Net sales of $1,117.9 million increased 0.9%

from the third quarter of fiscal 2023

Comparable store sales decreased

6.4%

Diluted earnings per share of $0.48

Opened 11 new warehouse stores

Floor & Decor Holdings, Inc. (NYSE: FND) (“We,” “Our,” the

“Company,” or “Floor & Decor”) announces its financial results

for the third quarter of fiscal 2024, which ended September 26,

2024.

Tom Taylor, Chief Executive Officer, stated, “We are incredibly

proud of how our store and store support teams executed our plans

and managed costs during a period when demand for large project

discretionary home improvement and hard surface flooring spending

remained challenging. In the face of these challenges, the hard

work and dedication of our associates enabled us to deliver fiscal

2024 third quarter diluted earnings per share of $0.48, which

exceeded our expectations. We continue implementing and executing

strategies designed to grow our market share while working

prudently to manage our profitability and maintain a strong balance

sheet in this challenging period. I particularly want to thank our

associates affected by the recent hurricanes for their hard work

and dedication to their communities. Thanks to their efforts, we

quickly reopened our stores to begin serving customers affected by

the hurricanes as they began their recovery and rebuilding

efforts.”

In the third quarter of fiscal 2024, we opened 11 new

warehouse-format stores, including eight openings in fiscal

September. As a result, we ended the third quarter operating 241

warehouse-format stores and five design studios compared with 207

warehouse-format stores and five design studios in the same period

last year. We plan to open ten warehouse-format stores in the

fourth quarter of fiscal 2024 to achieve our 30 new

warehouse-format store opening plan in fiscal 2024.

Please see “Comparable Store Sales” below for information on how

the Company calculates period-over-period changes in comparable

store sales.

For the Thirteen Weeks Ended September 26, 2024

- Net sales of $1,117.9 million increased 0.9% from $1,107.8

million in the third quarter of fiscal 2023.

- Comparable store sales decreased 6.4%.

- We opened 11 new warehouse stores, ending the quarter with 241

warehouse stores and five design studios.

- Operating income of $66.3 million decreased 21.8% from $84.8

million in the third quarter of fiscal 2023. Operating margin of

5.9% decreased 180 basis points from the third quarter of fiscal

2023.

- Net income of $51.7 million decreased 21.6% from $65.9 million

in the third quarter of fiscal 2023. Diluted earnings per share

(“EPS”) of $0.48 decreased 21.3% from $0.61 in the third quarter of

fiscal 2023.

- Adjusted EBITDA* of $132.9 million decreased 5.7% from $140.9

million in the third quarter of fiscal 2023.

For the Thirty-nine Weeks Ended September 26, 2024

- Net sales of $3,348.4 million decreased 0.5% from $3,365.8

million in the same period of fiscal 2023.

- Comparable store sales decreased 9.0%.

- We opened 20 new warehouse stores.

- Operating income of $197.0 million decreased 28.4% from $275.3

million in the same period of fiscal 2023. Operating margin of 5.9%

decreased 230 basis points from the same period of fiscal

2023.

- Net income of $158.4 million decreased 24.2% from $208.9

million in the same period of fiscal 2023. Diluted EPS of $1.46

decreased 24.7% from $1.94 in the same period of fiscal 2023.

- Adjusted EBITDA* of $392.8 million decreased 11.4% from $443.4

million in the same period of fiscal 2023.

*Non-GAAP financial measure. Please see “Non-GAAP Financial

Measures” and “Reconciliation of GAAP to Non-GAAP Financial

Measures” below for more information.

Updated Outlook for the Fiscal Year Ending December 26,

2024:

- Net sales of approximately $4,400 million to $4,430

million

- Comparable store sales of approximately (8.5)% to (7.5)%

- Diluted EPS of approximately $1.65 to $1.75

- Adjusted EBITDA* of approximately $490 million to $500

million

- Depreciation and amortization expense of approximately $235

million

- Interest expense, net of approximately $4 million

- Tax rate of approximately 18%

- Diluted weighted average shares outstanding of approximately

108 million shares

- Open 30 new warehouse stores

- Capital expenditures of approximately $360 million to $390

million

*Non-GAAP financial measure. Please see “Non-GAAP Financial

Measures” and “Reconciliation of GAAP to Non-GAAP Financial

Measures” below for more information.

