Upstart Holdings, Inc. (NASDAQ: UPST), the leading artificial

intelligence (AI) lending marketplace, today announced financial

results for its third quarter of fiscal year 2024 ended September

30, 2024. Upstart will host a conference call and webcast at 1:30

p.m. Pacific Time today. An earnings presentation and link to the

webcast are available at ir.upstart.com.

“With 43% sequential growth in lending volume and a return to

positive adjusted EBITDA, we continue to strengthen Upstart’s

position as the fintech leader in artificial intelligence,” said

Dave Girouard, co-founder and CEO of Upstart. “Even without a

significant boost from the macroeconomy, we’re back in growth

mode.”

Third Quarter 2024 Financial Highlights

- Revenue. Total revenue was $162 million, an increase of

20% from the third quarter of 2023, and up 27% sequentially. Total

fee revenue was $168 million, an increase of 14% year-over-year,

and up 28% sequentially.

- Transaction Volume and Conversion Rate. 188,149 loans

were originated, totaling $1.6 billion across our platform in the

third quarter of 2024, up 30% from the same quarter of the prior

year, and up 43% sequentially. Conversion on rate requests was

16.3% in the third quarter of 2024, up from 9.5% in the same

quarter of the prior year.

- Income (Loss) from Operations. Income (loss) from

operations was ($45.2) million, down from ($43.8) million in the

same quarter of the prior year.

- Net Income (Loss) and EPS. GAAP net income (loss) was

($6.8) million, up from ($40.3) million in the third quarter of the

prior year. Adjusted net income (loss) was ($5.3) million, down

from ($3.9) million in the same quarter of the prior year.

Accordingly, GAAP diluted earnings per share was ($0.07), and

diluted adjusted earnings per share was ($0.06) based on the

weighted-average common shares outstanding during the quarter.

- Contribution Profit. Contribution profit was $102.4

million in the third quarter of 2024, up 9% year-over-year, with a

contribution margin of 61% compared to a 64% contribution margin in

the same quarter of the prior year.

- Adjusted EBITDA. Adjusted EBITDA was $1.4 million, down

from $2.3 million in the same quarter of the prior year. The third

quarter 2024 Adjusted EBITDA margin was 1% of total revenue, down

from 2% in the same quarter of the prior year.

Financial Outlook

For the fourth quarter of 2024, Upstart expects:

- Revenue of approximately $180 million

- Revenue From Fees of approximately $185 million

- Net Interest Income (Loss) of approximately ($5)

million

- Contribution Margin of approximately 59%

- Net Income (Loss) of approximately ($35) million

- Adjusted Net Income (Loss) of approximately ($5)

million

- Adjusted EBITDA of approximately $5 million

- Basic Weighted-Average Share Count of approximately 91.7

million shares

- Diluted Weighted-Average Share Count of approximately

91.7 million shares

Upstart has not reconciled the forward-looking non-GAAP measures

above to comparable forward-looking GAAP measures because of the

potential variability and uncertainty of incurring these costs and

expenses in the future. Accordingly, a reconciliation is not

available without unreasonable effort.

Key Operating Metrics and Non-GAAP Financial Measures

For a description of our key operating measures, please see the

section titled “Key Operating Metrics” below.

Reconciliations of non-GAAP financial measures to the most

directly comparable financial results as determined in accordance

with GAAP are included at the end of this press release following

the accompanying financial data. For a description of these

non-GAAP financial measures, including the reasons management uses

each measure, please see the section titled "About Non-GAAP

Financial Measures” below.

Conference Call and Webcast

- Live Conference Call and Webcast at 1:30 p.m. PT on November

7, 2024. To access the call in the United States and Canada: +1

888-394-8218, conference code 8726199. To access the call outside

of the United States and Canada: +1 313-209-4906, conference code

8726199. A webcast is available at ir.upstart.com.

- Event Replay. A webcast of the event will be archived

for one year at ir.upstart.com.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

Forward-Looking Statements

This press release contains forward-looking statements,

including but not limited to, statements regarding our outlook for

the fourth quarter of 2024, continuing to strengthen our position

as the FinTech leader in artificial intelligence, and our return to

growth mode. You can identify forward-looking statements by the

fact that they do not relate strictly to historical or current

facts. These statements may include words such as "anticipate",

"estimate", "expect", "project", "plan", "intend", “target”, “aim”,

"believe", "may", "will", "should", “becoming”, “look forward”,

“could”, "can have", "likely" and other words and terms of similar

meaning in connection with any discussion of the timing or nature

of future operating or financial performance or other events.

