Delivers Record SaaS Annual Recurring Revenue

(“ARR”) of $53 million in Q3 2024

Returns Cash to Shareholders with Share

Repurchase

Focuses on Four Pillars to Drive Shareholder

Value and Customer Success

SmartRent, Inc. (NYSE: SMRT) (“SmartRent” or the “Company”), a

leading provider of smart communities solutions and smart

operations solutions for the rental housing industry, today

reported financial results for the three months ended September 30,

2024. Management is hosting an investor call to discuss results

today, November 6, 2024, at 11:30 a.m. Eastern Time.

Financial and Business Highlights for the Third Quarter

2024

- Total Revenue of $40.5 million, decreased by 30% percent

year-over year.

- SaaS Revenue of $13.3 million, increased by 23% percent

year-over year.

- Net Loss of $(9.9) million, increased by 29% percent from

$(7.7) million year-over-year.

- Adjusted EBITDA of $(3.8) million, improved by 24% percent,

from $(5.0) million year-over-year.

- Repurchased 9.8 million shares at an aggregate cost of $17.1

million.

- Balance Sheet: $163.7 million in cash, cash equivalents and

restricted cash as of September 30, 2024, no debt and an undrawn

credit facility of $75 million.

Management Commentary

"In the third quarter, SmartRent demonstrated remarkable

resilience and strategic focus amid a series of market headwinds

and operational transitions," stated John Dorman, Chairman of the

Board. "During the quarter, we confirmed and strengthened our firm

belief that the key issues affecting SmartRent performance are

execution issues, while the core business model, the growth

potential of our market, our market leadership position and the

differentiated value proposition for our customers all remain very

compelling,"

Dorman continued, "As a key step in addressing execution, we are

excited to announce the hiring of our new Chief Revenue Officer,

Natalie Cariola, to lead the revitalization of our sales strategy

with the goal of driving further revenue growth and market share

expansion. And, to further focus and align our efforts, we’ve

defined four strategic pillars: Sustainable ARR Growth, Platform

Superiority, Operational Excellence and Collaborative Innovation.

With a solid strategy in place and a clear focus on enhancing our

competitive strengths, SmartRent is well prepared to capitalize on

significant market opportunities, deliver high ROI to our customers

and create sustainable long-term value for our shareholders."

Third Quarter 2024 Results

The Company delivered a 23% year-over-year increase in SaaS

revenue, driven by improvements in SaaS ARPU and Units Deployed.

Over the same period, ARR increased to $53.2 million, up from $43.3

million in Q3 2023. SaaS ARPU for the quarter increased by 5%, to

$5.70 from $5.41 in Q3 2023, primarily due to improvements in

pricing. Additionally, Units Booked SaaS ARPU saw an increase of 8%

to $9.73 from $9.04 in Q3 2023.

Total revenue for the quarter was $40.5 million, a 30% decrease

from the same quarter in the prior year, driven by fewer Units

Shipped and New Units Deployed. Hosted services revenue, which

includes $13.3 million of SaaS revenue, was $18.5 million for the

quarter, a 12.0% increase from $16.5 million from the same quarter

in the prior year. Hardware revenue was $18.7 million, a decrease

of $16.9 million or 47% from the same quarter in the prior year.

Professional services revenue was $3.3 million, a decrease of $2.7

million, or 45% from the same quarter in the prior year.

As of September 30, 2024, Units Deployed reached 787,038, a 15%

increase with 104,406 more units compared to September 30, 2023.

The Company had 15,168 New Units Deployed during the quarter, a 53%

decrease with 32,308 New Units Deployed in the same quarter in the

prior year. Units Booked for the quarter was 17,048, a 63% decrease

with 29,224 fewer units compared to the same quarter in the prior

year. Total Bookings were $19.6 million, marking a $30.1 million or

61% decrease from the same quarter in the prior year. Daryl Stemm,

CFO and interim Principal Executive Officer commented, "Our New

Units Deployed and Total Bookings were disappointing but not

unexpected, as we anticipated some market headwinds and disruptions

stemming from our July leadership change. We are taking steps to

reorient our sales force under the leadership of Natalie Cariola,

our new Chief Revenue Officer."

