Futures Pointing To Roughly Flat Open On Wall Street

11 Outubro 2024 - 10:05AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Friday, with stocks likely to show a lack of direction

after ending the previous session modestly lower.

The futures remained little changed after the Labor Department

released a report showing producer prices in the U.S. were

unexpectedly unchanged in September.

The Labor Department said its producer price index for final

demand came in flat in September after rising by 0.2 percent in

August. Economists had expected producer prices to inch up by 0.1

percent.

The report also said the annual rate of growth by producer

prices slowed to 1.8 percent in September from an upwardly revised

1.9 percent in August.

Economists had expected the annual rate of producer price growth

to dip to 1.6 percent from the 1.7 percent originally reported for

the previous month.

Traders are also digesting earnings news from big-name banks,

with shares of Wells Fargo (NYSE:WFC) moving sharply higher in

pre-market trading after the company reported better than expected

third quarter earnings.

JPMorgan Chase (NYSE:JPM) may also move to the upside after

reporting third quarter results that exceeded analyst estimates on

both the top and bottom lines.

After turning in a strong performance in Wednesday’s session,

stocks saw modest weakness during trading on Thursday. The major

averages all gave back ground, with the Dow and the S&P 500

pulling back off Wednesday’s record closing highs.

The major averages moved to the upside going into the close of

trading but remained in the red. The Dow slipped 57.88 points or

0.1 percent to 42,454.12, the Nasdaq edged down 9.57 points or 0.1

percent to 18,282.05 and the S&P 500 dipped 11.99 points or 0.2

percent to 5,780.05.

The modest weakness on Wall Street came following the release of

a highly anticipated Labor Department report showing consumer

prices in the U.S. increased by slightly more than expected in the

month of September.

The Labor Department said its consumer price index rose by 0.2

percent in September, matching the increase seen in August.

Economists had expected consumer prices to inch up by 0.1

percent.

The report also said core consumer prices, which exclude food

and energy prices, climbed by 0.3 percent for the second

consecutive month. Core prices were expected to rise by 0.2

percent.

Meanwhile, the Labor Department said the annual rate of consumer

price growth slowed to 2.4 percent in September from 2.5 percent in

August. Economists had expected the pace of price growth to slow to

2.3 percent.

The annual rate of core consumer price growth accelerated to 3.3

percent in September from 3.2 percent in August, while economists

had expected the pace of growth to remain unchanged.

The bigger than expected increase by consumer prices further

offset optimism the Federal Reserve will continue to aggressively

lower interest rates in the coming months.

CME Group’s FedWatch Tool is currently indicating an 84.0

percent chance the Fed will lower rates by 25 basis points next

month after slashing rates by 50 basis points last month.

Following the data, Atlanta Federal Reserve President Raphael

Bostic told the Wall Street Journal he was “definitely open” to

leaving interest rates unchanged in November.

Negative sentiment was also generated in reaction to a separate

Labor Department report showing first-time claims for U.S.

unemployment benefits increased by much more than expected in the

week ended October 5th.

The report said initial jobless claims climbed to 258,000, an

increase of 33,000 from the previous week’s unrevised level of

225,000. Economists had expected jobless claims to edge up to

230,000.

With the much bigger than expected increase, jobless claims

reached their highest level since hitting a matching figure in the

week ended August 5th, 2023.

Housing stocks saw considerable weakness on the day, resulting

in a 1.2 percent decrease by the Philadelphia Housing Sector

Index.

Notable weakness was also visible among telecom stocks, as

reflected by the 1.1 percent loss posted by the NYSE Arca North

American Telecom Index.

Networking, commercial real estate and computer hardware stocks

also saw some weakness, while gold stocks moved sharply higher amid

an increase by the price of the precious metal.

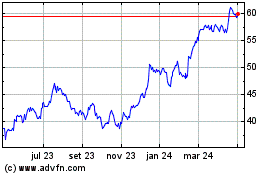

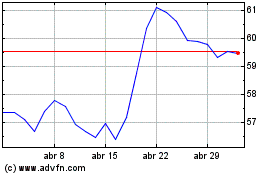

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024