Performance Reflects Continued Focus on

Near-Term Execution and Building a Foundation for Long-Term

Sustainable Growth

- Third Quarter Revenues were $11.9 Billion, increasing 8%

(+10% Adjusting for Foreign Exchange)

- Growth Portfolio Revenues were $5.8 Billion, increasing 18%

(+20% Adjusting for Foreign Exchange)

- GAAP EPS was $0.60 and Non-GAAP EPS was $1.80; Includes Net

Impact of $(0.09) Per Share for GAAP EPS and Non-GAAP EPS Due to

Acquired IPRD Charges and Licensing Income

- Achieved U.S. Approval of Cobenfy, the First New

Pharmacological Approach to Treat Schizophrenia in Decades

- Raising 2024 Revenue Guidance to Approximately +5% (+6%

Adjusting for Foreign Exchange), Non-GAAP EPS Range Increased to

$0.75 to $0.95

Bristol Myers Squibb (NYSE: BMY) today reports results for the

third quarter of 2024.

“We made important strides in the third quarter with the

landmark U.S. approval of Cobenfy in schizophrenia, continued sales

momentum, strong cash flow generation and key pipeline

achievements,” said Christopher Boerner, Ph.D., board chair and

chief executive officer, Bristol Myers Squibb. “We're focused on

closing out the year with strong execution as we deliver on our

Growth Portfolio, prioritize high-growth opportunities and continue

delivering transformational results for patients."

Third Quarter

$ in millions, except per share

amounts

2024

2023

Change

Change Excl. F/X**

Total Revenues

$11,892

$10,966

8%

10%

Earnings Per Share — GAAP*

0.60

0.93

(35)%

N/A

Earnings Per Share — Non-GAAP* **

1.80

2.00

(10)%

N/A

Acquired IPRD Charge and Licensing Income

Net Impact on Earnings Per Share

(0.09

)

(0.03

)

N/A

N/A

*GAAP and Non-GAAP earnings per share

include the net impact of Acquired IPRD charges and licensing

income.

**See "Use of Non-GAAP Financial

Information".

THIRD QUARTER RESULTS All

comparisons are made versus the same period in 2023 unless

otherwise stated.

- Bristol Myers Squibb posted third quarter revenues of $11.9

billion, an increase of 8%, or 10% when adjusted for foreign

exchange impacts, primarily driven by the Growth Portfolio and

Eliquis, partially offset by generic erosion of Sprycel due to the

loss of exclusivity.

- U.S. revenues increased 9% to $8.2 billion, and International

revenues increased 7% to $3.7 billion, primarily due to the Growth

Portfolio and higher demand for Eliquis, partially offset by

generic erosion of Sprycel due to the loss of exclusivity. The

negative impact from foreign exchange on International revenues was

4%.

- On a GAAP basis, gross margin decreased from 77.1% to 75.1%,

and on a non-GAAP basis decreased from 77.3% to 76.0%, primarily

due to product mix.

- On a GAAP and non-GAAP basis, marketing, selling and

administrative expenses remained relatively flat at $2.0

billion.

- On a GAAP basis, research and development expenses increased

6%, and 8% on a non-GAAP basis, to $2.4 billion, primarily due to

recent acquisitions.

- On a GAAP and non-GAAP basis, Acquired IPRD increased to $262

million from $80 million. On a GAAP and non-GAAP basis, licensing

income was $25 million compared to $12 million.

- On a GAAP basis, amortization of acquired intangible assets

increased 7% to $2.4 billion, primarily due to the RayzeBio

acquisition in 2024 and approval of Augtyro in the fourth quarter

of 2023.

- On a GAAP basis, the effective tax rate increased from 9.5% to

27.5%, and on a non-GAAP basis increased from 11.6% to 18.5%,

primarily due to jurisdictional earnings mix and adjustments in

2023 to reflect IRS income tax guidance issued in 2023 regarding

deductibility of certain non-U.S. research and development

expenses.

- On a GAAP basis, the company reported net income attributable

to Bristol Myers Squibb of $1.2 billion, or $0.60 per share, during

the third quarter of 2024 compared to $1.9 billion, or $0.93 per

share, for the same period a year ago. The company reported

non-GAAP net earnings attributable to Bristol Myers Squibb of $3.7

billion, or $1.80 per share, during the third quarter of 2024

compared to $4.1 billion, or $2.00 per share, for the same period a

year ago. In addition to the items above, GAAP and non-GAAP

earnings per share were impacted by higher interest expense.

THIRD QUARTER

PRODUCT REVENUE HIGHLIGHTS

($ amounts in millions)

Quarter Ended September 30,

2024

% Change from Quarter Ended

September 30, 2023

% Change from Quarter Ended

September 30, 2023 Ex-F/X**

U.S.

Int'l (c)

WW(d)

U.S.

Int'l(c)

WW(d)

Int'l(c)

WW(d)

Growth Portfolio

Opdivo

$

1,366

$

994

$

2,360

2%

7%

4%

16%

7%

Orencia

706

230

936

—%

6%

1%

13%

3%

Yervoy

399

243

642

11%

10%

11%

17%

13%

Reblozyl

358

89

447

79%

85%

80%

90%

81%

Opdualag

216

17

233

33%

>200%

40%

>200%

40%

Abecma

77

47

124

12%

96%

33%

100%

34%

Zeposia

105

42

147

11%

50%

20%

46%

19%

Breyanzi

173

51

224

125%

>200%

143%

>200%

143%

Camzyos

135

21

156

101%

>200%

129%

>200%

129%

Sotyktu

51

15

66

(18)%

>200%

—%

>200%

—%

Augtyro

10

—

10

N/A

N/A

N/A

N/A

N/A

Krazati

32

2

34

N/A

N/A

N/A

N/A

N/A

Other Growth Products(a)

172

261

433

15%

61%

39%

64%

41%

Total Growth Portfolio

3,800

2,012

5,812

15%

22%

18%

29%

20%

Legacy Portfolio

Eliquis

2,045

957

3,002

15%

3%

11%

2%

11%

Revlimid

1,212

200

1,412

—%

(9)%

(1)%

(6)%

(1)%

Pomalyst/Imnovid

697

201

898

15%

(24)%

3%

(24)%

3%

Sprycel

225

65

290

(44)%

(45)%

(44)%

(42)%

(43)%

Abraxane

151

102

253

(15)%

24%

(3)%

37%

1%

Other Legacy Products(b)

102

123

225

17%

(18)%

(5)%

(19)%

(5)%

Total Legacy Portfolio

4,432

1,648

6,080

4%

(7)%

1%

(6)%

1%

Total Revenues

$

8,232

$

3,660

$

11,892

9%

7%

8%

11%

10%

**

See "Use of Non-GAAP Financial

Information".

