Smartsheet Shareholders to Receive $56.50 Per

Share in Cash

Purchase Price Represents a 41% Premium to the

90-Day VWAP of the Unaffected Share Price

Smartsheet (NYSE:SMAR) (“Smartsheet” or the “Company”), the

enterprise platform for modern work management, today announced

that it has entered into a definitive agreement to be acquired by

funds managed by Blackstone and Vista Equity Partners (the

“Buyers”) in an all-cash transaction valued at approximately $8.4

billion.

Under the terms of the agreement, the Buyers would acquire all

the outstanding shares held by Smartsheet shareholders for $56.50

per share in cash upon the closing of the proposed transaction.

This price represents a premium of approximately 41% to the volume

weighted average closing price of Smartsheet stock for the 90

trading days ending on July 17, 2024, the last full trading day

prior to media reports regarding a possible sale transaction

involving the Company, and a 16% premium to the highest closing

stock price over the last 12 months ending July 17, 2024.

“For more than a decade, we have built a thriving community of

employees, partners, and customers, each focused on building and

benefiting from Smartsheet’s industry-leading work management

platform. Our next phase of growth and customer success is

underway, and we look forward to partnering with Blackstone and

Vista Equity Partners to accelerate our vision of modernizing work

management for enterprises, globally,” said Mark Mader, CEO of

Smartsheet. “This transaction is a testament to our employees’

outstanding work in serving customers and partners, and building an

enterprise-grade, market-leading platform. As we look to the

future, we are confident that Blackstone and Vista’s expertise and

resources will help us ensure Smartsheet remains a great place to

work where our employees thrive, while driving innovation and

delivering even greater value for customers and stakeholders.”

Martin Brand, Head of North America Private Equity and Global

Co-Head of Technology Investing at Blackstone, and Sachin Bavishi,

a Senior Managing Director at Blackstone, said, “Across

increasingly distributed, cross-functional and global workforces,

Smartsheet’s innovative and market-leading solutions are

mission-critical in helping teams collaborate at scale to achieve

superior results. We are excited to partner with Smartsheet’s

management team to drive long-term growth by leveraging our and our

partner Vista’s combined scale and resources to accelerate

investments in the next generation of work management solutions.”

Blackstone will invest in Smartsheet through its flagship private

equity vehicle and its private equity strategy for individual

investors.

“Modern enterprises rely on Smartsheet’s simple and scalable

solutions to manage a diverse range of business-critical processes

every single day because they enable seamless collaboration,

enhanced productivity and faster and more informed

decision-making,” said Monti Saroya, Co-Head of Vista’s Flagship

Fund and Senior Managing Director, and John Stalder, Managing

Director at Vista. “We look forward to partnering closely with

Blackstone and Smartsheet to support its ambitious goal of making

its platform accessible for every organization, team and worker

relying on collaborative work to achieve successful outcomes.”

Vista is a leading global investment firm focused exclusively on

enterprise software, data and technology-enabled businesses.

Additional Transaction Terms

The merger agreement for the transaction includes a 45-day

“go-shop” period that expires on November 8, 2024. During this

period, Smartsheet and its advisors will be permitted to actively

solicit alternative acquisition proposals from certain third

parties, and potentially enter into negotiations with other parties

that make alternative acquisition proposals. The Smartsheet Board

of Directors will have the right to terminate the merger agreement

to accept a superior proposal, subject to the terms and conditions

of the merger agreement. There can be no assurance that this

“go-shop” process will or will not result in a superior proposal,

and Smartsheet does not intend to disclose related developments

unless and until it determines that such disclosure is appropriate

or otherwise required.

The transaction is currently expected to close in the fourth

quarter of Smartsheet’s fiscal year ending January 31, 2025,

subject to the approval of Smartsheet’s shareholders, the

satisfaction of required regulatory clearances and other customary

closing conditions. The Smartsheet Board of Directors unanimously

approved the merger agreement and recommends Smartsheet

shareholders vote their shares in support of the transaction at a

special meeting of shareholders to vote on the transaction.

Upon completion of the transaction, Smartsheet’s Class A common

stock will no longer be listed on any public market and Smartsheet

will become a privately held company. The Company will continue to

operate under the Smartsheet name and brand.

Advisors

Qatalyst Partners is acting as exclusive financial advisor to

Smartsheet. Fenwick & West LLP is acting as legal counsel to

Smartsheet.

Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC are

acting as financial advisors and Kirkland & Ellis LLP and

Simpson Thacher & Bartlett LLP are acting as legal counsel to

Blackstone and Vista Equity Partners.

About Smartsheet

Smartsheet is the modern enterprise work management platform

trusted by millions of people at companies across the globe,

including approximately 85% of the 2024 Fortune 500 companies. As a

pioneer and market leader in this category, Smartsheet delivers

powerful solutions fueling performance and driving the next wave of

innovation. Visit www.smartsheet.com to learn more.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We

seek to deliver compelling returns for institutional and individual

investors by strengthening the companies in which we invest. Our

more than US$1 trillion in assets under management include global

investment strategies focused on real estate, private equity,

infrastructure, life sciences, growth equity, credit, real assets,

secondaries and hedge funds. Further information is available at

www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter),

and Instagram.

About Vista Equity Partners

Vista is a leading global investment firm with more than $100

billion in assets under management as of March 31, 2024. The firm

exclusively invests in enterprise software, data and

technology-enabled organizations across private equity, permanent

capital, credit and public equity strategies, bringing an approach

that prioritizes creating enduring market value for the benefit of

its global ecosystem of investors, companies, customers and

employees. Vista’s investments are anchored by a sizable long-term

capital base, experience in structuring technology-oriented

transactions and proven, flexible management techniques that drive

sustainable growth. Vista believes the transformative power of

technology is the key to an even better future – a healthier

planet, a smarter economy, a diverse and inclusive community and a

broader path to prosperity. Further information is available at

vistaequitypartners.com. Follow Vista on LinkedIn, @Vista Equity

Partners, and on X, @Vista_Equity.

Cautionary Statement Regarding Forward-Looking

Statements

This communication may contain forward-looking statements made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, among other

things, statements regarding the ability of the parties to complete

the proposed transaction and the expected timing of completion of

the proposed transaction; the prospective performance and outlook

of Smartsheet’s business, performance and opportunities;

Smartsheet’s ability to achieve future financial performance

results; as well as any assumptions underlying any of the

foregoing. When used in this communication, or any other documents,

words such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “forecast,” “goal,” “objective,”

“plan,” “project,” “seek,” “strategy,” “target,” and similar

expressions should be considered forward-looking statements made in

good faith by Smartsheet, as applicable, and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the beliefs and assumptions

of management at the time that these statements were prepared and

are subject to risks, uncertainties, and assumptions that could

cause Smartsheet’s actual results to differ materially from those

expressed or implied in the forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. These risks include, but are not

limited to, risks and uncertainties related to: (i) the ability to

obtain the requisite approval from shareholders of Smartsheet; (ii)

the risk that the proposed transaction may not be completed in a

timely manner or at all; (iii) the possibility that competing

offers or acquisition proposals for Smartsheet will be made; (iv)

the possibility that any or all of the various conditions to the

consummation of the proposed transaction may not be satisfied or

waived, including the failure to receive any required regulatory

approvals from any applicable governmental entities; (v) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the merger agreement, including in

circumstances that would require Smartsheet to pay a termination

fee or other expenses; (vi) the effect of the pendency of the

proposed transaction on Smartsheet’s ability to retain and hire key

personnel, its ability to maintain relationships with its

customers, suppliers and others with whom it does business, its

business generally or its stock price; (vii) risks related to

diverting management’s attention from Smartsheet’s ongoing business

operations or the loss of one or more members of the management

team; (viii) the risk that shareholder litigation in connection

with the proposed transaction may result in significant costs of

defense, indemnification and liability; (ix) Smartsheet’s ability

to achieve future growth and sustain its growth rate; (x)

Smartsheet’s ability to attract and retain talent; (xi)

Smartsheet’s ability to attract and retain customers (including

government customers) and increase sales to its customers; (xii)

Smartsheet’s ability to develop and release new products and

services and to scale its platform; (xiii) Smartsheet’s ability to

increase adoption of its platform through its self-service model;

(xiv) Smartsheet’s ability to maintain and grow its relationships

with channel and strategic partners; (xv) the highly competitive

and rapidly evolving market in which it participates; (xvi)

Smartsheet’s ability to identify targets for, execute on, or

realize the benefits of, potential acquisitions; and (xvii) its

international expansion strategies. Further information on risks

that could affect Smartsheet’s results is included in its filings

with the SEC, including its most recent Quarterly Report on Form

10-Q and its Annual Report on Form 10-K for the fiscal year ended

January 31, 2024, and any current reports on Form 8-K that it may

file from time to time. Should any of these risks or uncertainties

materialize, actual results could differ materially from

expectations. Except as required by applicable law, Smartsheet

assumes no obligation to, and does not currently intend to, update

or supplement any such forward-looking statements to reflect actual

results, new information, future events, changes in its

expectations or other circumstances that exist after the date of

this communication.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed transaction involving Smartsheet Inc.

