- Achieved $67.8 million in total net revenue and $55.5 million

in net product revenue for the third quarter of 2024, representing

year-over-year growth of 24% and 36%, respectively

- Generated $17.0 million in cash flow from operations in the

third quarter and had cash, cash equivalents, restricted cash, and

investments of $348.7 million as of September 30, 2024

- Anticipates a one-time restructuring charge in the fourth

quarter of 2024 of $15 to $19 million and estimates

post-restructuring annualized cash-based operating expense savings

of more than $40 million

- Reiterates 2024 net product revenue guidance range of $210 to

$220 million for fiscal year 2024

Webcast and conference call to be hosted today

at 8:30 a.m. ET

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the

Company) today issued its financial results for the third quarter

and nine months ended September 30, 2024. With continued strong

commercial execution, the Company achieved significant

year-over-year growth in total net revenue and net product revenue

and $17.0 million in cash flow from operations in the third

quarter. Having achieved $158.6 million in net product revenue for

the nine months ended September 30, 2024, the Company is

reiterating its net product revenue guidance range of $210 to $220

million for fiscal year 2024.

Aurinia is implementing a strategic restructuring to sharpen the

Company’s focus on continued LUPKYNIS® growth and the rapid

development of AUR200. This restructuring will result in a

workforce reduction of approximately 45% and will focus the

Company’s LUPKYNIS commercial strategy on the highest growth

drivers. The restructuring will also improve operational

efficiency, with anticipated post-restructuring annualized

cash-based operating expense savings of more than $40 million.

“We are pleased to report continued strong momentum through the

first nine months of the year,” stated Peter Greenleaf, President

and Chief Executive Officer of Aurinia. “Going forward, our

streamlined organization will enable us to lean further into key

areas of the commercial LUPKYNIS business that have historically

delivered optimal returns, while at the same time accelerating the

development of our important pipeline product, AUR200.”

In the third quarter of 2024, the Company added 364 PSFs and 146

new patients who were either restarting LUPKYNIS or receiving it

through a hospital pharmacy. Together, these total 510, which is

17% higher than the 436 PSFs in the third quarter of 2023.

Conversion rates (PSFs converted to patients on therapy), time to

conversion, and adherence rates remained consistent with the prior

quarter.

Recent Milestones Achieved

- In September 2024, the first participant was dosed in a Phase 1

study of AUR200, a differentiated, potential best-in-class therapy

for autoimmune diseases that targets both BAFF (B-cell Activating

Factor) and APRIL (A Proliferation-Inducing Ligand). The Company

continues to expect to report initial results from this study in

the first half of 2025.

- In September 2024, the Japanese Ministry of Health, Labour, and

Welfare approved LUPKYNIS, triggering the recognition of an

additional $10 million milestone payment from Aurinia’s

collaboration partner, Otsuka Pharmaceutical Co., Ltd.

Financial Results for the Three and Nine Months Ended

September 30, 2024

Total net revenue was $67.8 million for the three months ended

September 30, 2024, and $54.5 million for the same period in 2023,

representing growth of 24%. Year to date total net revenue was

$175.3 million for the nine months ended September 30, 2024,

compared to $130.4 million for the same period in 2023,

representing growth of 34%.

Net product revenue was $55.5 million for the three months ended

September 30, 2024, and $40.8 million for the same period in 2023,

representing growth of 36%. Net product revenue was $158.6 million

for the nine months ended September 30, 2024, and $116.2 million

for the same period in 2023, representing growth of 36%. The

increase in both periods is primarily due to increased LUPKYNIS

sales to the Company’s two main specialty pharmacies, driven

predominantly by further penetration of the lupus nephritis (LN)

market. Additionally, for the nine months ended September 30, 2024,

Aurinia had sales of semi-finished product to Otsuka to support

continued commercialization in its territories.

U.S. market penetration grew 25% year-over-year, with 2,422

patients on LUPKYNIS therapy as of September 30, 2024, compared to

1,939 as of September 30, 2023.

License, collaboration, and royalty revenues were $12.3 million

and $13.7 million for the three months ended September 30, 2024,

and September 30, 2023, respectively, and $16.7 million and $14.2

million for the nine months ended September 30, 2024, and September

30, 2023, respectively. The revenue is primarily due to a $10.0

million milestone recognized in the third quarter of 2024 for the

Japanese Ministry of Health, Labour, and Welfare approval of

LUPKYNIS and a $10.0 million milestone recognized in the third

quarter of 2023 for pricing and reimbursement approval, coupled

with manufacturing services revenue from Otsuka related to shared

capacity services that commenced in late June 2023.

