Kodiak Gas Services, Inc. (NYSE: KGS) (“Kodiak” or the

“Company”), a leading provider of critical energy infrastructure

and contract compression services, today reported financial and

operating results for the quarter ended June 30, 2024 and also

updated full-year 2024 guidance.

Second Quarter 2024 and Recent Highlights

- Total revenues were $309.7 million compared to $203.3 million

in the second quarter of 2023

- Contract Services segment revenues and Adjusted Gross Margin

Percentage(1) were $276.3 million and 64.0%, respectively

- Net income was $6.7 million compared to net income of $17.5

million in the second quarter of 2023

- Record quarterly Adjusted EBITDA(1) of $154.3 million compared

to $107.9 million in the second quarter of 2023

- Increased expected transaction run-rate cost synergies to

greater than $30 million

- Deployed 41,500 horsepower of new large horsepower compression

units

- Horsepower utilization on units with >1,000 horsepower was

~98% at June 30, 2024

- Entered into an agreement to divest a significant number of

small horsepower units both in the U.S and internationally

- Declared a cash dividend of $0.41 per share, or $1.64 per share

annualized, representing an 8% increase over the first quarter 2024

dividend

Updated 2024 Guidance

- Raised full-year 2024 Adjusted EBITDA guidance to a range of

$590 to $610 million, a $10 million increase to the low end of the

range

- Expect to generate Discretionary Cash Flow(1) in the range of

$365 to $385 million in 2024

(1)

Adjusted Gross Margin Percentage, Adjusted

EBITDA, and Discretionary Cash Flow are Non-GAAP Financial

Measures. Definitions and reconciliations to the most comparable

GAAP financial measure is included herein.

“We are pleased with our second quarter 2024 results as we

completed the acquisition of CSI Compressco to form the industry’s

largest contract compression fleet and delivered record revenues

and Adjusted EBITDA,” stated Mickey McKee, Kodiak’s President and

Chief Executive Officer. “We’ve made tremendous progress on

integration and have raised our estimate of the synergies we expect

to realize through the combination to over $30 million, driving

margin expansion and growth in future cash flows.

"Our leading position in the Permian Basin positions us to

benefit from the coming growth in U.S. natural gas supply to meet

demand from LNG and electricity load growth to power data centers.

Large horsepower compression remains in high demand, and our new

unit deliveries are effectively fully contracted through 2025. This

positive outlook along with our solid execution gives us confidence

to raise the low end of our 2024 Adjusted EBITDA guidance range and

increase our quarterly dividend. We’re committed to returning

capital to shareholders within our capital allocation framework,

while also investing for future growth and driving towards our

total leverage target of 3.5x.”

Second Quarter 2024 Financial Results

Net income for the second quarter of 2024 was $6.7 million,

compared to $17.5 million in the second quarter of 2023. Adjusted

EBITDA for the second quarter of 2024 was $154.3 million compared

to $107.9 million in the second quarter of 2023.

Selling, general and administrative expenses were $59.9 million

in the second quarter of 2024, compared to $13.4 million in the

second quarter of 2023. Second quarter 2024 selling, general and

administrative expenses were negatively impacted by $17.4 million

in transaction expenses and $9.0 million in severance costs related

to the CSI Acquisition, and a $4.5 million provision for expected

credit losses.

Segment Information

Kodiak formerly managed its business through two operating

segments: Compression Operations and Other Services. After the

acquisition of CSI Compressco (the “CSI Acquisition”), the Company

manages its business through the following two operating segments:

Contract Services and Other Services and operates predominantly in

the U.S. and in select international regions. Contract Services

consists of operating Company-owned compression, customer-owned

compression, and gas treating and cooling infrastructure, pursuant

to fixed-revenue contracts, to enable the production, gathering and

transportation of natural gas and oil. Other Services consists of

station construction, maintenance and overhaul, freight and crane

charges, part sales and other time and material-based

offerings.