Conference Call Details

A conference call to discuss the third quarter fiscal 2024

financial results is scheduled for today, October 30, 2024, at 5:00

p.m. Eastern Time. A live audio webcast of the conference call,

together with related materials, will be available online at

ir.flooranddecor.com.

A recorded replay of the conference call is expected to be

available approximately three hours after the conclusion of the

call and can be accessed both online at ir.flooranddecor.com and by

dialing 844-512-2921 (international callers please dial

412-317-6671). The pin number to access the telephone replay is

13748389. The replay will be available until November 6, 2024.

About Floor & Decor Holdings, Inc.

Floor & Decor is a multi-channel specialty retailer and

commercial flooring distributor operating 241 warehouse-format

stores and five design studios across 38 states as of September 26,

2024. The Company offers a broad assortment of in-stock

hard-surface flooring, including tile, wood, laminate and vinyl,

and natural stone along with decorative accessories and wall tile,

installation materials, and adjacent categories at everyday low

prices. The Company was founded in 2000 and is headquartered in

Atlanta, Georgia.

Comparable Store Sales

Comparable store sales refer to period-over-period comparisons

of our net sales among the comparable store base and are based on

when the customer obtains control of the product, which is

typically at the time of sale. A store is included in the

comparable store sales calculation on the first day of the

thirteenth full fiscal month following a store’s opening, which is

when we believe comparability has been achieved. Changes in our

comparable store sales between two periods are based on net sales

for stores that were in operation during both of the two periods.

Any change in the square footage of an existing comparable store,

including for remodels and relocations within the same primary

trade area of the existing store being relocated, does not

eliminate that store from inclusion in the calculation of

comparable store sales. Stores that are closed for a full fiscal

month or longer are excluded from the comparable store sales

calculation for each full fiscal month that they are closed. Since

our e-commerce, regional account manager, and design studio sales

are fulfilled by individual stores, they are included in comparable

store sales only to the extent the fulfilling store meets the above

mentioned store criteria. Sales through our Spartan Surfaces, LLC

(“Spartan”) subsidiary do not involve our stores and are therefore

excluded from the comparable store sales calculation.

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA (which are shown in the

reconciliation below) are presented as supplemental measures of

financial performance that are not required by, or presented in

accordance with, accounting principles generally accepted in the

United States (“GAAP”). We define EBITDA as net income before

interest, taxes, depreciation and amortization. We define Adjusted

EBITDA as net income before interest, taxes, depreciation and

amortization, adjusted to eliminate the impact of non-cash

stock-based compensation expense and certain items that we do not

consider indicative of our core operating performance.

Reconciliations of these measures to the most directly comparable

GAAP financial measure are set forth in the table below.

EBITDA and Adjusted EBITDA are key metrics used by management

and our board of directors to assess our financial performance and

enterprise value. We believe that EBITDA and Adjusted EBITDA are

useful measures, as they eliminate certain items that are not

indicative of our core operating performance and facilitate a

comparison of our core operating performance on a consistent basis

from period to period. We also use Adjusted EBITDA as a basis to

determine covenant compliance with respect to our credit

facilities, to supplement GAAP measures of performance to evaluate

the effectiveness of our business strategies, to make budgeting

decisions, and to compare our performance against that of other

peer companies using similar measures. EBITDA and Adjusted EBITDA

are also frequently used by analysts, investors and other

interested parties to evaluate companies in our industry.

