Concurrently Announces Full Redemption of

4.750% Senior Notes due 2026

Tender Offer and Redemption Continue Coty’s

Deleveraging Agenda

Regulatory News:

Coty Inc. (NYSE: COTY) (Paris:COTY) (“Coty” or the “Company”)

today announced its offer to purchase for cash up to $250,000,000

aggregate principal amount (subject to increase) (the “Notes Cap”)

of its outstanding 5.000% Senior Secured Notes due 2026 (the

“Notes”). Such offer to purchase is referred to herein as the

“Tender Offer.”

Title of Security

Security Identifiers

Principal Amount

Outstanding

Tender Offer

Consideration(1)(2)

Early

Tender

Premium(1)(2)

Total

Consideration(1)(2)(3)

5.000% Senior Secured Notes due

2026

CUSIPs: 222070AE4 U2203CAE1

ISINs:

US222070AE41 (144A) USU2203CAE13

(Reg S)

$650,000,000

$970.00

$30.00

$1,000.00

(1) Per $1,000 principal amount of Notes validly tendered on or

prior to the Early Tender Date (as defined below) and accepted for

purchase by the Company. (2) Does not include Accrued Interest (as

defined below), which will also be payable as described below. (3)

Includes the Early Tender Premium (as defined below).

The Tender Offer is being made upon the terms and subject to

conditions described in the Offer to Purchase, dated November 6,

2024 (as it may be amended or supplemented from time to time, the

“Offer to Purchase”), which sets forth a detailed description of

the Tender Offer. The Company reserves the right, but is under no

obligation, to increase or decrease the Notes Cap in its sole

discretion at any time without extending or reinstating withdrawal

rights, subject to compliance with applicable law.

The Tender Offer will expire at 5:00 p.m., New York City time,

on December 6, 2024, or any other date and time to which the

Company extends the Tender Offer (such date and time, as it may be

extended with respect to the Tender Offer, the “Expiration Date”),

unless earlier terminated. Holders of Notes must validly tender and

not validly withdraw their Notes prior to or at 5:00 p.m., New York

City time, on November 20, 2024 (such date and time, as it may be

extended with respect to the Tender Offer, the “Early Tender

Date”), and the holder’s Notes must be accepted for purchase, to be

eligible to receive the Total Consideration (as defined below). If

a holder validly tenders Notes after the Early Tender Date but

prior to or at the Expiration Date, and the holder’s Notes are

accepted for purchase, the holder will only be eligible to receive

the Tender Offer Consideration (as defined below).

Subject to the Notes Cap and proration, if applicable, the total

consideration for each $1,000 principal amount of the Notes validly

tendered (and not validly withdrawn) prior to the Early Tender Date

and accepted for purchase pursuant to the Tender Offer will be as

set forth in the table above (excluding Accrued Interest (as

defined below), the “Total Consideration”). The Total Consideration

includes an early tender premium per $1,000 principal amount of

Notes accepted for purchase as set forth in the table above (the

“Early Tender Premium”). Notes validly tendered after the Early

Tender Date but prior to the Expiration Date and accepted for

purchase will receive the Total Consideration minus the Early

Tender Premium (the “Tender Offer Consideration”).

In addition to the consideration described above, all holders of

Notes accepted for purchase in the Tender Offer will receive

accrued and unpaid interest on such Notes from the last interest

payment date with respect to such Notes to, but not including, the

applicable settlement date (“Accrued Interest”).

The Company intends to fund the purchase of validly tendered and

accepted Notes with available cash on hand and other sources of

liquidity. The purpose of the Tender Offer is to purchase a portion

of the Notes, subject to the Notes Cap, in order to reduce the

Company’s total outstanding public debt consistent with the

Company’s previously announced deleveraging strategy.

The Tender Offer will expire on the Expiration Date. Except as

set forth below, payment for the Notes that are validly tendered

prior to or at the Expiration Date and that are accepted for

purchase will be made on a date promptly following the Expiration

Date, which is currently anticipated to be December 10, 2024, the

second business day after the Expiration Date. The Company reserves

the right, in its sole discretion, to make payment for Notes that

are validly tendered prior to or at the Early Tender Date and that

are accepted for purchase on an earlier settlement date, which, if

applicable, is currently anticipated to be November 22, 2024,

provided that the conditions to the satisfaction of the Tender

Offer are satisfied. The Company is not obligated to conduct any

early settlement or have any early settlement occur on any

particular date.

Tendered Notes may be withdrawn prior to or at, but not after,

5:00 p.m., New York City time, on November 20, 2024.