In the third quarter, total gross margin improved to 33.2% from

23.3%, or approximately 1,000 basis points, from the same quarter

in the prior year, primarily driven by changes to product mix, cost

management and improvements to our operating model. SaaS gross

margin decreased to 73.0% from 74.2%, for a decrease of

approximately 100-basis points from the same quarter in the prior

year. Total gross profit in the third quarter was $13.5 million and

was essentially flat from the same quarter in the prior year.

Hardware gross profit was $4.9 million, a 39.8% decrease from $8.1

million from the same quarter in the prior year. Professional

services gross loss narrowed to $(3.5) million from $(5.2) million

in the same quarter of the previous year, primarily due to overall

reduced volume in New Units Deployed, followed by the benefits of

cost management initiatives. Hosted services gross profit increased

to $12.1 million from $10.6 million in the same quarter in the

prior year and continues to be the Company’s most profitable

revenue stream.

In the third quarter of 2024, operating expenses were $25.2

million, an increase from $23.5 million in the same quarter from

the prior year, primarily reflecting the impact of one-time

separation expenses. Net losses in the third quarter were $(9.9)

million, compared to $(7.7) million in the third quarter of 2023.

Adjusted EBITDA was $(3.8) million, a 24% improvement from $(5.0)

million in the same quarter from the prior year.

Under the Company’s authorized $50 million share repurchase

program, SmartRent repurchased approximately 9.8 million shares at

an aggregate cost of $17.1 million in the quarter. Following the

close of the quarter through November 4, 2024, the Company

repurchased an additional 2.4 million shares, leaving approximately

$22.6 million available for future repurchases. The Company ended

the quarter with a cash balance of approximately $164 million.

"We believe our solid balance sheet and prudent capital

management will enable us to work through the current leadership

transition, address our operational challenges and allow us to

invest in advancing our growth strategies,” stated Stemm.

Revenue Drivers

For the three months ended

September 30,

2024

2023

% Change

Hardware

Hardware Units Shipped

44,763

62,585

-28

%

Hardware ARPU

$

418

$

569

-27

%

Professional Services

New Units Deployed

15,168

32,308

-53

%

Professional Services ARPU

$

443

$

253

75

%

Hosted Services

Units Deployed (1)

787,038

682,632

15

%

Average aggregate units deployed

779,454

666,478

17

%

SaaS ARPU

$

5.70

$

5.41

5

%

Bookings

Units Booked

17,048

46,272

-63

%

Bookings (in 000's)

$

19,582

$

49,661

-61

%

Units Booked SaaS ARPU

$

9.73

$

9.04

8

%

(1) As of the last date of the quarter

Conference Call Information

SmartRent is hosting a conference call today, November 6, 2024,

at 11:30 a.m. ET to discuss its financial results. To join the

call, please register on the Company’s investor relations website

here. A copy of the third quarter 2024 earnings deck is available

on the Investor Relations section of SmartRent’s website.

About SmartRent

Founded in 2017, SmartRent, Inc. (NYSE: SMRT) is a leading

provider of smart communities solutions and smart operations

solutions to the rental housing industry. SmartRent’s end-to-end

ecosystem powers smarter living and working in rental housing by

automating operations, protecting assets, reducing energy

consumption and more. The Company’s differentiators - purpose-built

software and hardware, and end-to-end implementation and support -

create an exceptional experience, with 15 of the top 20 multifamily

operators and millions of users leveraging SMRT solutions daily.

For more information, please visit smartrent.com.

Forward-Looking Statements

This press release contains forward-looking statements which

address the Company's expected future business and financial

performance, areas of focus, including our sales organization, the

Company's approach to operational and financial discipline,

leadership transition, expected growth, strategy, performance,

financial review, stock repurchase program and expected benefits

from stock repurchase program, and other future events and

forward-looking statements. Forward-looking statements may contain

words such as "goal," "target," "future," "estimate," "expect,"

"anticipate," "intend," "plan," "believe," "seek," "project,"

