SVP’s Acquisition of Vista Outdoor’s Revelyst

Segment for $1.125 Billion Expected to Bring New Opportunities

through Significant Investment and Expanded Resources

Contingent Upon Close of Vista Outdoor’s

Transaction with CSG, Which is Pending Stockholder Approval

Revelyst, a collective of world-class maker brands that design

and manufacture performance gear and precision technologies and a

segment of Vista Outdoor Inc. (NYSE: VSTO), and Strategic Value

Partners, LLC, (together with its affiliates, “SVP” or the “firm”),

a global alternative investment firm with approximately $19 billion

of assets under management, today announced that they have entered

into an agreement under which SVP-managed funds will acquire

Revelyst in an all-cash transaction based on an enterprise value of

$1.125 billion. The transaction is expected to close by January

2025, subject to the completion of the $2.225 billion CSG

Transaction (separate press release), as well as the receipt of

necessary regulatory approvals and other customary closing

conditions.

Revelyst’s world-renowned, category-defining maker brands are

known for their meticulous craftsmanship and steadfast obsession

with creating products and technologies that support consumers in a

wide range of pursuits. The company’s purpose is to harness this

collective expertise and cross-collaboration to pursue new

innovations that redefine what is humanly possible in the outdoors.

Revelyst’s power brands include Foresight Sports, Bushnell Golf,

Fox, Bell, Giro, CamelBak, Bushnell and Simms Fishing.

After consolidating its real estate footprint in the past year,

Revelyst operates three platforms: Revelyst Adventure Sports in

Irvine, Calif.; Revelyst Outdoor Performance in Bozeman, Mont.; and

Revelyst Precision Sports Technology in San Diego. That

consolidation was part of the company’s ongoing GEAR Up

transformation initiative in which Revelyst is working to unlock

its potential by directing resources to better meet consumer

demand, synergizing and prioritizing strength in supply chain and

doubling down on the equity and innovation of the company’s

industry-leading brands.

The acquisition by SVP will position Revelyst to continue to

capitalize on the increasing demand for outdoor activities and gear

by leveraging Revelyst’s strong market presence and ability to

drive long-term growth and profitability. The strategic partnership

is expected to allow Revelyst to unlock new opportunities and

propel margin expansion across its integrated international house

of brands.

David Geenberg, Head of North American Corporate Investments at

SVP, said, “We look forward to working with Eric Nyman and the rest

of the team leading this world-class outdoor gear and technology

business. For almost a year, we closely followed Revelyst’s

progress with this complex transaction. During that time, Revelyst

has gained share through a difficult period for consumer spending

thanks to the strength of its leadership, its employees and efforts

like GEAR UP. With this investment, we plan to put SVP’s full

operating resources and network behind Revelyst to help accelerate

the success of this market leader.”

“We are excited to partner with SVP and believe this acquisition

is a positive step for Revelyst’s future,” said Revelyst CEO Eric

Nyman. “As I reflect on the last year, I am incredibly appreciative

of our management team, our employees and our maker community for

getting us here. We couldn’t have done this without everyone’s

contribution. I believe the best is yet to come for Revelyst and

for our customers, suppliers and retail partners. This partnership

with SVP is going to make us a stronger company and afford us more

opportunities to innovate and deliver top-tier products to outdoor

enthusiasts while enhancing our market leadership in the outdoor

recreation industry.”

Goldman Sachs & Co. LLC is acting as sole financial adviser

to SVP and Paul, Weiss, Rifkind, Wharton & Garrison LLP is

providing legal counsel.

About Revelyst Revelyst, a segment of Vista Outdoor Inc.

(NYSE: VSTO), is a collective of world-class maker brands that

design and manufacture performance gear and precision technologies.

Our category-defining brands leverage meticulous craftsmanship and

cross-collaboration to pursue new innovations that redefine what is

humanly possible in the outdoors. Portfolio brands include

Foresight Sports, Bushnell Golf, Fox, Bell, Giro, CamelBak,

Bushnell, Simms Fishing and more. For more information, visit our

website at www.revelyst.com.

