CSG Increases Purchase Price for The Kinetic

Group to $2.225 Billion

SVP Transaction Contingent Upon Close of CSG

Transaction

Vista Outdoor Inc. (“Vista Outdoor” or “the Company”) (NYSE:

VSTO) today announced it has entered into a definitive agreement

with funds managed by Strategic Value Partners, LLC, and its

affiliates (“SVP”), a global alternative investment firm with

approximately $19 billion of assets under management, to sell

Revelyst in an all-cash transaction based on an enterprise value of

$1.125 billion (the “SVP Transaction”). In connection with the SVP

Transaction, Vista Outdoor also entered into an amendment to the

merger agreement with Czechoslovak Group a.s. (“CSG”) to acquire

The Kinetic Group, increasing the purchase price for the Kinetic

Group to $2.225 billion (the “CSG Transaction”).

The SVP Transaction is subject to the completion of the CSG

Transaction. Together, the CSG Transaction and the SVP Transaction

represent an enterprise value of $3.35 billion for Vista Outdoor

and will deliver an estimated $45 per share in cash to Vista

Outdoor stockholders.

“The Board has worked tirelessly to deliver maximum value to its

stockholders, and we are pleased to have reached this agreement

with SVP and CSG which helps us achieve that objective,” said

Michael Callahan, Chairman of the Vista Outdoor Board of Directors.

“The Board engaged in a thorough process to identify the best

avenues to unlock value – and through these two separate, but

contingent, transactions with SVP and CSG, we have identified a

path that reflects the true strength and potential of both Revelyst

and The Kinetic Group.”

David Geenberg, Head of SVP’s North American Corporate

Investment Team, said, “We are strong believers in the Revelyst

story and the potential of this business. With a portfolio of

diverse, market-leading brands in the outdoor industry, Revelyst

has an unparalleled opportunity to capture market share through its

exceptional consumer focus and strengthen its platforms through its

operational and supply chain enhancements. We are happy to be

partnering with the strong leadership team at Revelyst to help

unlock its full potential with SVP’s resources.”

“We look forward to creating long-term value at The Kinetic

Group as part of the CSG portfolio,” said Michal Strnad, CEO and

Owner of CSG. “The Kinetic Group has a deep heritage of delivering

high-quality, innovative products and we will provide significant

resources, investment and expertise to continue growing the

business and serving its customers with leading ammunition

products. We are confident CSG’s acquisition of the Kinetic Group

is the best outcome for Vista Outdoor stockholders, employees of

the Company and the American economy.”

Transaction Details

The SVP Transaction has been unanimously approved by the Board

and is expected to close by January 2025, subject to the completion

of the CSG Transaction, as well as the receipt of necessary

regulatory approvals and other customary closing conditions. Vista

Outdoor and CSG have received all regulatory approvals required

under the merger agreement for the CSG Transaction and are prepared

to close the CSG Transaction prior to the end of 2024, subject to

receipt of stockholder approval and satisfaction of other customary

closing conditions. CSG and Vista Outdoor have mutually agreed to

extend the termination date of the CSG merger agreement to December

11, 2024.

At the closing of the CSG Transaction, CSG will pay the Company

$2.225 billion, subject to certain purchase price adjustments, and

Vista Outdoor stockholders will receive $25.75 in cash per Vista

Outdoor share and one share of Revelyst common stock for each share

of Vista Outdoor common stock. At the closing of the SVP

Transaction, SVP will pay Revelyst stockholders an aggregate of

$1.125 billion, subject to a net cash adjustment, representing an

estimated $19.25 in cash per share of Revelyst common stock, based

on current management estimates of expected net cash of Revelyst as

of the closing of the SVP Transaction.

As part of the SVP Transaction and the CSG Transaction, Vista

Outdoor, CSG and SVP have agreed to certain amendments to the

separation agreement currently in place to separate the Kinetic

Group and Revelyst. In addition, CSG will no longer be investing in

Revelyst at the closing of the CSG Transaction.

In connection with the announcement of the SVP Transaction and

the CSG Transaction, the Company will adjourn the special meeting

of stockholders currently scheduled for October 9, 2024.

Additional details will be filed with the U.S. Securities and

Exchange Commission.

Advisers

Morgan Stanley & Co. LLC is acting as sole financial adviser

to Vista Outdoor and Cravath, Swaine & Moore LLP is acting as

legal adviser to Vista Outdoor. Moelis & Company LLC is acting

as sole financial adviser to the independent directors of Vista

Outdoor and Gibson, Dunn & Crutcher LLP is acting as legal

adviser to the independent directors of Vista Outdoor.

J.P. Morgan is acting as sole financial adviser to CSG with

Clifford Chance LLP acting as legal adviser.

About Vista Outdoor Inc. Vista Outdoor (NYSE: VSTO) is

the parent company of more than three dozen renowned brands that

design, manufacture and market sporting and outdoor products.

Brands include Bushnell, CamelBak, Bushnell Golf, Foresight Sports,

Fox Racing, Bell Helmets, Camp Chef, Giro, Simms Fishing, QuietKat,

Stone Glacier, Federal Ammunition, Remington Ammunition and more.

