Wells Fargo Expands API Capabilities for its Commercial Banking Business

17 Setembro 2024 - 10:30AM

Business Wire

Broad suite of new API solutions will provide faster and more

flexible inventory management, order processing, invoicing,

accounts payable, and supply chain management

Wells Fargo & Company (NYSE: WFC) today announced the launch

of specialized Application Programming Interfaces (APIs) tailored

for its Commercial Banking clients. This expansion of Wells Fargo’s

API portfolio provides immediate access to real-time data that may

help increase sales, improve liquidity, reduce credit risk, and

reduce expenses for floorplan and channel finance clients in the

following industries: auto, motorsports, outdoor products and

equipment, recreational vehicles, consumer electronics, appliances,

and technology.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240917438566/en/

Wells Fargo Expands API Capabilities for

its Commercial Banking Business - Broad suite of new API solutions

will provide faster and more flexible inventory management, order

processing, invoicing, accounts payable, and supply chain

management. (Graphic: Wells Fargo)

Wells Fargo’s API platform enables manufacturers, distributors,

and dealers to directly connect from their system of choice.

Updates will happen automatically and flow between trading partners

so there’s no delay in sending and receiving information, and no

need to manually enter, upload, download, or transmit important

files, allowing clients instant access to critical business

insights.

“Our new APIs provide clients real-time, on-demand information

so they can efficiently and seamlessly manage inventory, supply

chain, and payments,” said Daniel Pfeiffer, head of Wells Fargo

Global Receivables, Trade, and Inventory Finance. “By expanding our

API technology, we took a step forward in taking out the complexity

of navigating various systems allowing clients to embed the

functionality they need to manage their inventory and processes in

their system of choice,” he added.

The new APIs offer Wells Fargo Commercial Banking clients

several important benefits:

- Faster order processing means avoiding delays in

shipping inventory with the ability to check credit availability

and receive approvals with the click of a button within their own

system, which reduces time to invoice and expands the window to

address credit line increases or order payoffs, if needed.

- Accurate inventory planning provides instant visibility

into on-demand real-time inventory data, which allows more precise

forecasting, so clients have the right level and right kind of

inventory. Companies will have the data to control their supply

chain without waiting on batch run updates, human intervention, or

processing issues.

- Real-time invoicing means recognizing revenue faster

when invoices are processed instantaneously, eliminating delays due

to file failures, manual processing, outages, and human

intervention.

- Seamless technology integration from Wells Fargo’s APIs

provide connectivity to client systems so they can eliminate manual

data entry, and other workarounds when retrieving data, and

performing activities such as loading inventory, checking inventory

status and balances due, and paying off inventory, all within their

system of choice.

- Easier money management helps clients identify inventory

for payment, apply payments, and see when and how to apply wire

payments, or create payment plans. This streamlines the ability for

clients to manage their money, reducing manual steps and providing

instant daily transaction reconciliation.

“Wells Fargo has been a leader in the API development space by

focusing on solving real problems for our clients. Having the right

tools in place is critical as we see growing client expectations

around providing solutions that are easy to implement and use,”

said Reetika Grewal, Wells Fargo’s head of Digital for Commercial

Banking and Corporate & Investment Banking. “This expansion of

our portfolio will allow our clients to be even more connected to

the platforms they are using and ensure they have an end-to-end

view that can streamline their business operations and provide

information at a faster speed.”

What are APIs?

APIs, or Application Programming Interfaces, are software

applications that simplify and execute a set of rules or commands,

created by the owner, that link digital worlds together to create a

secure way to exchange data, features, and functionality. For

example, e-commerce transactions offer consumers a variety of ways

to pay for a purchase from your phone; those are APIs that are

talking to each other so that the money is transferred securely and

safely.

Wells Fargo is continuously looking for new ways to improve our

client experiences and has a history of delivering APIs that meet

evolving expectations. To illustrate, as demands for availability

and flexibility grow, Wells Fargo released an instant payments API

last year. This API provides clearing at any time to support

business 24/7 and simple access to payment statuses.

To view and explore Wells Fargo Commercial Banking API

opportunities,

https://developer.wellsfargo.com/products/overview/manufacturers-distributors-dealers

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial

services company that has approximately $1.9 trillion in assets. We

provide a diversified set of banking, investment and mortgage

products and services, as well as consumer and commercial finance,

through our four reportable operating segments: Consumer Banking

and Lending, Commercial Banking, Corporate and Investment Banking,

and Wealth & Investment Management. Wells Fargo ranked No. 34

on Fortune’s 2024 rankings of America’s largest corporations. In

the communities we serve, the company focuses its social impact on

building a sustainable, inclusive future for all by supporting

housing affordability, small business growth, financial health, and

a low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

LinkedIn: https://www.linkedin.com/company/wellsfargo/

Cautionary Statement about Forward-Looking Statements

This news release contains forward-looking statements about our

future financial performance and business. Because forward-looking

statements are based on our current expectations and assumptions

regarding the future, they are subject to inherent risks and

uncertainties. Do not unduly rely on forward-looking statements as

actual results could differ materially from expectations.

Forward-looking statements speak only as of the date made, and we

do not undertake to update them to reflect changes or events that

occur after that date. For information about factors that could

cause actual results to differ materially from our expectations,

refer to our reports filed with the Securities and Exchange

Commission, including the discussion under “Risk Factors” in our

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the Securities and Exchange Commission and available on

its website at www.sec.gov.

News Release Category: WF-PS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917438566/en/

Media Trisha Schultz, 424-268-6202

Trisha.Schultz@wellsfargo.com

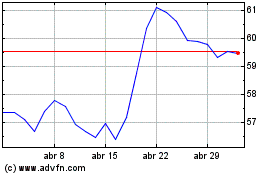

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

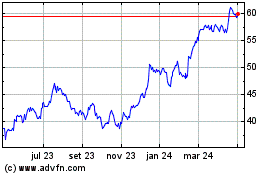

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024