The Tender Offer is subject to the satisfaction or waiver of

certain conditions which are specified in the Offer to Purchase.

The Tender Offer is not conditioned on any minimum principal amount

of Notes being tendered.

Information Relating to the Tender Offer

The Offer to Purchase is being distributed to holders beginning

today. MUFG Securities Americas Inc. is serving as Dealer Manager

in connection with the Tender Offer. Investors with questions

regarding the terms and conditions of the Tender Offer may contact

the dealer manager as follows:

MUFG Securities Americas Inc. 1221 Avenue of

the Americas, 6th Floor New York, New York 10020 Attn: Liability

Management U.S.: +1 (212) 405-7481 U.S. Toll-Free: +1 (877)

744-4532

D.F. King & Co., Inc. is the Tender and Information Agent

for the Tender Offer. Any questions regarding procedures for

tendering Notes or request for copies of the Offer to Purchase

should be directed to D.F. King & Co., Inc. by any of the

following means: by telephone at +1 (800) 714-3306 (toll-free) or

+1 (212) 269-5550 (collect) or by email at coty@dfking.com.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, the Notes. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such an offer, solicitation or sale would be unlawful. The

Tender Offer is being made solely pursuant to the Offer to Purchase

made available to holders of the Notes. None of the Company or its

affiliates, their respective boards of directors, the dealer

manager, the tender and information agent or the trustee with

respect to any series of Notes is making any recommendation as to

whether or not holders should tender or refrain from tendering all

or any portion of their Notes in response to the Tender Offer.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, consult their own investment and tax advisors

and make their own decisions whether to tender Notes in the Tender

Offer, and, if so, the principal amount of Notes to tender.

Full Redemption of 4.750% Senior Notes due 2026

On November 6, 2024, the Company issued a notice of full

redemption for the €180.3 million outstanding aggregate principal

amount of its 4.750% Senior Notes due 2026 (the “4.750% Notes”).

The 4.750% Notes will be redeemed in full on December 6, 2024 (the

“Redemption Date”), at a redemption price equal to 100% of the

principal amount of the 4.750% Notes to be redeemed, plus accrued

and unpaid interest thereon to, but excluding, the Redemption Date.

The Tender Offer is not conditioned on the completion of the

redemption of the 4.750% Notes.

About Coty Inc.

Founded in Paris in 1904, Coty is one of the world’s largest

beauty companies with a portfolio of iconic brands across

fragrance, color cosmetics, and skin and body care. Coty serves

consumers around the world, selling prestige and mass market

products in more than 125 countries and territories. Coty and its

brands empower people to express themselves freely, creating their

own visions of beauty; and Coty is committed to protecting the

planet.

Cautionary Note Regarding Forward Looking Statements

The statements contained in this press release include certain

“forward-looking statements” within the meaning of the securities

laws. These forward-looking statements reflect Coty’s current views

with respect to, among other things, the proposed Tender Offer, the

expected source of funds, and the redemption of the 4.750% Notes.

These forward-looking statements are generally identified by words

or phrases, such as “anticipate,” “are going to,” “estimate,”

“plan,” “project,” “expect,” “believe,” “intend,” “foresee,”

“forecast,” “will,” “may,” “should,” “outlook,” “continue,”

“temporary,” “target,” “aim,” “potential,” “goal” and similar words

or phrases. These statements are based on certain assumptions and

estimates that Coty considers reasonable and are not guarantees of

Coty’s future performance, but are subject to a number of risks and

uncertainties, many of which are beyond Coty’s control, which could

cause actual events or results (including Coty’s financial

condition, results of operations, cash flow and prospects) to

differ materially from such statements, including Coty’s ability to

consummate the Tender Offer or the redemption of the 4.750% Notes

on the terms and timing described herein, or at all, and other

factors identified in “Risk Factors” included in Coty’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2024 and its

subsequent quarterly report on Form 10-Q. All forward-looking

statements made in this press release are qualified by these

cautionary statements. These forward-looking statements are made

only as of the date of this press release, and Coty does not

undertake any obligation, other than as may be required by law, to

update or revise any forward-looking or cautionary statements to

reflect changes in assumptions, the occurrence of events,

unanticipated or otherwise, or changes in future operating results

over time or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106783175/en/

For more information contact: Investor Relations

Olga Levinzon +1 212 389-7733 olga_levinzon@cotyinc.com

Media Antonia Werther +31 621 394495

antonia_werther@cotyinc.com

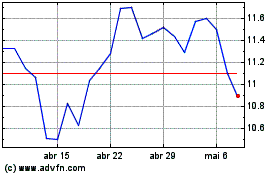

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024