Contract Services segment revenues were $276.3 million in the

second quarter of 2024, a 52% increase compared to $181.6 million

in the second quarter of 2023. Contract Services segment Adjusted

Gross Margin was $176.9 million in the second quarter of 2024, a

52% increase compared to $116.6 million in the second quarter of

2023. Second quarter 2024 Contract Services cost of operations

included a $3.3 million accrual for potential sales and use taxes

related to compressor parts purchases spanning several years.

Other Services segment revenues were $33.4 million in the second

quarter of 2024 compared to $21.7 million in the second quarter of

2023. Other Services segment Adjusted Gross Margin was $5.5 million

in the second quarter of 2024, compared to $3.6 million in the

second quarter of 2023.

Compression Fleet Update

Subsequent to June 30, 2024, Kodiak entered into an agreement to

sell a significant number of small horsepower units both in the

U.S. and internationally in a transaction that is anticipated to

close in the third quarter of 2024.

Long-Term Debt and Liquidity

Total debt outstanding was $2.5 billion as of June 30, 2024,

principally comprised of borrowings on the ABL Facility and senior

notes due 2029. At June 30, 2024, the Company had $411.4 million

available on its ABL Facility.

Summary Financial Data

(in thousands, except percentages)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Total revenues

$

309,653

$

215,492

$

203,306

Net income

$

6,713

$

30,232

$

17,517

Adjusted EBITDA (1)

$

154,342

$

117,762

$

107,885

Adjusted EBITDA percentage (1)

49.8

%

54.6

%

53.1

%

Contract Services revenue

$

276,250

$

193,399

$

181,619

Contract Services Adjusted Gross Margin

(1)

$

176,917

$

127,517

$

116,602

Contract Services Adjusted Gross Margin

Percentage (1)

64.0

%

65.9

%

64.2

%

Other Services revenue

$

33,403

$

22,093

$

21,687

Other Services Adjusted Gross Margin

(1)

$

5,467

$

4,409

$

3,588

Other Services Adjusted Gross Margin

Percentage (1)

16.4

%

20.0

%

16.5

%

Maintenance capital expenditures

$

19,147

$

10,642

$

10,940

Growth capital expenditures(2)

$

90,390

$

59,401

$

32,529

Discretionary Cash Flow (1)

$

90,617

$

71,925

$

64,873

Free Cash Flow (1)

$

638

$

12,524

$

33,367

(1)

Adjusted EBITDA, Adjusted EBITDA

Percentage, Adjusted Gross Margin, Adjusted Gross Margin

Percentage, Discretionary Cash Flow and Free Cash Flow are non-GAAP

financial measures. For definitions and reconciliations to the most

directly comparable financial measures calculated and presented in

accordance with GAAP, see “Non-GAAP Financial Measures” below.

(2)

For the three months ended June 30, 2024,

March 31, 2024 and June 30, 2023, growth capital expenditures

include a non-cash increase in the sales tax accrual on compression

equipment purchases of $19.8 million, $0.3 million and $0.3

million, respectively. These accrual amounts are estimated based on

the best-known information as it relates to open audit periods with

the state of Texas.

Summary Operating Data

(as of the dates indicated)

June 30, 2024

March 31, 2024

June 30, 2023

Fleet horsepower (1)

4,481,900

3,290,971

3,180,906

Revenue-generating horsepower (2)

4,224,839

3,285,592

3,177,286

Fleet compression units

7,317

3,091

3,038

Revenue-generating compression units

5,753

3,064

3,023

Revenue-generating horsepower per

revenue-generating compression unit (3)

734

1,072

1,051

Horsepower utilization (4)

94.3

%

99.8

%

99.9

%

(1)

Fleet horsepower includes owned horsepower

excluding 27,663, 27,663 and 32,340 of non-marketable or obsolete

horsepower as of June 30, 2024, March 31, 2024, and June 30, 2023,

respectively.

(2)

Revenue-generating horsepower includes

fleet horsepower that is under contract, operating and generating

revenue.

(3)

Calculated as (i) revenue-generating

horsepower divided by (ii) revenue-generating compression units at

period end.

(4)

Horsepower utilization is calculated as

(i) revenue-generating horsepower divided by (ii) fleet

horsepower.