(“Smartsheet”) and affiliates of the Buyers. In connection with the

proposed transaction, Smartsheet intends to file with the

Securities and Exchange Commission (the “SEC”) and furnish to

shareholders a proxy statement seeking Smartsheet shareholder

approval of the proposed transaction. This communication is not a

substitute for the proxy statement or any other document that

Smartsheet may file with the SEC or send to its shareholders in

connection with the proposed transaction. INVESTORS AND

SHAREHOLDERS OF SMARTSHEET ARE URGED TO READ THE PROXY STATEMENT

AND OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BEFORE

MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SMARTSHEET

AND THE PROPOSED TRANSACTION. The materials to be filed by

Smartsheet will be made available to Smartsheet’s investors and

shareholders at no expense to them and copies may be obtained free

of charge on Smartsheet’s website at

https://investors.smartsheet.com/. In addition, all of those

materials will be available at no charge on the SEC’s website at

www.sec.gov. Any vote in respect of resolutions to be proposed at

Smartsheet’s shareholder meeting to approve the proposed

transaction or other responses in relation to the proposed

transaction should be made only on the basis of the information

contained in the proxy statement.

Participants in Solicitation

Smartsheet and its directors, executive officers, other members

of its management and employees may be deemed to be participants in

the solicitation of proxies of Smartsheet shareholders in

connection with the proposed transaction under SEC rules.

Information about the Company’s directors and executive officers is

set forth under the captions “Proposal 1–Election of Directors,”

“Non-Employee Director Compensation,” “Executive Officers,”

“Security Ownership of Certain Beneficial Owners, Directors, and

Management,” “Executive Compensation,” “Pay Versus Performance” and

“Equity Compensation Plan Information,” sections of the definitive

proxy statement for the Company’s 2024 annual meeting of

shareholders, filed with the SEC on May 1, 2024, and in the

Company’s Current Reports on Form 8-K filed with the SEC on March

14, 2024 and March 22, 2024. Additional information regarding

ownership of Smartsheet’s securities by its directors and executive

officers is included in such persons’ SEC filings on Forms 3 and 4.

These documents may be obtained free of charge at the SEC’s web

site at www.sec.gov and on Smartsheet’s website at

https://investors.smartsheet.com/.

Information concerning the interests of Smartsheet’s

participants in the solicitation, which may, in some cases, be

different than those of the Smartsheet’s shareholders generally,

will be set forth in the proxy statement relating to the proposed

transaction when it becomes available.

No Offer or Solicitation

This communication is for information purposes only and is not

intended to and does not constitute, or form part of, an offer,

invitation or the solicitation of an offer or invitation to

purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities, or the solicitation of any vote or

approval in any jurisdiction, pursuant to the proposed transaction

or otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240924199901/en/

For Smartsheet

Investor Relations Contact Aaron Turner

investorrelations@smartsheet.com

Media Contact Jennifer Henderson pr@smartsheet.com

OR

FGS Global Smartsheet@FGSGlobal.com

For Blackstone

Matt Anderson (518) 248-7310 Matthew.Anderson@blackstone.com

Mariel Seidman-Gati (646) 482-3712

Mariel.SeidmanGati@blackstone.com

For Vista Equity Partners

Brian Steel (212) 804-9170 media@vistaequitypartners.com

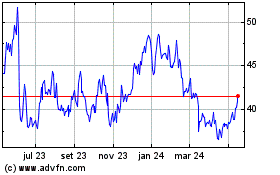

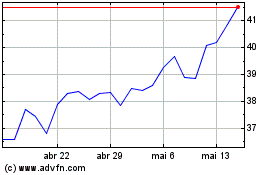

Smartsheet (NYSE:SMAR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Smartsheet (NYSE:SMAR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025