(a)

Includes Nulojix, Onureg, Inrebic,

Empliciti and royalty revenue.

(b)

Includes other mature brands.

(c)

Beginning in 2024, Puerto Rico revenues

are included in International revenues. Prior period amounts have

been reclassified to conform to the current presentation.

(d)

Worldwide (WW) includes U.S. and

International (Int'l).

THIRD QUARTER PRODUCT REVENUE

HIGHLIGHTS Growth Portfolio Growth Portfolio

worldwide revenues increased to $5.8 billion compared to $4.9

billion in the prior year period, representing growth of 18% on a

reported basis or 20% when adjusted for foreign exchange impacts.

Growth Portfolio revenues were primarily driven by higher demand

for Reblozyl, Breyanzi, Camzyos and Opdualag.

Legacy Portfolio Revenues for the Legacy Portfolio in the

third quarter were $6.1 billion compared to $6.0 billion in the

prior year period, representing growth of 1% on a reported basis

and when adjusted for foreign exchange impacts. Legacy Portfolio

revenues were primarily driven by higher demand for Eliquis,

partially offset by a decline in demand for Sprycel due to generic

erosion.

PRODUCT AND PIPELINE UPDATE

Bristol Myers Squibb recently achieved several important clinical

and regulatory milestones, including the U.S. approval of Cobenfy

and the disclosure of long-term cardiovascular and oncology data

that underscore the strength of the company's science.

With Cobenfy, the company is re-establishing its presence in

neuroscience and introducing the first new pharmacological approach

to treat schizophrenia in decades.

Today, the company is providing an update on data from two Phase

3 oncology trials, CheckMate -8HW and CheckMate -901. Please see

the table below for more information.

Neuroscience

Category

Asset

Milestone

Regulatory

CobenfyTM (xanomeline and trospium

chloride)

The U.S. Food and Drug Administration

(FDA) approved Cobenfy, previously referred to as KarXT, for the

treatment of schizophrenia in adults, with a mechanism of action

distinct from current therapies. The approval is based on data from

the EMERGENT clinical program, which includes three

placebo-controlled efficacy and safety trials and two open-label

trials evaluating the long-term safety and tolerability of Cobenfy

for up to one year.

Cardiovascular

Category

Asset

Milestone

Clinical & Research

Camzyos® (mavacamten)

Long-term follow-up results from the

EXPLORER-LTE cohort of the MAVA-Long-Term Extension study

evaluating Camzyos in adult patients with New York Heart

Association (NYHA) class II-III symptomatic obstructive

hypertrophic cardiomyopathy demonstrated that patients experienced

consistent and sustained improvements in echocardiographic measures

and biomarkers after up to 3.5 years of continuous treatment.

Patients experienced an improvement in

symptoms and functional capacity as measured by NYHA class and

patient-reported outcomes. The safety profile of Camzyos for up to

3.5 years remained consistent with the established safety profile

and no new safety signals were identified.

Oncology

Category

Asset

Milestone

Regulatory

Opdivo® (nivolumab)

The FDA approved Opdivo for the treatment

of adult patients with resectable (tumors ≥ 4cm or node positive)

non-small cell lung cancer (NSCLC) and no known epidermal growth

factor receptor mutations or anaplastic lymphoma kinase

rearrangements, for neoadjuvant treatment, in combination with

platinum-doublet chemotherapy, followed by single-agent Opdivo as

adjuvant treatment after surgery. The approval is based on results

from the Phase 3 randomized CheckMate -77T trial.

Opdivo + Yervoy® (ipilimumab)

The FDA accepted the supplemental

Biologics License Application for Opdivo plus Yervoy as a potential

first-line treatment for adult patients with unresectable

hepatocellular carcinoma. The acceptance is based on results from

the Phase 3 CheckMate -9DW trial. The FDA assigned a Prescription

Drug User Fee Act goal date of April 21, 2025.

Clinical & Research

Opdivo

The Phase 3 CheckMate -8HW trial

evaluating Opdivo plus Yervoy compared to Opdivo monotherapy across

all lines of therapy as a treatment for patients with

microsatellite instability-high or mismatch repair deficient

metastatic colorectal cancer met the dual primary endpoint of

progression-free survival (PFS) as assessed by Blinded Independent

Central Review at a pre-specified interim analysis. Previously,

Opdivo plus Yervoy demonstrated a statistically significant and

clinically meaningful improvement in PFS compared to

chemotherapy.

Opdivo plus Yervoy demonstrated a

statistically significant and clinically meaningful improvement in

PFS compared to Opdivo monotherapy across all lines of therapy. The

study is ongoing to assess various secondary endpoints, including

overall survival (OS). The safety profile for the combination of

Opdivo plus Yervoy remained consistent with previously reported

data, with no new safety signals identified.

Opdivo

The Phase 3 CheckMate -901 trial

evaluating Opdivo plus Yervoy versus standard-of-care

non-cisplatin-based chemotherapy in patients with unresectable or

metastatic urothelial carcinoma (UC) who are ineligible for

cisplatin-based chemotherapy did not meet its primary endpoint of

OS. The safety profile for Opdivo and Yervoy was consistent with

previously reported data, with no new safety signals

identified.

Opdivo has previously shown clinical

benefit across various stages of UC. These results do not impact

those data or approved indications.

nivolumab + relatlimab high dose

The company announced plans to initiate a

Phase 3 trial evaluating the fixed-dose combination of nivolumab

and high-dose relatlimab plus chemotherapy as a first-line

treatment for stage IV or recurrent non-squamous NSCLC with tumor

cell PD-L1 expression of 1 to 49%. The decision was supported by

findings from the Phase 2 RELATIVITY-104 trial.

Opdivo + Yervoy

10-year follow-up data from the Phase 3

CheckMate -067 trial showed continued durable improvement in

survival with first-line Opdivo plus Yervoy therapy and Opdivo

monotherapy, versus Yervoy alone, in patients with previously

untreated advanced or metastatic melanoma. With a minimum follow up

of 10 years, median OS was 71.9 months with Opdivo plus Yervoy, the

longest reported median OS in a Phase 3 advanced melanoma

trial.

