impact of any acquisitions, divestitures,

new joint ventures, transactions and other extraordinary events;

any lingering negative effects associated directly or indirectly

with the COVID-19 pandemic; and macroeconomic conditions and global

supply chain issues. Additionally, the expectations regarding 2024

Adjusted EBITDA assumes the calculation of this non-GAAP financial

measure in the same manner as described above and adding back the

estimated Amazon warrant charges described above and without

adjustments for any other items that may arise during 2024 that

management deems appropriate to exclude. These expectations are

forward-looking statements and are qualified by the statement under

“Safe Harbor Statement” below.

(in thousands)

2024 Outlook

GAAP Net loss attributable to Clean Energy

Fuels Corp.

$

(91,000) - (81,000)

Income tax expense (benefit)

700

Interest expense

31,200

Interest income

(13,000)

Depreciation and amortization

47,500

Stock-based compensation

11,000

Loss (income) from SAFE&CEC S.r.l. and

Rimere equity method investments

10,000

Loss (gain) from change in fair value of

derivative instruments

—

Amazon warrant charges

63,000

Depreciation and amortization from RNG

equity method investments

4,000

Interest expense from RNG equity method

investments

600

Interest income from RNG equity method

investments

(2,000)

Adjusted EBITDA

$

62,000 - 72,000

The tables below present a further breakdown of the above

consolidated Adjusted EBITDA:

(in thousands)

2024 Outlook

GAAP Net loss attributable to fuel

distribution

$

(74,300) - (68,300)

Income tax expense (benefit)

700

Interest expense

31,200

Interest income

(13,000)

Depreciation and amortization

47,500

Stock-based compensation

11,000

Loss (income) from SAFE&CEC S.r.l. and

Rimere equity method investments

10,000

Loss (gain) from change in fair value of

derivative instruments

—

Amazon warrant charges

63,000

Adjusted EBITDA attributable to fuel

distribution

$

76,100 - 82,100

(in thousands)

2024 Outlook

Net loss from RNG equity method

investments attributable to Clean Energy Fuels Corp.

$

(16,700) - (12,700)

Depreciation and amortization from RNG

equity method investments

4,000

Interest expense from RNG equity method

investments

600

Interest income from RNG equity method

investments

(2,000)

Adjusted EBITDA of RNG equity method

investments attributable to Clean Energy Fuels Corp.

$

(14,100) - (10,100)

Today’s Conference Call

The Company will host an investor conference call today at 4:30

p.m. Eastern time (1:30 p.m. Pacific). Investors interested in

participating in the live call can dial 1.844.826.3035 from the

U.S. and international callers can dial 1.412.317.5195. A telephone

replay will be available approximately three hours after the call

concludes through Saturday, September 7, 2024, by dialing

1.844.512.2921 from the U.S., or 1.412.317.6671 from international

locations, and entering Replay Pin Number 10190553. There also will

be a simultaneous, live webcast available on the Investor Relations

section of the Company’s web site at www.cleanenergyfuels.com,

which will be available for replay for 30 days.

About Clean Energy Fuels Corp.

Clean Energy Fuels Corp. is the country’s largest provider of

the cleanest fuel for the transportation market. Our mission is to

decarbonize transportation through the development and delivery of

renewable natural gas (“RNG”), a sustainable fuel derived from

organic waste. Clean Energy allows thousands of vehicles, from

airport shuttles to city buses to waste and heavy-duty trucks, to

reduce their amount of climate-harming greenhouse gas. We operate a

vast network of fueling stations across the U.S. and Canada. Visit

www.cleanenergyfuels.com and follow @ce_renewables on X (formerly

known as Twitter).

Non-GAAP Financial Measures

To supplement the Company’s unaudited consolidated financial

statements presented in accordance with GAAP, the Company uses

non-GAAP financial measures that it calls non-GAAP income (loss)

per share (“non-GAAP income (loss) per share”) and adjusted EBITDA

(“Adjusted EBITDA”). Management presents non-GAAP income (loss) per

share and Adjusted EBITDA because it believes these measures

provide meaningful supplemental information about the Company’s

performance for the following reasons: (1) they allow for greater

transparency with respect to key metrics used by management to

assess the Company’s operating performance and make financial and

operational decisions; (2) they exclude the effect of items that

management believes are not directly attributable to the Company’s

core operating performance and may obscure trends in the business;

and (3) they are used by institutional investors and the analyst

community to help analyze the Company’s business. In future

quarters, the Company may adjust for other expenditures, charges or

gains to present non-GAAP financial measures that the Company’s

management believes are indicative of the Company’s core operating

performance.