Full-Year 2024 Guidance

Kodiak is providing revised guidance for the full year 2024. The

full-year 2024 guidance below incorporates three quarters of the

financial impact of the CSI Acquisition that closed on April 1,

2024. Amounts below are in thousands except percentages.

Full-Year 2024

Guidance

Low

High

Adjusted EBITDA (1)

$

590,000

$

610,000

Discretionary Cash Flow (1)(2)

$

365,000

$

385,000

Segment Information

Contract Services revenues

$

1,000,000

$

1,040,000

Contract Services Adjusted Gross Margin

Percentage (1)

64

%

66

%

Other Services revenues

$

120,000

$

140,000

Other Services Adjusted Gross Margin

Percentage (1)

14

%

17

%

Capital Expenditures

Growth capital expenditures (3)

$

210,000

$

230,000

Maintenance capital expenditures

$

60,000

$

70,000

(1)

The Company is unable to reconcile

projected Adjusted EBITDA to projected net income (loss) and

Discretionary Cash Flow to projected net cash provided by operating

activities, the most comparable financial measures calculated in

accordance with GAAP, respectively, without unreasonable efforts

because components of the calculations are inherently

unpredictable, such as changes to current assets and liabilities,

unknown future events, and estimating certain future GAAP measures.

The inability to project certain components of the calculation

would significantly affect the accuracy of the reconciliations.

(2)

Discretionary Cash Flow assumes no change

to Secured Overnight Financing Rate futures.

(3)

Growth capital expenditures guidance

excludes (i) approximately $30 million in one-time capital

expenditures related to the CSI Acquisition, (ii) a $20 million

non-cash accrual for sales taxes on compression units purchased in

prior years and (iii) proceeds from the pending sale of small

horsepower compression units.

Conference Call

Kodiak will conduct a conference call on Tuesday, August 13,

2024, at 11:00 a.m. Eastern Time (10:00 a.m. Central Time) to

discuss financial and operating results for the quarter ended June

30, 2024. To listen to the call by phone, dial 877-407-4012 and ask

for the Kodiak Gas Services call at least 10 minutes prior to the

start time. To listen to the call via webcast, please visit the

Investors tab of Kodiak’s website at www.kodiakgas.com.

About Kodiak

Kodiak is the largest contract compression services provider in

the United States, serving as a critical link in the infrastructure

enabling the safe and reliable production and transportation of

natural gas and oil. Headquartered in The Woodlands, Texas, Kodiak

provides contract compression and related services to oil and gas

producers and midstream customers in high–volume gas gathering

systems, processing facilities, multi-well gas lift applications

and natural gas transmission systems. More information is available

at www.kodiakgas.com.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as net income (loss) before interest

expense, net; income tax expense (benefit); and depreciation and

amortization; plus (i) loss (gain) on derivatives; (ii) equity

compensation expense; (iii) severance expenses; (iv) transaction

expenses; and (v) loss (gain) on sale of assets. Adjusted EBITDA

Percentage is defined as Adjusted EBITDA divided by total revenues.

Adjusted EBITDA and Adjusted EBITDA Percentage are used as

supplemental financial measures by our management and external

users of our financial statements, such as investors, commercial

banks and other financial institutions, to assess: (i) the

financial performance of our assets without regard to the impact of

financing methods, capital structure or historical cost basis of

our assets; (ii) the viability of capital expenditure projects and

the overall rates of return on alternative investment

opportunities; (iii) the ability of our assets to generate cash

sufficient to make debt payments and pay dividends; and (iv) our

operating performance as compared to those of other companies in

our industry without regard to the impact of financing methods and

capital structure. We believe Adjusted EBITDA and Adjusted EBITDA

Percentage provide useful information to investors because, when

viewed with our GAAP results and the accompanying reconciliation,

they provide a more complete understanding of our performance than

GAAP results alone. We also believe that external users of our

financial statements benefit from having access to the same

financial measures that management uses in evaluating the results

of our business. Reconciliations of Adjusted EBITDA to net income

(loss), the most directly comparable GAAP financial measure, and

net cash provided by operating activities are presented below.

Adjusted Gross Margin is defined as revenue less cost of

operations, exclusive of depreciation and amortization expense.