"may," "should," "will" or similar expressions. Examples of

forward-looking statements include, among others, statements

regarding the expected financial results, product portfolio

enhancements, expansion plans and opportunities and earnings

guidance related to financial and operational metrics.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those

currently anticipated. Some of the factors that could cause actual

results to differ materially from those expressed or implied by the

forward-looking statements include, among other things, our ability

to: (1) accelerate adoption of our products and services; (2)

anticipate the uncertainties inherent in the development of new

business lines and business strategies; (3) manage risks associated

with our third-party suppliers and manufacturers and partners for

our products; (4) manage risks associated with adverse

macroeconomic conditions, including inflation, slower growth or

recession, barriers to trade, changes to fiscal and monetary

policy, tighter credit, higher interest rates, high unemployment,

and currency fluctuations; (5) attract, train, and retain effective

officers, key employees and directors and manage risks associated

with the leadership transition; (6) develop, design, manufacture,

and sell products and services that are differentiated from those

of competitors; (7) realize the benefits expected from our

acquisitions; (8) acquire or make investments in other businesses,

patents, technologies, products or services to grow the business;

(9) successfully pursue, defend, resolve or anticipate the outcome

of pending or future litigation matters; (10) comply with laws and

regulations applicable to our business, including privacy

regulations; (11) realize the benefits expected from our stock

repurchase program; and (12) maintain key strategic relationships

with partners and distributors. The forward-looking statements

herein represent the judgment of the Company, as of the date of

this release, and SmartRent disclaims any intent or obligation to

update forward-looking statements. This press release should be

read in conjunction with the information included in the Company's

other press releases, reports and other filings with the SEC.

Understanding the information contained in these filings is

important in order to fully understand the Company's reported

financial results and our business outlook for future periods.

Use of Non-GAAP Financial Measures

In addition to disclosing financial results that are determined

in accordance with GAAP, SmartRent also discloses certain non-GAAP

financial measures in this press release, including EBITDA and

Adjusted EBITDA. These financial measures are not recognized

measures under GAAP and should not be considered in isolation or as

a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP.

We define Adjusted EBITDA as EBITDA before the following items:

non-recurring legal matters, stock-based compensation expense,

non-recurring warranty provisions, impairment of investment in a

non-affiliate, compensation expenses in connection with

acquisitions, non-recurring expenses in connection with

acquisitions, other acquisition expenses, and other expenses caused

by non-recurring, or unusual, events that are not indicative of our

ongoing business. We define EBITDA as net income or loss computed

in accordance with GAAP before interest income/expense, income tax

expense and depreciation and amortization.

EBITDA and Adjusted EBITDA may be determined or calculated

differently by other companies. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP financial measures

have been provided in the financial statement tables included in

this press release, and investors are encouraged to review the

reconciliations.

EBITDA and Adjusted EBITDA are not used as measures of

SmartRent’s liquidity and should not be considered alternatives to

net income or loss or any other measure of financial performance

presented in accordance with GAAP.

SmartRent’s management uses EBITDA and Adjusted EBITDA in a

number of ways to assess the Company’s financial and operating

performance and believes that these measures provide useful

information to investors regarding financial and business trends

related to SmartRent’s results of operations. EBITDA and Adjusted

EBITDA are also used to identify certain expenses and make

decisions designed to help SmartRent meet its current financial

goals and optimize its financial performance, while neutralizing

the impact of expenses included in its operating results which

could otherwise mask underlying trends in its business. SmartRent’s

management believes that investors are provided with a more

meaningful understanding of SmartRent’s ongoing operating

performance when non-GAAP financial information is viewed with GAAP

financial information.

Operating Metrics Defined

SmartRent regularly monitors several operating metrics including

the following which the Company believes are key measures of its

growth, to evaluate its operating performance, identify trends

affecting its business, formulate business plans, measure its

progress, and make strategic decisions. These metrics may not

provide accurate predictions of future GAAP financial results.

Units Deployed is defined as the aggregate number of Hub

Devices that have been installed (including customer

self-installations) and have an active subscription as of a stated

measurement date.

New Units Deployed is defined as the aggregate number of

Hub Devices that were installed (including customer

self-installations) and resulted in a new active subscription

during a stated measurement period.

Units Shipped is defined as the aggregate number of Hub

Devices that have been shipped to customers during a stated

measurement period.

Units Booked is defined as the aggregate number of Hub

Device units subject to binding orders executed during a stated

measurement period that will result in a New Unit Deployed. The

Company utilizes the concept of Units Booked to measure estimated

near-term resource demand and the resulting approximate range of

post-delivery revenue that it will earn and record. Units Booked

represent binding orders only.

Bookings represent the contract value of hardware,

professional services, and the first year of ARR for binding orders

executed during a stated measurement period.

Annual Recurring Revenue (“ARR”) is defined as the

annualized value of our SaaS revenue earned in the current

quarter.