Non-GAAP financial measures are limited as an analytical tool

and should not be considered in isolation from, or as a substitute

for, the Company’s GAAP results. The Company expects to continue

reporting non-GAAP financial measures, adjusting for the items

described below (and/or other items that may arise in the future as

the Company’s management deems appropriate), and the Company

expects to continue to incur expenses, charges or gains like the

non-GAAP adjustments described below. Accordingly, unless expressly

stated otherwise, the exclusion of these and other similar items in

the presentation of non-GAAP financial measures should not be

construed as an inference that these costs are unusual, infrequent,

or non-recurring. Non-GAAP income (loss) per share and Adjusted

EBITDA are not recognized terms under GAAP and do not purport to be

an alternative to GAAP income (loss), GAAP income (loss) per share

or any other GAAP measure as an indicator of operating performance.

Moreover, because not all companies use identical measures and

calculations, the Company’s presentation of non-GAAP income (loss)

per share and Adjusted EBITDA may not be comparable to other

similarly titled measures used by other companies.

Non-GAAP Income (Loss) Per Share

Non-GAAP income (loss) per share, which the Company presents as

a non-GAAP measure of its performance, is defined as net income

(loss) attributable to Clean Energy Fuels Corp., plus Amazon

warrant charges, plus stock-based compensation expense, plus

(minus) loss (income) from Rimere equity method investment, plus

(minus) loss (income) from the SAFE&CEC S.r.l. equity method

investment, plus (minus) any loss (gain) from changes in the fair

value of derivative instruments, and minus amortization of

investment tax credit from RNG equity method investments, the total

of which is divided by the Company’s weighted-average common shares

outstanding on a diluted basis. The Company’s management believes

excluding non-cash expenses related to the Amazon warrant charges

provides useful information to investors regarding the Company’s

performance because the Amazon warrant charges are measured based

upon a fair value determined using a variety of assumptions and

estimates, and the Amazon warrant charges do not affect the

Company’s operating cash flows related to the delivery and sale of

vehicle fuel to its customer. The Company’s management believes

excluding non-cash expenses related to stock-based compensation

provides useful information to investors regarding the Company’s

performance because of the varying available valuation

methodologies, the volatility of the expense (which depends on

market forces outside of management’s control), the subjectivity of

the assumptions and the variety of award types that a company can

use, which may obscure trends in a company’s core operating

performance. In addition, the Company’s management believes

excluding the results from the Rimere equity method investment is

useful to investors because Rimere is an investment belonging to

the non-core operations of the Company, and its results are not

indicative of the Company’s ongoing operations. Similarly, the

Company’s management believes excluding the non-cash results from

the SAFE&CEC S.r.l. equity method investment is useful to

investors because these charges are not part of or representative

of the core operations of the Company. In addition, the Company’s

management believes excluding the non-cash loss (gain) from changes

in the fair value of derivative instruments is useful to investors

because the valuation of the derivative instruments is based on a

number of subjective assumptions, the amount of the loss or gain is

derived from market forces outside of management’s control, and the

exclusion of these amounts enables investors to compare the

Company’s performance with other companies that do not use, or use

different forms of, derivative instruments. Furthermore, the

Company’s management believes excluding other income relating to

the amortization of investment tax credit from RNG equity method

investments is useful to investors because such income is not

generated from the core operations of the Company and may obscure

trends of the Company’s core operations.

Adjusted EBITDA

Adjusted EBITDA, which the Company presents as a non-GAAP

measure of its performance, is defined as net income (loss)

attributable to Clean Energy Fuels Corp., plus (minus) income tax

expense (benefit), plus interest expense (including any losses from

the extinguishment of debt), minus interest income, plus

depreciation and amortization expense, plus Amazon warrant charges,

plus stock-based compensation expense, plus (minus) loss (income)

from the Rimere equity method investment, plus (minus) loss

(income) from the SAFE&CEC S.r.l. equity method investment,

plus (minus) any loss (gain) from changes in the fair value of

derivative instruments, plus depreciation and amortization expense

from RNG equity method investments, plus interest expense from RNG

equity method investments, minus interest income from RNG equity

method investments, and minus amortization of investment tax credit

from RNG equity method investments. The Company’s management

believes Adjusted EBITDA provides useful information to investors

regarding the Company’s performance for the same reasons discussed

above with respect to non-GAAP income (loss) per share. In

addition, management internally uses Adjusted EBITDA to determine

elements of executive and employee compensation.

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including statements about, among other things, our fiscal

2024 outlook, our volume growth, customer expansion, production

sources, joint ventures, governmental regulations, and the benefits

of our fuels.

