Continued Strength in Consumer Demand for

Premium Products

New Railing Product Introductions to

Accelerate Market Share Gains

Provides Update on New Arkansas

Facility

Reaffirms Full Year 2024 Sales Guidance and

Expects to Achieve High End of EBITDA Guidance Range

Trex Company, Inc. (NYSE:TREX), the world’s largest manufacturer

of wood-alternative decking and railing, and a leader in

high-performance, low-maintenance outdoor living products, today

announced financial results for the third quarter of 2024.

Third Quarter

Financial 2024 Highlights

- Net sales of $234 million

- Gross margin of 39.9%

- Net income of $41 million and diluted earnings per share of

$0.37

- EBITDA of $68 million and EBITDA margin of 29.1%

- Trex repurchased 1.6 million shares year-to-date for $100

million

CEO

Comments

“Our third quarter results were ahead of our expectations led by

sustained consumer demand for our premium-priced products, for

which we estimate sell-through increased by high-single digits

year-on-year and contractor lead time continued to average 6 to 8

weeks. As anticipated, sell-through of our lower-priced products

was below last year’s levels, consistent with a pullback in

spending by consumers in this segment, although the decline was

sequentially stable and less pronounced than we had expected.

During the third quarter, our channel partners reduced their

inventory levels by approximately $70 million, in line with our

expectations and seasonal demand trends. Our strong EBITDA margin

in the third quarter reflected the benefits of our continuous

cost-out programs, which partially offset the impact of lower

utilization rates, as well as lower SG&A expenses,” said Bryan

Fairbanks, President and CEO.

“New product development remains a strategic priority and a key

driver of future double-digit growth for Trex. In the nine months

ended September 30th, products launched within the last 36 months

accounted for approximately 18% of our year-to-date net revenues of

$984 million, demonstrating how well aligned our products are with

consumer preferences. Among the latest Trex railing additions are

new steel, mesh and aluminum railing systems, cable and glass

systems, and enhancements to the Trex Select® and Trex Enhance®

composite railing systems that are designed to provide an

alternative to vinyl railing. Together, these offerings expand our

railing portfolio to cover broader audience segments and are

essential components to our goal of doubling Trex’s share of the

railing market over the next five years. Additionally, we

introduced two new colors with our proprietary heat-mitigating

technology* to the Trex Enhance® decking line and are adding two

new colors to our successful Trex Transcend® Lineage™ collection,

which pioneered the use of this technology. These, and other

advances on the drawing board, further the appeal and

differentiation of Trex products.

“With respect to adjacencies, our recently introduced line of

Trex®-branded deck fasteners continue to garner positive customer

demand given their ease of installation and the cohesive aesthetic

they provide to contractors and consumers. These launches, from

railing to decking to fasteners, give our channel partners a

competitive edge by allowing them to deliver end-to-end solutions

from one supplier—Trex—and enabling them to compete more

effectively at all price points while making Trex available to a

wider range of homeowners,” Mr. Fairbanks noted.

* Although Trex decking products with heat-mitigating technology

are designed to be cooler than most other composite decking

products of a similar color, on a hot sunny day, it will get hot.

On hot days, care should be taken to avoid extended contact between

exposed skin and the deck surface, especially with young children

and those with special needs.

Third Quarter 2024

Results

Third quarter 2024 net sales were $234 million, a decrease of

23% compared to $304 million reported in the prior-year quarter.

Third quarter sales reflected an approximately $70 million channel

inventory reduction.

Gross profit was $93 million and gross margin was 39.9%.

Excluding the special warranty benefit recognized in last year’s

third quarter, this compares to an adjusted gross profit of $127

million and adjusted gross margin of 41.8% in the similar 2023

period. Continued benefits from ongoing cost-out initiatives

partially offset the impact of lower utilization.

Selling, general and administrative expenses were $39 million,

or 16.6% of net sales, compared to $45 million, or 14.7% of net

sales, in the 2023 third quarter, with the decline primarily

resulting from reduced incentive compensation.

Net income for the 2024 third quarter was $41 million, or $0.37

per diluted share, a decrease of 38% from $65 million, or $0.60 per

diluted share, reported in the 2023 third quarter. EBITDA decreased

32% to $68 million from $99 million, and EBITDA margin contracted

360 basis points to 29.1% from 32.7% in the prior year period.

Excluding the warranty benefit, third quarter 2023 net income was

$62 million, or $0.57 per diluted share, EBITDA was $96 million,

and EBITDA margin was 31.5%.

