3iQ and CoinDesk Indices Collaborate to Launch Funds Globally That Track the CoinDesk 20 Index

16 Setembro 2024 - 9:02AM

Business Wire

3iQ Corp. (“3iQ”), a pioneer in digital asset management, today

announced it has partnered with CoinDesk Indices, a leading

provider of digital asset indices since 2014, to make the CoinDesk

20 Index available in several fund structures globally, starting

with CoinDesk 20 SP (the “Fund”), a Segregated Portfolio Company of

3iQ Investment Partners SPC.

This partnership marks a milestone in 3iQ’s mission to bring

clients innovative investment products and provide global investors

desired access to a diversified digital asset portfolio as they

seek to expand their exposure beyond bitcoin.

The collaboration continues the relationship between two trusted

organizations with expertise in offering investor access and

choice. Designed for scalability, the CoinDesk 20 tracks the

performance of top digital assets, applying a capped market

capitalization-weighted methodology to improve diversification,

similar to major equity indexes. The Fund will follow all 20

constituents in the index.

"CoinDesk Indices provides a highly liquid and tradeable means

to access digital assets," said Pascal St-Jean, President & CEO

of 3iQ. "Advisors have an appetite for digital assets but don’t

have the conviction to track assets beyond Bitcoin. This offering

opens up broad-based exposure as they seek a diversified digital

asset portfolio.”

“The CoinDesk 20 has been embraced by leading market-making

firms, unlocking the digital asset opportunity in one step,” said

Alan Campbell, President of CoinDesk Indices. “We are thrilled 3iQ

will enable investors worldwide to access the CoinDesk 20,

addressing the growing need for diversified digital asset

exposure.”

3iQ will leverage its extensive experience by utilizing multiple

custodians and staking providers. The Fund will offer monthly

liquidity, and 3iQ will be waiving the management fee for the first

6 months.

For more information on 3iQ, and to be the first to know about

updates regarding the Fund’s launch, visit www.3iq.io/cd20.

To learn more about CoinDesk 20, visit

www.coindesk.com/indices/coindesk20.

About 3iQ Corp

Founded in 2012, 3iQ is one of the world’s leading digital asset

investment fund managers, offering investors convenient and

familiar investment products to gain exposure to digital assets.

3iQ Corp., 3iQ’s affiliated company, was the first Canadian

investment fund manager to offer public bitcoin investment funds:

The Bitcoin Fund (TSX: QBTC) (TSX: QBTC.U) and the 3iQ Bitcoin ETF

(TSX: BTCQ) (TSX: BTCQ.U), as well as public Ether investment

funds: The Ether Fund (TSX: QETH.UN) (TSX: QETH.U) and the 3iQ

Ether Staking ETF (TSX: ETHQ) (TSX: ETHQ.U). To learn more about

3iQ, visit 3iq.io.

About CoinDesk Indices

Since 2014, CoinDesk Indices has been at the forefront of the

digital asset revolution, empowering investors globally. A

portfolio company of the Bullish group, our indices form the

foundation of the world's largest digital asset products. Known for

their precision and compliance, flagships such as the CoinDesk

Bitcoin Price Index (XBX) and the CoinDesk 20 Index set the

industry standard for measuring, trading, and investing in digital

assets. With tens of billions of dollars in benchmarked assets,

CoinDesk Indices is a trusted partner. Discover more at

coindeskmarkets.com.

3iQ Disclaimer:

This press release is for informational and educational purposes

only and is only intended for investors who are located outside of

the United States and are not U.S. persons (as defined in

Regulation S under U.S. Securities Act of 1933, as amended). The

information contained herein is not and should not be considered to

be any of the following: investment advice or investment research;

a solicitation, offer, or recommendation to sell or buy any

specific asset, strategy, product, or program; or legal, tax, or

other advice. The purchase of cryptocurrency or an interest in a

pooled investment vehicle investing in cryptocurrency is

speculative and involves a high degree of risk and should be

undertaken only by individuals whose experience allows them to

evaluate the risks of such an investment, whose financial resources

are sufficient to enable them to bear the economic risks of their

purchase for an extended period of time, and who can afford a

significant or entire loss of the value of those assets. 3iQ has no

obligation to update, modify or amend this press release or to

otherwise notify a reader thereof in the event that any matter

stated herein changes or subsequently becomes inaccurate.

CoinDesk Indices Disclaimer:

CoinDesk is a portfolio company of the Bullish group. CoinDesk

Indices, Inc. ("CDI") does not sponsor, endorse, sell, promote or

manage any investment offered by any third party that seeks to

provide an investment return based on the performance of any index.

CDI is neither an investment adviser nor a commodity trading

advisor and makes no representation regarding the advisability of

making an investment linked to any CDI index. CDI does not act as a

fiduciary. A decision to invest in any asset linked to a CDI index

should not be made in reliance on any of the statements set forth

in this document or elsewhere by CDI. All content contained or used

in any CDI index (the "Content") is owned by CDI and/or its

third-party data providers and licensors, unless stated otherwise

by CDI. CDI does not guarantee the accuracy, completeness,

timeliness, adequacy, validity or availability of any of the

Content. CDI is not responsible for any errors or omissions,

regardless of the cause, in the results obtained from the use of

any of the Content. CDI does not assume any obligation to update

the Content following publication in any form or format. © 2024

CoinDesk Indices, Inc. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916079053/en/

For media inquiries: Greg Jawski, Allison Worldwide:

greg.jawski@allisonworldwide.com

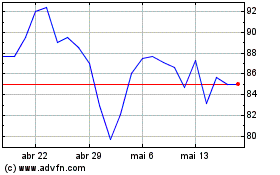

The Bitcoin (TSX:QBTC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

The Bitcoin (TSX:QBTC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025