Hematology

Category

Asset

Milestone

Regulatory

Breyanzi® (lisocabtagene maraleucel)

The European Medicines Agency (EMA)

validated the Type II variation application to expand the

indication for Breyanzi to include the treatment of adult patients

with relapsed or refractory follicular lymphoma (FL) who have

received two or more prior lines of systemic therapy. The

application is supported by data from the Phase 2 TRANSCEND FL

study. Validation of the application confirms the submission is

complete and begins the EMA’s centralized review process.

In addition, Japan's Ministry of Health,

Labour and Welfare approved the supplemental New Drug Application

for Breyanzi for the treatment of relapsed or refractory FL after

one prior line of systemic therapy in patients with high-risk FL

and after two or more lines of systemic therapy.

Immunology

Category

Asset

Milestone

Clinical & Research

Zeposia® (ozanimod)

Data from the Phase 3 DAYBREAK trial

demonstrated that decreased rates of brain volume loss were

sustained in the open-label extension (OLE) for patients treated

with Zeposia for relapsing forms of multiple sclerosis.

A separate DAYBREAK OLE safety analysis

demonstrated declining or stable incidence rates of

treatment-emergent adverse events, with relatively low rates of

infections, serious infections and opportunistic infections over

more than eight years of treatment with Zeposia.

Financial Guidance Bristol

Myers Squibb is raising its 2024 line-item guidance as noted

below.

2024 Line-Item

Guidance

Non-GAAP2

July (Prior)

October

(Updated)

Total Revenues

Upper end of low single- digit

range

~5% increase

Total Revenues (excl.

F/X)

Upper end of low single- digit

range

~6% increase

Gross Margin %

Between ~74% and ~75%

Between ~74.5% and ~75%

Operating Expenses1

Low single-digit increase

~4% to ~5% increase

Other income/(expense)

~($50M)

~$125M

Effective tax rate

~66%

~60%

Diluted EPS

$0.60 - $0.90

$0.75 - $0.95

1 Operating Expenses = MS&A and

R&D, excluding Acquired IPRD and Amortization of acquired

intangible assets.

2 See "Use of Non-GAAP Financial

Information."

The 2024 financial guidance excludes the impact of any potential

future strategic acquisitions, divestitures, specified items that

have not yet been identified and quantified, and the impact of

future Acquired IPRD charges. To the extent we have quantified the

impact of significant R&D charges or other income resulting

from upfront or contingent milestone payments in connection with

asset acquisitions or licensing of third-party intellectual

property rights, we may update this information from time to time

on our website www.bms.com, in the "Investors" section. Non-GAAP

guidance assumes current exchange rates. The financial guidance is

subject to risks and uncertainties applicable to all

forward-looking statements as described elsewhere in this press

release.

A reconciliation of forward-looking non-GAAP measures, including

non-GAAP EPS, to the most directly comparable GAAP measures is not

provided because comparable GAAP measures for such measures are not

reasonably accessible or reliable due to the inherent difficulty in

forecasting and quantifying measures that would be necessary for

such reconciliation. Namely, we are not, without unreasonable

effort, able to reliably predict the impact of accelerated

depreciation and impairment charges, legal and other settlements,

gains and losses from equity investments and other adjustments. In

addition, the company believes such a reconciliation would imply a

degree of precision and certainty that could be confusing to

investors. These items are uncertain, depend on various factors and

may have a material impact on our future GAAP results. See

"Cautionary Statement Regarding Forward-Looking Statements" and

"Use of Non-GAAP Financial Information."

Environmental, Social & Governance

(ESG) As a leading biopharmaceutical company, Bristol

Myers Squibb's passion for making an impact extends beyond the

discovery, development and delivery of innovative medicines that

help patients prevail over serious diseases. To learn more about

our priorities and goals, please visit our latest ESG report.

Conference Call Information

Bristol Myers Squibb will host a conference call today, Thursday,

October 31, 2024, at 8:00 a.m. ET, during which company executives

will review quarterly financial results and address inquiries from

investors and analysts. Investors and the general public are

invited to listen to a live webcast of the call at

http://investor.bms.com.

Investors and the public can register for the live conference

call here. Those unable to register can access the live conference

call by dialing in the U.S. toll-free 1-833-816-1116 or

international +1 412-317-0705. Materials related to the call will

be available at http://investor.bms.com prior to the start of the

conference call.

A replay of the webcast will be available at

http://investor.bms.com approximately three hours after the

conference call concludes. A replay of the conference call will be

available beginning at 11:30 a.m. ET on October 31, 2024, through

11:30 a.m. ET on November 14, 2024, by dialing in the U.S. toll

free 1-877-344-7529 or international +1 412-317-0088, confirmation

code: 9624003.

About Bristol Myers Squibb

Bristol Myers Squibb is a global biopharmaceutical company whose

mission is to discover, develop and deliver innovative medicines

that help patients prevail over serious diseases. For more

information about Bristol Myers Squibb, visit us at BMS.com or

follow us on LinkedIn, X (formerly Twitter), YouTube, Facebook, and

Instagram.

corporatefinancial-news

Use of Non-GAAP Financial

Information In discussing financial results and

guidance, the company refers to financial measures that are not in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP). The non-GAAP financial measures are provided as

supplemental information to the financial measures presented in

this press release that are calculated and presented in accordance

with GAAP and are presented because management has evaluated the

company’s financial results both including and excluding the

adjusted items or the effects of foreign currency translation, as

applicable, and believes that the non-GAAP financial measures

presented portray the results of the company's baseline

performance, supplement or enhance management's, analysts' and

investors' overall understanding of the company’s underlying

financial performance and trends and facilitate comparisons among

current, past and future periods. In addition, non-GAAP gross

margin, which is gross profit excluding certain specified items, as

a percentage of revenues, non-GAAP operating margin, which is gross

profit less marketing, selling and administrative expenses and

research and development expenses excluding certain specified items

as a percentage of revenues, non-GAAP operating expenses, which is

marketing, selling and administrative and research and development

expenses excluding certain specified items, non-GAAP marketing,

selling and administrative expenses, which is marketing, selling

and administrative expenses excluding certain specified items, and

non-GAAP research and development expenses, which is research and

development expenses excluding certain specified items, are

relevant and useful for investors because they allow investors to

view performance in a manner similar to the method used by our

management and make it easier for investors, analysts and peers to

compare our operating performance to other companies in our

industry and to compare our year-over-year results.

