Smith Micro Founder and CEO Bill Smith to Invest $3.0 Million in Financing

02 Outubro 2024 - 9:30AM

Business Wire

Anticipated Proceeds of Two Concurrent

Financings Total $6.9 Million

Smith Micro Software, Inc.(the “Company” or “Smith Micro”)

(NASDAQ: SMSI) today announced that it has entered into definitive

agreements with respect to two separate offerings; a registered

offering with certain institutional and accredited investors, and

an unregistered offering with the Company’s chief executive

officer. Both offerings have been priced based on the market value

of the offered securities as of the time of signing the purchase

agreements. The aggregate gross proceeds of the two offerings are

expected to be approximately $6.9 million, which includes a

committed investment of $3.0 million from the Company’s chief

executive officer.

Registered Offering

The Company and certain investors have entered into a definitive

agreement for the issuance of an aggregate of 3,321,881 registered

shares of the Company’s common stock (together with an accompanying

unregistered warrant) at a price of $1.165 per share (the

“Registered Offering”). Each warrant will be exercisable for one

share of common stock at an exercise price of $1.04 per share. The

warrants will become exercisable six months after they are issued

and will expire five years thereafter.

The Registered Offering will result in gross proceeds to the

Company of approximately $3.9 million prior to offering expenses.

The Registered Offering is expected close on October 2, 2024,

subject to customary closing conditions.

Private Placement

In addition, the Company concurrently entered into a definitive

purchase agreement for an investment in Company securities by the

Company’s chief executive officer, to be completed pursuant to the

private placement of 2,575,107 unregistered shares of the Company’s

common stock (together with unregistered warrants to purchase an

equal number of shares) at a purchase price of $1.165 per share,

which represents the market value of the securities as of the

signing of the definitive purchase agreement for the transaction

(the “Private Placement”). Each warrant issued as part of the

Private Placement transaction will be exercisable for one share of

common stock at an exercise price of $1.04 per share, will become

exercisable six months after it is issued and will expire five

years thereafter; provided, however, that the warrants will not be

exercisable if such exercise would cause the holder’s ownership of

Company common stock to exceed 19.99%, unless and until the

transaction is approved by Company stockholders in accordance with

NASDAQ Listing Rule 5635(b).

The Private Placement transaction is expected to result in

aggregate gross proceeds to the Company of approximately $3.0

million. The Private Placement transaction is expected close on

October 2, 2024.

Smith Micro intends to use the net proceeds from both the

Registered Offering and the Private Placement transaction for

working capital and general corporate purposes. Buchanan Ingersoll

& Rooney PC served as legal counsel to the Company.

A shelf registration statement on Form S-3, File No. 333-264667,

relating to the Registered Offering of the shares of common stock

described above was filed with the Securities and Exchange

Commission (“SEC”) and declared effective on May 12, 2022. A

prospectus supplement describing the terms of the Registered

Offering and the accompanying base prospectus will be filed with

the SEC and will be available for free on the SEC’s website located

at http://www.sec.gov. The offering of the securities in the

Registered Offering may be made only by means of a prospectus.

Electronic copies of the prospectus supplement and the accompanying

prospectus relating to the Registered Offering, when available, may

be obtained by contacting: Smith Micro Software, Inc., 5800

Corporate Drive, Pittsburgh, PA 15237 Attn: Investor Relations,

telephone: 412-837-5300, or by email at ir@smithmicro.com.

The common stock issued in the Private Placement transaction and

the warrants for the Registered Offering and Private Placement

transaction were offered and are being sold in a transaction exempt

from the registration requirements of the Securities Act of 1933,

as amended, pursuant to the exemption for transactions by an issuer

not involving any public offering under Section 4(a)(2) of the

Securities Act and Rule 506 of Regulation D of the Securities Act

and in reliance on similar exemptions under applicable state laws.

Accordingly, the privately placed shares, all warrants and

underlying shares of common stock issuable upon exercise of the

warrants issued in both the Registered Offering and Private

Placement transaction may not be offered or sold in the United

States except pursuant to an effective registration statement or an

applicable exemption from the registration requirements of the Act

and such applicable state securities laws. The Company has agreed

to file a registration statement with the SEC registering the

resale of the shares of common stock issued in the Private

Placement transaction, and the shares of common stock issuable upon

exercise of the warrants issued in connection with the Registered

Offering and the Private Placement transaction.

This press release is not an offer to sell, or a solicitation of

an offer to buy, nor shall there be any sale of these securities in

any state or jurisdiction in which such an offer, solicitation, or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About Smith Micro Software, Inc.

Smith Micro develops software to simplify and enhance the mobile

experience, providing solutions to some of the leading wireless

service providers around the world. From enabling the family

digital lifestyle to providing powerful voice messaging

capabilities, our solutions enrich today’s connected lifestyles

while creating new opportunities to engage consumers via

smartphones and consumer IoT devices. The Smith Micro portfolio

also includes a wide range of products for creating, sharing and

monetizing rich content, such as visual voice messaging, optimizing

retail content display and performing analytics on any product set.

For more information, visit www.smithmicro.com.

Forward-Looking Statements

Certain statements in this release are forward-looking

statements regarding future events or results, including statements

related to the Company’s market and other conditions; the ability

of the Company to satisfy all conditions precedent to the closing

of the offerings; the ability of the Company to satisfy its

post-closing obligations in connection with the offerings; the

anticipated use of proceeds from the offerings; and other

statements using such words as “expect,” “anticipate,” “believe,”

“plan,” “intend,” “could,” “may,” “will” and other similar

expressions. Forward-looking statements involve risks and

uncertainties, which could cause actual results to differ

materially from those expressed or implied in the forward-looking

statements, including risks and uncertainties related to completion

of the offerings on the anticipated terms or at all, market

conditions, risks that the second closing of the Private Placement

may not occur, the satisfaction of offering-related contractual

post-closing obligations in connection with the offerings, and the

use of proceeds from the offerings These and other factors

discussed in our filings with the Securities and Exchange

Commission, including our filings on Forms 10-K and 10-Q, could

cause actual results to differ materially from those expressed or

implied in any forward-looking statements. The forward-looking

statements contained in this release are made on the basis of the

views and assumptions of management, and we do not undertake any

obligation to update these statements to reflect events or

circumstances occurring after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002062728/en/

PR/IR INQUIRIES: Charles Messman Investor Relations (949)

362-2306 IR@smithmicro.com

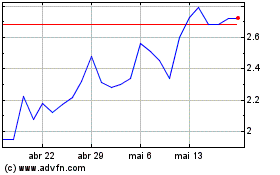

Smith Micro Software (NASDAQ:SMSI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Smith Micro Software (NASDAQ:SMSI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024