The Trade Desk, Inc. (“The Trade Desk,” the “Company” or “we”)

(NASDAQ: TTD), a provider of a global technology platform for

buyers of advertising, today announced financial results for its

third quarter ended September 30, 2024.

“The Trade Desk delivered strong performance in the third

quarter, with revenue of $628 million, accelerating growth to 27%.

This performance underlines the value that advertisers are placing

on precision and transparency as they work with us to maximize the

impact of their campaigns,” said Jeff Green, Co-founder and CEO of

The Trade Desk. “As we enter our busiest time of year and look

ahead to 2025, we have never been in a better position to capture

greater share of the $1 trillion advertising TAM. 2024 has been a

banner year for CTV. Many of the largest media companies are now

working with us to help clients capture the full value of CTV

advertising via programmatic. We are similarly excited about the

momentum in retail media and the pace of adoption by advertisers

who are taking advantage of our retail data marketplace. And the

performance improvements that our clients are seeing with Kokai -

our largest platform upgrade to date - showcase the value of

audience-driven, AI-enabled innovation.”

Third Quarter 2024 Financial

Highlights:

The following table summarizes our unaudited consolidated

financial results for the three and nine months ended September 30,

2024 and 2023 ($ in millions, except per share amounts):

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Results

Revenue

$

628

$

493

$

1,704

$

1,340

Increase in revenue year over year

27

%

25

%

27

%

23

%

Net income

$

94

$

39

$

211

$

82

Net income margin

15

%

8

%

12

%

6

%

GAAP diluted earnings per share

$

0.19

$

0.08

$

0.42

$

0.16

Non-GAAP Results

Adjusted EBITDA

$

257

$

200

$

661

$

488

Adjusted EBITDA margin

41

%

40

%

39

%

36

%

Non-GAAP net income

$

207

$

167

$

536

$

421

Non-GAAP diluted earnings per share

$

0.41

$

0.33

$

1.07

$

0.84

Third Quarter and Recent Business

Highlights:

- Strong Customer Retention: Customer retention remained

over 95% during the third quarter, as it has for the past ten

consecutive years.

- Continued Collaboration and Support for Unified ID 2.0:

The Trade Desk is building support for Unified ID 2.0 (UID2), an

industry-wide approach to identity that preserves the value of

relevant advertising, while putting user control and privacy at the

forefront. UID2 is an upgrade and alternative to third-party

cookies. Recent partnerships and pledges of integration and support

include:

- Spotify is extending its partnership with The Trade Desk,

piloting integrations with OpenPath and UID2 through Spotify Ad

Exchange.

- Roku announced its adoption of UID2, allowing advertisers to

implement more precise targeting and a secure means to facilitate

data collaboration with Roku Media.

- Reach, a UK news publisher of 130 media brands, is adopting

EUID as part of their commitment to protecting journalism with a

best-in-class advertising experience for readers.

- Global media company Motorsport Network announced adoption of

EUID to provide relevant advertising while prioritizing consumer

privacy and transparency for its 60 million authenticated

users.

- Cint announced integration of UID2 to provide robust,

omnichannel brand lift measurement.

- Industry Recognition (2024):

- Institutional Investor Awards - Most Honored Company, Best CEO,

Best Company Board, Best IR Program, Best IR Professional, Best IR

Team, Best Analyst Day

- U.S. News & World Report Best Company to Work For

- Business Insider Rising Stars of Adtech

- AdExchanger Top Women in Media & Ad Tech

- MM+M 40 under 40

- Retail TouchPoints 40 under 40

- Share Repurchases: The Company repurchased $54 million

of its Class A common stock in the third quarter of 2024. As of

September 30, 2024, the Company had $521 million available and

authorized for repurchases.

Financial Guidance:

Fourth Quarter 2024 outlook summary:

- Revenue at least $756 million

- Adjusted EBITDA of approximately $363 million

We have not provided an outlook for GAAP net income or

reconciliation of Adjusted EBITDA guidance to net income, the

closest corresponding U.S. GAAP measure, because net income outlook

is not available without unreasonable efforts on a forward-looking

basis due to the variability and complexity with respect to the

charges included in the calculation of this non-GAAP measure; in

particular, the measures and effects of our stock-based

compensation expense that are directly impacted by unpredictable

fluctuations in our share price. We expect the variability of the

above charges could have a significant and potentially

unpredictable impact on our future U.S. GAAP financial results.