Adjusted Gross Margin Percentage is defined as Adjusted Gross

Margin divided by revenues. We believe Adjusted Gross Margin and

Adjusted Gross Margin Percentage are useful as supplemental

measures to investors of our operating profitability.

Reconciliations of Adjusted Gross Margin to gross margin are

presented below.

Discretionary Cash Flow is defined as net cash provided by

operating activities less (i) maintenance capital expenditures;(ii)

gain on sale of capital assets; (iii) certain changes in operating

assets and liabilities; and (iv) certain other expenses; plus (x)

cash loss on extinguishment of debt; and (y) transaction expenses.

We believe Discretionary Cash Flow is a useful liquidity and

performance measure and supplemental financial measure for us and

our investors in assessing our ability to pay cash dividends to our

stockholders, make growth capital expenditures and assess our

operating performance. Reconciliations of Discretionary Cash Flow

to net income and net cash provided by operating activities are

presented below.

Free Cash Flow is defined as net cash provided by operating

activities less (i) maintenance capital expenditures; (ii) gain on

sale of capital assets; (iii) certain changes in operating assets

and liabilities; (iv) certain other expenses; and (v) net growth

capital expenditures; plus (x) transaction expenses; and (y)

proceeds from sale of capital assets. We believe Free Cash Flow is

a liquidity measure and useful supplemental financial measure for

us and investors in assessing our ability to pursue business

opportunities and investments to grow our business and to service

our debt. Reconciliations of Free Cash Flow to net income and net

cash provided by operating activities are presented below.

Cautionary Note Regarding Forward-Looking Statements

This news release contains, and our officers and representatives

may from time to time make, “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Forward-looking

statements can be identified by words such as: “anticipate,”

“intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “will”

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding: (i) expected operating results, such as revenue

growth and earnings, including changes due to CSI Acquisition, and

our ability to service our indebtedness; (ii) anticipated levels of

capital expenditures and uses of capital; (iii) current or future

volatility in the credit markets and future market conditions; (iv)

potential and pending acquisition transactions or other strategic

transactions, the timing thereof, the receipt of necessary

approvals to close those transactions, our ability to finance such

transactions and our ability to achieve the intended operational,

financial and strategic benefits from any such transactions; (v)

expected synergies and efficiencies to be achieved as a result of

the CSI Acquisition; (vi) expectations regarding leverage and

dividend profile as a result of the CSI Acquisition, including the

amount and timing of future dividend payments; (vii) expectations

of the effect on our financial condition of claims, litigation,

environmental costs, contingent liabilities and governmental and

regulatory investigations and proceedings; (viii) production and

capacity forecasts for the natural gas and oil industry; (ix)

strategy for customer retention, growth, fleet maintenance, market

position, and financial results; (x) our interest rate hedges; and

(xi) strategy for risk management.

Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of our control. Our actual results and financial condition

may differ materially from those indicated in the forward-looking

statements. Therefore, you should not place undue reliance on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: (i) a reduction in the demand

for natural gas and oil; (ii) the loss of, or the deterioration of

the financial condition of, any of our key customers; (iii)

nonpayment and nonperformance by our customers, suppliers or

vendors; (iv) competitive pressures that may cause us to lose

market share; (v) the structure of our Contract Services contracts

and the failure of our customers to continue to contract for

services after expiration of the primary term; (vi) our ability to

successfully integrate any acquired business, including CSI

Compressco, and realize the expected benefits thereof; (vii) our

ability to fund purchases of additional compression equipment;

(viii) a deterioration in general economic, business, geopolitical

or industry conditions, including as a result of the conflict

between Russia and Ukraine, inflation, and slow economic growth in

the United States; (ix) tax legislation and administrative

initiatives or challenges to our tax positions; (x) the loss of key

management, operational personnel or qualified technical personnel;

(xi) our dependence on a limited number of suppliers; (xii) the

cost of compliance with existing governmental regulations and

proposed governmental regulations, including climate change

legislation; (xiii) the cost of compliance with regulatory

initiatives and stakeholder pressures, including environmental,

social and governance scrutiny; (xiv) the inherent risks associated

with our operations, such as equipment defects and malfunctions;