Year-to-Date

Results

Year-to-date net sales increased 9% to $984 million from $899

million in the year-ago period. Gross profit was $431 million and

gross margin was 43.8%, up 13% and 130 basis points, respectively,

from the $382 million and 42.5% during the same period in 2023.

Selling, general and administrative expenses were $141 million,

or 14.3% of net sales, compared to $134 million, or 14.9% of net

sales, in the year-ago period.

Net income year-to-date was $217 million, or $1.99 per share,

representing 18% growth from the $183 million, or $1.69 per share,

reported in the first nine months of 2023. EBITDA was $331 million,

up 16% from $285 million in the prior year. EBITDA margin expanded

by 200 basis points to 33.7% from 31.7% in 2023.

Recent Developments

& Recognitions

- Trex added two new colors to the brand’s popular Trex Enhance®

decking line.

- Trex introduced All-In-One Post Kits for its Trex Select® and

Trex Enhance® railing. Designed to simplify the railing purchase

and installation process, these budget-friendly kits come complete

with a composite post sleeve, post cap and post skirt, all packaged

together.

- Trex continues to demonstrate its commitment to tackling

America’s plastic waste problem through the NexTrex® Grassroots

Movement, which promotes responsible disposal of polyethylene

plastic waste and gives it new life as beautiful, durable and

environmentally friendly Trex® composite decking. Since launching

in August of 2022, this collaborative recycling initiative has

experienced tremendous growth with an impressive 227% increase in

participation from eco-minded businesses, municipalities,

educational institutions and other organizations across the

country.

Update on New Arkansas

Facility

We are providing the following additional details on our new

Arkansas facility, which represent our best estimates of related

costs and the current timetable. We continue to adopt a modular

approach to the development of the Arkansas campus, bringing on

production lines in line with demand. Once completed, Arkansas will

be our most efficient production site, incorporating our latest

proprietary equipment and technology and situated to support

long-term growth. With the completion of the plant, Trex’s total

manufacturing capacity will be in excess of $2 billion per

year.

- Recycled plastic processing at the Company’s new

Arkansas facility will begin in early 2025. We anticipate that the

associated one-time start-up costs will total approximately $5

million beginning in the first quarter of 2025 and the associated

annualized depreciation of $10 million beginning in the second

quarter of 2025. We expect these operations will be running at

target utilization rates by the third quarter of 2025.

- Decking manufacturing production efficiencies at our

existing manufacturing facilities have yielded increased capacity

that will allow us to meet the projected demand through 2026.

Therefore, the Company plans to commence decking board production

at its new Arkansas campus in the first half of 2027. We expect the

one-time start-up costs to be approximately $12 million beginning

in the first half of 2027, with associated annualized depreciation

of $20 million beginning at the same time. We expect these

operations will be running at target utilization rates by the end

of 2027.

- Capital expenditures for the Arkansas facility are

expected to be approximately $550 million, of which $340 million

have already been disbursed. The increase from the Company’s prior

guidance for the project primarily reflects management’s decision

to build redundancies to mitigate potential production constraints

within our existing manufacturing facilities as well as

inflationary pressures on installation and building material costs.

Upon completion of the project, total Company capital expenditures

are expected to return to substantially lower levels, resulting in

significant free cash flow generation.

Summary and

Outlook

“Based on our year-to-date results and our channel visibility,

we are pleased to reaffirm net sales guidance at the midpoint of

our range, $1.14 billion and we expect EBITDA margin to reach the

high end of our guidance, 30.5%.

“Looking ahead to 2025, we will be working closely with our

channel partners to maximize the benefits of our expanded railing

line, and we anticipate that several of our exclusive decking

distributors will adopt exclusivity for Trex® railing as well. This

is expected to significantly increase our penetration of the $3.3

billion railing market and to have a multiplier effect on both our

decking and railing sales. We anticipate the initial cost to Trex

of this transition to be approximately $5 million and occur almost

exclusively in 2025. Thanks to the continued success of our ongoing

cost-out programs, we expect our underlying EBITDA margin in 2025,

adjusted for the one-time Arkansas start-up costs and railing

transition expense, to exceed 31%.

“As the market leader, with the greatest brand awareness in the

category, the largest and most trusted network of distributors,

dealers and home centers in North America, and the most robust

product portfolio across decking and railing, Trex is positioned to

capture the greatest share of the industry’s growth opportunities.

Demonstrating our confidence in the long-term outlook for the Trex

Company, we returned $100 million to our shareholders through the

repurchase of 1.6 million shares of our outstanding common stock in

the third quarter and fourth quarter to-date,” Mr. Fairbanks

concluded.

