Regulatory News:

Eurofins’ (Paris:ERF) organic growth momentum remained robust in

Q3 in most business lines:

- Reported revenues in 9M 2024 reached €5,142m, +6.7% vs 9M 2023,

supported by organic growth in the Core Business6 but restrained by

FX headwinds (-0.5%).

- Organic revenue growth6 in the Core Business (excluding

COVID-19-related clinical testing and reagent revenues) was 5.2% in

9M 2024 and 4.4% in Q3 2024:

- In Europe, organic growth (9M 2024: 5.4%, Q3 2024: 5.1%) was

led by Environment Testing and Food and Feed Testing but restrained

by negative market trends in ancillary BioPharma activities such as

Agrosciences, Discovery and CDMO.

- Organic growth in North America (9M 2024: 3.9%, Q3 2024: 2.0%)

was driven by the continued strong development of Environment and

Food and Feed Testing but restrained by soft demand in BioPharma

activities, in particular early-stage clinical activities and

Agrosciences.

- Organic growth in Rest of the World (9M 2024: 8.6%, Q3 2024:

10.0%) remained at a robust level, led by diverse activities

including Food and Feed Testing and Consumer and Technology

Products Testing.

- Start-ups contributed 0.9% to organic growth in 9M 2024, with

18 new start-up laboratories and 23 blood collection points opened

during the period.

- The pace of acquisitions has remained strong throughout 9M

2024, as Eurofins closed 24 business combinations with FY 2023

pro-forma revenues of more than €200m. Transactions closed in Q3

2024 include:

- Infinity Laboratories, operator of eight state-of-the-art

laboratories across the U.S. offering microbiology, chemistry,

sterilisation and package testing to pharmaceutical, biotechnology

and medical device clients.

- Orchid Cellmark, a leading provider of forensic services in the

U.K.

- Regarding Eurofins’ planned acquisition of SGS’ crop science

operations, Eurofins remains committed to following through with

the transaction and therefore filed an arbitration against SGS in

Switzerland in early August 2024.

- Eurofins companies made numerous valuable and innovative

contributions to Testing for Life in Q3 2024, including:

- Eurofins CDMO Alphora Inc. announced the construction of a new

GMP Biologics manufacturing facility in Mississauga, Ontario, to

manufacture monoclonal antibodies and protein therapies for

clinical and commercial applications.

- Gold Standard Diagnostics Frankfurt GmbH launched Mplex Mpox,

Orthopox, Clade 1b, an advanced multiplex PCR assay specifically

designed to detect the mpox virus variant Clade-1b. This variant

shows higher mortality rate and is cited as responsible for the

recent outbreak causing WHO to announce a Public Health Emergency

of International Concern. The innovative test delivers rapid

results within one hour, supporting global pandemic response.

- Eurofins Sustainability Services has grown its extensive

service offering to include a deforestation impact assessment that

provides expert guidance and critical supply chain insights that

businesses need to meet the requirements of the European Union’s

Deforestation Regulation (EUDR).

- Eurofins MTS Consumer Product Testing U.S. has completed a

significant expansion of its Norwood, Boston (U.S.) laboratory to

support the changing needs of its customers, retailers and brands

in the United States, as they prioritise quality and sustainability

and adapt to developing market trends such as a call for greater

environmental responsibility and the growth of consumer spending on

furniture.

2024 to 2027 Objectives

- 2024 is the second year of the 2023-2027 programme. Objectives

for FY 2027 were shared on 1 March 2023. In addition, once a year

when publishing its annual results, Eurofins management also shares

objectives for the current year. Eurofins’ policy is not to update

these annual objectives unless very significant and unforeseen

changes occur. Due to the strong profitability improvement,

currency valuation changes, and the stronger than expected

temporary effect from the reset of BioPharma pipelines, objectives

for FY 2024, which were announced at the FY 2023 results

presentation on 27 February 2024, have been partly updated.

Objectives for FY 2027, announced on 1 March 2023, remain

unchanged.