Our reporting segments, Outdoor Products and Sporting Products,

provide consumers with a wide range of performance-driven,

high-quality and innovative outdoor and sporting products. For news

and information, visit our website at

www.vistaoutdoor.com.

About SVP SVP is a global alternative investment firm

that focuses on special situations, private equity, opportunistic

credit and financing opportunities. The firm uses a combination of

sourcing, financial and operational expertise to unlock value in

its portfolio companies. Today SVP manages approximately $19

billion in assets under management, and since inception, has

invested more than $48 billion of capital, including more than $18

billion in Europe. The firm, established by Victor Khosla in 2001,

has over 200 employees, including more than 100 investment

professionals, across its main offices in Greenwich (CT) and

London, and a presence in Tokyo. Learn more at

www.svpglobal.com.

About CSG The global industrial and technological group

CSG, owned by Czech entrepreneur Michal Strnad, has key production

facilities in the Czech Republic, Slovakia, Spain, Italy, India,

the UK, and the U.S. and exports its products worldwide. CSG is

continuously investing into the development of its companies while

expanding in its core business areas. The Group includes, for

example, the Czech truck manufacturer Tatra Trucks, the world's

leading manufacturer of small caliber ammunition Fiocchi, and the

Czech radar manufacturer Eldis. More than 10,000 employees work in

the companies included in the CSG group and in their associated

companies. In 2023, the Group's consolidated sales reached USD 1.73

billion. CSG's main fields of activity are the engineering,

automotive, rail, aerospace, and defense industries and small

caliber ammunition production. CSG's products can be found on all

continents thanks to its strong export orientation.

CSG's companies in Europe are major suppliers of tanks,

artillery systems and high caliber ammunition for Ukraine which is

co-financed also by the U.S. and other NATO member states.

Forward-Looking Statements

Some of the statements made and information contained in this

press release, excluding historical information, are

“forward-looking statements,” including those that discuss, among

other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or

“our”) plans, objectives, expectations, intentions, strategies,

goals, outlook or other non-historical matters; projections with

respect to future revenues, income, earnings per share or other

financial measures for Vista Outdoor; and the assumptions that

underlie these matters. The words “believe,” “expect,”

“anticipate,” “intend,” “aim,” “should” and similar expressions are

intended to identify such forward-looking statements. To the extent

that any such information is forward-looking, it is intended to fit

within the safe harbor for forward-looking information provided by

the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our

actual results to differ materially from the expectations described

in such forward-looking statements, including the following: risks

related to the previously announced transaction among Vista

Outdoor, Revelyst, Inc., CSG Elevate II Inc., CSG Elevate III Inc.

and CZECHOSLOVAK GROUP a.s. (the “CSG Transaction”) and risks

related to the transaction among Vista Outdoor, Revelyst, Olibre

LLC and Cabin Ridge, Inc. (the “Revelyst Transaction”) including

(i) the failure to receive, on a timely basis or otherwise, the

required approval of the CSG Transaction by our stockholders, (ii)

the possibility that any or all of the various conditions to the

consummation of the CSG Transaction or the Revelyst Transaction may

not be satisfied or waived, including the failure to receive any

required regulatory approvals from any applicable governmental

entities (or any conditions, limitations or restrictions placed on

such approvals), (iii) the possibility that competing offers or

acquisition proposals may be made, (iv) the occurrence of any

event, change or other circumstance that could give rise to the

termination of the merger agreement relating to the CSG Transaction

or the Revelyst Transaction, including in circumstances which would

require Vista Outdoor or Revelyst, as applicable, to pay a

termination fee, (v) the effect of the announcement or pendency of

the CSG Transaction or the Revelyst Transaction on our ability to

attract, motivate or retain key executives and employees, our

ability to maintain relationships with our customers, vendors,

service providers and others with whom we do business, or our

operating results and business generally, (vi) risks related to the

CSG Transaction or the Revelyst Transaction diverting management’s

attention from our ongoing business operations and (vii) that the

CSG Transaction or the Revelyst Transaction may not achieve some or

all of any anticipated benefits with respect to either business

segment and that the CSG Transaction or the Revelyst Transaction

may not be completed in accordance with our expected plans or

anticipated timelines, or at all;; impacts from the COVID-19

pandemic on our operations, the operations of our customers and

suppliers and general economic conditions; supplier capacity

constraints, production or shipping disruptions or quality or price

issues affecting our operating costs; the supply, availability and

costs of raw materials and components; increases in commodity,

energy, and production costs; seasonality and weather conditions;

