OFG Bancorp (NYSE: OFG), the financial holding company for

Oriental Bank, today reported results for the third quarter ended

September 30, 2024. EPS diluted of $1.00 compared to $1.08 in 2Q24

and $0.95 in 3Q23. Total core revenues of $174.1 million compared

to $179.4 million in 2Q24 and $172.2 million in 3Q23.

CEO Comment

José Rafael Fernández, Chief Executive Officer, said: “The third

quarter was another solid quarter of performance with EPS-diluted

up 5.3% year-over-year on a 1.1% increase in total core revenues.

We continued to produce consistent, core operating results, and

digital adoption of our new and upgraded products, services, and

self-service tools keeps steadily growing. Today we celebrate our

60th anniversary in business by renewing our commitment to bring

progress to our customers, employees, shareholders, and the

communities we serve. Thanks to all our team members for always

being more than ready to help our customers today and

tomorrow.”

3Q24 Highlights

Performance Metrics: Net interest margin of 5.43%, return

on average assets of 1.66%, return on average tangible common

stockholders’ equity of 15.94%, and efficiency ratio of 52.60%.

Total Interest Income of $189.0 million compared to

$187.7 million in 2Q24 and $165.7 million in 3Q23. Compared to

2Q24, 3Q24 increased $1.4 million, primarily reflecting higher

balances of investment securities and yields, higher balances of

loans, and the absence of a $2.1 million loan recovery in 2Q24.

Total Interest Expense of $41.2 million compared to $40.3

million in 2Q24 and $23.9 million in 3Q23. Compared to 2Q24, 3Q24

increased $0.8 million, reflecting higher average balances of

higher-cost borrowings and brokered deposits and slightly reduced

average core deposit balances and cost.

Total Banking & Financial Service Revenues of $26.3

million compared to $32.1 million in 2Q24 and $30.4 million in

3Q23. 3Q24 primarily reflected $2.7 million in reduced interchange

fees due to the Durbin Amendment, $2.1 million reduced MSR

valuation due to lower long-term rates, and $0.3 million revenue

from the acquisition in late August of a $1.7 billion Puerto Rico

residential mortgage servicing portfolio.

Pre-Provision Net Revenues of $83.1 million compared to

$86.8 million in 2Q24 and $82.3 million in 3Q23.

Total Provision for Credit Losses of $21.4 million

compared to $15.6 million in 2Q24 and $16.4 million in 3Q23. 3Q24

primarily reflected $18.7 million for increased loan volume; $5.2

million related to the annual update of auto risk drivers and

consumer loan loss factors, and the extension of cash flows in a PR

commercial loan up for renewal; and a $2.7 million reserve release

mainly due to an improved U.S. macroeconomic perspective.

Credit Quality: Net charge-offs of $17.1 million (0.90%

of average loans) compared to $15.0 million (0.79%) in 2Q24 and

$18.8 million (1.05%) in 3Q23. 3Q24 early and total delinquency

rates were 2.78% and 4.10%, respectively. The nonperforming loan

rate was 1.11%. The 3Q24 total delinquency rate increased

sequentially due to booking of the GNMA buy-back option program

related to the previously mentioned mortgage servicing portfolio

acquisition.

Total Non-Interest Expense of $91.6 million compared to

$93.0 million in 2Q24 and $90.2 million in 3Q23. 3Q24 included a

$2.3 million credit and debit card processing business contract

renewal rebate and $1.3 million in expenses related to sales of

repossessed assets.

Effective Tax Rate of 23.9% compared to 28.2% in 2Q24 and

31.9% in 3Q23. Lower 3Q24 ETR reflected an estimated 2024 ETR of

26.8% due to higher forecasted business activities with

preferential tax treatment under the Puerto Rico tax code, coupled

with discrete benefits of $3.1 million mainly related to stock

vested in 1Q24 and tax credit purchases.

Loans Held for Investment (EOP) of $7.75 billion compared

to $7.64 billion in 2Q24 and $7.26 billion in 3Q23. Compared to

2Q24, 3Q24 increased 1.5%, reflecting growth in Puerto Rico and

U.S. commercial loans and Puerto Rico auto and consumer loans, and

regular paydowns and securitization of residential mortgages. Year

over year, 3Q24 loans increased 6.7%.