€m

FY 2024A

FY 2027A

Revenues

Close to €7bn

(Previously €7.075bn –

€7.175bn)

Approaching €10bn

Adjusted1 EBITDA3

€1.525bn – €1.575bn

(Margin increase vs previous

objectives)

Margin: 24%

FCFF before investment in owned

sites16

€800m - €840m

(unchanged)

Approaching €1.5bn

- Similar to the achievement of an improved adjusted1 EBITDA3

margin in H1 2024 vs H1 2023, anticipated further improvements in

adjusted1 EBITDA3 margin in FY 2024 and towards the FY 2027

objective are underpinned by programmes that continue to align

pricing to cost inflation, as well as innovation, productivity,

digitalisation and automation initiatives, and better utilisation

of Eurofins’ state-of-the-art laboratory network.

- In the coming year, Eurofins expects to continue its high

intensity of start-up activities. Due to temporary losses related

to these start-ups, Separately Disclosed Items2 (SDI) at the

EBITDA3 level should remain at an elevated level of about €125m in

FY 2024. Thereafter, as newly initiated start-ups ramp up and

become profitable, the objective is that SDI2 at the EBITDA3 level

should decline gradually towards about 0.5% of revenues in FY

2027.

- Capital allocation for strategically important investments

remain key to Eurofins’ long-term value creation strategy.

Priorities for net operating capex in FY 2024 and in the mid-term

will continue to include start-ups in high-growth/high-return

areas, and the development and deployment of sector-leading

proprietary IT solutions. Capital allocation for net operating

capex is expected to be ca. €400m p.a.

- In addition, Eurofins will prioritise, if required, the

stepwise acquisition of sites owned by related parties, if decided

by a majority of its non-related shareholders, over the acquisition

of new sites from third parties. Investment in site ownership is

assumed to be around €200m p.a.

- Eurofins is fully committed to protecting the sustainability of

its balance sheet within its stated financial leverage objectives

with adequate headroom. It targets to maintain a financial leverage

of 1.5-2.5x in the mid-term period and less than 1.5x by FY

2027.

Outlook: In 2025 and

beyond

Management expects continued strength in Life and Consumer and

Technology Products Testing, low-to-mid single digit growth in

Clinical Diagnostics, post absorption of reimbursement cuts of 10

September 2024 in routine clinical testing in France as faster

growth specialty testing compensates for lower routine testing

growth, and a strong rebound in BioPharma in the second half of

2025 when large studies that ended in early 2024 should be replaced

by larger programmes partly already contracted. The outlook for

Agrosciences, which was down over 10% in Q3 2024, is more uncertain

as expected growth in seeds and biostimulants may not compensate

for reductions in client spending on research and development for

agrochemicals.

Comments from the CEO, Dr Gilles Martin:

“In spite of the volatile and more challenging environment in

BioPharma and Agrosciences, Eurofins companies continue to deliver

strong results. In terms of area of activity, performance in Life

and Consumer and Technology Products Testing has been particularly

strong due to continued solid execution by Eurofins teams,

innovating for our customers, investing in growing our laboratory

network and leveraging digitalisation and automation to improve our

service quality and cost competitiveness. In contrast, certain

business lines within Biopharma, in particular early-stage clinical

activities and Agrosciences, have been affected by the broad

slowdown in research and development activities currently underway

among many of the larger players in the industries they serve.

Though the timing and shape of demand recovery is uncertain, we

remain firmly convinced that Eurofins companies are competitively

positioned to capture long-term opportunities in their respective

markets. In the meantime, we remain focussed on executing on our

operational and strategic plans and are highly confident in our

ability to deliver on our profitability and cash flow objectives

for FY 2024 in absolute value, increasing both profit margin

and cash conversion ratio vs the initially announced objectives for

this year.”

Conference Call

Eurofins will hold a conference call with analysts and investors

today at 15:00 CEST to discuss the results and the performance of

Eurofins, as well as its outlook, and will be followed by a

questions and answers (Q&A) session.