EBITDA and Adjusted EBITDA are non-GAAP measures of our

financial performance and should not be considered as alternatives

to net income as a measure of financial performance, or any other

performance measure derived in accordance with GAAP, and they

should not be construed as an inference that our future results

will be unaffected by unusual or non-recurring items. Additionally,

EBITDA and Adjusted EBITDA are not intended to be measures of

liquidity or free cash flow for management’s discretionary use. In

addition, these non-GAAP measures exclude certain non-recurring and

other charges. Each of these non-GAAP measures has its limitations

as an analytical tool, and you should not consider them in

isolation or as a substitute for analysis of our results as

reported under GAAP. In evaluating EBITDA and Adjusted EBITDA, you

should be aware that in the future we may incur expenses that are

the same as or similar to some of the items eliminated in the

adjustments made to determine EBITDA and Adjusted EBITDA, such as

stock-based compensation expense, fair value adjustments related to

contingent earn-out liabilities, and other adjustments. Our

presentation of EBITDA and Adjusted EBITDA should not be construed

to imply that our future results will be unaffected by any such

adjustments. Definitions and calculations of EBITDA and Adjusted

EBITDA differ among companies in the retail industry, and therefore

EBITDA and Adjusted EBITDA disclosed by us may not be comparable to

the metrics disclosed by other companies.

Please see “Reconciliation of GAAP to Non-GAAP Financial

Measures” below for reconciliations of non-GAAP financial measures

used in this release to their most directly comparable GAAP

financial measures. The Company does not provide a reconciliation

of forward-looking measures where it believes such a reconciliation

would imply a degree of precision and certainty that could be

confusing to investors and the Company is unable to reasonably

predict certain items contained in the GAAP measures without

unreasonable efforts. This is due to the inherent difficulty of

forecasting the timing or amount of various items that have not yet

occurred and are out of the Company’s control or cannot be

reasonably predicted. For the same reasons, the Company is unable

to address the probable significance of the unavailable

information. Forward-looking non-GAAP financial measures provided

without the most directly comparable GAAP financial measures may

vary materially from the corresponding GAAP financial measures.

Floor & Decor Holdings,

Inc.

Condensed Consolidated Statements of

Income

(In thousands, except for per share

data)

(Unaudited)

Thirteen Weeks Ended

September 26, 2024

September 28, 2023

% Increase

(Decrease)

Amount

% of Net Sales

Amount

% of Net Sales

Net sales

$

1,117,926

100.0

%

$

1,107,812

100.0

%

0.9

%

Cost of sales

632,056

56.5

640,357

57.8

(1.3

)%

Gross profit

485,870

43.5

467,455

42.2

3.9

%

Operating expenses:

Selling and store operating

339,135

30.3

308,581

27.9

9.9

%

General and administrative

67,687

6.1

59,870

5.3

13.1

%

Pre-opening

12,731

1.2

14,232

1.3

(10.5

)%

Total operating expenses

419,553

37.6

382,683

34.5

9.6

%

Operating income

66,317

5.9

84,772

7.7

(21.8

)%

Interest expense, net

189

—

1,246

0.2

(84.8

)%

Income before income taxes

66,128

5.9

83,526

7.5

(20.8

)%

Income tax expense

14,438

1.3

17,603

1.5

(18.0

)%

Net income

$

51,690

4.6

%

$

65,923

6.0

%

(21.6

)%

Basic weighted average shares

outstanding

107,185

106,393

Diluted weighted average shares

outstanding

108,292

108,002

Basic earnings per share

$

0.48

$

0.62

(22.6

)%

Diluted earnings per share

$

0.48

$

0.61

(21.3

)%

Thirty-nine Weeks

Ended

September 26, 2024

September 28, 2023

% Increase

(Decrease)

Amount

% of Net Sales

Amount

% of Net Sales

Net sales

$

3,348,354

100.0

%

$

3,365,763

100.0

%

(0.5

)%

Cost of sales

1,901,424

56.8

1,949,557

57.9

(2.5

)%

Gross profit

1,446,930

43.2

1,416,206

42.1

2.2

%

Operating expenses:

Selling and store operating

1,014,888

30.3

923,658

27.4

9.9

%

General and administrative

202,135

6.0

185,060

5.5

9.2

%

Pre-opening

32,951

1.0

32,226

1.0

2.2

%

Total operating expenses

1,249,974

37.3

1,140,944

33.9

9.6

%

Operating income

196,956

5.9

275,262

8.2

(28.4

)%

Interest expense, net

2,807

0.1

9,006

0.3

(68.8

)%

Income before income taxes

194,149

5.8

266,256

7.9

(27.1

)%

Income tax expense

35,761

1.1

57,357

1.7

(37.7

)%

Net income

$

158,388

4.7

%

$

208,899

6.2

%

(24.2

)%

Basic weighted average shares

outstanding

107,000

106,187

Diluted weighted average shares

outstanding

108,282

107,850

Basic earnings per share

$

1.48

$

1.97

(24.9

)%

Diluted earnings per share

$

1.46

$

1.94

(24.7

)%

Condensed Consolidated Balance

Sheets

(In thousands, except for share and per

share data)

