AM Best Affirms Credit Ratings of Assurant, Inc.; Its Property/Casualty Subsidiaries; and Life/Health Subsidiaries

06 Setembro 2024 - 11:27AM

Business Wire

AM Best has affirmed the Financial Strength Rating (FSR)

of A+ (Superior) and the Long-Term Issuer Credit Ratings (Long Term

ICR) of “aa-” (Superior) of the U.S. property/casualty (P/C)

subsidiaries of Assurant, Inc. (Assurant) (headquartered in

Atlanta, GA) [NYSE: AIZ]. These companies are collectively referred

to as Assurant P&C Group (Assurant P&C). At the same time,

AM Best has affirmed the Long-Term ICR of “a-” (Excellent) all

associated Long-Term Issue Credit Ratings (Long-Term IR),

indicative Long-Term IRs and the Short-Term IR of Assurant.

Concurrently, AM Best has affirmed the FSR of A (Excellent) and the

Long-Term ICRs of “a” (Excellent) of Assurant’s credit and

life/health (L/H) subsidiaries: American Bankers Life Assurance

Company of Florida (Miami, FL) and Caribbean American Life

Assurance Company (San Juan, PR) collectedly known as Assurant

Lifestyle L&H. The outlook on all these Credit Ratings

(ratings) is stable. (See below for a detailed list of the

companies and Long- and Short-Term IRs.)

The ratings of Assurant P&C reflect its balance sheet

strength, which AM Best assesses as very strong, as well as its

strong operating performance, favorable business profile and

appropriate enterprise risk management (ERM).

Assurant P&C’s very strong balance sheet strength is

supported by risk-adjusted capitalization at the strongest level,

as measured by Best’s Capital Adequacy Ratio (BCAR), and its very

strong earnings power with relatively low volatility (a significant

portion of which is derived from its low-risk businesses,

particularly its business in the global lifestyle segment). The

group’s favorable balance sheet position is further bolstered by

its positive cash flows and stable reserves. This is partially

offset by Assurant’s property catastrophe exposure, which stems

mostly from its lender placed homeowners’ business in global

housing, and its heavy reliance on high-quality third-party

reinsurance that is effective in mitigating this risk to a level

more commensurate with the group’s overall risk appetite.

Assurant’s operating performance is a byproduct of its highly

specialized niche businesses, earnings diversification and

management’s strategy to partner with market leaders in both its

global lifestyle and global housing segments. Both segments are

steady contributors to Assurant’s profits. As a result, Assurant

P&C consistently outperforms its peers and generates superior

returns on capital.

The ratings of Assurant Lifestyle L&H reflect its balance

sheet strength, which AM Best assesses as very strong, as well as

its strong operating performance, limited business profile and

appropriate ERM. Assurant Lifestyle also receives one level of

rating enhancement from its affiliate, Assurant P&C, as it is

considered important to the Assurant brand as a licensed credit

life and credit accident & health insurer. The credit insurance

business adds to overall product diversity for Assurant; however,

Assurant Lifestyle L&H primarily offers credit insurance

products to credit card related debt. The regulatory environment

remains favorable for the products offered by the group. AM Best

notes that Assurant remains a recognizable name in these

markets.

The FSR of A+ (Superior) and the Long-Term ICRs of “aa-”

(Superior) have been affirmed with stable outlooks for the

following P/C subsidiaries of Assurant, Inc.:

- American Bankers Insurance Company of Florida

- American Security Insurance Company

- Standard Guaranty Insurance Company

- Caribbean American Property Insurance Company

- Voyager Indemnity Insurance Company

- Virginia Surety Company, Inc.

- Reliable Lloyds Insurance Company

The following Short-Term IR has been affirmed:

Assurant, Inc.— -- to AMB-1+ (Strongest) on commercial paper

The following Long-Term IRs have been affirmed, with stable

outlooks:

Assurant, Inc.— -- “a-” (Excellent) on USD 300 million 4.90%

senior unsecured bonds, due 2028 -- “a-” (Excellent) on USD 350

million 3.70% senior unsecured bonds, due 2030 -- “a-” (Excellent)

on USD 475 million 6.75% senior unsecured bonds, due 2034 (USD 275

million outstanding) -- “bbb+” (Good) on USD 400 million 7.00%

subordinated bonds, due 2048 -- “bbb+” (Good) on USD 250 million

5.25% subordinated bonds, due 2061

The following indicative Long-Term IRs on securities available

under the shelf registration have been affirmed with stable

outlooks:

Assurant, Inc.— -- “a-” (Excellent) on senior unsecured --

“bbb+” (Good) on subordinated debt -- “bbb” (Good) on preferred

stock

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240906776478/en/

Jieqiu Fan Associate Director +1 908 882

1762 jieqiu.fan@ambest.com Daniel J. Ryan Senior

Director +1 908 882 2290 daniel.ryan@ambest.com

Michael Sweeney Financial Analyst +1 908 882

2384 michael.sweeney@ambest.com Christopher Sharkey

Associate Director, Public Relations +1 908 882 2310

christopher.sharkey@ambest.com Al Slavin Senior Public

Relations Specialist +1 908 882 2318

al.slavin@ambest.com

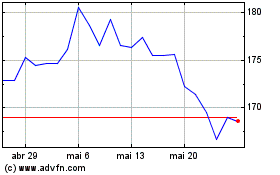

Assurant (NYSE:AIZ)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Assurant (NYSE:AIZ)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025