Click here to Join Call >> From any device, click the link

above to join the conference call.

Table 1: Organic Growth Calculation and Revenue

Reconciliation

In €m except otherwise stated

9M 2023 reported revenues

4,821

+ 2023 acquisitions - revenue part not

consolidated in 9M 2023 at 9M 2023 FX

59

- 9M 2023 revenues of discontinued

activities / disposals8

-21**

= 9M 2023 pro-forma revenues (at 9M 2023

FX rates)

4,858

+ 9M 2024 FX impact on 9M 2023 pro-forma

revenues

-23

= 9M 2023 pro-forma revenues (at 9M

2024 FX rates) (a)

4,836

9M 2024 organic scope* revenues (at 9M

2024 FX rates) (b)

5,064

9M 2024 organic growth rate

(b/a-1)

4.7%***

2024 acquisitions - revenue part

consolidated in 9M 2024 at 9M 2024 FX

77

9M 2024 revenues of discontinued

activities / disposals8

1

9M 2024 reported revenues

5,142

In €m except otherwise stated

Q3 2023 reported revenues

1,611

+ 2023 acquisitions - revenue part not

consolidated in Q3 2023 at Q3 2023 FX

13

- Q3 2023 revenues of discontinued

activities / disposals8

-3

= Q3 2023 pro-forma revenues (at Q3 2023

FX rates)

1,621

+ Q3 2024 FX impact on Q3 2023 pro-forma

revenues

-8

= Q3 2023 pro-forma revenues (at Q3

2024 FX rates) (a)

1,614

Q3 2024 organic scope* revenues (at Q3

2024 FX rates) (b)

1,681

Q3 2024 organic growth rate

(b/a-1)

4.2%***

2024 acquisitions - revenue part

consolidated in Q3 2024 at Q3 2024 FX

41

Q3 2024 revenues of discontinued

activities / disposals8

1

Q3 2024 reported revenues

1,723

* Organic scope consists of all companies that were part of the

Group as at 01/01/2024. This corresponds to 2023 pro-forma scope.

** Q1 2024 impacted by discontinuation15 of the OmniGraf

dual-biomarker rejection panel following revised billing guidance

by MolDX in the U.S. effective 1 April 2023. *** Not corrected for

the decline in COVID-19 related clinical testing and reagent

revenues.