(Unaudited)

As of September 26,

2024

As of December 28,

2023

Assets

Current assets:

Cash and cash equivalents

$

180,771

$

34,382

Income taxes receivable

3,317

27,870

Receivables, net

104,351

99,513

Inventories, net

1,046,007

1,106,150

Prepaid expenses and other current

assets

54,419

48,725

Total current assets

1,388,865

1,316,640

Fixed assets, net

1,763,980

1,629,917

Right-of-use assets

1,346,653

1,282,625

Intangible assets, net

151,119

153,869

Goodwill

257,940

257,940

Deferred income tax assets, net

16,635

14,227

Other assets

7,037

7,332

Total long-term assets

3,543,364

3,345,910

Total assets

$

4,932,229

$

4,662,550

Liabilities and stockholders’

equity

Current liabilities:

Current portion of term loan

$

2,103

$

2,103

Current portion of lease liabilities

134,629

126,428

Trade accounts payable

737,845

679,265

Accrued expenses and other current

liabilities

305,971

332,940

Deferred revenue

12,472

11,277

Total current liabilities

1,193,020

1,152,013

Term loan

194,630

194,939

Lease liabilities

1,368,514

1,301,754

Deferred income tax liabilities, net

53,373

67,188

Other liabilities

11,637

15,666

Total long-term liabilities

1,628,154

1,579,547

Total liabilities

2,821,174

2,731,560

Stockholders’ equity

Capital stock:

Preferred stock, $0.001 par value;

10,000,000 shares authorized; 0 shares issued and outstanding at

September 26, 2024 and December 28, 2023

—

—

Common stock Class A, $0.001 par value;

450,000,000 shares authorized; 107,223,985 shares issued and

outstanding at September 26, 2024 and 106,737,532 issued and

outstanding at December 28, 2023

107

107

Common stock Class B, $0.001 par value;

10,000,000 shares authorized; 0 shares issued and outstanding at

September 26, 2024 and December 28, 2023

—

—

Common stock Class C, $0.001 par value;

30,000,000 shares authorized; 0 shares issued and outstanding at

September 26, 2024 and December 28, 2023

—

—

Additional paid-in capital

536,238

513,060

Accumulated other comprehensive (loss)

income, net

(79

)

1,422

Retained earnings

1,574,789

1,416,401

Total stockholders’ equity

2,111,055

1,930,990

Total liabilities and stockholders’

equity

$

4,932,229

$

4,662,550

Condensed Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Thirty-nine Weeks

Ended

September 26, 2024

September 28, 2023

Operating activities

Net income

$

158,388

$

208,899

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

172,690

146,947

Stock-based compensation expense

25,618

20,336

Deferred income taxes

(15,813

)

4,953

Loss on asset impairments and disposals,

net

1,511

858

Change in fair value of contingent

earn-out liabilities

(866

)

2,329

Interest cap derivative contracts

110

85

Changes in operating assets and

liabilities, net of effects of acquisition:

Receivables, net

(4,838

)

2,931

Inventories, net

60,143

195,590

Trade accounts payable

60,747

109,338

Accrued expenses and other current

liabilities

21,939

2,950

Income taxes

24,840

(8,912

)

Deferred revenue

1,195

3,323

Other, net

(3,896

)

9,348

Net cash provided by operating

activities

501,768

698,975

Investing activities

Purchases of fixed assets

(349,360

)

(413,717

)

Acquisition, net of cash acquired

—

(17,353

)

Net cash used in investing activities

(349,360

)

(431,070

)

Financing activities

Payments on term loan

(1,577

)

(1,577

)

Borrowings on revolving line of credit

258,600

518,900

Payments on revolving line of credit

(258,600

)

(729,100

)

Payments of contingent earn-out

liabilities

(2,002

)

(5,241

)