(xv) our reliance on third-party components for use in our

information technology systems; (xvi) legal and reputational risks

and expenses relating to the privacy, use and security of employee

and client information; (xvii) threats of cyber-attacks or

terrorism; (xviii) agreements that govern our debt contain features

that may limit our ability to operate our business and fund future

growth and also increase our exposure to risk during adverse

economic conditions; (xix) volatility in interest rates; (xx) our

ability to access the capital and credit markets or borrow on

affordable terms to obtain additional capital that we may require;

(xxi) the effectiveness of our disclosure controls and procedures;

and (xxii) such other factors as discussed throughout the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of our Annual Report

on Form 10-K for the year ended December 31, 2023, as filed with

the U.S. Securities and Exchange Commission.

Any forward-looking statement made by us in this news release is

based only on information currently available to us and speaks only

as of the date on which it is made. Except as may be required by

applicable law, we undertake no obligation to publicly update any

forward-looking statement whether as a result of new information,

future developments or otherwise.

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and

per share data)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Revenues:

Contract Services

$

276,250

$

193,399

$

181,619

Other Services

33,403

22,093

21,687

Total revenues

309,653

215,492

203,306

Operating expenses:

Cost of operations (exclusive of

depreciation and amortization shown below)

Contract Services

99,333

65,882

65,017

Other Services

27,936

17,684

18,099

Depreciation and amortization

69,463

46,944

45,430

Selling, general and administrative

expenses

59,927

24,824

13,438

Gain on sale of property, plant and

equipment

(1,173

)

—

(738

)

Total operating expenses

255,486

155,334

141,246

Income from operations

54,167

60,158

62,060

Other income (expenses):

Interest expense, net

(52,133

)

(39,740

)

(73,658

)

Gain on derivatives

6,797

19,757

34,934

Other income (expense), net

218

(68

)

32

Total other expenses, net

(45,118

)

(20,051

)

(38,692

)

Income before income taxes

9,049

40,107

23,368

Income tax expense

2,336

9,875

5,851

Net income

6,713

30,232

17,517

Less: Net income attributable to

noncontrolling interests

485

—

—

Net Income attributable to common

shareholders

$

6,228

$

30,232

$

17,517

Earnings per share attributable to common

shareholders:

Basic net earnings per share

$

0.07

$

0.39

$

0.30

Diluted net earnings per share

$

0.06

$

0.39

$

0.30

Basic weighted average shares of common

stock outstanding

84,202,352

77,432,283

59,000,000

Diluted weighted average shares of common

stock outstanding

90,669,239

78,102,450

59,000,000

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share data)

As of June 30, 2024

As of December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

3,852

$

5,562

Accounts receivable, net

203,426

113,192

Inventories, net

119,649

76,238

Fair value of derivative instruments

5,590

8,194

Contract assets

5,424

17,424

Prepaid expenses and other current

assets

14,418

10,353

Total current assets

352,359

230,963

Property, plant and equipment, net

3,424,849

2,536,091

Operating lease right-of-use assets,

net

53,939

33,716

Finance lease right-of-use assets, net

4,698

—

Goodwill

403,390

305,553

Identifiable intangible assets, net

165,213

122,888

Fair value of derivative instruments

31,153

14,256

Deferred tax assets

17

—

Other assets

3,662

639

Total assets

$

4,439,280

$

3,244,106

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

65,592

$

49,842

Accrued liabilities

197,424

97,078

Contract liabilities

71,418

63,709

Total current liabilities

334,434

210,629

Long-term debt, net of unamortized debt

issuance cost

2,486,767

1,791,460

Operating lease liabilities

49,392

34,468

Financing lease liabilities

2,555

—

Deferred tax liabilities

97,861

62,748

Other liabilities

4,889

2,148

Total liabilities

2,975,898

2,101,453

Commitments and contingencies (Note

14)

Stockholders’ equity:

Preferred stock, par value $0.01 per

share; 50,000,000 shares of preferred stock authorized, 5,562,273

and zero issued and outstanding as of June 30, 2024, and December

31, 2023, respectively

56

—

Common stock, par value $0.01 per share;

