- One time cash payment of USD 50 million in the form of bonds

issuance from OrbiMed

- In return OrbiMed to obtain the royalties received by Poxel

from sales by Sumitomo Pharma of TWYMEEG® in Japan for a total

amount of USD 100 million

- Rights to royalty payments returned to Poxel once OrbiMed

receives an aggregate payment of USD 100 million

- Proceeds from the OrbiMed’s bonds issuance will be used to

(i) reduce the Company's debt towards IPF Partners and the PGE

banks, after amendment of the loan agreements, to a total remaining

amount of EUR 15,3 million and (ii) to support its strategic plan

in rare diseases, while pursuing partnership discussions for its

products

- Return of Imeglimin rights for countries covered by the

agreement with Sumitomo Pharma other than Japan1, as Sumitomo

Pharma intends to focus its efforts on TWYMEEG® commercialization

in its domestic market, Japan

- Ongoing partnering discussions to develop and market

Imeglimin in China, the world's second-largest type 2 diabetes

market

- Cash runway extension until end of 2025 including the full

residual drawdown of the equity-linked financing facility put in

place with IRIS

The management team will host webinars today, on September 30,

2024, at:

- 1:00 pm CEST, Paris time (7:00 am ET) in French

and

- 8:45 am ET, New York time (2:45 pm CEST) in

English.

A presentation will be available on Poxel's website in the

Investor section.

To register for the webinar in French:

https://app.livestorm.co/newcap-1/poxel-presentation-de-laccord-de-monetisation-des-redevances-issues-des-ventes-de-twymeeg-r-conclu-avec-orbimed?type=detailed

To register for the webinar in English:

https://app.livestorm.co/newcap-1/poxel-presentation-of-the-royalty-monetization-agreement-based-on-twymeeg-r-sales-with-orbimed?type=detailed

Regulatory News:

POXEL SA (Euronext : POXEL - FR0012432516), a clinical stage

biopharmaceutical company developing innovative treatments for

chronic serious diseases with metabolic pathophysiology, including

non-alcoholic steatohepatitis (NASH) and rare metabolic disorders,

today announces that it entered into a non-dilutive financing

agreement with OrbiMed for USD 50 million to monetize a portion of

Poxel's future royalties and sales-based payments from TWYMEEG®

sales by Sumitomo Pharma in Japan. Poxel intends to use the

proceeds of the transaction to pursue its activities in the field

of rare diseases, reduce the Company's debt towards IPF Partners

and the PGE banks, and finance general corporate purposes. TWYMEEG®

is Poxel’s first-in-class product marketed for the treatment of

type 2 diabetes in Japan.

“This transaction with OrbiMed, a leading healthcare investment

firm, reflects the significant value of TWYMEEG® in Japan, based on

our strategic partnership with Sumitomo Pharma. We are pleased that

this transaction strengthens our balance sheet and provides

non-dilutive financing to continue our strategic plan in rare

diseases and reduce the Company's debt towards IPF Partners and the

PGE banks. We aim to finalize our ongoing advanced discussions with

several potential partners for each of our products, before

finalizing our investment decisions and executing our development

plans for PXL770 and PXL065,” stated Thomas Kuhn, Chief

Executive Officer of Poxel.

“We are delighted to partner with Poxel to provide a

non-dilutive source of financing that aligns with our mission to

accelerate innovation in the biopharmaceutical industry,” added

Matthew Rizzo, General Partner of OrbiMed.

Royalty monetization agreement based on

TWYMEEG® sales with OrbiMed

Under the terms of the agreement, Poxel received a gross upfront

payment of USD 50 million from the OrbiMed funds in exchange for an

issuance of its bonds in the same aggregate amount. From such

proceeds, a deposit of USD 7.5 million has been made by the Company

into a deposit account, from which USD 1.25 million will be

withdrawn quarterly and paid in partial repayment of the bonds

issued to OrbiMed, until net sales of TWYMEEG® reach JPY 5 billion

(USD 31.5 million2), at which point OrbiMed will begin to receive

sales-based payments and royalties (anticipated in early 2025,

based on the expected achievement of this sales threshold by the

end of 20243). The residual amount of the deposit will then be

available to the Company, in addition to the USD 42.5 million

deposit received upon signature of the agreement.