This earnings release and the accompanying tables also provide

certain revenues and expenses, as well as non-GAAP measures,

excluding the impact of foreign exchange ("Ex-Fx"). We calculate

foreign exchange impacts by converting our current-period local

currency financial results using the prior period average currency

rates and comparing these adjusted amounts to our current-period

results. Ex-Fx financial measures are not accounted for according

to GAAP because they remove the effects of currency movements from

GAAP results.

Non-GAAP financial measures such as non-GAAP earnings and

related EPS information are adjusted to exclude certain costs,

expenses, gains and losses and other specified items that are

evaluated on an individual basis after considering their

quantitative and qualitative aspects and typically have one or more

of the following characteristics, such as being highly variable,

difficult to project, unusual in nature, significant to the results

of a particular period or not indicative of past or future

operating results. These items are excluded from non-GAAP earnings

and related EPS information because the company believes they

neither relate to the ordinary course of the company’s business nor

reflect the company’s underlying business performance. Similar

charges or gains were recognized in prior periods and will likely

reoccur in future periods, including amortization of acquired

intangible assets, including product rights that generate a

significant portion of our ongoing revenue and will recur until the

intangible assets are fully amortized, unwinding of inventory

purchase price adjustments, acquisition and integration expenses,

restructuring costs, accelerated depreciation and impairment of

property, plant and equipment and intangible assets, costs of

acquiring a priority review voucher, divestiture gains or losses,

stock compensation resulting from acquisition-related equity

awards, pension, legal and other contractual settlement charges,

equity investment and contingent value rights fair value

adjustments (including fair value adjustments attributed to limited

partnership equity method investments), income resulting from the

change in control of the Nimbus Therapeutics TYK2 Program and

amortization of fair value adjustments of debt acquired from

Celgene in our 2019 exchange offer, among other items. Deferred and

current income taxes attributed to these items are also adjusted

for considering their individual impact to the overall tax expense,

deductibility and jurisdictional tax rates. Certain other

significant tax items are also excluded such as the impact

resulting from a non-U.S. tax ruling regarding the deductibility of

a statutory impairment of subsidiary investments and release of

income tax reserves relating to the Celgene acquisition.

Because the non-GAAP financial measures are not calculated in

accordance with GAAP, they should not be considered superior to and

are not intended to be considered in isolation or as a substitute

for the related financial measures presented in the press release

that are prepared in accordance with GAAP and may not be the same

as or comparable to similarly titled measures presented by other

companies due to possible differences in method and in the items

being adjusted. We encourage investors to review our financial

statements and publicly-filed reports in their entirety and not to

rely on any single financial measure.

Reconciliations of the non-GAAP financial measures to the most

comparable GAAP measures are provided in the accompanying financial

tables and will also be available on the company’s website at

www.bms.com. Within the accompanying financial tables presented,

certain columns and rows may not add due to the use of rounded

numbers. Percentages and earnings per share amounts presented are

calculated from the underlying amounts.

A reconciliation of forward-looking non-GAAP measures, including

non-GAAP EPS, to the most directly comparable GAAP measures is not

provided because comparable GAAP measures for such measures are not

reasonably accessible or reliable due to the inherent difficulty in

forecasting and quantifying measures that would be necessary for

such reconciliation. Namely, we are not, without unreasonable

effort, able to reliably predict the impact of accelerated

depreciation and impairment charges, legal and other settlements,

gains and losses from equity investments and other adjustments. In

addition, the company believes such a reconciliation would imply a

degree of precision and certainty that could be confusing to

investors. These items are uncertain, depend on various factors and

may have a material impact on our future GAAP results.

Website Information We

routinely post important information for investors on our website,

BMS.com, in the “Investors” section. We may use this website as a

means of disclosing material, non-public information and for

complying with our disclosure obligations under Regulation FD.

Accordingly, investors should monitor the Investors section of our

website, in addition to following our press releases, Securities

and Exchange Commission ("SEC") filings, public conference calls,

presentations and webcasts. We may also use social media channels

to communicate with our investors and the public about our company,

our products and other matters, and those communications could be

deemed to be material information. The information contained on, or

that may be accessed through, our website or social media channels

are not incorporated by reference into, and are not a part of, this

document.

Cautionary Statement Regarding

Forward-Looking Statements This earnings release and the

related attachments (as well as the oral statements made with

respect to information contained in this release and the

attachments) contain certain “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, the company’s 2024

financial guidance, plans and strategy, including its business

development and capital allocation strategy, ESG priorities and

goals, anticipated developments in the company’s pipeline,

expectations with respect to the company’s future market position

and the projected benefits of the company’s alliances and other

business development activities. These statements may be identified

by the fact that they use words such as “should,” “could,”

“expect,” “anticipate,” “estimate,” “target,” “may,” “project,”

“guidance,” “intend,” “plan,” “believe,” “will” and other words and

terms of similar meaning and expression in connection with any

discussion of future operating or financial performance, although

not all forward-looking statements contain such terms. All

statements that are not statements of historical facts are, or may

be deemed to be, forward-looking statements. No forward-looking

statement can be guaranteed and there is no assurance that the

company will achieve its financial guidance and long-term targets,

that the company’s future clinical studies will support the data

described in this release, that the company’s product candidates

will receive necessary clinical and manufacturing regulatory

approvals, that the company’s pipeline products will prove to be

commercially successful, that clinical and manufacturing regulatory

approvals will be sought or obtained within currently expected

timeframes, or that contractual milestones will be achieved.