750,000,000 shares of common stock authorized, 84,312,360 and

77,400,000 shares of common stock issued and outstanding as of June

30, 2024, and December 31, 2023, respectively

842

774

Additional paid-in capital

1,157,735

963,760

Noncontrolling interest

152,529

—

Retained earnings

152,220

178,119

Total stockholders’ equity

1,463,382

1,142,653

Total liabilities and stockholders’

equity

$

4,439,280

$

3,244,106

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net Income

$

36,945

$

5,174

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

116,407

90,327

Equity compensation expense

8,159

908

Amortization of debt issuance costs

4,946

11,071

Non-cash lease expense

1,648

1,786

Provision for credit losses

4,589

2

Inventory reserve

476

250

Gain on sale of property, plant and

equipment

(1,173

)

(721

)

Change in fair value of derivatives

(14,293

)

21,529

Deferred tax provision

7,104

761

Changes in operating assets and

liabilities, exclusive of effects of business acquisition:

Accounts receivable

(45,933

)

(21,705

)

Inventories

(3,147

)

(4,907

)

Contract assets

12,000

(958

)

Prepaid expenses and other current

assets

4,671

(10,681

)

Accounts payable

21,983

10,954

Accrued and other liabilities

11,871

(14,971

)

Contract liabilities

6,308

29,149

Other assets

63

—

Net cash provided by operating

activities

172,624

117,968

Cash flows from investing

activities:

Net cash acquired in acquisition of CSI

Compressco LP

9,458

—

Purchase of property, plant and

equipment

(177,186

)

(94,034

)

Proceeds from sale of property, plant and

equipment

411

1,055

Other

(35

)

(14

)

Net cash used in investing activities

(167,352

)

(92,993

)

Cash flows from financing

activities:

Borrowings on debt instruments

1,945,775

499,279

Payments on debt instruments

(1,867,851

)

(428,812

)

Principal payments on other borrowings

(1,843

)

—

Payment of debt issuance cost

(16,346

)

(32,202

)

Dividends paid to stockholders

(62,393

)

—

Principal payments on finance leases

(408

)

—

Offering costs

(1,162

)

—

Cash paid for shares withheld to cover

taxes

(294

)

—

Distribution to stockholders

—

(42,300

)

Distribution to noncontrolling

interest

(2,460

)

—

Net cash used in financing activities

(6,982

)

(4,035

)

Net (decrease) increase in cash and cash

equivalents

(1,710

)

20,940

Cash and cash equivalents - beginning of

period

5,562

20,431

Cash and cash equivalents - end of

period

$

3,852

$

41,371

Supplemental cash disclosures:

Cash paid for interest

$

40,861

$

116,370

Cash paid for taxes

$

9,225

$

5,726

Supplemental disclosure of non-cash

investing activities:

Decrease in accrued capital

expenditures

$

2,702

$

9,946

Supplemental disclosure of non-cash

financing activities:

Dividends equivalent

$

(455

)

$

—

Issuance of common shares

$

188,099

$

—

Issuance of preferred shares and

noncontrolling interest

$

154,186

$

—

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET INCOME

TO ADJUSTED EBITDA

(in thousands, excluding

percentages; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net income

$

6,713

$

30,232

$

17,517

Interest expense, net

52,133

39,740

73,658

Income tax expense

2,336

9,875

5,851

Depreciation and amortization

69,463

46,944

45,430

Gain on derivatives

(6,797

)

(19,757

)

(34,934

)

Equity compensation expense(1)

5,311

2,848

29

Severance expense(2)

8,969

—

—

Transaction expenses(3)

17,387

7,880

1,072

Gain on sale of property, plant and

equipment

(1,173

)

—

(738

)

Adjusted EBITDA

$

154,342

$

117,762

$

107,885

Adjusted EBITDA Percentage

49.8

%

54.6

%

53.1

%

(1)

For the three months ended June 30, 2024, March 31, 2024, and

June 30, 2023, there were $5.3 million, $2.8 million and $0.0

million, respectively, of non-cash adjustments for equity

compensation expense.