New Loan Production of $572.2 million compared to $589.0

million in 2Q24 and $567.5 million in 3Q23. Compared to 2Q24, 3Q24

production reflected increases in U.S. commercial and Puerto Rico

consumer lending, and decreases in Puerto Rico commercial and auto

lending.

Total Investments (EOP) of $2.61 billion compared to

$2.48 billion in 2Q24 and $2.07 billion in 3Q23.

Customer Deposits (EOP) of $9.53 billion compared to

$9.60 billion in 2Q24 and $8.54 billion in 3Q23. Compared to 2Q24,

3Q24 reflected increases in savings and time deposits, and lower

demand deposits.

Total Borrowings & Brokered Deposits (EOP) of $346.5

million compared to $201.2 million in 2Q24 and $454.4 million in

3Q23.

Cash & Cash Equivalents (EOP) of $680.6 million

compared to $740.4 million in 2Q24 and $532.7 million in 3Q23.

Capital: CET1 ratio was 14.37% compared to 14.29% in 2Q24

and 14.06% in 3Q23. The Tangible Common Equity ratio was 10.72%

compared to 10.09% in 2Q24 and 9.74% in 3Q23. Tangible Book Value

per share increased to $26.15 compared to $24.18 in 2Q24 and $21.01

in 3Q23.

Conference Call, Financial Supplement &

Presentation

A conference call to discuss 3Q24 results, outlook and related

matters will be held today at 10:00 AM ET. Phone (800) 225-9448 or

(203) 518-9708. Conference ID: OFGQ324. The call can also be

accessed live on www.ofgbancorp.com with webcast replay shortly

thereafter. OFG’s Financial Supplement, with full financial tables

for the quarter ended September 30, 2024, and the 3Q24 Conference

Call Presentation, can be found on the Quarterly Results page on

OFG’s Investor Relations website at www.ofgbancorp.com.

Non-GAAP Financial Measures

In addition to our financial information presented in accordance

with GAAP, management uses certain “non-GAAP financial measures”

within the meaning of SEC Regulation G, to clarify and enhance

understanding of past performance and prospects for the future.

Please refer to Tables 8-1 and 8-2 in OFG’s above-mentioned

Financial Supplement for a reconciliation of GAAP to non-GAAP

measures and calculations.

Forward Looking Statements

The information included in this document contains certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and involve certain

risks and uncertainties that may cause actual results to differ

materially from those expressed in the forward-looking statements.

Factors that might cause such a difference include but are not

limited to (i) general business and economic conditions, including

changes in interest rates; (ii) cybersecurity breaches; (iii)

hurricanes, earthquakes, pandemics, and other natural disasters;

and (iv) competition in the financial services industry. For a

discussion of such factors and certain risks and uncertainties to

which OFG is subject, please refer to OFG’s annual report on Form

10-K for the year ended December 31, 2023, as well as its other

filings with the U.S. Securities and Exchange Commission. Other

than to the extent required by applicable law, including the

requirements of applicable securities laws, OFG assumes no

obligation to update any forward-looking statements to reflect

occurrences or unanticipated events or circumstances after the date

of such statements.

About OFG Bancorp

Now in its 60th year in business, OFG Bancorp is a diversified

financial holding company that operates under U.S., Puerto Rico and

U.S. Virgin Islands banking laws and regulations. Its three

principal subsidiaries, Oriental Bank, Oriental Financial Services,

and Oriental Insurance, provide a wide range of retail and

commercial banking, lending and wealth management products,

services, and technology, primarily in Puerto Rico and U.S. Virgin

Islands. Our mission is to make progress possible for our

customers, employees, shareholders, and the communities we serve.

Visit us at www.ofgbancorp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015577417/en/

Puerto Rico & USVI: Lumarie Vega López

(lumarie.vega@orientalbank.com) and Victoria Maldonado Rodríguez

(victoria.maldonado@orientalbank.com) at (787) 771-6800

US: Gary Fishman (gfishman@ofgbancorp.com) and

Steven Anreder (sanreder@ofgbancorp.com) at (212) 532-3232

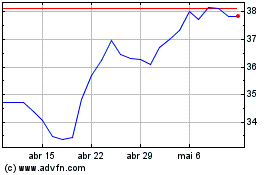

OFG Bancorp (NYSE:OFG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

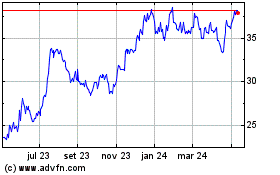

OFG Bancorp (NYSE:OFG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025