Forward-looking statements are based on current expectations and

projections about the company’s future financial results, goals,

plans and objectives and involve inherent risks, assumptions and

uncertainties, including internal or external factors that could

delay, divert or change any of them in the next several years, that

are difficult to predict, may be beyond the company’s control and

could cause the company’s future financial results, goals, plans

and objectives to differ materially from those expressed in, or

implied by, the statements. Such risks, uncertainties and other

matters include, but are not limited to: increasing pricing

pressures from market access, pharmaceutical pricing controls and

discounting; market actions taken by private and government payers

to manage drug utilization and contain costs; the company’s ability

to retain patent exclusivity of certain products; regulatory

changes that result in lower prices, lower reimbursement rates and

smaller populations for whom payers will reimburse; changes under

the 340B Drug Pricing Program; the company’s ability to obtain and

maintain regulatory approval for its product candidates; the

company’s ability to obtain and protect market exclusivity rights

and enforce patents and other intellectual property rights; the

possibility of difficulties and delays in product introduction and

commercialization; increasing industry competition; potential

difficulties, delays and disruptions in manufacturing, distribution

or sale of products; the company’s ability to identify potential

strategic acquisitions, licensing opportunities or other beneficial

transactions; failure to complete, or delays in completing,

collaborations, acquisitions, divestitures, alliances and other

portfolio actions and the failure to achieve anticipated benefits

from such transactions and actions; the risk of an adverse patent

litigation decision or settlement and exposure to other litigation

and/or regulatory actions or investigations; the impact of any

healthcare reform and legislation or regulatory action in the

United States and international markets; increasing market

penetration of lower-priced generic products; the failure of the

company’s suppliers, vendors, outsourcing partners, alliance

partners and other third parties to meet their contractual,

regulatory and other obligations; the impact of counterfeit or

unregistered versions of the company’s products and from stolen

products; product label changes or other measures that could reduce

the market acceptance for the company's products and result in

declining sales; safety or efficacy concerns regarding the

company’s products or any product in the same class as the

company’s products; the risk of cyber-attacks on the company’s

information systems or products and unauthorized disclosure of

trade secrets or other confidential data; the company’s ability to

execute its financial, strategic and operational plans; the

company’s dependency on several key products; any decline in the

company’s future royalty streams; the company’s ability to attract

and retain key personnel; the impact of the company’s significant

indebtedness; political and financial instability of international

economies and sovereign risk; interest rate and currency exchange

rate fluctuations, credit and foreign exchange risk management;

risks relating to the use of social media platforms; the impact of

our exclusive forum provision in our by-laws for certain lawsuits

on our stockholders’ ability to obtain a judicial forum that they

find favorable for such lawsuits; issuance of new or revised

accounting standards; and risks relating to public health

outbreaks, epidemics and pandemics.

Forward-looking statements in this earnings release should be

evaluated together with the many risks and uncertainties that

affect the company’s business and market, particularly those

identified in the cautionary statement and risk factors discussion

in the company’s Annual Report on Form 10-K for the year ended

December 31, 2023, as updated by the company’s subsequent Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K and other filings

with the SEC. The forward-looking statements included in this

document are made only as of the date of this document and except

as otherwise required by applicable law, the company undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

changed circumstances or otherwise.

BRISTOL-MYERS SQUIBB

COMPANY

CONSOLIDATED STATEMENTS OF

EARNINGS

(Unaudited, dollars and shares

in millions except per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net product sales

$

11,483

$

10,645

$

34,967

$

32,610

Alliance and other revenues

409

321

991

919

Total Revenues

11,892

10,966

35,958

33,529

Cost of products sold(a)

2,957

2,506

9,156

7,948

Marketing, selling and administrative

1,983

2,003

6,278

5,699

Research and development

2,374

2,242

7,968

6,821

Acquired IPRD

262

80

13,343

313

Amortization of acquired intangible

assets

2,406

2,256

7,179

6,769

Other (income)/expense, net

234

(258

)

588

(787

)

Total Expenses

10,216

8,829

44,512

26,763

(Loss)/Earnings Before Income Taxes

1,676

2,137

(8,554

)

6,766

Provision for Income Taxes

461

203

455

488

Net (Loss)/Earnings

1,215

1,934

(9,009

)

6,278

Noncontrolling Interest

4

6

11

15

Net (Loss)/Earnings Attributable to

BMS

$

1,211

$

1,928

$

(9,020

)

$

6,263

Weighted-Average Common Shares

Outstanding:

Basic

2,028

2,057

2,026

2,083

Diluted

2,031

2,064

2,026

2,093

(Loss)/Earnings per Common

Share:

Basic

$

0.60

$

0.94

$

(4.45

)

$

3.01

Diluted

0.60

0.93

(4.45

)

2.99

Other (income)/expense, net

Interest expense(b)

$

505

$

280

$

1,451

$

850

Royalty and licensing income

(180

)

(365

)

(532

)

(1,068

)

Royalty income - divestitures

(284

)

(217

)

(820

)

(623

)

Equity investment (gains)/losses

(12

)

—

(221

)

213

Integration expenses

69

54

214

180

Intangible asset impairments

47

29

47

29

Litigation and other settlements

—

(61

)

71

(393

)

Investment income

(94

)

(107

)

(364

)

(304

)

Provision for restructuring

78

141

558

321

Acquisition expense

—

—

50

—

Other

105

(12

)

134

8

Other (income)/expense, net

$

234

$

(258

)

$

588

$

(787

)

(a) Excludes amortization of acquired

intangible assets.

(b) Includes amortization of purchase

price adjustments to Celgene debt.

BRISTOL-MYERS SQUIBB

COMPANY

PRODUCT REVENUES

FOR THE THREE MONTHS ENDED

SEPTEMBER 30, 2024 AND 2023

(Unaudited, dollars in

millions)

Change vs. 2023

2024

2023

GAAP

Excl. F/X**

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

Growth Portfolio

Opdivo

$

1,366

$

994

$

2,360

$

1,343

$

932

$

2,275

2%

7%

4%

2%

16%

7%

Orencia

706

230

936

708

217

925

—%

6%

1%

—%

13%

3%

Yervoy

399

243

642

359

220

579

11%

10%

11%

11%

17%

13%

Reblozyl

358

89

447

200

48

248

79%

85%

80%

79%

90%

81%

Opdualag

216

17

233

162

4

166

33%

>200%

40%

33%

>200%

40%

Abecma

77

47

124

69

24

93

12%

96%

33%

12%

100%

34%

Zeposia

105

42

147

95

28

123

11%

50%

20%

11%

46%

19%

Breyanzi

173

51

224

77

15

92

125%

>200%

143%

125%

>200%

143%

Camzyos

135

21

156

67

1

68

101%

>200%

129%

101%

>200%

129%

Sotyktu

51

15

66

62

4

66

(18)%

>200%

—%

(18)%

>200%

—%

Augtyro

10

—

10

—

—

—

N/A

N/A

N/A

N/A

N/A

N/A

Krazati

32

2

34

—

—

—

N/A

N/A

N/A

N/A

N/A

N/A

Other Growth Products(a)