(2)

For the three months ended June 30, 2024 there were $9.0 million

of severance expenses related to the CSI Acquisition. There were no

such expenses for the three months ended March 31, 2024 and June

30, 2023.

(3)

Represents certain costs associated with non-recurring

professional services, primarily related to the CSI Acquisition for

the three months ended June 30, 2024 and March 31, 2024.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO ADJUSTED EBITDA

(in thousands; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net cash provided by operating

activities

$

121,082

$

51,542

$

94,678

Interest expense, net

52,133

39,740

73,658

Income tax (benefit) expense

2,336

9,875

5,851

Deferred tax provision

(843

)

(6,261

)

(3,282

)

Cash received on derivatives

(6,745

)

(5,516

)

(38,529

)

Severance expense(1)

8,969

—

—

Transaction expenses(2)

17,387

7,880

1,072

Other(3)

(7,605

)

(4,054

)

(6,763

)

Change in operating assets and

liabilities

(32,372

)

24,556

(18,800

)

Adjusted EBITDA

$

154,342

$

117,762

$

107,885

(1)

For the three months ended June 30, 2024 there were $9.0 million

of severance expenses related to the CSI Acquisition. There were no

such expenses for the three months ended March 31, 2024 and June

30, 2023.

(2)

Represents certain costs associated with non-recurring

professional services, primarily related to the CSI Acquisition for

the three months ended June 30, 2024 and March 31, 2024.

(3)

Includes amortization of debt issuance costs, non-cash lease

expense, provision for credit losses and inventory reserve.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF ADJUSTED

GROSS MARGIN TO GROSS MARGIN FOR CONTRACT SERVICES

(in thousands, excluding

percentages; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Total revenues

$

276,250

$

193,399

$

181,619

Cost of sales (excluding depreciation and

amortization)

(99,333

)

(65,882

)

(65,017

)

Depreciation and amortization

(69,463

)

(46,944

)

(45,430

)

Gross margin

$

107,454

$

80,573

$

71,172

Gross margin percentage

38.9

%

41.7

%

39.2

%

Depreciation and amortization

69,463

46,944

45,430

Adjusted Gross Margin

$

176,917

$

127,517

$

116,602

Adjusted Gross Margin Percentage(1)

64.0

%

65.9

%

64.2

%

(1)

Calculated using Adjusted Gross Margin for Contract Services as

a percentage of total Contract Services revenues.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF ADJUSTED

GROSS MARGIN TO GROSS MARGIN FOR OTHER SERVICES

(in thousands, excluding

percentages; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Total revenues

$

33,403

$

22,093

$

21,687

Cost of sales (excluding depreciation and

amortization)

(27,936

)

(17,684

)

(18,099

)

Depreciation and amortization

—

—

—

Gross margin

$

5,467

$

4,409

$

3,588

Gross margin percentage

16.4

%

20.0

%

16.5

%

Depreciation and amortization

—

—

—

Adjusted Gross Margin

$

5,467

$

4,409

$

3,588

Adjusted Gross Margin Percentage(1)

16.4

%

20.0

%

16.5

%

(1)

Calculated using Adjusted Gross Margin for Other Services as a

percentage of total Other Services revenues.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET INCOME

TO DISCRETIONARY CASH FLOW AND FREE CASH FLOW

(in thousands; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net income

$

6,713

$

30,232

$

17,517

Depreciation and amortization

69,463

46,944

45,430

Change in fair value of derivatives

(52

)

(14,241

)

3,595

Deferred tax provision

843

6,261

3,282

Amortization of debt issuance costs

2,303

2,643

5,626

Equity compensation expense(1)

5,311

2,848

29

Severance expense(2)

8,969

—

—

Transaction expenses(3)

17,387

7,880

1,072

Gain on sale of property, plant and

equipment

(1,173

)

—

(738

)

Maintenance capital expenditures

(19,147

)

(10,642

)

(10,940

)

Discretionary Cash Flow

$

90,617

$

71,925

$

64,873

Growth capital expenditures(4)(5)(6)

(90,390

)

(59,401

)

(32,529

)

Proceeds from sale of property, plant and

equipment

411

—

1,023

Free Cash Flow

$

638

$

12,524

$

33,367

(1)

For the three months ended June

30, 2024, March 31, 2024, and June 30, 2023, there were $5.3

million, $2.8 million and $0.0 million, respectively, of non-cash

adjustments for equity compensation expense.