Forward-looking statements are statements other than historical

facts and relate to future events or circumstances or the Company’s

future performance, and are based on the Company’s current

assumptions, expectations and beliefs concerning future

developments and their potential effect on the Company and its

business. As a result, actual results, performance or achievements

and the timing of events could differ materially from those

anticipated in or implied by these forward-looking statements as a

result of many factors including, among others: the willingness of

fleets and other consumers to adopt natural gas as a vehicle fuel,

and the rate and level of any such adoption; the market’s

perception of the benefits of RNG and conventional natural gas

relative to other alternative vehicle fuels; natural gas vehicle

and engine cost, fuel usage, availability, quality, safety,

convenience, design, performance and residual value, as well as

operator perception with respect to these factors, in general and

in the Company’s key customer markets, including heavy-duty

trucking; the Company’s ability to further develop and manage its

RNG business, including its ability to procure adequate supplies of

RNG and generate revenues from sales of such RNG; the Company and

its suppliers’ ability to successfully develop and operate projects

and produce expected volumes of RNG; the impact of a bankruptcy or

failure of any source owners at our projects; the Company’s

dependence on the production of vehicles and engines by

manufacturers over which the Company has no control; the long and

variable development cycle required to secure ADG RNG from new

projects; the potential commercial viability, solvency, financial

capacity, and operational capability of livestock waste and dairy

farm projects to produce RNG; the Company’s history of net losses

and the possibility that the Company could incur additional net

losses in the future; the Company’s and its partners’ ability to

acquire, finance, construct and develop other commercial projects;

the Company’s ability to invest in hydrogen stations or modify its

fueling stations to reform its RNG to fuel hydrogen and charge

electric vehicles; the future supply, demand, use and prices of

crude oil, gasoline, diesel, natural gas, and other vehicle fuels,

including overall levels of and volatility in these factors;

changes in the competitive environment in which we operate,

including potentially increasing competition in the market for

vehicle fuels generally; the Company’s ability to manage and

increase its business of transporting and selling CNG for

non-vehicle purposes via virtual natural gas pipelines and

interconnects, as well as its station design and construction

activities; construction, permitting and other factors that could

cause delays or other problems at station construction projects;

the Company’s ability to procure and maintain contracts with

government entities; the Company’s ability to execute and realize

the intended benefits of any acquisitions, divestitures,

investments or other strategic relationships or transactions;

significant fluctuations in the Company’s results of operations,

which make it difficult to predict future results of operations;

the Company’s warranty reserves may not adequately cover its

warranty obligations; the director and indirect impact of the

COVID-19 pandemic or other pandemics; the future availability of

and the Company’s access to additional capital, which may include

debt or equity financing, in the amounts and at the times needed to

fund growth in the Company’s business and the repayment of its debt

obligations (whether at or before their due dates) or other

expenditures, as well as the terms and other effects of any such

capital raising transaction; the Company’s ability to generate

sufficient cash flows to repay its debt obligations as they come

due; the availability of environmental, tax and other government

legislation, regulations, programs and incentives that promote

natural gas, such as AFTC, or other alternatives as a vehicle fuel,

including long-standing support for gasoline- and diesel-powered

vehicles and growing support for electric and hydrogen-powered

vehicles that could result in programs or incentives that favor

these or other vehicles or vehicle fuels over natural gas; the

Company’s ability to comply with various registration and

regulatory requirements related to its RNG projects; the effect of,

or potential for changes to greenhouse gas emissions requirements

or other environmental regulations applicable to vehicles powered

by gasoline, diesel, natural gas or other vehicle fuels and crude

oil and natural gas fueling, drilling, production, transportation

or use; the Company’s ability to manage the health, safety and

environmental risks inherent in its operations; the Company’s

compliance with all applicable government and environmental

regulations; the impact of the foregoing on the trading price of

the Company’s common stock; the interests of the Company’s

significant stockholders may differ from the Company’s other

stockholders; the Company’s ability to protect against any material

failure, inadequacy, interruption or security failure of is

information technology; and general political, regulatory, economic

and market conditions.

The forward-looking statements made in this press release speak

only as of the date of this press release and the Company

undertakes no obligation to update publicly such forward-looking

statements to reflect subsequent events or circumstances, except as

otherwise required by law. The Company’s periodic reports filed

with the Securities and Exchange Commission (www.sec.gov),

including its Quarterly Report on Form 10-Q for the quarter ended

June 30, 2024 that the Company expects to file with the Securities

and Exchange Commission on or about August 7, 2024, contain

additional information about these and other risk factors that may

cause actual results to differ materially from the forward-looking

statements contained in this press release, and such risk factors

may be amended, supplemented or superseded from time to time by

other reports the Company files with the Securities and Exchange

Commission.