Cost of sales were $6.0 million and $6.8 million for the three

months ended September 30, 2024, and September 30, 2023,

respectively, and $22.7 million and $8.8 million for the nine

months ended September 30, 2024, and September 30, 2023,

respectively. The increase for the nine months ended September 30,

2024, is primarily due to the amortization of the monoplant finance

right of use asset, which was placed into service in late June 2023

and therefore only partially impacted prior year results.

Gross margin was 91% and 88% for the three months ended

September 30, 2024, and September 30, 2023, respectively, and 87%

and 93% for the nine months ended September 30, 2024, and September

30, 2023, respectively.

SG&A expenses, inclusive of share-based compensation, were

$42.4 million and $47.8 million for the three months ended

September 30, 2024, and September 30, 2023, respectively, and

$135.0 million and $145.0 million for the nine months ended

September 30, 2024, and September 30, 2023, respectively. The

decrease in both periods is primarily due to lower employee related

costs, including share-based compensation and overhead costs, as a

result of a reduction in general and administrative headcount,

which occurred late in the first quarter of 2024.

R&D expenses, inclusive of share-based compensation expense,

were $3.0 million and $13.6 million for the three months ended

September 30, 2024, and September 30, 2023, respectively, and $12.7

million and $39.4 million for the nine months ended September 30,

2024, and September 30, 2023, respectively. The primary drivers in

both periods were lower employee costs due to a reduction in

headcount late in the first quarter of 2024, a decrease of expenses

related to ceasing Aurinia’s AUR300 development program, and timing

of expenses related to developing AUR200.

Restructuring expenses were nil and $7.8 million for the three

and nine months ended September 30, 2024, and nil for the three and

nine months ended September 30, 2023. Restructuring expenses

primarily included employee severance, one-time benefit payments,

and contract termination expenses related to the restructuring,

which occurred late in the first quarter of 2024.

For the three months ended September 30, 2024, Aurinia recorded

net income of $14.4 million or $0.10 net income per common share,

as compared to a net loss of $(13.4) million or $(0.09) net loss

per common share for the three months ended September 30, 2023. For

the nine months ended September 30, 2024, Aurinia recorded a net

income of $4.3 million or $0.03 net income per common share, as

compared to a net loss of $(51.1) million or $(0.36) net loss per

common share for the nine months ended September 30, 2023.

Financial Liquidity at September 30, 2024

As of September 30, 2024, Aurinia had cash, cash equivalents,

restricted cash, and investments of $348.7 million, compared to

$350.7 million at December 31, 2023.

Cash flow from operations was $17.0 million for the three months

ended September 30, 2024, compared to $(13.3) million for the three

months ended September 30, 2023. Cash flow from operations was

$14.3 million for the nine months ended September 30, 2024,

compared to $(47.8) million for the nine months ended September 30,

2023.

All amounts in this press release are expressed in U.S. dollars.

This press release is intended to be read in conjunction with the

Company’s unaudited condensed consolidated financial statements and

Management's Discussion and Analysis for the quarter and nine

months ended September 30, 2024, in the Company’s Quarterly Report

on Form 10-Q and the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, including risk factors disclosed

therein, which will be accessible on Aurinia's website at

www.auriniapharma.com, on SEDAR at www.sedarplus.ca or on EDGAR at

www.sec.gov/edgar.

Webcast & Conference Call Details

The link to the audio webcast is available here. To join the

conference call, please dial (800) 715-9871 / +1 (646) 307-1963.

Conference ID: 6251719 or company name required for entry. A replay

of the webcast will be available on Aurinia’s website.

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical

company focused on delivering therapies to people living with

autoimmune diseases with high unmet medical needs. In January 2021,

the Company introduced LUPKYNIS® (voclosporin), the first

FDA-approved oral therapy dedicated to the treatment of adult

patients with active lupus nephritis. Aurinia is also developing

AUR200, a differentiated, potential best-in-class therapy for

autoimmune diseases that targets both BAFF (B-cell Activating

Factor) and APRIL (A Proliferation-Inducing Ligand).