Proceeds from exercise of stock

options

6,211

7,909

Proceeds from employee stock purchase

plan

5,459

5,159

Tax payments for stock-based compensation

awards

(14,110

)

(12,121

)

Net cash used in financing activities

(6,019

)

(216,071

)

Net increase in cash and cash

equivalents

146,389

51,834

Cash and cash equivalents, beginning of

the period

34,382

9,794

Cash and cash equivalents, end of the

period

$

180,771

$

61,628

Supplemental disclosures of cash flow

information

Buildings and equipment acquired under

operating leases

$

167,135

$

192,906

Cash paid for interest, net of capitalized

interest

$

3,959

$

8,871

Cash paid for income taxes, net of

refunds

$

26,728

$

62,105

Fixed assets accrued at the end of the

period

$

89,090

$

150,111

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands)

(Unaudited)

EBITDA and Adjusted EBITDA

Thirteen Weeks Ended

September 26, 2024

September 28, 2023

Net income (GAAP):

$

51,690

$

65,923

Depreciation and amortization (a)

57,328

50,336

Interest expense, net

189

1,246

Income tax expense

14,438

17,603

EBITDA

123,645

135,108

Stock-based compensation expense (b)

10,031

5,289

Other (c)

(779

)

542

Adjusted EBITDA

$

132,897

$

140,939

Thirty-nine Weeks

Ended

September 26, 2024

September 28, 2023

Net income (GAAP):

$

158,388

$

208,899

Depreciation and amortization (a)

171,044

145,439

Interest expense, net

2,807

9,006

Income tax expense

35,761

57,357

EBITDA

368,000

420,701

Stock-based compensation expense (b)

25,618

20,336

Other (c)

(866

)

2,329

Adjusted EBITDA

$

392,752

$

443,366

(a)

Excludes amortization of deferred

financing costs, which is included as part of interest expense, net

in the table above.

(b)

Non-cash charges related to

stock-based compensation programs, which vary from period to period

depending on the timing of awards and forfeitures.

(c)

Other adjustments include amounts

management does not consider indicative of our core operating

performance. Amounts for both the thirteen and thirty-nine weeks

ended September 26, 2024 and September 28, 2023 relate to changes

in the fair value of contingent earn-out liabilities.

Forward-Looking Statements

This release and the associated webcast/conference call contain

forward-looking statements within the meaning of the federal

securities laws. All statements other than statements of historical

fact contained in this release and the associated

webcast/conference call, including statements regarding the

Company’s future operating results and financial position, business

strategy and plans, and objectives of management for future

operations, are forward-looking statements. In some cases, you can

identify forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “seeks,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “budget,” “potential,” or “continue” or

the negative of these terms or other similar expressions.

The forward-looking statements contained in this release and the

associated webcast/conference call are based on our current

expectations, assumptions, estimates, and projections regarding the

Company’s business, the economy, and other future conditions,

including the impact of natural disasters on sales. These

statements involve known and unknown risks, uncertainties, and

other important factors that may cause the Company’s actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements expressed or

implied by the forward-looking statements.

Although the Company believes that the expectations reflected in

the forward-looking statements in this release and the associated

webcast/conference call are reasonable, the Company cannot

guarantee future events, results, performance or achievements. A

number of important factors could cause actual results to differ

materially from those indicated by the forward-looking statements

in this release or the associated webcast/conference call,

including, without limitation, (1) an overall decline in the health

of the economy, the hard surface flooring industry, consumer

confidence and discretionary spending, and the housing market,

including as a result of persistently high or rising inflation or

interest rates, (2) our failure to successfully manage the

challenges that our planned new store growth poses or the impact of

unexpected difficulties or higher costs during our expansion, (3)

our inability to enter into leases for additional stores on

acceptable terms or renew or replace our current store leases, (4)

our failure to successfully anticipate and manage trends, consumer

preferences, and demand, (5) our inability to successfully manage

increased competition, (6) our inability to manage our inventory,

including the impact of inventory obsolescence, shrinkage, and

damage, (7) political and regulatory conditions that contribute to

uncertainty and market volatility, including the upcoming U.S.