Table 2: Breakdown of Revenue by Operating Segment

€m

9M 2024

As % of total

9M 2023

As % of total

Y-o-Y variation %

Organic growth6 in the Core

Business*

Europe

2,620

51%

2,435

51%

7.6%

5.4%

North America

1,974

38%

1,870

39%

5.6%

3.9%

Rest of the World

547

11%

515

11%

6.2%

8.6%

Total

5,142

100%

4,821

100%

6.7%

5.2%

€m

Q3 2024

As % of total

Q3 2023

As % of total

Y-o-Y variation %

Organic growth6 in the Core

Business*

Europe

873

51%

813

50%

7.4%

5.1%

North America

663

38%

628

39%

5.6%

2.0%

Rest of the World

188

11%

171

11%

9.7%

10.0%

Total

1,723

100%

1,611

100%

7.0%

4.4%

* Excluding COVID-19 related clinical testing and reagent

revenues

Table 3: Breakdown of Revenue by Area of Activity

€m

9M 2024

As % of total

9M 2023

As % of total

Y-o-Y variation %

Organic growth13 in the Core

Business*

Life

2,093

41%

1,904

39%

9.9%

7.6%

BioPharma

1,501

29%

1,473

31%

1.9%

1.6%

Diagnostic Services & Products

1,025

20%

958

20%

6.9%

4.3%

Consumer & Technology Products

Testing

523

10%

485

10%

7.8%

7.9%

Total

5,142

100%

4,821

100%

6.7%

5.2%

€m

Q3 2024

As % of total

Q3 2023

As % of total

Y-o-Y variation %

Organic growth13 in the Core

Business*

Life

714

41%

647

40%

10.3%

7.2%

BioPharma

501

29%

498

31%

0.7%

-0.3%

Diagnostic Services & Products

334

19%

306

19%

9.1%

3.9%

Consumer & Technology Products

Testing

174

10%

160

10%

8.9%

8.8%

Total

1,723

100%

1,611

100%

7.0%

4.4%

* Excluding COVID-19 related clinical testing and reagent

revenues

1 Adjusted results – reflect the ongoing performance of the

mature14 and recurring activities excluding “separately disclosed

items”2. 2 Separately disclosed items – include one-off costs from

integration and reorganisation, discontinued operations, other

non-recurring income and costs, temporary losses and other costs

related to network expansion, start-ups and new acquisitions

undergoing significant restructuring, share-based payment charge5,

impairment of goodwill, amortisation of acquired intangible assets

and negative goodwill, gains/losses on disposal of businesses and

transaction costs related to acquisitions as well as income from

reversal of such costs and from unused amounts due for business

acquisitions, net finance costs related to borrowing and investing

excess cash and one-off financial effects (net of finance income),

net finance costs related to hybrid capital and the related tax

effects. 3 EBITDA – Earnings before interest, taxes, depreciation

and amortisation, share-based payment charge and

acquisition-related expenses, net5 and gain and loss on disposal of

subsidiaries, net. 4 EBITAS – EBITDA less depreciation and

amortisation. 5 Share-based payment charge and acquisition-related

expenses, net – Share-based payment charge, impairment of goodwill,

amortisation of acquired intangible assets, negative goodwill, and

transaction costs related to acquisitions as well as income from

reversal of such costs and from unused amounts due for business

acquisitions. 6 EBIT – EBITAS less Share-based payment charge,

acquisition-related expenses, net5 and gain and loss on disposal of

subsidiaries, net. 7 Net Profit – Net profit for owners of the

Company and hybrid capital investors before non-controlling

interests. 8 Basic EPS – basic earnings per share attributable to

owners of the Company. 9 Net capex – Purchase, capitalisation of

intangible assets, property, plant and equipment less capex trade

payables change of the period and proceeds from disposals of such

assets. 10 Free Cash Flow to the Firm – Net cash provided by

operating activities, less Net capex9. 11 Net debt – Current and

non-current borrowings, less cash and cash equivalents. 12 Net

working capital – Inventories, trade receivables and contract

assets, prepaid expenses and other current assets less trade

accounts payable, contract liabilities and other current

liabilities excluding accrued interest receivable and payable. 13

Organic growth for a given period (Q1, Q2, Q3, Half Year, Nine

Months or Full Year) – non-IFRS measure calculating the growth in

revenues during that period between 2 successive years for the same

scope of businesses using the same exchange rates (of year Y) but

excluding discontinued operations. For the purpose of organic

growth calculation for year Y, the relevant scope used is the scope

of businesses that have been consolidated in the Group's income

statement of the previous financial year (Y-1). Revenue

contribution from companies acquired in the course of Y-1 but not

consolidated for the full year are adjusted as if they had been

consolidated as of 1st January Y-1. All revenues from businesses

acquired since 1st January Y are excluded from the calculation. 14

Mature scope: excludes start-ups and acquisitions in significant

restructuring. A business will generally be considered mature when:

i) The Group’s systems, structure and processes have been deployed;

ii) It has been audited, accredited and qualified and used by the

relevant regulatory bodies and the targeted client base; iii) It no

longer requires above-average annual capital expenditures,

exceptional restructuring or abnormally large costs with respect to

current revenues for deploying new Group IT systems. The list of

entities classified as mature is reviewed at the beginning of each

year and is relevant for the whole year. 15 Discontinued activities

/ divestments: discontinued operations are a component of the

Group’s Core Business or product lines that have been disposed of,

or liquidated; or a specific business unit or a branch of a

business unit that has been shut down or terminated, and is

reported separately from continued operations. For more

information, please refer to Note 2.26 of the Consolidated

Financial Statements for the year ended 31 December 2023 and to

Note 2.3 and Note 2.6 of the Interim Condensed Consolidated

Financial Statements for the period ended 30 June 2024. 16 FCFF

before investment in owned sites: FCFF10 less Net capex9 spent on

purchase of land, buildings and investments to purchase, build or

modernise owned sites/buildings (excludes laboratory equipment and

IT).