172

261

433

149

162

311

15%

61%

39%

15%

64%

41%

Total Growth Portfolio

3,800

2,012

5,812

3,291

1,655

4,946

15%

22%

18%

15%

29%

20%

Legacy Portfolio

Eliquis

2,045

957

3,002

1,772

933

2,705

15%

3%

11%

15%

2%

11%

Revlimid

1,212

200

1,412

1,209

220

1,429

—%

(9)%

(1)%

—%

(6)%

(1)%

Pomalyst/Imnovid

697

201

898

606

266

872

15%

(24)%

3%

15%

(24)%

3%

Sprycel

225

65

290

399

118

517

(44)%

(45)%

(44)%

(44)%

(42)%

(43)%

Abraxane

151

102

253

178

82

260

(15)%

24%

(3)%

(15)%

37%

1%

Other Legacy Products(b)

102

123

225

87

150

237

17%

(18)%

(5)%

17%

(19)%

(5)%

Total Legacy Portfolio

4,432

1,648

6,080

4,251

1,769

6,020

4%

(7)%

1%

4%

(6)%

1%

Total Revenues

$

8,232

$

3,660

$

11,892

$

7,542

$

3,424

$

10,966

9%

7%

8%

9%

11%

10%

**

See "Use of Non-GAAP Financial

Information".

(a)

Includes Onureg, Inrebic, Nulojix,

Empliciti and royalty revenues.

(b)

Includes other mature brands.

(c)

Beginning in 2024, Puerto Rico revenues

are included in International revenues. Prior period amounts have

been reclassified to conform to the current presentation.

(d)

Worldwide (WW) includes U.S. and

International (Int'l).

BRISTOL-MYERS SQUIBB COMPANY

PRODUCT REVENUES

FOR THE NINE MONTHS ENDED

SEPTEMBER 30, 2024 AND 2023

(Unaudited, dollars in

millions)

Change vs. 2023

2024

2023

GAAP

Excl. F/X**

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

U.S.

Int'l (c)

WW (d)

Growth Portfolio

Opdivo

$

3,927

$

2,898

$

6,825

$

3,845

$

2,777

$

6,622

2%

4%

3%

2%

14%

7%

Orencia

2,020

662

2,682

1,954

662

2,616

3%

—%

3%

3%

8%

5%

Yervoy

1,171

684

1,855

1,039

633

1,672

13%

8%

11%

13%

15%

14%

Reblozyl

999

227

1,226

534

154

688

87%

47%

78%

87%

50%

79%

Opdualag

637

37

674

429

8

437

48%

>200%

54%

48%

>200%

54%

Abecma

183

118

301

302

70

372

(39)%

69%

(19)%

(39)%

74%

(18)%

Zeposia

288

120

408

219

82

301

32%

46%

36%

32%

45%

35%

Breyanzi

382

102

484

218

45

263

75%

127%

84%

75%

131%

85%

Camzyos

342

37

379

142

1

143

141%

>200%

165%

141%

>200%

165%

Sotyktu

126

37

163

101

6

107

25%

>200%

52%

25%

>200%

54%

Augtyro

23

—

23

—

—

—

N/A

N/A

N/A

N/A

N/A

N/A

Krazati

82

5

87

—

—

—

N/A

N/A

N/A

N/A

N/A

N/A

Other Growth Products(a)

488

605

1,093

455

431

886

7%

40%

23%

7%

44%

25%

Total Growth Portfolio

10,668

5,532

16,200

9,238

4,869

14,107

15%

14%

15%

15%

22%

18%

Legacy Portfolio

Eliquis

7,410

2,728

10,138

6,610

2,722

9,332

12%

—%

9%

12%

1%

9%

Revlimid

3,830

604

4,434

3,951

696

4,647

(3)%

(13)%

(5)%

(3)%

(9)%

(4)%

Pomalyst/Imnovid

2,010

712

2,722

1,712

839

2,551

17%

(15)%

7%

17%

(14)%

7%

Sprycel

848

240

1,088

1,011

393

1,404

(16)%

(39)%

(23)%

(16)%

(35)%

(21)%

Abraxane

450

251

701

526

231

757

(14)%

9%

(7)%

(14)%

24%

(3)%

Other Legacy Products(b)

293

382

675

250

481

731

17%

(21)%

(8)%

17%

(19)%

(6)%

Total Legacy Portfolio

14,841

4,917

19,758

14,060

5,362

19,422

6%

(8)%

2%

6%

(6)%

2%

Total Revenues

$

25,509

$

10,449

$

35,958

$

23,298

$

10,231

$

33,529

9%

2%

7%

9%

7%

9%

**

See "Use of Non-GAAP Financial

Information".

(a)

Includes Onureg, Inrebic, Nulojix,

Empliciti and royalty revenues.

(b)

Includes other mature brands.

(c)

Beginning in 2024, Puerto Rico revenues

are included in International revenues. Prior period amounts have

been reclassified to conform to the current presentation.

(d)

Worldwide (WW) includes U.S. and

International (Int'l).

BRISTOL-MYERS SQUIBB COMPANY

INTERNATIONAL

REVENUES(a)

FOREIGN EXCHANGE IMPACT

(%)

(Unaudited)

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

Revenue Change %

F/X % Favorable/ (Unfavorable)

**

Revenue Change % Ex- F/X

**

Revenue Change %

F/X % Favorable/ (Unfavorable)

**

Revenue Change % Ex- F/X

**

Growth Portfolio

Opdivo

7%

(9)%

16%

4%

(10)%

14%

Orencia

6%

(7)%

13%

—%

(8)%

8%

Yervoy

10%

(7)%

17%

8%

(7)%

15%

Reblozyl

85%

(5)%

90%

47%

(3)%

50%

Opdualag

>200%

NM

>200%

>200%

NM

>200%

Abecma

96%

(4)%

100%

69%

(5)%

74%

Zeposia

50%

4%

46%

46%

1%

45%

Breyanzi

>200%

NM

>200%

127%

(4)%

131%

Camzyos

>200%

NM

>200%

>200%

NM

>200%

Sotyktu

>200%

NM

>200%

>200%

NM

>200%

Augtyro

N/A

N/A

N/A

N/A

N/A

N/A

Krazati

N/A

N/A

N/A

N/A

N/A

N/A

Other Growth Products(b)