Third Quarter 2024

Conference Call and Webcast Information

Trex will hold a conference call to discuss its third quarter

2024 results on Monday, October 28, 2024, at 5:00 p.m. ET. To

participate on the day of the call, dial 1-844-792-3734, or

internationally 1-412-317-5126, approximately ten minutes before

the call, and tell the operator you wish to join the Trex Company

Conference Call.

A live webcast of the conference call will be available in the

Investor Relations section of the Trex Company website at 3Q24

Earnings Webcast. For those who cannot listen to the live

broadcast, an audio replay of the conference call will be available

within 24 hours of the call on the Trex website. The audio replay

will be available for 30 days.

Use of Non-GAAP

Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(GAAP). To supplement our consolidated financial statements

reported on a GAAP basis, we provide the following non-GAAP

financial measures of adjusted gross profit, adjusted gross margin,

adjusted net income and adjusted diluted earnings per share,

earnings before interest, income taxes, depreciation and

amortization (EBITDA) and EBITDA as a percentage of net sales,

EBITDA margin, and adjusted EBITDA and adjusted EBITDA margin.

Management believes these non-GAAP financial measures provide

investors with additional meaningful financial information that

should be considered when assessing our underlying business

performance and trends. Further, management believes these non-GAAP

financial measures also enhance investors’ ability to compare

period-to-period financial results. Non-GAAP financial measures

should be viewed in addition to, and not as an alternative for, the

Company’s reported results prepared in accordance with GAAP and are

not meant to be considered superior to or a substitute for our GAAP

results. Our non-GAAP financial measures do not represent a

comprehensive basis of accounting. Therefore, our non-GAAP

financial measures may not be comparable to similarly titled

measures reported by other companies. Reconciliations of these

non-GAAP financial measures to GAAP information are included below.

Management uses these non-GAAP financial measures in making

financial, operating, compensation and planning decisions and in

evaluating the Company’s performance. Disclosing these non-GAAP

financial measures allows investors and management to view our

operating results excluding the impact of items that are not

reflective of the underlying operating performance.

Reconciliation of gross profit (GAAP) to adjusted gross profit

(non-GAAP) is as follows:

Three Months Ended Nine Months Ended September

30, September 30, Trex Company, Inc.

2024

2023

2024

2023

($ in thousands) ($ in thousands)

Net sales

$

233,717

$

303,836

$

983,822

$

899,092

Cost of sales

140,512

172,941

552,896

517,321

Gross profit

$

93,205

$

130,895

$

430,926

$

381,771

Warranty adjustment

-

(3,800

)

-

(3,800

)

Adjusted Gross Profit

$

93,205

$

127,095

$

430,926

$

377,971

Gross margin

39.9

%

43.1

%

43.8

%

42.5

%

Adjusted Gross Margin

39.9

%

41.8

%

43.8

%

42.0

%

Reconciliation of net income (GAAP) to adjusted net income

(non-GAAP) is as follows:

Three Months Ended Nine Months Ended September

30, September 30, Trex Company, Inc.

2024

2023

2024

2023

($ in thousands) ($ in thousands)

Net Income

$

40,553

$

65,266

$

216,620

$

183,433

Warranty adjustment

-

(3,800

)

-

(3,800

)

Income tax effect *

-

969

-

969

Adjusted Net Income

$

40,553

$

62,435

$

216,620

$

180,602

Diluted earnings per share

$

0.37

$

0.60

$

1.99

$

1.69

Adjusted diluted earnings per share

$

0.37

$

0.57

$

1.99

$

1.66

*Income tax effect calculated using the effective tax rate

for the applicable period of 25.5%.

Reconciliation of net income (GAAP) to EBITDA and adjusted

EBITDA (non-GAAP) is as follows:

Three Months Ended Nine Months Ended September

30, September 30, Trex Company, Inc.