Use of Non-GAAP Financial

Information

Included within this press release are the non-GAAP financial

measures of Adjusted EBITDA, Adjusted EBITDA margin, Non-GAAP net

income and Non-GAAP diluted earnings per share (“EPS”) that

supplement the Condensed Consolidated Statements of Operations of

The Trade Desk, Inc. (the Company) prepared under generally

accepted accounting principles (GAAP). Adjusted EBITDA is earnings

before depreciation and amortization; stock-based compensation;

interest income, net; and provision for income taxes. Adjusted

EBITDA margin is Adjusted EBITDA divided by revenue, and Adjusted

EBITDA margin’s closest corresponding U.S. GAAP measure is net

income margin, which is GAAP net income divided by revenue.

Non-GAAP net income excludes charges and the related income tax

effects for stock-based compensation. Tax rates on the

tax-deductible portions of the stock-based compensation expense

approximating 25% to 30% have been used in the computation of

non-GAAP net income and non-GAAP diluted EPS. Reconciliations of

GAAP to non-GAAP amounts for the periods presented herein are

provided in schedules accompanying this release and should be

considered together with the Condensed Consolidated Statements of

Operations. These non-GAAP measures are not meant as a substitute

for GAAP, but are included solely for informational and comparative

purposes. The Company's management believes that this information

can assist investors in evaluating the Company's operational

trends, financial performance, and cash-generating capacity.

Management believes these non-GAAP measures allow investors to

evaluate the Company’s financial performance using some of the same

measures as management. However, the non-GAAP financial measures

should not be regarded as a replacement for or superior to

corresponding, similarly captioned, GAAP measures and may be

different from non-GAAP financial measures used by other

companies.

Third Quarter 2024 Financial Results

Webcast and Conference Call Details

- When: November 7, 2024 at 2:00 P.M. Pacific Time (5:00

P.M. Eastern Time).

- Webcast: A live webcast of the call can be accessed from

the Investor Relations section of The Trade Desk’s website at

http://investors.thetradedesk.com/. Following the call, a replay

will be available on the Company’s website.

- Dial-in: To access the call via telephone in North

America, please dial 888-506-0062. For callers outside the United

States, please dial 1-973-528-0011. Participants should reference

the conference call ID code “349188” after dialing in.

- Audio replay: An audio replay of the call will be

available beginning about two hours after the call. To listen to

the replay in the United States, please dial 877-481-4010 (replay

code: 51455). Outside the United States, please dial 1-919-882-2331

(replay code: 51455). The audio replay will be available via

telephone until November 14, 2024.

The Trade Desk, Inc. uses its Investor Relations website

(http://investors.thetradedesk.com/), its Twitter feed

(@TheTradeDesk), LinkedIn page

(https://www.linkedin.com/company/the-trade-desk/), Facebook page

(https://www.facebook.com/TheTradeDesk/) and Jeff Green’s LinkedIn

profile (https://www.linkedin.com/in/jefftgreen/) as a means of

disclosing information about the Company and for complying with its

disclosure obligations under Regulation FD. The information that is

posted through these channels may be deemed material. Accordingly,

investors should monitor these channels in addition to The Trade

Desk’s press releases, SEC filings, public conference calls and

webcasts.