61%

(3)%

64%

40%

(4)%

44%

Total Growth Portfolio

22%

(7)%

29%

14%

(8)%

22%

Legacy Portfolio

Eliquis

3%

1%

2%

—%

(1)%

1%

Revlimid

(9)%

(3)%

(6)%

(13)%

(4)%

(9)%

Pomalyst/Imnovid

(24)%

—%

(24)%

(15)%

(1)%

(14)%

Sprycel

(45)%

(3)%

(42)%

(39)%

(4)%

(35)%

Abraxane

24%

(13)%

37%

9%

(15)%

24%

Other Legacy Products(c)

(18)%

1%

(19)%

(21)%

(2)%

(19)%

Total Legacy Portfolio

(7)%

(1)%

(6)%

(8)%

(2)%

(6)%

Total Revenues

7%

(4)%

11%

2%

(5)%

7%

NM

Not meaningful

**

See "Use of Non-GAAP Financial

Information".

(a)

Beginning in 2024, Puerto Rico revenues

are included in International revenues. Prior period amounts have

been reclassified to conform to the current presentation.

(b)

Includes Onureg, Nulojix, Empliciti and

royalty revenues.

(c)

Includes other mature brands.

BRISTOL-MYERS SQUIBB

COMPANY

WORLDWIDE REVENUES(a)

FOREIGN EXCHANGE IMPACT

(%)

(Unaudited)

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

Revenue Change %

F/X % Favorable/ (Unfavorable)

**

Revenue Change % Ex- F/X

**

Revenue Change %

F/X % Favorable/ (Unfavorable)

**

Revenue Change % Ex- F/X

**

Growth Portfolio

Opdivo

4%

(3)%

7%

3%

(4)%

7%

Orencia

1%

(2)%

3%

3%

(2)%

5%

Yervoy

11%

(2)%

13%

11%

(3)%

14%

Reblozyl

80%

(1)%

81%

78%

(1)%

79%

Opdualag

40%

—%

40%

54%

—%

54%

Abecma

33%

(1)%

34%

(19)%

(1)%

(18)%

Zeposia

20%

1%

19%

36%

1%

35%

Breyanzi

143%

—%

143%

84%

(1)%

85%

Camzyos

129%

—%

129%

165%

—%

165%

Sotyktu

—%

—%

—%

52%

(2)%

54%

Augtyro

N/A

N/A

N/A

N/A

N/A

N/A

Krazati

N/A

N/A

N/A

N/A

N/A

N/A

Other Growth Products(b)

39%

(2)%

41%

23%

(2)%

25%

Total Growth Portfolio

18%

(2)%

20%

15%

(3)%

18%

Legacy Portfolio

Eliquis

11%

—%

11%

9%

—%

9%

Revlimid

(1)%

—%

(1)%

(5)%

(1)%

(4)%

Pomalyst/Imnovid

3%

—%

3%

7%

—%

7%

Sprycel

(44)%

(1)%

(43)%

(23)%

(2)%

(21)%

Abraxane

(3)%

(4)%

1%

(7)%

(4)%

(3)%

Other Legacy Products(c)

(5)%

—%

(5)%

(8)%

(2)%

(6)%

Total Legacy Portfolio

1%

—%

1%

2%

—%

2%

Total Revenues

8%

(2)%

10%

7%

(2)%

9%

**

See "Use of Non-GAAP Financial

Information".

(a)

Worldwide (WW) includes U.S. and

International (Int'l).

(b)

Includes Onureg, Nulojix, Empliciti and

royalty revenues.

(c)

Includes other mature brands.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF GAAP AND

NON-GAAP GROWTH DOLLARS AND PERCENTAGES EXCLUDING FOREIGN EXCHANGE

IMPACT *

(Unaudited, dollars in

millions)

THREE MONTHS

2024

2023

Change $

Change %

Favorable / (Unfavorable) F/X

$ **

2024 Excl. F/X **

Favorable / (Unfavorable) F/X

% **

% Change Excl. F/X **

Revenues

$

11,892

$

10,966

$

926

8%

$

(135)

$

12,027

(2)%

10%

Gross profit

8,935

8,460

475

6%

N/A

N/A

N/A

N/A

Gross profit excluding specified

items(a)

9,036

8,476

560

7%

N/A

N/A

N/A

N/A

Gross margin(b)

75.1

%

77.1

%

Gross margin excluding specified items

76.0

%

77.3

%

Marketing, selling and administrative

1,983

2,003

(20

)

(1)%

15

1,998

1%

—%

Marketing, selling and administrative

excluding specified items(a)

1,976

1,938

38

2%

15

1,991

1%

3%

Research and development

2,374

2,242

132

6%

8

2,382

—%

6%

Research and development excluding

specified items(a)

2,353

2,178

175

8%

8

2,361

—%

8%

Operating margin(c)

38.5

%

38.4

%

Operating margin excluding specified

items

39.6

%

39.8

%

NINE MONTHS

2024

2023

Change $

Change %

Favorable / (Unfavorable) F/X

$ **

2024 Excl. F/X **

Favorable / (Unfavorable) F/X

% **

% Change Excl. F/X **

Revenues

$

35,958

$

33,529

$

2,429

7%

$

(512)

$

36,470

(2)%

9%

Gross profit

26,802

25,581

1,221

5%

N/A

N/A

N/A

N/A

Gross profit excluding specified

items(a)

27,221

25,718

1,503

6%

N/A

N/A

N/A

N/A

Gross margin(b)

74.5

%

76.3

%

Gross margin excluding specified items

75.7

%

76.7

%

Marketing, selling and administrative

6,278

5,699

579

10%

68

6,346

1%

11%

Marketing, selling and administrative

excluding specified items(a)

5,887

5,614

273

5%

68

5,955

1%

6%

Research and development

7,968

6,821

1,147

17%

32

8,000

—%

17%

Research and development excluding

specified items(a)

6,994

6,636

358

5%

32

7,026

1%

6%

Operating margin(c)

34.9

%

39.0

%

Operating margin excluding specified

items

39.9

%

40.2

%

*

Foreign exchange impacts were derived by

converting our current-period local currency financial results

using the prior period average currency rates and comparing these

adjusted amounts to our current-period results.

**

See "Use of Non-GAAP Financial

Information".

(a)

Refer to the Specified Items schedule

below for further details.