Average Revenue per Unit (“ARPU”) is used to assess the

growth and health of the overall business and reflects our ability

to acquire, retain, engage and monetize our customers, and thereby

drive revenue. Each revenue stream ARPU is calculated as

follows:

Hardware ARPU is total hardware

revenue during a given period divided by the total Units Shipped

during the same period.

Professional Services ARPU is total

professional services revenue during a given period divided by the

total New Units Deployed, excluding customer self-installations,

during the same period.

SaaS ARPU is total SaaS revenue during

a given period divided by the average aggregate Units Deployed in

the same period.

Units Booked SaaS ARPU is the first

year ARR for binding orders executed during the stated measurement

period divided by the total Units Booked in the same period.

Net Revenue Retention is defined as SaaS revenue at the

end of the current period related to properties which had SaaS

revenue at the end of the same period in the prior year, divided by

SaaS revenue at the end of the same period in the prior year for

those same properties. This includes additions to revenue from

price increases on existing products, and additions of new products

at existing properties offset by any reductions in revenue caused

by cancellations or downgrades.

SMARTRENT, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share

amounts)

For the three months ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

Revenue

Hardware

$

18,707

$

35,631

$

72,460

$

100,744

Professional services

3,308

5,962

12,582

28,781

Hosted services

18,495

16,511

54,475

47,060

Total revenue

40,510

58,104

139,517

176,585

Cost of revenue

Hardware

13,843

27,556

48,845

82,118

Professional services

6,840

11,130

22,157

44,573

Hosted services

6,370

5,887

18,330

17,365

Total cost of revenue

27,053

44,573

89,332

144,056

Operating expense

Research and development

6,596

7,573

22,442

21,340

Sales and marketing

4,444

4,636

13,714

14,626

General and administrative

14,154

11,269

42,843

33,891

Total operating expense

25,194

23,478

78,999

69,857

Loss from operations

(11,737

)

(9,947

)

(28,814

)

(37,328

)

Interest income, net

2,019

2,233

6,718

6,064

Other income (expense), net

(187

)

(42

)

7

(45

)

Loss before income taxes

(9,905

)

(7,756

)

(22,089

)

(31,309

)

Income tax expense (benefit)

18

(33

)

131

(22

)

Net loss

(9,923

)

(7,723

)

(22,220

)

(31,287

)

Other comprehensive loss

Foreign currency translation

adjustment

270

(188

)

265

(93

)

Comprehensive loss

(9,653

)

(7,911

)

(21,955

)

(31,380

)

Net loss per common share

Basic and diluted

$

(0.05

)

$

(0.04

)

$

(0.11

)

$

(0.16

)

Weighted-average number of shares used in

computing net loss per share

Basic and diluted

198,731

201,584

201,391

199,858

SMARTRENT, INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except per share

amounts)

As of

September 30, 2024

December 31, 2023

ASSETS

Current assets

Cash and cash equivalents

$

163,403

$

215,214

Restricted cash, current portion

247

495

Accounts receivable, net

63,013

61,903

Inventory

35,948

41,575

Deferred cost of revenue, current

portion

10,158

11,794

Prepaid expenses and other current

assets

12,217

9,359

Total current assets

284,986

340,340

Property and equipment, net

1,357

1,400

Deferred cost of revenue

4,713

11,251

Goodwill

117,268

117,268

Intangible assets, net

24,343

27,249

Other long-term assets

15,926

12,248

Total assets

$

448,593

$

509,756

LIABILITIES, CONVERTIBLE PREFERRED

STOCK AND STOCKHOLDERS' EQUITY

Current liabilities

Accounts payable

$

9,535

$

15,076

Accrued expenses and other current

liabilities

26,574

24,976

Deferred revenue, current portion

49,861

77,257

Total current liabilities

85,970

117,309

Deferred revenue

50,111

45,903

Other long-term liabilities

7,371

4,096

Total liabilities

143,452

167,308

Commitments and contingencies

Convertible preferred stock, $0.0001 par

value; 50,000 shares authorized as of September 30, 2024 and

December 31, 2023; no shares of preferred stock issued and

outstanding as of September 30, 2024 and December 31, 2023

-

-

Stockholders' equity

Class A common stock, $0.0001 par value;