For the bonds issued by Poxel, the OrbiMed funds will receive

(i) royalties payable by Sumitomo Pharma on net sales of TWYMEEG®

in Japan, net of Poxel's obligation to Merck, (ii) sales-based

payments due by Sumitomo Pharma in connection with the

commercialization of TWYMEEG® in Japan, and (iii) a portion of the

cash flows received by the Company, in the event of partnership for

the development and commercialization of Imeglimin in Asian

countries other than Japan1, and for which Poxel just recovered the

rights from Sumitomo Pharma4,5. The Company has initiated

discussions to develop and market Imeglimin in China, the world's

second largest type 2 diabetes market.

The agreement will expire, and the bonds be deemed repaid once

OrbiMed receives a capped return equivalent to 2 times its

investment, i.e. USD 100 million, plus specified expenses, if any.

Upon such repayment, Poxel will regain full rights to TWYMEEG®

royalties in Japan and to any sales-based commercial payments and

will use the majority of these proceeds to repay the outstanding

amount owed to IPF Partners.

Besides usual recourses in case of breaches of representations,

warranties and covenants, the financing provided by OrbiMed is

non-recourse to Poxel, except for additional quarterly payments of

USD 1,25 million and up to a total of USD 5 million to the extent

that the deposit account is exhausted and the JPY 5 billion

TWYMEEG® net sales level is not reached.

Part of the bonds issuance amount from this transaction was used

to reduce the Company's debt towards IPF Partners and the PGE

banks:

(i)

EUR 23.7 million for partial

repayment of IPF debt, reducing it to EUR 12.3 million; and

(ii)

EUR 2.8 million for partial

repayment of the debt to the banks that granted the PGE Loan,

reducing it to EUR 3 million.

Consequently, the Company amended its agreements respectively

with IPF Partners and the banks that granted a PGE loan for the

repayment of the outstanding principal of each of these debts.

Amendment to the bond loan contracted

with IPF Partners

The revised financing arrangement with

IPF Partners is as follows:

- From the proceeds of the OrbiMed transaction, Poxel will repay

IPF Partners EUR 23.7 million, broken down as follows:

- Full reimbursement of Tranche A bonds for an amount of EUR 6.4

million

- Full reimbursement of Tranche B bonds for an amount of EUR 10.4

million

- Partial reimbursement of Tranche C bonds for an amount of EUR

4.7 million

- Early repayment fees of EUR 2.2 million

- Remaining debt owed on Tranche C, of EUR 12.3 million

- The Company and IPF Partners agreed to restructure the

repayment terms of the remaining debt, the main features of which

are as follows:

- Cash interest rate decreased to 0% (from 6.5% previously)

- Capitalized interest rate (PIK Interests) increased to 27%

(from 11% previously), which may be reduced to 25% in the event of

partnerships for the development and commercialization of, inter

alia, Imeglimin in the rest of the world

- Existing exit commissions of EUR 4.1 million maintained

- Reimbursement of the remaining debt and exit fees mainly paid

as follows:

- 100% of the residual amount from the USD 7.5 million deposit as

part of the transaction with OrbiMed

- 75% of TWYMEEG® royalties in Japan, following the OrbiMed funds

receipt of its full return

- The terms & conditions also plan for additional sources of

debt repayment:

- 75% of cash flows received by the Company, in the event of a

partnership for the development and commercialization of Imeglimin

in the rest of the world, pro rata to receivables held by IPF

Partners and by the PGE lenders

- 50% of drawdowns under the structured finance facility with

IRIS

- Financial covenants removed, with the exception of the

requirement to maintain, at any time, a cash position in excess of

EUR 500,000,

- Release of all the security package previously granted to IPF

Partners in respect of the initial bond loan, and

- Waiver, by IPF Partners, of any recourse against Poxel from an

additional partial repayment of EUR 2.7 million (expected beginning

of 2025 through the repayment of the remaining amount from the

OrbiMed deposit account after reaching the TWYMEEG® net sales JPY 5

billion level)

The terms and conditions of the existing warrants held by IPF

Partners, which were attached to the Tranches A, B and C bonds,

entitling their holders to subscribe for 630,804 shares at

respectively EUR 7.37, EUR 7.14 and EUR 6.72 per warrant for each

tranche, remain unchanged and therefore do not entail any potential

additional dilution.

The agreement with IPF Partners also introduces the ability for

the Company to draw down an additional Tranche D of the IPF bond

loan with warrants for a maximum amount of EUR 6.250 million,

available only if the Company's cash position would fall below EUR

1 million, so as to guarantee the Company's long-term viability

until full repayment of the remaining debt to IPF Partners. Such

drawdowns would be combined with a new savings plan aimed at

reducing the drawdowns of Tranche D bonds. These Tranche D bonds

have the same conditions as Tranche C bonds6.