About SVP SVP is a global alternative investment firm

that focuses on special situations, private equity, opportunistic

credit and financing opportunities. The firm uses a combination of

sourcing, financial and operational expertise to unlock value in

its portfolio companies. Today SVP manages approximately $19

billion in assets under management, and since inception, has

invested more than $48 billion of capital, including more than $18

billion in Europe. The firm, established by Victor Khosla in 2001,

has over 200 employees, including more than 100 investment

professionals, across its main offices in Greenwich (CT) and

London, and a presence in Tokyo. Learn more at

www.svpglobal.com.

Forward-Looking Statements

Some of the statements made and information contained in this

press release, excluding historical information, are

“forward-looking statements,” including those that discuss, among

other things: Revelyst’s (“Revelyst”, “we”, “us” or “our”) plans,

objectives, expectations, intentions, strategies, goals, outlook or

other non-historical matters; projections with respect to future

revenues, income, earnings per share or other financial measures

for Revelyst; and the assumptions that underlie these matters. The

words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should”

and similar expressions are intended to identify such

forward-looking statements. To the extent that any such information

is forward-looking, it is intended to fit within the safe harbor

for forward-looking information provided by the Private Securities

Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our

actual results to differ materially from the expectations described

in such forward-looking statements, including the following: risks

related to the previously announced transaction among Vista

Outdoor, Revelyst, Inc., CSG Elevate II Inc., CSG Elevate III Inc.

and CZECHOSLOVAK GROUP a.s. (the “CSG Transaction”) and risks

related to the transaction among Vista Outdoor, Revelyst, Olibre

LLC and Cabin Ridge, Inc. (the “Revelyst Transaction”) including

(i) the failure to receive, on a timely basis or otherwise, the

required approval of the CSG Transaction by Vista Outdoor’s

stockholders, (ii) the possibility that any or all of the various

conditions to the consummation of the CSG Transaction or the

Revelyst Transaction may not be satisfied or waived, including the

failure to receive any required regulatory approvals from any

applicable governmental entities (or any conditions, limitations or

restrictions placed on such approvals), (iii) the possibility that

competing offers or acquisition proposals may be made, (iv) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the merger agreement relating to

the CSG Transaction or the Revelyst Transaction, including in

circumstances which would require Vista Outdoor or Revelyst, as

applicable, to pay a termination fee, (v) the effect of the

announcement or pendency of the CSG Transaction or the Revelyst

Transaction on and Vista Outdoor’s ability to attract, motivate or

retain key executives and employees, our ability to maintain

relationships with our customers, vendors, service providers and

others with whom we do business, or our operating results and

business generally, (vi) risks related to the CSG Transaction or

the Revelyst Transaction diverting management’s attention from our

ongoing business operations and (vii) that the CSG Transaction or

the Revelyst Transaction may not achieve some or all of any

anticipated benefits with respect to either business segment and

that the CSG Transaction or the Revelyst Transaction may not be

completed in accordance with our expected plans or anticipated

timelines, or at all;; impacts from the COVID-19 pandemic on our

operations, the operations of our customers and suppliers and

general economic conditions; our ability to successfully implement

the acquisition component of Revelyst’s strategic leverage

strategy, particularly if Revelyst is unable to raise the capital

necessary to finance acquisitions; our ability to make the changes

necessary to operate as an independent, publicly traded company;