500,000 shares authorized as of September 30, 2024 and December 31,

2023, respectively; 192,971 and 203,327 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

19

20

Additional paid-in capital

636,418

628,156

Accumulated deficit

(331,345

)

(285,512

)

Accumulated other comprehensive loss

49

(216

)

Total stockholders' equity

305,141

342,448

Total liabilities, convertible preferred

stock and stockholders' equity

$

448,593

$

509,756

SMARTRENT, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

For the nine months ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net loss

$

(22,220

)

$

(31,287

)

Depreciation and amortization

4,730

3,991

Impairment of investment in

non-affiliate

2,250

-

Provision for warranty expense

(837

)

-

Non-cash lease expense

1,079

733

Stock-based compensation related to

acquisition

-

109

Stock-based compensation

9,523

10,120

Compensation expense related to

acquisition

-

1,913

Change in fair value of earnout related to

acquisition

140

225

Non-cash interest expense

107

103

Provision for excess and obsolete

inventory

2,697

1,780

Provision for expected credit losses

804

39

Non-cash legal expense

7,255

-

Accounts receivable

(1,739

)

(1,142

)

Inventory

(2,020

)

26,423

Deferred cost of revenue

8,175

9,928

Prepaid expenses and other assets

4,474

537

Accounts payable

(5,581

)

(9,338

)

Accrued expenses and other liabilities

(5,338

)

(12,299

)

Deferred revenue

(23,189

)

(2,378

)

Lease liabilities

(1,208

)

(823

)

Net cash used in operating activities

(20,898

)

(1,366

)

Purchase of property and equipment

(524

)

(116

)

Capitalized software costs

(4,501

)

(3,197

)

Net cash used in investing activities

(5,025

)

(3,313

)

Payments for repurchases of Class A common

stock

(23,462

)

-

Proceeds from options exercise

2

899

Proceeds from ESPP purchases

586

809

Taxes paid related to net share

settlements of stock-based compensation awards

(1,849

)

(1,506

)

Payment of earnout related to

acquisition

(1,530

)

(1,702

)

Net cash used in financing activities

(26,253

)

(1,500

)

Effect of exchange rate changes on cash

and cash equivalents

117

(40

)

Net decrease in cash, cash equivalents,

and restricted cash

(52,059

)

(6,219

)

Cash, cash equivalents, and restricted

cash - beginning of period

215,709

217,713

Cash, cash equivalents, and restricted

cash - end of period

$

163,650

$

211,494

Cash and cash equivalents

$

163,403

$

211,000

Restricted cash, current portion

247

247

Restricted cash, included in other

long-term assets

-

247

Total cash, cash equivalents, and

restricted cash

$

163,650

$

211,494

SMARTRENT, INC.

RECONCILIATION OF NON-GAAP

MEASURES

For the three months ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

(dollars in thousands)

(dollars in thousands)

Net loss

$

(9,923

)

$

(7,723

)

$

(22,220

)

$

(31,287

)

Interest income, net

(2,019

)

(2,233

)

(6,718

)

(6,064

)

Income tax expense (benefit)

18

(33

)

131

(22

)

Depreciation and amortization

1,644

1,395

4,730

3,991

EBITDA

(10,280

)

(8,594

)

(24,077

)

(33,382

)

Legal matter

2,325

-

7,625

-

Stock-based compensation

1,653

3,273

8,218

10,229

Impairment of investment in

non-affiliate

-

-

2,250

-

Non-recurring warranty provision

(522

)

-

(59

)

-

Compensation expense in connection with

acquisitions

-

15

-

2,010

Other acquisition expenses

(4

)

(23

)

253

408

Other non-operating expenses

3,006

317

3,267

805

Adjusted EBITDA

$

(3,822

)

$

(5,012

)

$

(2,523

)

$

(19,930

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106368931/en/

Investor Contact Kelly Reisdorf Head of Investor

Relations investors@smartrent.com

Media Contact Amanda Chavez Vice President, Marketing

& Communications media@smartrent.com

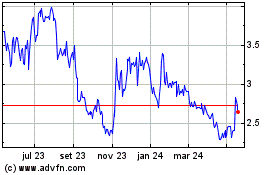

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

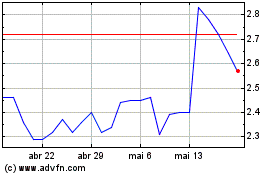

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024