Once all IPF bonds and associated exit fees are fully repaid,

Poxel will regain full rights on royalties from TWYMEEG® sales in

Japan and on potential sales-based commercial payments and cash

flows in the event of a partnership for the development and

commercialization of Imeglimin in the rest of the world.

As a security for the payment of the royalty streams to OrbiMed

and IPF Partners and in consideration for a release of all the

security interests held by IPF Partners, the Company set up three

security trusts into which several assets (including patents,

license agreements, future cash flows and receivables) are

transferred.

Trust 1: A trust agreement has been signed between (i) Poxel, as

grantor and beneficiary, (ii) Merck and the OrbiMed funds, as

first-ranking beneficiaries, (iii) IPF Partners, as second-ranking

beneficiary, and (iv) Pristine, as the trustee. The main purpose of

this agreement, and the other transaction agreements concurrently

entered into, is to regulate the transfer of assets related to

Imeglimin in Japan and to distribute the royalties received by

Poxel under the partnership with Sumitomo Pharma among the various

beneficiaries of the trust. Once the OrbiMed funds and IPF Partners

have been fully repaid, all the assets held in the trust will be

recovered by the Company.

Trust 2: A trust agreement has been signed between (i) Poxel, as

grantor and beneficiary, (ii) Merck and IPF Partners, as

first-ranking beneficiary, (iii) the OrbiMed funds, as

second-ranking beneficiary and (iv) Pristine, as the trustee. The

main purpose of this agreement, and the other transaction

agreements concurrently entered into, is to regulate the transfer

of assets related to Imeglimin in the rest of the world and to

distribute the potential royalties to be received by Poxel under

future partnerships among the various beneficiaries of the trust

and the PGE banks. Once IPF Partners and the OrbiMed funds have

been fully paid, all the assets held in the trust will be recovered

by the Company.

Trust 3: A trust agreement has been signed between (i) Poxel, as

grantor and beneficiary, (ii) IPF Partners, as first-ranking

beneficiary, and (iii) Pristine, as the trustee. The main purpose

of this agreement is to regulate the transfer of Poxel’s other

intellectual property rights (including the transfer of the PXL770

and PXL065 assets) on the understanding that Poxel will benefit

from 100% of the financial flows in the event of a partnership for

PXL770 and PXL065. Once IPF Partners have been fully repaid, all

the assets held in the trust will be recovered by the Company.

Amendment to the PGE loan

agreement

- Partial reimbursement of EUR 2.8 million corresponding to the

amount due at that date, under the initial PGE loan schedule agreed

prior to the March 2023 restructuring

- Outstanding capital amounting to EUR 3 million

- Amendment of the repayment schedule for the remaining balance

due with a quarterly repayment schedule with linear maturities

- Similar interest rate as for the March 2023 agreement

Following this transaction, and according to Poxel's current

forecasts, including in particular:

(i)

the Company’s cash position

estimated, as of August 31st, 2024, at EUR 2,9 million

(ii)

the net upfront payment of USD

42.5 million (EUR 38,1 million7) from the monetization of royalties

from TWYMEEG® sales

(iii)

the partial redemption of the IPF

Partners bond loan and the PGE loans for a total amount of EUR 26,5

million

(iv)

the advisory fees linked to the

transaction

(v)

the full residual drawdown of the

equity-linked financing facility put in place with IRIS8; and

(vi)

the anticipated business plan

including strict control of its operating expenses;

the Company expects that its resources will be sufficient to

finance its operations and capital expenditures until the end of

2025.

Morgan Stanley & Co. LLC acted as Poxel's sole structuring

agent for the transaction. Dechert LLP advised Poxel. Covington

& Burling LLP and Bryan Cave Leighton Paisner LLP acted as

legal advisors to OrbiMed.

About Poxel SA

Poxel is a clinical stage biopharmaceutical company

developing innovative treatments for chronic serious diseases

with metabolic pathophysiology, including non-alcoholic

steatohepatitis (NASH) and rare disorders. For the treatment of

NASH, PXL065 (deuterium-stabilized R-pioglitazone) met its

primary endpoint in a streamlined Phase 2 trial (DESTINY-1). In

rare diseases, development of PXL770, a first-in-class

direct adenosine monophosphate-activated protein kinase (AMPK)

activator, is focused on the treatment of adrenoleukodystrophy

(ALD) and autosomal dominant polycystic kidney disease (ADPKD).

