Helen of Troy Limited (NASDAQ: HELE), designer,

developer, and worldwide marketer of branded consumer home,

outdoor, beauty, and wellness products, today announced that its

Board of Directors has authorized the repurchase of $500 million of

its outstanding common shares (“common stock” or “shares”) in

keeping with its stated intention to opportunistically return to

shareholders capital not otherwise deployed for core business

growth or strategic acquisitions. The authorization was approved as

part of the Board’s regular process of reviewing the Company’s

capital allocation and existing authorization. It is effective

August 20, 2024, for a period of three years and replaces Helen of

Troy’s existing repurchase authorization, of which approximately

$245.3 million remained at the time the new authorization was

approved.

Helen of Troy may purchase shares on a discretionary basis from

time to time through open market purchases, issuer tender offers,

privately negotiated transactions, and accelerated share repurchase

programs, or other means, including through Rule 10b5-1 trading

plans. The timing and amount of any transactions will be subject to

the discretion of Helen of Troy and may be based upon market

conditions as well as other opportunities that Helen of Troy may

have for the use or investment of its capital. The repurchase

program does not require the purchase of any minimum number of

shares and may be implemented, modified, suspended or discontinued

in whole or in part at any time without further notice.

In total, the $500 million share repurchase authorization

represents approximately 43% of the Company’s outstanding common

stock, based upon the Company’s closing price on August 20, 2024.

As of August 20, 2024, Helen of Troy had approximately 22.8 million

shares outstanding.

Noel M. Geoffroy, Chief Executive Officer, stated: “This share

repurchase authorization underscores the confidence our management

team and our Board have in our strategic initiatives, the strength

of our brands, and the long-term growth opportunities we have ahead

of us. Our business continues to generate significant cash flow and

we remain committed to our planned growth investments, to reducing

our net leverage ratio by the end of the fiscal year, and to the

disciplined deployment of capital to deliver long-term, sustainable

value creation for our shareholders.”

About Helen of Troy

Limited

Helen of Troy Limited (NASDAQ: HELE) is a leading global

consumer products company offering creative products and solutions

for its customers through a diversified portfolio of

well-recognized and widely-trusted brands, including OXO, Hydro

Flask, Osprey, Vicks, Braun, Honeywell, PUR, Hot Tools, Drybar,

Curlsmith and Revlon. All trademarks herein belong to Helen of Troy

Limited (or its subsidiaries) and/or are used under license from

their respective licensors.

For more information about Helen of Troy, please visit

https://investor.helenoftroy.com

Forward-Looking Statements

Certain written and oral statements made by the Company and

subsidiaries of the Company may constitute “forward-looking

statements” as defined under the Private Securities Litigation

Reform Act of 1995. This includes statements made in this press

release, in other filings with the SEC, and in certain other oral

and written presentations. Generally, the words “anticipates”,

“assumes”, “believes”, “expects”, “plans”, “may”, “will”, “might”,

“would”, “should”, “seeks”, “estimates”, “project”, “predict”,

“potential”, “currently”, “continue”, “intends”, “outlook”,

“forecasts”, “targets”, “reflects”, “could”, and other similar

words identify forward-looking statements. All statements that

address operating results, events or developments that the Company

expects or anticipates may occur in the future, including

statements related to sales, expenses, EPS results, and statements

expressing general expectations about future operating results, are

forward-looking statements and are based upon its current

expectations and various assumptions. The Company believes there is

a reasonable basis for these expectations and assumptions, but

there can be no assurance that the Company will realize these

expectations or that these assumptions will prove correct.

Forward-looking statements are only as of the date they are made

and are subject to risks that could cause them to differ materially

from actual results. Accordingly, the Company cautions readers not

to place undue reliance on forward-looking statements. The

forward-looking statements contained in this press release should

be read in conjunction with, and are subject to and qualified by,

the risks described in the Company's Form 10-K for the year ended

February 29, 2024, and in the Company's other filings with the SEC.