our ability to complete acquisitions, realize expected benefits

from acquisitions and integrate acquired businesses; reductions in

or unexpected changes in or our inability to accurately forecast

demand for ammunition, accessories, or other outdoor sports and

recreation products; disruption in the service or significant

increase in the cost of our primary delivery and shipping services

for our products and components or a significant disruption at

shipping ports; risks associated with diversification into new

international and commercial markets, including regulatory

compliance; our ability to take advantage of growth opportunities

in international and commercial markets; our ability to obtain and

maintain licenses to third-party technology; our ability to attract

and retain key personnel; disruptions caused by catastrophic

events; risks associated with our sales to significant retail

customers, including unexpected cancellations, delays, and other

changes to purchase orders; our competitive environment; our

ability to adapt our products to changes in technology, the

marketplace and customer preferences, including our ability to

respond to shifting preferences of the end consumer from brick and

mortar retail to online retail; our ability to maintain and enhance

brand recognition and reputation; our association with the firearms

industry, others’ use of social media to disseminate negative

commentary about us, our products, and boycotts; the outcome of

contingencies, including with respect to litigation and other

proceedings relating to intellectual property, product liability,

warranty liability, personal injury, and environmental remediation;

our ability to comply with extensive federal, state and

international laws, rules and regulations; changes in laws, rules

and regulations relating to our business, such as federal and state

ammunition regulations; risks associated with cybersecurity and

other industrial and physical security threats; interest rate risk;

changes in the current tariff structures; changes in tax rules or

pronouncements; capital market volatility and the availability of

financing; our debt covenants may limit our ability to complete

acquisitions, incur debt, make investments, sell assets, merge or

complete other significant transactions; foreign currency exchange

rates and fluctuations in those rates; general economic and

business conditions in the United States and our markets outside

the United States, including as a result of the war in Ukraine and

the imposition of sanctions on Russia, the conflict in the Gaza

strip, the COVID-19 pandemic or another pandemic, conditions

affecting employment levels, consumer confidence and spending,

conditions in the retail environment, and other economic conditions

affecting demand for our products and the financial health of our

customers.

You are cautioned not to place undue reliance on any

forward-looking statements we make, which are based only on

information currently available to us and speak only as of the date

hereof. A more detailed description of risk factors that may affect

our operating results can be found in Part 1, Item 1A, Risk

Factors, of our Annual Report on Form 10-K for fiscal year 2024,

and in the filings we make with the SEC from time to time. We

undertake no obligation to update any forward-looking statements,

except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a

solicitation of an offer to buy any securities, the solicitation of

any vote, consent or approval in any jurisdiction pursuant to or in

connection with the CSG Transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended, and otherwise

in accordance with applicable law.

Additional Information and Where to Find

It

These materials may be deemed to be solicitation material in

respect of the CSG Transaction. In connection with the CSG

Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with

the SEC on January 16, 2024 a registration statement on Form S-4 in

connection with the proposed issuance of shares of common stock of

Revelyst to Vista Outdoor stockholders pursuant to the CSG

Transaction, which Form S-4 includes a proxy statement of Vista

Outdoor that also constitutes a prospectus of Revelyst (the “proxy

statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO

READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY

STATEMENT/PROSPECTUS AND ANY AMENDMENTS AND SUPPLEMENTS THERETO,

BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE CSG

TRANSACTION, THE REVELYST TRANSACTION AND THE PARTIES TO EACH

TRANSACTION. The registration statement was declared effective by

the SEC on March 22, 2024, and the definitive proxy

statement/prospectus was mailed to each of our stockholders

entitled to vote at the meeting relating to the approval of the CSG

Transaction. Investors and stockholders may obtain the proxy

statement/prospectus and any other documents free of charge through

the SEC’s website at www.sec.gov. Copies of the documents filed

with the SEC by Vista Outdoor are available free of charge on our

website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III

Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors,

executive officers and certain other members of management and

employees, under SEC rules, may be deemed to be “participants” in

the solicitation of proxies from our stockholders in respect of the

CSG Transaction. Information about our directors and executive

officers is set forth in our proxy statement on Schedule 14A for

our 2024 Annual Meeting of Stockholders, which was filed with the

SEC on July 24, 2024, and subsequent statements of changes in

beneficial ownership on file with the SEC. These documents are

available free of charge through the SEC’s website at www.sec.gov.

Additional information regarding the interests of potential

participants in the solicitation of proxies in connection with the

CSG Transaction, which may, in some cases, be different than those

of our stockholders generally, is also included in the proxy

statement/prospectus relating to the CSG Transaction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241004821693/en/

Vista Outdoor Contacts Investor: Tyler Lindwall

Phone: 612-704-0147 Email: investor.relations@vistaoutdoor.com

Media: Eric Smith Phone: 720-772-0877 Email:

media.relations@vistaoutdoor.com SVP Contacts

Todd Fogarty Kekst CNC Phone: 917-992-1170 Email:

todd.fogarty@kekstcnc.com CSG Contacts Media

Contacts: United States: Dan Zacchei / Joe Germani Longacre

Square Partners dzacchei@longacresquare.com /

JGermani@longacresquare.com CSG Corporate: Andrej Čírtek

+420 602 494 208 e-mail: andrej.cirtek@czechoslovakgroup.cz

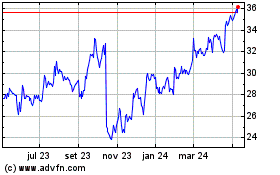

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

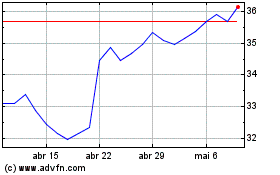

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024