supplier capacity constraints, supplier production disruptions,

supplier quality issues; the supply, availability and costs of raw

materials and components; increases in commodity, energy, and

production costs; seasonality and weather conditions; the impacts

of climate change on our supply chain, product costs and consumer

behavior; reductions in or unexpected changes in or our inability

to accurately forecast demand for ammunition, accessories, or other

outdoor sports and recreation products; impairment related to our

goodwill and intangible assets could negatively impact our results

of operations and parent company equity; disruption in the service

or significant increase in the cost of our primary delivery and

shipping services for our products and components or a significant

disruption at shipping ports; risks associated with diversification

into new international and commercial markets, including regulatory

compliance; our ability to take advantage of growth opportunities

in international and commercial markets; our ability to obtain and

maintain licenses to third-party technology; our ability to attract

and retain key personnel; disruptions caused by catastrophic

events; risks associated with our sales to significant retailers

and distributors, including unexpected cancellations, delays,

changes to purchase orders; insolvency or credit problems; our

competitive environment; risk associated with retailer or

distributor insolvency, credit problems or other financial

difficulties; our ability to adapt our products to changes in

technology, the marketplace and customer preferences, including our

ability to respond to shifting preferences of the end consumer from

brick and mortar retail to online retail; our ability to expand our

e-commerce business; our ability to maintain and enhance brand

recognition and reputation; others’ use of social media to

disseminate negative commentary about us, our products, and

boycotts; the outcome of contingencies, including with respect to

litigation and other proceedings relating to intellectual property,

product liability, warranty liability, personal injury, and

environmental remediation; our ability to comply with extensive

federal, state and international laws, rules and regulations and

any changes thereto, including the expectations with respect to

climate change and other Environmental, Social and Governance

matters and the additional cost associated therewith; risks

associated with cybersecurity and other industrial and physical

security threats; failure to comply with data privacy and security

laws and regulations; interest rate risk; changes in the current

tariff structures; changes in tax rules or pronouncements; capital

market volatility and the availability of financing; foreign

currency exchange rates and fluctuations in those rates; general

economic and business conditions in the United States and our

markets outside the United States, including as a result of the war

in Ukraine and the imposition of sanctions on Russia, the conflict

in the Gaza strip, the COVID-19 pandemic or another pandemic,

conditions affecting employment levels, consumer confidence and

spending, conditions in the retail environment, and other economic

conditions affecting demand for our products and the financial

health of our customers; and risks relating to the market for

Revelyst common stock.

You are cautioned not to place undue reliance on any

forward-looking statements we make, which are based only on

information currently available to us and speak only as of the date

hereof. A more detailed description of risk factors that may affect

our operating results can be found in Part 1, Item 1A, Risk

Factors, of our Annual Report on Form 10-K for fiscal year 2024,

and in the filings we make with the SEC from time to time. We

undertake no obligation to update any forward-looking statements,

except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a

solicitation of an offer to buy any securities, the solicitation of

any vote, consent or approval in any jurisdiction pursuant to or in

connection with the CSG Transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended, and otherwise

in accordance with applicable law.

Additional Information and Where to Find

It

These materials may be deemed to be solicitation material in

respect of the CSG Transaction. In connection with the CSG

Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with

the SEC on January 16, 2024 a registration statement on Form S-4 in

connection with the proposed issuance of shares of common stock of

Revelyst to Vista Outdoor stockholders pursuant to the CSG

Transaction, which Form S-4 includes a proxy statement of Vista

Outdoor that also constitutes a prospectus of Revelyst (the “proxy

statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO

READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY

STATEMENT/PROSPECTUS AND ANY AMENDMENTS AND SUPPLEMENTS THERETO,

BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE CSG

TRANSACTION, THE REVELYST TRANSACTION AND THE PARTIES TO EACH

TRANSACTION. The registration statement was declared effective by

the SEC on March 22, 2024, and the definitive proxy

statement/prospectus was mailed to each Vista Outdoor stockholder

entitled to vote at the meeting relating to the approval of the CSG

Transaction. Investors and stockholders may obtain the proxy

statement/prospectus and any other documents free of charge through

the SEC’s website at www.sec.gov.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III

Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors,

executive officers and certain other members of management and

employees, under SEC rules, may be deemed to be “participants” in

the solicitation of proxies from our stockholders in respect of the

CSG Transaction. Information about our directors and executive

officers is set forth in our Form 10-K/A, which was filed with the

SEC on July 29, 2024. These documents are available free of charge

through the SEC’s website at www.sec.gov. Additional information

regarding the interests of potential participants in the

solicitation of proxies in connection with the CSG Transaction,

which may, in some cases, be different than those of our

stockholders generally, is also included in the proxy

statement/prospectus relating to the CSG Transaction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241004730435/en/

Revelyst Contacts

Investor Contact: Tyler Lindwall Phone: 612-704-0147 Email:

investor.relations@vistaoutdoor.com

Media Contact: Eric Smith Phone: 720-772-0877 Email:

media.relations@revelyst.com

SVP Contact

Todd Fogarty Kekst CNC Phone: 917-992-1170 Email:

todd.fogarty@kekstcnc.com

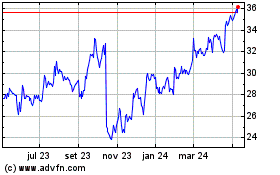

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

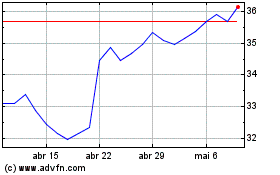

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024