(2)

For the three months ended June

30, 2024 there were $9.0 million of severance expenses related to

the CSI Acquisition. There were no such expenses for the three

months ended March 31, 2024 and June 30, 2023.

(3)

Represents certain costs

associated with non-recurring professional services, primarily

related to the CSI Acquisition for the three months ended June 30,

2024, and other costs.

(4)

For the three months ended June

30, 2024, March 31, 2024, and June 30, 2023, growth capital

expenditures include a $12.6 million decrease, a $9.9 million

increase and a $2.0 million decrease in accrued capital

expenditures, respectively.

(5)

For the three months ended June

30, 2024, March 31, 2024 and June 30, 2023, there were $7.2

million, $5.8 million and $4.8 million of non-unit growth capital

expenditures, respectively.

(6)

For the three months ended June

30, 2024, March 31, 2024 and June 30, 2023, growth capital

expenditures include a non-cash increase in the sales tax accrual

on compression equipment purchases of $19.8 million, $0.3 million

and $0.3 million, respectively. These accrual amounts are estimated

based on the best known information as it relates to open audit

periods with the state of Texas.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO DISCRETIONARY CASH FLOW AND

FREE CASH FLOW

(in thousands; unaudited)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net cash provided by operating

activities

$

121,082

$

51,542

$

94,678

Maintenance capital expenditures

(19,147

)

(10,642

)

(10,940

)

Severance expense(1)

8,969

—

—

Transaction expenses(2)

17,387

7,880

1,072

Gain on sale of property, plant and

equipment

(1,173

)

—

(738

)

Change in operating assets and

liabilities

(32,372

)

24,556

(18,800

)

Other(3)

(4,129

)

(1,411

)

(399

)

Discretionary Cash Flow

$

90,617

$

71,925

$

64,873

Growth capital expenditures(4)(5)(6)

(90,390

)

(59,401

)

(32,529

)

Proceeds from sale of property, plant and

equipment

411

—

1,023

Free Cash Flow

$

638

$

12,524

$

33,367

(1)

For the three months ended June

30, 2024 there were $9.0 million of severance expenses related to

the CSI Acquisition. There were no such expenses for the three

months ended March 31, 2024, and June 30, 2023.

(2)

Represents certain costs

associated with non-recurring professional services, primarily

related to the CSI Acquisition for the three months ended June 30,

2024, and other costs.

(3)

Includes non-cash lease expense,

provision for credit losses and inventory reserve.

(4)

For the three months ended June

30, 2024, March 31, 2024, and June 30, 2023, growth capital

expenditures include a $12.6 million decrease, a $9.9 million

increase and a $2.0 million decrease in accrued capital

expenditures, respectively.

(5)

For the three months ended June

30, 2024, March 31, 2024 and June 30, 2023, there were $7.2

million, $5.8 million and $4.8 million of non-unit growth capital

expenditures, respectively.

(6)

For the three months ended June

30, 2024, March 31, 2024 and June 30, 2023, growth capital

expenditures include a non-cash increase in the sales tax accrual

on compression equipment purchases of $19.8 million, $0.3 million

and $0.3 million, respectively. These accrual amounts are estimated

based on the best known information as it relates to open audit

periods with the state of Texas.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812158226/en/

Investor Contact Graham Sones, VP – Investor Relations

ir@kodiakgas.com (936) 755-3529

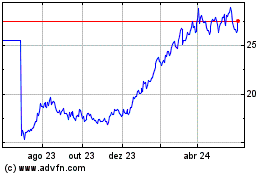

Kodiak Gas Services (NYSE:KGS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

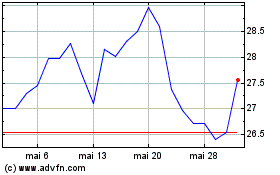

Kodiak Gas Services (NYSE:KGS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025