presidential election and legislative, regulatory, trade and

policies associated with a new administration, (8) any disruption

in our distribution capabilities, supply chain, and our related

planning and control processes, including carrier capacity

constraints, port congestion or shut down, transportation costs,

and other supply chain costs or product shortages, (9) any

increases in wholesale prices of products, materials, and

transportation costs beyond our control, including increases in

costs due to inflation, (10) the resignation, incapacitation, or

death of any key personnel, including our executive officers, (11)

our inability to attract, hire, train, and retain highly qualified

managers and staff, (12) the impact of any labor activities, (13)

our dependence on foreign imports for the products we sell,

including risks associated with obtaining products from abroad,

(14) geopolitical risks, such as the conflict in the Middle East,

the ongoing war in Ukraine, and U.S. policies related to global

trade and tariffs, such as import restrictions under the Uyghur

Forced Labor Prevention Act, or any antidumping and countervailing

duties, any of which could impact our ability to import from

foreign suppliers or raise our costs, (15) our ability to manage

our comparable store sales, (16) any failure by any of our

suppliers to supply us with quality products on attractive terms

and prices or to adhere to the quality standards that we set for

our products, (17) our inability to locate sufficient suitable

natural products, (18) the effects of weather conditions, natural

disasters, or other unexpected events, including public health

crises, that may disrupt our operations, (19) our inability to

maintain sufficient levels of cash flow or liquidity to fund our

expanding business and service our existing indebtedness, (20)

restrictions imposed by our indebtedness on our current and future

operations, including risks related to our variable rate debt, (21)

any allegations, investigations, lawsuits, or violations of laws

and regulations applicable to us, our products, or our suppliers,

(22) our inability to adequately protect the privacy and security

of information related to our customers, us, our associates, our

suppliers, and other third parties, (23) any material disruption in

our information systems, including our website, (24) new or

changing laws or regulations, including tax laws and trade policies

and regulations, (25) any failure to protect our intellectual

property rights or disputes regarding our intellectual property or

the intellectual property of third parties, (26) the impact of any

future strategic transactions, and (27) our ability to manage risks

related to corporate social responsibility. Additional information

concerning these and other factors are described in

“Forward-Looking Statements,” Item 1, “Business,” Item 1A, “Risk

Factors,” and Item 1C “Cybersecurity” of Part I and Item 7,

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and Item 9A, “Controls and Procedures” of

Part II of the Company’s Annual Report on Form 10-K for the fiscal

year ended December 28, 2023, filed with the Securities and

Exchange Commission (the “SEC”) on February 22, 2024 (the “Annual

Report”) and elsewhere in the Annual Report, as well as those

described in Item 2, “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” of the Company’s

Quarterly Report on Form 10-Q for the quarterly period ended

September 26, 2024 (the “10-Q”) and elsewhere in the 10-Q, and

those described in the Company’s other filings with the SEC.

Because forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified, you should not rely on these forward-looking statements

as predictions of future events. The forward-looking statements

contained in this release or the associated webcast/conference call

speak only as of the date hereof. New risks and uncertainties arise

over time, and it is not possible for the Company to predict those

events or how they may affect the Company. If a change to the

events and circumstances reflected in the Company’s forward-looking

statements occurs, the Company’s business, financial condition, and

operating results may vary materially from those expressed in the

Company’s forward-looking statements. Except as required by

applicable law, the Company does not plan to publicly update or

revise any forward-looking statements contained herein or in the

associated webcast/conference call, whether as a result of any new

information, future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030358030/en/

Investor Contacts:

Wayne Hood Senior Vice President of Investor Relations

678-505-4415 wayne.hood@flooranddecor.com

or

Matt McConnell Senior Manager of Investor Relations 770-257-1374

matthew.mcconnell@flooranddecor.com

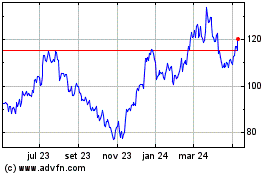

Floor and Decor (NYSE:FND)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

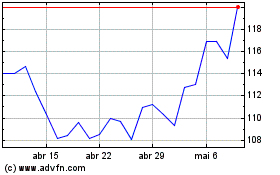

Floor and Decor (NYSE:FND)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025