Notes to Editors:

For more information, please visit www.eurofins.com.

About Eurofins – the global leader in bio-analysis

Eurofins is Testing for Life. The Eurofins Scientific S.E.

network of independent companies believes that it is a global

leader in food, environment, pharmaceutical and cosmetic product

testing and in discovery pharmacology, forensics, advanced material

sciences and agroscience contract research services. It is also one

of the market leaders in certain testing and laboratory services

for genomics, and in the support of clinical studies, as well as in

biopharma contract development and manufacturing. It also has a

rapidly developing presence in highly specialised and molecular

clinical diagnostic testing and in-vitro diagnostic products.

With ca. 62,000 staff across a decentralised and entrepreneurial

network of more than 900 laboratories in over 1,000 companies in 62

countries, Eurofins offers a portfolio of over 200,000 analytical

methods to evaluate the safety, identity, composition,

authenticity, origin, traceability and purity of a wide range of

products, as well as providing innovative clinical diagnostic

testing services and in-vitro diagnostic products.

Eurofins companies’ broad range of services are important for

the health and safety of people and our planet. The ongoing

investment to become fully digital and maintain the best network of

state-of-the-art laboratories and equipment supports our objective

to provide our customers with high-quality services, innovative

solutions and accurate results in the best possible turnaround time

(TAT). Eurofins companies are well positioned to support clients’

increasingly stringent quality and safety standards and the

increasing demands of regulatory authorities as well as the

evolving requirements of healthcare practitioners around the

world.

The Eurofins network has grown very strongly since its inception

and its strategy is to continue expanding its technology portfolio

and its geographic reach. Through R&D and acquisitions, its

companies draw on the latest developments in the field of

biotechnology and analytical chemistry to offer their clients

unique analytical solutions.

Shares in Eurofins Scientific S.E. are listed on the Euronext

Paris Stock Exchange (ISIN FR0014000MR3, Reuters EUFI.PA, Bloomberg

ERF FP).

Until it has been lawfully made public widely by Eurofins

through approved distribution channels, this document contains

inside information for the purpose of Regulation (EU) 596/2014 of

the European Parliament and of the Council of 16 April 2014 on

market abuse, as amended.

Important disclaimer:

This press release contains forward-looking statements and

estimates that involve risks and uncertainties. The forward-looking

statements and estimates contained herein represent the judgment of

Eurofins Scientific’s management as of the date of this release.

These forward-looking statements are not guarantees for future

performance, and the forward-looking events discussed in this

release may not occur. Eurofins Scientific disclaims any intent or

obligation to update any of these forward-looking statements and

estimates. All statements and estimates are made based on the

information available to the Company’s management as of the date of

publication, but no guarantees can be made as to their completeness

or validity.

A The FY 2024 and FY 2027 objectives assume the same average

exchange rates as in FY 2023 and zero contribution from COVID-19

clinical testing and reagents. From FY 2024 to FY 2027, Eurofins

targets average organic growth13 of 6.5% p.a. and potential average

revenues from acquisitions of €250m p.a. over the period

consolidated at mid-year. In addition, Eurofins will remain prudent

with its acquisition strategy and only acquire businesses that meet

its objectives for return on capital employed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021594378/en/

Investor Relations Eurofins Scientific SE Phone: +32 2 766 1620

E-mail: ir@sc.eurofinseu.com

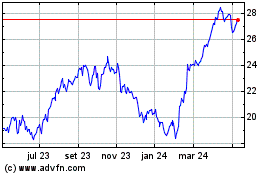

Enerplus (TSX:ERF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Enerplus (TSX:ERF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024