Forward-looking statements give our current expectations and

projections relating to our financial condition; macroeconomic

factors; plans; objectives; product development; growth

opportunities; assumptions; risks; future performance; business;

investments; and results of operations, including revenue

(including revenue from fees and net interest income (loss)),

contribution margin, net income (loss), non-GAAP adjusted net

income (loss), Adjusted EBITDA, basic weighted-average share count

and diluted weighted-average share count. Neither we nor any other

person assumes responsibility for the accuracy and completeness of

any of these forward-looking statements. The forward-looking

statements included in this press release and on the related

conference call and webcast relate only to events as of the date

hereof. Upstart undertakes no obligation to update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

All forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those that we expected. More information about factors that

could affect our results of operations and risks and uncertainties

are provided in our public filings with the Securities and Exchange

Commission (the "SEC"), copies of which may be obtained by visiting

our investor relations website at www.upstart.com or the SEC’s

website at www.sec.gov. These risks and uncertainties include, but

are not limited to, our ability to manage the adverse effects of

macroeconomic conditions and disruptions in the banking sector and

credit markets, including inflation and related changes in interest

rates and monetary policy; our ability to access sufficient loan

funding, including through securitizations, committed capital and

other co-investment arrangements, whole loan sales, and warehouse

credit facilities; the effectiveness of our credit decisioning

models and risk management efforts, including reflecting the impact

of macroeconomic conditions on borrowers' credit risk; our ability

to retain existing, and attract new, lending partners; our future

growth prospects and financial performance; our ability to manage

risks associated with the loans on our balance sheet; our ability

to improve and expand our platform and products; and our ability to

operate successfully in a highly-regulated industry.

Key Operating Metrics

We review a number of operating metrics, including transaction

volume, dollars; transaction volume, number of loans; and

conversion rate to evaluate our business, measure our performance,

identify trends affecting our business, formulate business plans

and make strategic decisions.

We define “transaction volume, dollars” as the total principal

of loan originations (or committed amounts for HELOCs) facilitated

on our marketplace during the periods presented. We define

“transaction volume, number of loans” as the number of loan

originations (or commitments issued for HELOCs) facilitated on our

marketplace during the periods presented. We believe these metrics

are good proxies for our overall scale and reach as a platform.

We define “conversion rate” as the transaction volume, number of

loans in a period divided by the number of rate inquiries received

that we estimate to be legitimate, which we record when a borrower

requests a loan offer on our platform. We track this metric to

understand the impact of improvements to the efficiency of our

borrower funnel on our overall growth.

About Non-GAAP Financial Measures

In addition to our results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), we believe the non-GAAP measures of Contribution Profit,

Contribution Margin, Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Net Income (Loss), and Adjusted Net Income (Loss) Per

Share are useful in evaluating our operating performance. Certain

of these non-GAAP measures exclude stock-based compensation and

certain payroll tax expense, expense on convertible notes,

depreciation, amortization, as well as certain items that are not

related to core business and ongoing operations, such as gain on

debt extinguishment and reorganization expenses. We exclude

stock-based compensation, expense on convertible notes and other

non-operating expenses because they are non-cash in nature and are

excluded in order to facilitate comparisons to other companies’

results.

We believe non-GAAP information is useful in evaluating the

operating results, ongoing operations, and for internal planning

and forecasting purposes. We also believe that non-GAAP financial

measures provide consistency and comparability with past financial

performance and assist investors with comparing Upstart to other

companies, some of which use similar non-GAAP financial measures to

supplement their GAAP results. However, non-GAAP financial measures

are presented for supplemental informational purposes only and

should not be considered a substitute for, or superior to,

financial information presented in accordance with GAAP and may be

different from similarly titled non-GAAP financial measures used by

other companies.

Key limitations of our non-GAAP financial measures include:

- Contribution Profit and Contribution Margin are not GAAP

financial measures of, nor do they imply, profitability. Even if

our revenue exceeds variable expenses over time, we may not be able

to achieve or maintain profitability, and the relationship of

revenue to variable expenses is not necessarily indicative of

future performance;

- Contribution Profit and Contribution Margin do not reflect all

of our variable expenses and involve some judgment and discretion

around what costs vary directly with loan volume. Other companies

that present contribution profit and contribution margin may

calculate it differently and, therefore, similarly titled measures

presented by other companies may not be directly comparable to

ours;

- Although depreciation expense is a non-cash charge, the assets

being depreciated may have to be replaced in the future, and

Adjusted EBITDA and Adjusted EBITDA Margin do not reflect cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements;

- Adjusted EBITDA and Adjusted EBITDA Margin exclude stock-based

compensation expense and certain employer payroll taxes on employee

stock transactions. Stock-based compensation expense has been, and

will continue to be for the foreseeable future, a significant

recurring expense for our business and an important part of our

compensation strategy. The amount of employer payroll tax-related

expense on employee stock transactions is dependent on our stock

price and other factors that are beyond our control and which may

not correlate to the operation of the business;

- Adjusted EBITDA and Adjusted EBITDA Margin do not reflect: (1)

changes in, or cash requirements for, our working capital needs;

(2) interest expense, or the cash requirements necessary to service

interest or principal payments on our debt, which reduces cash

available to us; or (3) tax payments that may represent a reduction

in cash available to us; and

- The expenses and other items that we exclude in our calculation

of Adjusted EBITDA and Adjusted EBITDA Margin may differ from the

expenses and other items, if any, that other companies may exclude

from adjusted EBITDA and adjusted EBITDA margin when they report

their operating results.