2024

2023

2024

2023

($ in thousands) ($ in thousands)

Net Income

$

40,553

$

65,266

$

216,620

$

183,433

Interest income (expense), net

(5

)

(734

)

(11

)

2,555

Income tax expense

13,756

21,831

73,609

62,089

Depreciation and amortization

13,611

12,996

41,218

37,194

EBITDA

$

67,915

$

99,359

$

331,436

$

285,271

Warranty Adjustment

$

-

$

(3,800

)

$

-

$

(3,800

)

Adjusted EBITDA

$

67,915

$

95,559

$

331,436

$

281,471

Net income as a percentage of net sales

17.3

%

21.5

%

22.0

%

20.4

%

EBITDA as a percentage of net sales (EBITDA margin)

29.1

%

32.7

%

33.7

%

31.7

%

Adjusted EBITDA as a percentage of net sales (EBITDA margin)

29.1

%

31.5

%

33.7

%

31.3

%

About Trex

Company

For more than 30 years, Trex Company [NYSE: TREX] has invented,

reinvented and defined the composite decking category. Today, the

Company is the world’s #1 brand of sustainably made,

wood-alternative decking and deck railing, and a leader in high

performance, low-maintenance outdoor living products. The

undisputed global leader, Trex boasts the industry’s strongest

distribution network with products sold through more than 6,700

retail outlets across six continents. Through strategic licensing

agreements, the Company offers a comprehensive outdoor living

portfolio that includes deck drainage, flashing tapes, LED

lighting, outdoor kitchen components, pergolas, spiral stairs,

fencing, lattice, cornhole and outdoor furniture – all marketed

under the Trex® brand. Based in Winchester, Va., Trex is proud to

have been named America’s Most Trusted® Outdoor Decking** four

years in a row (2021-2024). The Company was also recently included

on Barron’s list of the 100 Most Sustainable U.S. Companies 2024,

named one of America’s Most Responsible Companies 2024 by Newsweek

and ranked as one of the 100 Best ESG Companies for 2023 by

Investor’s Business Daily. For more information, visit Trex.com.

You may also follow Trex on Facebook (trexcompany), Instagram

(trexcompany), X (Trex_Company), LinkedIn (trex-company), TikTok

(trexcompany), Pinterest (trexcompany) and Houzz

(trex-company-inc), or view product and demonstration videos on the

brand’s YouTube channel (TheTrexCo).

**Trex received the highest numerical score in the proprietary

Lifestory Research 2021-2024 America’s Most Trusted® Outdoor

Decking studies. Study results are based on experiences and

perceptions of people surveyed. Your experiences may vary. Visit

www.lifestoryresearch.com.

Forward-Looking

Statements

The statements in this press release regarding the Company’s

expected future performance and condition constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These statements are subject to risks and

uncertainties that could cause the Company’s actual operating

results to differ materially. Such risks and uncertainties include,

but are not limited to: the extent of market acceptance of the

Company’s current and newly developed products; the costs

associated with the development and launch of new products and the

market acceptance of such new products; the sensitivity of the

Company’s business to general economic conditions; the impact of

seasonal and weather-related demand fluctuations on inventory

levels in the distribution channel and sales of the Company’s

products; the availability and cost of third-party transportation

services for the Company’s products and raw materials; the

Company’s ability to obtain raw materials, including scrap

polyethylene, wood fiber, and other materials used in making our

products, at acceptable prices; increasing inflation in the

macro-economic environment; the Company’s ability to maintain

product quality and product performance at an acceptable cost; the

Company’s ability to increase throughput and capacity to adequately

match supply with demand; the level of expenses associated with

warranty claims, product replacement and consumer relations

expenses related to product quality; the highly competitive markets

in which the Company operates; cyber-attacks, security breaches or

other security vulnerabilities; the impact of current and upcoming

data privacy laws and the EU General Data Protection Regulation and

the related actual or potential costs and consequences; material

adverse impacts from global public health pandemics and

geopolitical conflicts; and material adverse impacts related to

labor shortages or increases in labor costs. Documents filed with

the U.S. Securities and Exchange Commission by the Company,

including in particular its latest annual report on Form 10-K and

quarterly reports on Form 10-Q, discuss some of the important

factors that could cause the Company’s actual results to differ

materially from those expressed or implied in these forward-looking

statements. The Company expressly disclaims any obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

TREX COMPANY, INC.

Condensed Consolidated Statements of Comprehensive Income

(In thousands, except share and per share data)

Three

Months EndedSeptember 30, Nine Months EndedSeptember 30,

2024

2023

2024

2023

(Unaudited) (Unaudited) Net sales

$

233,717

$

303,836

$

983,822

$

899,092

Cost of sales

140,512

172,941

552,896

517,321

Gross profit

93,205

130,895

430,926

381,771

Selling, general and administrative expenses

38,901

44,532

140,708

133,694

Income from operations

54,304

86,363

290,218

248,077

Interest income (expense), net

(5

)

(734

)

(11

)

2,555

Income before income taxes

54,309

87,097

290,229

245,522

Provision for income taxes

13,756

21,831

73,609

62,089

Net income

$

40,553

$

65,266

$

216,620

$

183,433

Basic earnings per common share

$

0.37

$

0.60

$

2.00

$

1.69

Basic weighted average common shares outstanding

108,258,401

108,583,009

108,529,825

108,707,699

Diluted earnings per common share

$

0.37

$

0.60

$

1.99

$

1.69

Diluted weighted average common shares outstanding

108,379,416

108,702,495

108,659,118

108,829,374

Comprehensive income

$

40,553

$

65,266

$

216,620

$

183,433

TREX COMPANY, INC.