Investors are urged to refer to the risk factors referred to above

for a description of these risks. Such risks include, among others,

the geographic concentration of certain United States (“U.S.”)

distribution facilities which increases its risk to disruptions

that could affect the Company's ability to deliver products in a

timely manner, the occurrence of cyber incidents or failure by the

Company or its third-party service providers to maintain

cybersecurity and the integrity of confidential internal or

customer data, a cybersecurity breach, obsolescence or

interruptions in the operation of the Company's central global

Enterprise Resource Planning systems and other peripheral

information systems, the Company's ability to develop and introduce

a continuing stream of innovative new products to meet changing

consumer preferences, actions taken by large customers that may

adversely affect the Company's gross profit and operating results,

the Company's dependence on sales to several large customers and

the risks associated with any loss of, or substantial decline in,

sales to top customers, the Company's dependence on third-party

manufacturers, most of which are located in Asia, and any inability

to obtain products from such manufacturers, the Company's ability

to deliver products to its customers in a timely manner and

according to their fulfillment standards, the risks associated with

trade barriers, exchange controls, expropriations, and other risks

associated with domestic and foreign operations including

uncertainty and business interruptions resulting from political

changes and events in the U.S. and abroad, and volatility in the

global credit and financial markets and economy, the Company's

dependence on the strength of retail economies and vulnerabilities

to any prolonged economic downturn, including a downturn from the

effects of macroeconomic conditions, any public health crises or

similar conditions, risks associated with weather conditions, the

duration and severity of the cold and flu season and other related

factors, the Company's reliance on its Chief Executive Officer and

a limited number of other key senior officers to operate its

business, risks associated with the use of licensed trademarks from

or to third parties, the Company's ability to execute and realize

expected synergies from strategic business initiatives such as

acquisitions, divestitures and global restructuring plans,

including Project Pegasus, the risks of potential changes in laws

and regulations, including environmental, employment and health and

safety and tax laws, and the costs and complexities of compliance

with such laws, the risks associated with increased focus and

expectations on climate change and other environmental, social and

governance matters, the risks associated with significant changes

in or the Company's compliance with regulations, interpretations or

product certification requirements, the risks associated with

global legal developments regarding privacy and data security that

could result in changes to its business practices, penalties,

increased cost of operations, or otherwise harm the business, the

risks of significant tariffs or other restrictions being placed on

imports from China, Mexico or Vietnam or any retaliatory trade

measures taken by China, Mexico or Vietnam, the Company's

dependence on whether it is classified as a “controlled foreign

corporation” for U.S. federal income tax purposes which impacts the

tax treatment of its non-U.S. income, the risks associated with

legislation enacted in Bermuda and Barbados in response to the

European Union's review of harmful tax competition, the risks

associated with accounting for tax positions and the resolution of

tax disputes, the risks associated with product recalls, product

liability and other claims against the Company, and associated

financial risks including but not limited to, increased costs of

raw materials, energy and transportation, significant impairment of

the Company's goodwill, indefinite-lived and definite-lived

intangible assets or other long-lived assets, risks associated with

foreign currency exchange rate fluctuations, the risks to the

Company's liquidity or cost of capital which may be materially

adversely affected by constraints or changes in the capital and

credit markets, interest rates and limitations under its financing

arrangements, and projections of product demand, sales and net

income, which are highly subjective in nature, and from which

future sales and net income could vary by a material amount. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements as a result of new information, future

events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905464118/en/

Investors: Helen of Troy Limited Anne Rakunas, Director,

External Communications (915) 225-4841 ICR, Inc. Allison Malkin,

Partner (203) 682-8200

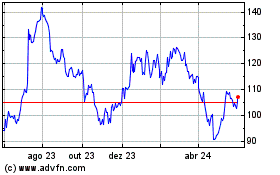

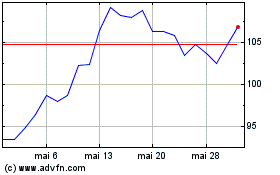

Helen of Troy (NASDAQ:HELE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Helen of Troy (NASDAQ:HELE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025