Gold Resource Corporation Announces Preliminary Third Quarter and Year-to-Date Results

23 Outubro 2024 - 7:58PM

Business Wire

Gold Resource Corporation (NYSE American: GORO) (the “Company”)

announces its preliminary third quarter results, which includes the

sale of 1,357 ounces of gold and 181,434 ounces of silver,

resulting in total gold equivalent (“AuEq”) ounces of 3,526.

Additionally, the Company sold 1,473 tonnes of zinc, 98 tonnes of

copper, and 467 tonnes of lead. During the nine months ending

September 30, 2024, the Company sold 15,325 AuEq ounces, 4,926

tonnes of zinc, 559 tonnes of copper, and 1,625 tonnes of lead.

Sales Statistics

For the three months ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

Metal produced and sold

Gold (ozs.)

1,357

3,982

7,638

14,777

Silver (ozs.)

181,434

208,905

632,529

777,977

Copper (tonnes)

98

245

559

904

Lead (tonnes)

467

947

1,625

3,681

Zinc (tonnes)

1,473

2,571

4,926

8,772

Average metal prices realized

(1)

Gold ($ per oz.)

$

2,561

$

1,934

$

2,309

$

1,948

Silver ($ per oz.)

$

30.61

$

23.61

$

28.06

$

23.86

Copper ($ per tonne)

$

8,832

$

8,185

$

9,260

$

8,624

Lead ($ per tonne)

$

2,065

$

2,196

$

2,080

$

2,166

Zinc ($ per tonne)

$

2,854

$

2,195

$

2,733

$

2,648

Gold equivalent ounces sold

Gold Ounces

1,357

3,982

7,638

14,777

Gold Equivalent Ounces from Silver

2,169

2,550

7,687

9,529

Total AuEq oz

3,526

6,532

15,325

24,306

(1)

Average metal prices realized

vary from the market metal prices due to final settlement

adjustments from our provisional invoices. Our average metal prices

realized will therefore differ from the average market metal prices

in most cases.

Trending Production Statistics

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Total tonnes milled

117,781

113,510

116,626

111,254

98,889

93,687

83,690

Average Grade

-

Gold (g/t)

2.33

1.59

1.52

1.44

1.89

1.27

0.54

Silver (g/t)

94

86

73

85

88

102

83

Copper (%)

0.37

0.37

0.32

0.39

0.37

0.26

0.19

Lead (%)

1.73

1.64

1.29

1.39

1.25

1.00

1.01

Zinc (%)

3.88

3.72

3.24

2.95

2.82

2.59

2.63

Metal production (before payable metal

deductions)

Gold (ozs.)

7,171

4,637

4,443

4,077

4,757

2,947

944

Silver (ozs.)

322,676

289,816

247,159

282,487

251,707

263,023

194,525

Copper (tonnes)

336

334

276

341

280

181

93

Lead (tonnes)

1,559

1,389

1,048

1,072

812

616

576

Zinc (tonnes)

3,837

3,569

3,223

2,884

2,310

2,020

1,741

Liquidity Update

As shown in the tables above, tonnes and grade have declined

during 2024 and are below budget, especially in the third quarter.

There are several factors that caused these declines. We have

encountered significant issues with equipment availability due to

the age and condition of some of the critical mining equipment in

use at the mine. Due to the continued challenges with equipment

availability and the decreased cash flow due to prior production

shortfalls, the Company has not been able to maintain its projected

timeline for development of future production zones. As a result,

the Company is currently mining only one face at a time in areas

that are accessible. The current lack of other available production

zones has placed additional pressure on the Company’s ability to

achieve its production estimates, as any problems encountered at

the current production zone cannot be offset by producing elsewhere

in the mine. In addition, the mill also experienced some mechanical

issues and wet ore handling difficulties due to unusually high rain

fall that resulted in lower throughput and a production shortfall.

To minimize the mechanical issues and return the mine to a cash

positive position, capital is necessary to replace some of the

mining fleet and upgrade the mill.

The Don David Gold Mine (“DDGM”) in Mexico has significant

potential to generate positive cash flow based on the information

to date from the new areas of The Three Sisters as well as other

areas that have been discovered near the existing mining zones. In

order to develop access and better define these new areas, an

investment must be made in the equipment and mine plan. Without the

addition of these areas to the life-of-mine plan, we do not believe

that DDGM will generate sufficient free cash flow in the near

term.

The Company’s inability to achieve its production estimates have

created a short-term liquidity concern. We currently anticipate

that we will require approximately $7 million to obtain additional

mining equipment and mill upgrades and approximately $8 million in

working capital in order to fund the initial development to access

the Three Sisters and Splay 31 systems. Due to the 2024 production

challenges described above, the Company does not believe that the

mine will generate sufficient cashflow to fund these improvements.

The Company is evaluating various financing options in order to

fund this development in the near term.

If the Company is unable to obtain this additional capital and

successfully develop these new mining areas, the continued

operation of the mine may not be possible beyond November 2024. If

continued operation of the mine is not possible, the Company may be

compelled to place the mine on “care and maintenance” status, which

would likely trigger significant severance and other costs which

the Company may not be able to pay.

Q3 2024 Conference Call

The Company has elected to forego hosting a Q3 2024 conference

call.

About GRC:

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with its operations centered on the Don

David Gold Mine in Oaxaca, Mexico. Under the direction of an

experienced board and senior leadership team, the Company’s focus

is to unlock the significant upside potential of its existing

infrastructure and large land position surrounding the mine in

Oaxaca, Mexico and to develop the Back Forty Project in Michigan,

USA. For more information, please visit the Company’s website,

located at www.goldresourcecorp.com.

Forward-Looking Statements:

This press release contains forward-looking statements that

involve risks and uncertainties. The statements contained in this

press release that are not purely historical are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended. When used in this press release, the words “plan,”

“target,” “anticipate,” “believe,” “estimate,” “intend” and

“expect” and similar expressions are intended to identify such

forward-looking statements. Such forward-looking statements

include, without limitation, (i) the Company’s anticipated

near-term capital needs and potential sources of capital and (ii)

the Company’s ability to continue to operate the Don David Gold

Mine in the absence of additional capital. All forward-looking

statements in this press release are based upon information

available to Gold Resource Corporation as of the date of this press

release, and the Company assumes no obligation to update any such

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties, and there can be no assurance

that such statements will prove to be accurate. The Company’s

actual results could differ materially from those discussed in this

press release. Also, there can be no assurance that production will

continue at any specific rate. Forward-looking statements are

subject to risks and uncertainties, including the ability of the

Company to obtain additional capital on favorable terms or at all,

production levels of the DDGM, possibility of lower than

anticipated revenue or higher than anticipated costs at the Don

David Gold Mine, volatility in commodity prices, and declines in

general economic conditions. Additional risks related to the

Company may be found in the periodic and current reports filed with

the Securities and Exchange Commission by the Company, including

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, which are available on the SEC’s website at

www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023749717/en/

Chet Holyoak Chief Financial Officer Chet.Holyoak@GRC-USA.com

www.GoldResourceCorp.com

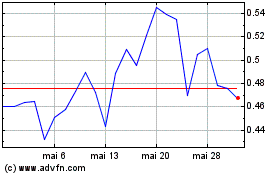

Gold Resource (AMEX:GORO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Gold Resource (AMEX:GORO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025