Upstart Launches T-Prime

24 Outubro 2024 - 3:00PM

Business Wire

Upstart (NASDAQ: UPST), the leading artificial intelligence (AI)

lending marketplace, today announced the launch of its T-Prime

lending program. This new initiative in the Upstart Referral

Network enables banks and credit unions to reach America’s more

affluent “super prime” borrowers. Fourteen lenders have already

signed up for T-Prime.

“Our goal at Upstart is to offer the best rates and best

borrowing process to all Americans—regardless of their credit

score,” said Dave Girouard, co-founder and CEO of Upstart. “We’ve

historically focused our AI platform on underserved consumers. But

with our expansion into T-Prime, we’re helping our bank and credit

union partners leverage their competitive cost of funding to win

the business of our nation’s more affluent borrowers.”

T-Prime focuses on the almost half of Americans who have credit

scores above 720, a demographic which money center banks and

fintechs commonly serve. By leveraging Upstart’s AI platform,

lenders of all sizes can make best-in-class offers that pair

competitive rates with instant and automated approvals. In 2024,

approximately 90 percent of Upstart-powered loans were approved

with zero documents to upload and zero time to wait.

“Alliant’s strategic partnership with Upstart exemplifies our

commitment to boldly disrupting banking norms to do good for our

members and communities,” said Dennis Devine, President and Chief

Executive Officer of Alliant Credit Union. “By partnering with

Upstart in T-Prime, we’re able to offer best-in-class loan options,

providing more flexibility, better rates, and broader access,

nationwide.”

T-Prime loan offers are now available to borrowers on

Upstart.com and will be available on partner sites soon. To learn

more about the T-Prime Lending program, visit

upstart.com/t-prime.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

Forward Looking Statements Disclaimer

All forward-looking statements or information on this press

release are subject to risks and uncertainties that may cause

actual results to differ materially from those that Upstart

expected. Any forward-looking statements or information on this

site are only as of the date hereof. Upstart undertakes no

obligation to update or revise any forward-looking statements or

information on this press release as a result of new information,

future events or otherwise. More information about these risks and

uncertainties is provided in Upstart’s public filings with the

Securities and Exchange Commission, copies of which may be obtained

by visiting Upstart’s investor relations website at www.upstart.com

or the SEC’s website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024618763/en/

Press press@upstart.com

Investors ir@upstart.com

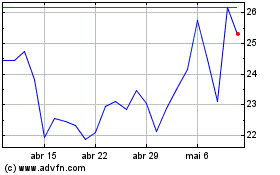

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

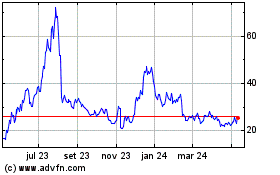

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024