Forward-Looking Statements

Certain statements made in this press release may constitute

forward-looking information within the meaning of applicable

Canadian securities law and forward-looking statements within the

meaning of applicable United States securities law. These

forward-looking statements or information include but are not

limited to statements or information with respect to: Aurinia’s

anticipation of a one-time restructuring charge in the fourth

quarter of 2024 of $15 to $19 million, with post-restructuring

annualized cash-based operating expense savings of more than $40

million; Aurinia’s estimates as to annual net product revenue from

sales of LUPKYNIS in the range of $210 to $220 million in fiscal

year 2024; Aurinia’s estimate that it will reduce its workforce by

approximately 45%; and Aurinia’s expectation that its restructuring

will further improve operational efficiency. It is possible that

such results or conclusions may change. Words such as “anticipate”,

“will”, “believe”, “estimate”, “expect”, “intend”, “target”,

“plan”, “goals”, “objectives”, “may” and other similar words and

expressions, identify forward-looking statements. The Company has

made numerous assumptions about the forward-looking statements and

information contained herein, including among other things,

assumptions about: the accuracy of reported data from third party

studies and reports; the expected number of patient start forms,

patients restarting therapy, and hospital fills, conversion rates

and time to convert for patients; pricing for LUPKYNIS and patient

persistency on the product; that Aurinia’s intellectual property

rights are valid and do not infringe the intellectual property

rights of third parties; the clinical development opportunities for

its pipeline products; Aurinia’s assumptions relating to the

capital required to fund operations; the timing and ability to

execute on Aurinia’s restructuring plans; the costs, benefits and

scope of Aurinia’s restructuring plans; that Aurinia’s current good

relationships with its suppliers, service providers and other third

parties will be maintained; assumptions relating to the burn rate

of Aurinia’s cash for operations; and that Aurinia’s third party

service providers will comply with their contractual

obligations.

Forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance, or

achievements of Aurinia to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking information. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking statements or information. Such risks,

uncertainties and other factors include, among others, the

following: Aurinia’s actual future financial and operational

results may differ from its expectations; difficulties Aurinia may

experience in completing the commercialization of LUPKYNIS;

difficulties Aurinia may experience executing its restructuring

program; challenges in the conduct of clinical studies; the market

for the LN business may not be as estimated; Aurinia may have to

pay unanticipated expenses; Aurinia may not be able to obtain

sufficient supply to meet commercial demand for LUPKYNIS in a

timely fashion; unknown impact and difficulties imposed by the

widespread health concerns on Aurinia’s business operations

including nonclinical, clinical, regulatory and commercial

activities; the results from Aurinia’s clinical studies and from

third party studies and reports may not be accurate; Aurinia’s

third party service providers may not, or may not be able to,

comply with their obligations under their agreements with Aurinia;

and Aurinia’s assets or business activities may be subject to

disputes that may result in litigation or other legal claims.

Although Aurinia has attempted to identify factors that would cause

actual actions, events, or results to differ materially from those

described in forward-looking statements and information, there may

be other factors that cause actual results, performances,

achievements, or events to not be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

or information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, you should not place undue reliance

on forward-looking statements or information. All forward-looking

information contained in this press release is qualified by this

cautionary statement. Additional information related to Aurinia,

including a detailed list of the risks and uncertainties affecting

Aurinia and its business, can be found in Aurinia’s most recent

Annual Report on Form 10-K and its other public available filings

available by accessing the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (SEDAR)

website at www.sedarplus.ca or the U.S. Securities and Exchange

Commission’s Electronic Document Gathering and Retrieval System

(EDGAR) website at www.sec.gov/edgar, and on Aurinia’s website at

www.auriniapharma.com.

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

September 30,

2024

December 31, 2023

ASSETS

Current assets

Cash, cash equivalents, and restricted

cash

$

37,142

$

48,875

Short-term investments

311,605

301,614

Accounts receivable, net

36,483

24,089

Inventories, net

38,714

39,705

Prepaid expenses and deposits

13,815

9,486

Other current assets

2,700

1,031

Total current assets

440,459

424,800

Non-current assets

Long-term investments

—

201

Other non-current assets

868

1,517

Property and equipment, net

2,887

3,354

Acquired intellectual property and other

intangible assets, net

4,509

4,977

Finance right-of-use assets, net

96,459

108,715

Operating right-of-use assets, net

4,179

4,498

Total assets

$

549,361

$

548,062

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

56,770

54,389

Deferred revenue

4,304

4,813

Other current liabilities

1,590

2,388

Finance lease liabilities

14,927

14,609

Operating lease liabilities

1,018

989

Total current liabilities

78,609

77,188

Non-current liabilities

Finance lease liabilities

65,955

75,479

Operating lease liabilities

5,951

6,530

Deferred compensation and other

non-current liabilities

10,844

10,911

Total liabilities

161,359

170,108

SHAREHOLDER’S EQUITY

Common shares - no par value, unlimited

shares authorized, 143,109 and 143,833 shares issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively

1,206,613

1,200,218

Additional paid-in capital

119,773

120,788

Accumulated other comprehensive loss

(385

)

(730

)

Accumulated deficit

(937,999

)

(942,322

)

Total shareholders' equity

388,002

377,954

Total liabilities and shareholders'

equity

$

549,361

$

548,062

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

(unaudited)

Revenue

Product revenue, net

$

55,503

$

40,781

$

158,604

$

116,218

License, collaboration, and royalty

revenue

12,268

13,734

16,662

14,200

Total revenue, net

67,771

54,515

175,266

130,418

Operating expenses

Cost of sales

6,035

6,769

22,696

8,753

Selling, general and administrative

42,367

47,759

134,996

144,964

Research and development

3,047

13,605

12,678

39,413

Restructuring expenses

—

—

7,755

—

Other expense (income), net

4,574

2,645

159

(695

)

Total cost of sales and operating

expenses

56,023

70,778

178,284

192,435

Income (Loss) from operations

11,748

(16,263

)

(3,018

)

(62,017

)

Interest expense

(1,208

)

(1,400

)

(3,689

)

(1,465

)

Interest income

4,267

4,514

12,982

12,429

Net income (loss) before income taxes

14,807

(13,149

)

6,275

(51,053

)

Income tax expense

457

298

1,952

92

Net income (loss)

$

14,350

$

(13,447

)

$

4,323

$

(51,145

)

Net income (loss) per share:

Basic

$

0.10

$

(0.09

)

$

0.03

$

(0.36

)

Diluted

$

0.10

$

(0.09

)

$

0.03

$

(0.36

)

Weighted-average common shares

outstanding:

Basic

143,051

142,847

143,353

143,085

Diluted

145,651

142,847

145,010

143,085

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

Nine Months Ended September

30,

2024

2023

(in thousands)

(unaudited)

Cash flows from operating

activities

Net income (loss)

$

4,323

$

(51,145

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

14,583

6,698

Net amortization of premiums and discounts

on short-term investments

(9,752

)

(8,836

)

Share-based compensation expense

22,650

33,543

Foreign exchange on finance lease

liability

(718

)

(1,335

)

Other, net

220

(1,659

)

Net changes in operating assets and

liabilities

Accounts receivable, net

(12,394

)

(24,463

)

Inventories, net

991

(8,984

)

Prepaid expenses and other current

assets

(6,001

)

(2,889

)

Non-current operating assets

(12

)

(16

)

Accounts payable, accrued and other

liabilities

934

11,812

Operating lease liabilities

(550

)

(499

)

Net cash provided by (used in) operating

activities

14,274

(47,773

)

Cash flows from investing

activities

Purchase of investments

(461,140

)

(379,213

)

Proceeds from investments

461,448

391,287

Upfront lease payment

(44

)

(11,864

)

Purchase of property and equipment

—

(419

)

Capitalized patent costs

(225

)

(240

)

Net cash provided by (used in) investing

activities

39

(449

)

Cash flows from financing

activities

Repurchase of common shares

(18,435

)

—

Principal portion of finance lease

payments

(8,959

)

(3,482

)

Proceeds from exercise of stock options

and employee share purchase plan

1,348

3,929

Cash (used in) provided by financing

activities

(26,046

)

447

Net decrease in cash, cash equivalents,

and restricted cash

(11,733

)

(47,775

)

Cash, cash equivalents, and restricted

cash, beginning of period

48,875

94,172

Cash, cash equivalents, and restricted

cash, end of period

$

37,142

$

46,397

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107603962/en/

Media & Investor Inquiries: Andrea Christopher

Corporate Communications & Investor Relations Aurinia

Pharmaceuticals Inc. achristopher@auriniapharma.com General

Investor Inquiries: ir@auriniapharma.com

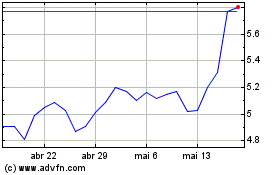

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025