(b)

Represents gross profit as a percentage of

Revenues.

(c)

Operating margin represents gross profit

less marketing, selling and administrative expenses and research

and development expenses, as a percentage of Revenues.

BRISTOL-MYERS SQUIBB

COMPANY

SPECIFIED ITEMS

(Unaudited, dollars in

millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Inventory purchase price accounting

adjustments

$

13

$

—

$

34

$

84

Intangible asset impairment

—

—

280

—

Site exit and other costs

88

16

105

53

Cost of products sold

101

16

419

137

Acquisition related charges(a)

—

—

372

—

Site exit and other costs

7

65

19

85

Marketing, selling and

administrative

7

65

391

85

IPRD impairments

—

60

590

80

Priority review voucher

—

—

—

95

Acquisition related charges(a)

—

—

348

—

Site exit and other costs

21

4

36

10

Research and development

21

64

974

185

Amortization of acquired intangible

assets

2,406

2,256

7,179

6,769

Interest expense(b)

(12

)

(12

)

(37

)

(39

)

Equity investment (gain)/losses

(13

)

(2

)

(222

)

206

Acquisition expenses

—

—

50

—

Integration expenses

69

54

214

180

Litigation and other settlements

—

(62

)

61

(397

)

Provision for restructuring

78

141

558

321

Intangible asset impairment

47

29

47

29

Other

106

(1

)

116

(6

)

Other (income)/expense, net

275

147

787

294

Increase to Earnings before income

taxes

2,810

2,548

9,750

7,470

Income taxes on items above

(371

)

(340

)

(1,296

)

(944

)

Income tax reserve releases

—

—

(502

)

—

Income taxes attributed to a non-U.S. tax

ruling

—

—

—

(656

)

Income taxes

(371

)

(340

)

(1,798

)

(1,600

)

Increase to net earnings

$

2,439

$

2,208

$

7,952

$

5,870

(a)

Includes cash settlement of unvested stock

awards, and other related costs incurred in connection with the

recent acquisitions of Karuna, RayzeBio and Mirati.

(b)

Includes amortization of purchase price

adjustments to Celgene debt.

BRISTOL-MYERS SQUIBB

COMPANY

RECONCILIATION OF CERTAIN GAAP

LINE ITEMS TO CERTAIN NON-GAAP LINE ITEMS

(Unaudited, dollars and shares

in millions except per share data)

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

GAAP

Specified Items(a)

Non-GAAP

GAAP

Specified Items(a)

Non-GAAP

Gross profit

$

8,935

$

101

$

9,036

$

26,802

$

419

$

27,221

Marketing, selling and administrative

1,983

(7

)

1,976

6,278

(391

)

5,887

Research and development

2,374

(21

)

2,353

7,968

(974

)

6,994

Amortization of acquired intangible

assets

2,406

(2,406

)

—

7,179

(7,179

)

—

Other (income)/expense, net

234

(275

)

(41

)

588

(787

)

(199

)

Earnings/(Loss) before income

taxes

1,676

2,810

4,486

(8,554

)

9,750

1,196

Provision for income taxes

461

371

832

455

1,798

2,253

Net earnings/(loss) attributable to BMS

used for diluted EPS calculation

$

1,211

$

2,439

$

3,650

$

(9,020

)

$

7,952

$

(1,068

)

Weighted-average common shares

outstanding—diluted

2,031

2,031

2,031

2,026

2,026

2,026

Diluted earnings/(loss) per share

$

0.60

$

1.20

$

1.80

$

(4.45

)

$

3.92

$

(0.53

)

Effective tax rate

27.5

%

(9.0

)%

18.5

%

(5.3

)%

193.7

%

188.4

%

Three Months Ended September

30, 2023

Nine Months Ended September

30, 2023

GAAP

Specified Items(a)

Non-GAAP

GAAP

Specified Items(a)

Non-GAAP

Gross profit

$

8,460

$

16

$

8,476

$

25,581

$

137

$

25,718

Marketing, selling and administrative

2,003

(65

)

1,938

5,699

(85

)

5,614

Research and development

2,242

(64

)

2,178

6,821

(185

)

6,636

Amortization of acquired intangible

assets

2,256

(2,256

)

—

6,769

(6,769

)

—

Other (income)/expense, net

(258

)

(147

)

(405

)

(787

)

(294

)

(1,081

)

Earnings before income taxes

2,137

2,548

4,685

6,766

7,470

14,236

Provision for income taxes

203

340

543

488

1,600

2,088

Net earnings attributable to BMS used

for diluted EPS calculation

$

1,928

$

2,208

$

4,136

$

6,263

$

5,870

$

12,133

Weighted-average common shares

outstanding—diluted

2,064

2,064

2,064

2,093

2,093

2,093

Diluted earnings per share

$

0.93

$

1.07

$

2.00

$

2.99

$

2.81

$

5.80

Effective tax rate

9.5

%

2.1

%

11.6

%

7.2

%

7.5

%

14.7

%

(a) Refer to the Specified Items schedule

above for further details. Effective tax rate on the Specified

Items represents the difference between the GAAP and Non-GAAP

effective tax rate.

BRISTOL-MYERS SQUIBB

COMPANY

NET DEBT CALCULATION

AS OF SEPTEMBER 30, 2024 AND

DECEMBER 31, 2023

(Unaudited, dollars in

millions)

September 30,

2024

December 31,

2023

Cash and cash equivalents

$

7,890

$

11,464

Marketable debt securities - current

204

816

Marketable debt securities -

non-current

324

364

Cash, cash equivalents and marketable

debt securities

$

8,418

$

12,644

Short-term debt obligations

(1,078

)

(3,119

)

Long-term debt

(48,674

)

(36,653

)

Net debt position

$

(41,334

)

$

(27,128

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031512594/en/

For more information, contact: Media Relations:

media@bms.com Investor Relations: investor.relations@bms.com

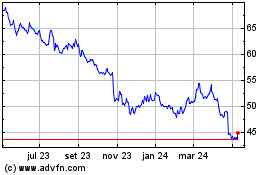

Bristol Myers Squibb (NYSE:BMY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

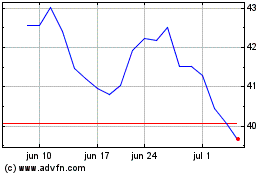

Bristol Myers Squibb (NYSE:BMY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024