TWYMEEG® (Imeglimin), Poxel’s first-in-class product that

targets mitochondrial dysfunction, is marketed for the treatment of

type 2 diabetes in Japan by Sumitomo Pharma and Poxel expects to

receive royalties and sales-based payments. Poxel has a strategic

partnership with Sumitomo Pharma for Imeglimin in Japan. Listed on

Euronext Paris, Poxel is headquartered in Lyon, France, and has

subsidiaries in Boston, MA, and Tokyo, Japan.

For more information, please visit: www.poxelpharma.com

About OrbiMed

OrbiMed is a leading healthcare investment firm, with

approximately $17 billion in assets under management. OrbiMed

invests globally across the healthcare industry, from start-ups to

large multinational corporations, through private equity funds,

public equity funds, and royalty/credit funds. OrbiMed seeks to be

a capital provider of choice, providing tailored financing

solutions and extensive global team resources to help build

world-class healthcare companies. OrbiMed’s team of over 100

professionals is based in New York City, London, San Francisco,

Shanghai, Hong Kong, Mumbai, Herzliya, and other key global

markets. For more information, please visit www.orbimed.com.

Forward-looking statements

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control. These

statements may include, without limitation, any statements preceded

by, followed by or including words such as “target,” “believe,”

“expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof. Forward-looking statements are subject to inherent risks

and uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements. The Company does not endorse or is

not otherwise responsible for the content of external hyperlinks

referred to in this press release.

Glossary

You will find below a list of words and/or expressions that are

used in this press release or in Poxel’s communication, with the

aim to bring clarification and transparency:

- Sumitomo Pharma fiscal year runs April to March. As an

example, Fiscal Year 2023 is April 1, 2023, through March 31,

2024.

- TWYMEEG® royalties: As per the Sumitomo Pharma’s

agreement, Poxel is entitled to receive royalties from the sales of

TWYMEEG® (Imeglimin) in Japan

- Sumitomo Pharma communicates gross

sales of TWYMEEG®, while TWYMEEG® royalties are calculated on

net sales.

- Net sales represent the amount of gross sales to which are

deducted potential rebates, allowances and costs such as prepaid

freight, postage, shipping, customs duties and insurance

charges.

- Poxel is entitled to receive escalating royalties of 8-18% on

TWYMEEG® net sales from Sumitomo

Pharma.

- Positive net royalties: As part of the Merck licensing

agreement, Poxel will pay Merck a fixed 8% royalty based on the net

sales of TWYMEEG®, independent of the level of sales. All royalties

that Poxel receives from TWYMEEG® net sales above the 8% level are

considered positive net royalties. Net royalties will therefore be

positive for Poxel when TWYMEEG® net sales exceed JPY 5 billion in

a fiscal year and royalties reach 10% and above.

_________________________ 1 China, South Korea, Taiwan,

Indonesia, Vietnam, Thailand, Malaysia, The Philippines, Singapore,

Republic of the Union of Myanmar, Kingdom of Cambodia and Lao

People's Democratic Republic. 2 Converted at the exchange rate on

September 27, 2024 3 Sumitomo Pharma fiscal year 2024 ends March

31, 2025 4 In accordance with the Sumitomo Pharma license

agreement, Poxel is entitled to receive escalating royalties of 8 -

18% on net sales of TWYMEEG® 5 As part of the Merck licensing

agreement, Poxel will pay Merck Santé (designated as Merck

hereafter) a fixed 8% royalty based on the net sales of Imeglimin,

independent of the level of sales. 6 It should be noted that the

Company's financing horizon to the end of 2025 does not include the

drawdown of this tranche D. 7 Converted at the exchange rate on

September 27, 2024 8 Since March 31, 2023, 14 additional tranches

have been drawn down for a total of EUR 7.3 million. 6 tranches are

currently secured for a total of EUR 3 million. and an additional

amount of 1.2 million euros could be drawn down by the Company

depending on the liquidity and exposure conditions under the

contract.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240929761058/en/

Investor relations / Media

NewCap Nicolas Fossiez, Aurélie Manavarere / Arthur Rouillé

investor@poxelpharma.com +33 1 44 71 94 94

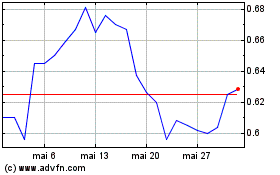

Poxel (EU:POXEL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Poxel (EU:POXEL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025