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of

advertising. Through its self-service, cloud-based platform, ad

buyers can create, manage, and optimize digital advertising

campaigns across ad formats and devices. Integrations with major

data, inventory, and publisher partners ensure maximum reach and

decisioning capabilities, and enterprise APIs enable custom

development on top of the platform. Headquartered in Ventura, CA,

The Trade Desk has offices across North America, Europe and Asia

Pacific. To learn more, visit thetradedesk.com or follow us on

Facebook, Twitter, LinkedIn and YouTube.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements relate to expectations concerning matters

that (a) are not historical facts, (b) predict or forecast future

events or results, or (c) embody assumptions that may prove to have

been inaccurate, including statements relating to industry and

market trends, the Company’s financial targets, such as revenue and

Adjusted EBITDA. When words such as “believe,” “expect,”

“anticipate,” “will,” “outlook” or similar expressions are used,

the Company is making forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, it cannot give readers

any assurance that such expectations will prove correct. These

forward-looking statements involve risks, uncertainties and

assumptions, including those related to the Company’s relatively

limited operating history, which makes it difficult to evaluate the

Company’s business and prospects, the market for programmatic

advertising developing slower or differently than the Company’s

expectations, the demands and expectations of clients and the

ability to attract and retain clients. The actual results may

differ materially from those anticipated in the forward-looking

statements as a result of numerous factors, many of which are

beyond the control of the Company. These are disclosed in the

Company’s reports filed from time to time with the Securities and

Exchange Commission, including its most recent Form 10-K and any

subsequent filings on Forms 10-Q or 8-K, available at www.sec.gov.

Readers are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company does not intend to update any

forward-looking statement contained in this press release to

reflect events or circumstances arising after the date hereof.

THE TRADE DESK, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Amounts in thousands, except

per share amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

628,016

$

493,266

$

1,703,819

$

1,340,323

Operating expenses (1):

Platform operations

122,656

93,382

336,745

264,903

Sales and marketing

140,296

112,466

395,888

321,177

Technology and development

117,705

117,772

335,426

309,790

General and administrative

138,878

131,969

403,902

388,411

Total operating expenses

519,535

455,589

1,471,961

1,284,281

Income from operations

108,481

37,677

231,858

56,042

Total other income, net

(18,697

)

(19,323

)

(53,845

)

(51,277

)

Income before income taxes

127,178

57,000

285,703

107,319

Provision for income taxes

33,020

17,648

74,856

25,702

Net income

$

94,158

$

39,352

$

210,847

$

81,617

Earnings per share:

Basic

$

0.19

$

0.08

$

0.43

$

0.17

Diluted

$

0.19

$

0.08

$

0.42

$

0.16

Weighted-average shares outstanding:

Basic

491,614

489,447

489,845

489,195

Diluted

502,563

501,880

500,273

500,348

___________________________

(1) Includes stock-based compensation

expense as follows:

THE TRADE DESK, INC.

STOCK-BASED COMPENSATION

EXPENSE

(Amounts in thousands)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Platform operations

$

7,617

$

5,729

$

20,444

$

14,642

Sales and marketing

25,294

21,116

70,654

54,039

Technology and development

36,958

43,727

97,441

91,283

General and administrative (1)

58,641

69,061

176,931

210,222

Total

$

128,510

$

139,633

$

365,470

$

370,186

___________________________

(1) Includes stock-based compensation

expense related to a long-term CEO performance grant of $30 million

and $48 million for the three months ended September 30, 2024 and

2023, respectively, as well as $102 million and $156 million for

the nine months ended September 30, 2024 and 2023,

respectively.

THE TRADE DESK, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands)

(Unaudited)

As of September 30,

2024

As of December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,221,475

$

895,129

Short-term investments, net

510,290

485,159

Accounts receivable, net

2,989,387

2,870,313

Prepaid expenses and other current

assets

117,221

63,353

Total current assets

4,838,373

4,313,954

Property and equipment, net

197,973

161,422

Operating lease assets

242,431

197,732

Deferred income taxes

154,849

154,849

Other assets, non-current

71,699

60,730

Total assets

$

5,505,325

$

4,888,687

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

2,409,773

$

2,317,318

Accrued expenses and other current

liabilities

142,459

137,996

Operating lease liabilities

62,858

55,524

Total current liabilities

2,615,090

2,510,838

Operating lease liabilities,

non-current

230,355

180,369

Other liabilities, non-current

34,130

33,261

Total liabilities

2,879,575

2,724,468

Stockholders' equity:

Preferred stock

—

—

Common stock

—

—

Additional paid-in capital

2,397,100

1,967,265

Retained earnings

228,650

196,954

Total stockholders' equity

2,625,750

2,164,219

Total liabilities and stockholders'

equity

$

5,505,325

$

4,888,687

THE TRADE DESK, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

Nine Months Ended September

30,

2024

2023

OPERATING ACTIVITIES:

Net income

$

210,847

$

81,617

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

63,378

59,889

Stock-based compensation

365,470

370,186

Noncash lease expense

41,522

36,672

Provision for expected credit losses on

accounts receivable

837

1,811

Other

(11,901

)

(8,312

)

Changes in operating assets and

liabilities:

Accounts receivable

(125,711

)

(130,650

)

Prepaid expenses and other current and

non-current assets

(68,490

)

(11,370

)

Accounts payable

87,175

125,661

Accrued expenses and other current and

non-current liabilities

8,846

18,439

Operating lease liabilities

(31,918

)

(36,741

)

Net cash provided by operating

activities

540,055

507,202

INVESTING ACTIVITIES:

Purchases of investments

(486,596

)

(448,251

)

Maturities of investments

475,022

425,400

Purchases of property and equipment

(78,048

)

(21,594

)

Capitalized software development costs

(6,708

)

(6,097

)

Net cash used in investing activities

(96,330

)

(50,542

)

FINANCING ACTIVITIES:

Repurchases of Class A common stock

(177,428

)

(426,684

)

Proceeds from exercise of stock

options

127,690

45,363

Proceeds from employee stock purchase

plan

30,122

21,316

Taxes paid related to net settlement of

restricted stock awards

(97,763

)

(55,397

)

Net cash used in financing activities

(117,379

)

(415,402

)

Increase in cash and cash equivalents

326,346

41,258

Cash and cash equivalents—Beginning of

period

895,129

1,030,506

Cash and cash equivalents—End of

period

$

1,221,475

$

1,071,764

Non-GAAP Financial Metrics

(Amounts in thousands, except per share

amounts)

(Unaudited)

The following tables show the Company’s

non-GAAP financial metrics reconciled to the comparable GAAP

financial metrics included in this release.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net income

$

94,158

$

39,352

$

210,847

$

81,617

Add back (deduct):

Depreciation and amortization expense

20,754

20,530

63,378

59,889

Stock-based compensation expense

128,510

139,633

365,470

370,186

Interest income, net

(19,408

)

(17,626

)

(53,886

)

(49,556

)

Provision for income taxes

33,020

17,648

74,856

25,702

Adjusted EBITDA

$

257,034

$

199,537

$

660,665

$

487,838

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income

$

94,158

$

39,352

$

210,847

$

81,617

Add back (deduct):

Stock-based compensation expense

128,510

139,633

365,470

370,186

Adjustment for income taxes

(15,441

)

(11,742

)

(40,739

)

(30,566

)

Non-GAAP net income

$

207,227

$

167,243

$

535,578

$

421,237

GAAP diluted earnings per share

$

0.19

$

0.08

$

0.42

$

0.16

GAAP weighted-average shares

outstanding—diluted

502,563

501,880

500,273

500,348

Non-GAAP diluted earnings per share

$

0.41

$

0.33

$

1.07

$

0.84

Non-GAAP weighted-average shares used in

computing Non-GAAP earnings per share, diluted

502,563

501,880

500,273

500,348

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107931247/en/

Investors Jake Graves Senior Manager, Investor Relations

The Trade Desk ir@thetradedesk.com

Media Melinda Zurich VP, Communications The Trade Desk

melinda.zurich@thetradedesk.com

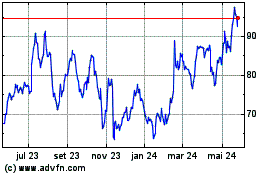

The Trade Desk (NASDAQ:TTD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

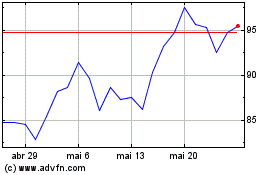

The Trade Desk (NASDAQ:TTD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024