Condensed Consolidated Balance Sheets (In thousands, except

share data) (unaudited)

September 30, December

31,

2024

2023

ASSETS Current assets: Cash and cash equivalents

$

12,838

$

1,959

Accounts receivable, net

140,060

41,136

Inventories

187,935

107,089

Prepaid expenses and other assets

11,885

22,070

Total current assets

352,718

172,254

Property, plant and equipment, net

852,912

709,402

Operating lease assets

36,110

26,233

Goodwill and other intangible assets, net

19,386

18,163

Other assets

6,094

6,833

Total assets

$

1,267,220

$

932,885

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable

$

61,480

$

23,963

Accrued expenses and other liabilities

113,634

56,734

Accrued warranty

6,104

4,865

Line of credit

70,000

5,500

Total current liabilities

251,218

91,062

Deferred income taxes

67,226

72,439

Operating lease liabilities

26,782

18,840

Non-current accrued warranty

17,530

17,313

Other long-term liabilities

16,560

16,560

Total liabilities

379,316

216,214

Preferred stock, $0.01 par value, 3,000,000 shares

authorized; none issued and outstanding

—

—

Common stock, $0.01 par value, 360,000,000 shares authorized;

141,087,688 and 140,974,843 shares issued and 107,901,982 and

108,611,537 shares outstanding at September 30, 2024 and December

31, 2023, respectively

1,411

1,410

Additional paid-in capital

145,198

140,157

Retained earnings

1,552,679

1,336,058

Treasury stock, at cost, 33,185,706 and 32,363,306 shares at

September 30, 2024 and December 31, 2023, respectively

(811,384

)

(760,954

)

Total stockholders’ equity

887,904

716,671

Total liabilities and stockholders’ equity

$

1,267,220

$

932,885

TREX COMPANY, INC.

Condensed Consolidated Statements of Cash Flows (In

thousands)

Nine Months EndedSeptember 30,

2024

2023

(unaudited)

Operating Activities Net income

$

216,620

$

183,433

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

41,218

37,194

Deferred Income Taxes

(5,212

)

-

Stock-based compensation

9,663

7,384

Loss on disposal of property, plant and equipment

2,262

1,081

Other non-cash adjustments

46

(169

)

Changes in operating assets and liabilities: Accounts receivable

(98,924

)

(102,852

)

Inventories

(80,847

)

80,971

Prepaid expenses and other assets

1,266

4,376

Accounts payable

681

10,678

Accrued expenses and other liabilities

52,125

39,039

Income taxes receivable/payable

13,504

27,090

Net cash provided by operating activities

152,402

288,225

Investing Activities Expenditures for property, plant

and equipment

(151,481

)

(112,920

)

Proceeds from sales of property, plant and equipment

106

-

Net cash used in investing activities

(151,375

)

(112,920

)

Financing Activities Borrowings under line of credit

608,300

509,500

Principal payments under line of credit

(543,800

)

(675,000

)

Repurchases of common stock

(55,655

)

(18,441

)

Proceeds from employee stock purchase and option plans

1,007

925

Financing costs

-

30

Net cash provided by (used in) financing activities

9,852

(182,986

)

Net increase (decrease) in cash and cash equivalents

10,879

(7,681

)

Cash and cash equivalents at beginning of period

1,959

12,325

Cash and cash equivalents at end of period

$

12,838

$

4,644

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028672313/en/

Brenda K. Lovcik Senior Vice President and CFO 540-542-6300

Lynn Morgen Casey Kotary ADVISIRY Partners 212-750-5800

lynn.morgen@advisiry.com casey.kotary@advisiry.com

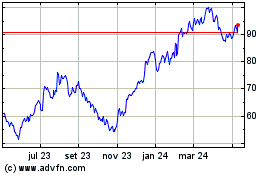

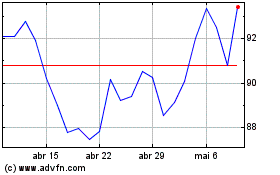

Trex (NYSE:TREX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Trex (NYSE:TREX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024