Clean Energy Fuels Corp. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share data; Unaudited)

December 31,

June 30,

2023

2024

Assets

Current assets:

Cash, cash equivalents and current portion

of restricted cash

$

106,963

$

125,142

Short-term investments

158,186

126,212

Accounts receivable, net of allowance of

$1,475 and $1,643 as of December 31, 2023 and June 30, 2024,

respectively

98,426

92,108

Other receivables

19,770

25,041

Inventory

45,335

49,406

Prepaid expenses and other current

assets

41,495

32,975

Total current assets

470,175

450,884

Operating lease right-of-use assets

92,324

99,673

Land, property and equipment, net

331,758

340,278

Notes receivable and other long-term

assets, net

35,735

34,501

Investments in other entities

258,773

250,257

Goodwill

64,328

64,328

Intangible assets, net

6,365

6,365

Total assets

$

1,259,458

$

1,246,286

Liabilities and Stockholders'

Equity

Current liabilities:

Current portion of debt

$

38

$

43

Current portion of finance lease

obligations

1,758

1,923

Current portion of operating lease

obligations

6,687

7,678

Accounts payable

56,995

33,842

Accrued liabilities

91,534

91,158

Deferred revenue

4,936

7,794

Derivative liabilities, related party

1,875

—

Total current liabilities

163,823

142,438

Long-term portion of debt

261,123

262,912

Long-term portion of finance lease

obligations

1,839

1,534

Long-term portion of operating lease

obligations

89,065

96,962

Other long-term liabilities

9,961

12,869

Total liabilities

525,811

516,715

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value.

1,000,000 shares authorized; no shares issued and outstanding

—

—

Common stock, $0.0001 par value.

454,000,000 shares authorized; 223,026,966 shares and 223,332,502

shares issued and outstanding as of December 31, 2023 and June 30,

2024, respectively

22

22

Additional paid-in capital

1,658,339

1,690,762

Accumulated deficit

(929,472

)

(964,208

)

Accumulated other comprehensive loss

(2,119

)

(3,535

)

Total Clean Energy Fuels Corp.

stockholders’ equity

726,770

723,041

Noncontrolling interest in subsidiary

6,877

6,530

Total stockholders’ equity

733,647

729,571

Total liabilities and stockholders’

equity

$

1,259,458

$

1,246,286

Clean Energy Fuels Corp. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except share

and per share data; Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2024

2023

2024

Revenue:

Product revenue

$

75,629

$

82,960

$

195,356

$

172,374

Service revenue

14,919

14,994

27,375

29,289

Total revenue

90,548

97,954

222,731

201,663

Operating expenses:

Cost of sales (exclusive of depreciation

and amortization shown separately below):

Product cost of sales

55,570

53,914

175,228

120,339

Service cost of sales

8,592

10,026

16,202

19,202

Selling, general and administrative

28,548

28,342

58,197

54,579

Depreciation and amortization

10,893

11,264

21,571

22,446

Total operating expenses

103,603

103,546

271,198

216,566

Operating loss

(13,055

)

(5,592

)

(48,467

)

(14,903

)

Interest expense

(4,365

)

(7,921

)

(8,719

)

(15,683

)

Interest income

2,766

3,639

5,483

7,218

Other income (expense), net

28

(40

)

71

58

Loss from equity method investments

(1,915

)

(5,795

)

(3,805

)

(11,193

)

Loss before income taxes

(16,541

)

(15,709

)

(55,437

)

(34,503

)

Income tax (expense) benefit

55

(758

)

119

(580

)

Net loss

(16,486

)

(16,467

)

(55,318

)

(35,083

)

Loss attributable to noncontrolling

interest

185

174

320

347

Net loss attributable to Clean Energy

Fuels Corp.

$

(16,301

)

$

(16,293

)

$

(54,998

)

$

(34,736

)

Net loss attributable to Clean Energy

Fuels Corp. per share:

Basic and diluted

$

(0.07

)

$

(0.07

)

$

(0.25

)

$

(0.16

)

Weighted-average common shares

outstanding:

Basic and diluted

222,908,402

223,289,936

222,813,286

223,250,123

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806243118/en/

Media Contact: Gary Foster (949) 437-1113

Gary.Foster@cleanenergyfuels.com

Investor Contact: Thomas Driscoll (949) 437-1191

Thomas.Driscoll@cleanenergyfuels.com

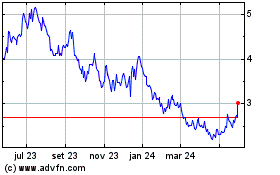

Clean Energy Fuels (NASDAQ:CLNE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

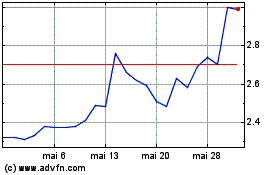

Clean Energy Fuels (NASDAQ:CLNE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024