Reconciliation tables of the most comparable GAAP financial

measures to the non-GAAP financial measures used in this press

release are included below.

UPSTART HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Thousands, Except Share

and Per Share Data)

(Unaudited)

December 31,

September 30,

2023

2024

Assets

Cash

$

368,405

$

445,274

Restricted cash

99,382

210,493

Loans (at fair value)(1)

1,156,413

656,120

Property, equipment, and software, net

42,655

38,328

Operating lease right of use assets

54,694

46,318

Beneficial interest assets (at fair

value)

41,012

131,483

Non-marketable equity securities

41,250

41,250

Goodwill

67,062

67,062

Other assets (includes $48,897 and $70,676

at fair value as of December 31, 2023 and September 30, 2024,

respectively)

146,227

172,652

Total assets

$

2,017,100

$

1,808,980

Liabilities and Stockholders’

Equity

Liabilities:

Payable to investors

$

53,580

$

60,778

Borrowings

1,040,424

887,367

Payable to securitization note holders (at

fair value)

141,416

100,335

Accrued expenses and other liabilities

(includes $10,510 and $18,671 at fair value as of December 31, 2023

and September 30, 2024, respectively)

84,051

111,616

Operating lease liabilities

62,324

53,348

Total liabilities

1,381,795

1,213,444

Stockholders’ equity:

Common stock, $0.0001 par value;

700,000,000 shares authorized; 86,330,303 and 90,998,255, shares

issued and outstanding as of December 31, 2023 and September 30,

2024, respectively

9

9

Additional paid-in capital

917,872

1,003,929

Accumulated deficit

(282,576)

(408,402)

Total stockholders’ equity

635,305

595,536

Total liabilities and stockholders’

equity

$

2,017,100

$

1,808,980

(1)

Includes $179.1 million and

$118.5 million of loans, at fair value, contributed as collateral

for the consolidated securitization as of December 31, 2023 and

September 30, 2024, respectively.

UPSTART HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS and COMPREHENSIVE LOSS

(In Thousands, Except Share

and Per Share Data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2024

2023

2024

Revenue:

Revenue from fees, net

$

146,755

$

167,590

$

407,585

$

436,190

Interest income, interest expense, and

fair value adjustments, net:

Interest income(1)

37,692

40,845

116,923

144,899

Interest expense(1)

(9,414)

(10,818)

(20,828)

(33,002)

Fair value and other adjustments(1)

(40,476)

(35,477)

(130,430)

(130,523)

Total interest income, interest expense,

and fair value adjustments, net

(12,198)

(5,450)

(34,335)

(18,626)

Total revenue

134,557

162,140

373,250

417,564

Operating expenses:

Sales and marketing

33,042

43,229

88,371

111,337

Customer operations

36,914

39,302

114,301

117,394

Engineering and product development

54,941

64,887

222,986

186,431

General, administrative, and other

53,505

59,874

156,616

170,508

Total operating expenses

178,402

207,292

582,274

585,670

Loss from operations

(43,845)

(45,152)

(209,024)

(168,106)

Other income, net

3,540

5,078

11,334

8,993

Gain on debt extinguishment

—

33,361

—

33,361

Net loss before income taxes

(40,305)

(6,713)

(197,690)

(125,752)

Provision for income taxes

10

45

44

74

Net loss

$

(40,315)

$

(6,758)

$

(197,734)

$

(125,826)

Net loss per share, basic

$

(0.48)

$

(0.07)

$

(2.38)

$

(1.42)

Net loss per share, diluted

$

(0.48)

$

(0.07)

$

(2.38)

$

(1.42)

Weighted-average number of shares

outstanding used in computing net loss per share, basic

84,404,966

90,119,481

83,158,146

88,534,495

Weighted-average number of shares

outstanding used in computing net loss per share, diluted

84,404,966

90,119,481

83,158,146

88,534,495

(1)

Balances for the three and nine

months ended September 30, 2023 include $10.0 million of interest

income, ($3.8) million of interest expense, and $0.4 million of

fair value and other adjustments, net related to the consolidated

securitization. Balances for the three months ended September 30,

2024 include $6.7 million of interest income, ($2.3) million of

interest expense, and ($5.7) million of fair value and other

adjustments, net related to the consolidated securitization.

Balances for the nine months ended September 30, 2024 include $23.1

million of interest income, ($7.5) million of interest expense, and

($25.6) million of fair value and other adjustments, net related to

the consolidated securitization.

UPSTART HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

Nine Months Ended September

30,

2023

2024

Cash flows from operating

activities

Net loss

$

(197,734)

$

(125,826)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Change in fair value of loans

131,222

167,545

Change in fair value of servicing

assets

16,888

12,838

Change in fair value of servicing

liabilities

(1,655)

(877)

Change in fair value of beneficial

interest assets

9,128

(35,825)

Change in fair value of beneficial

interest liabilities

(848)

12,633

Change in fair value of other financial

instruments

(3,418)

8,263

Stock-based compensation

142,273

103,604

Gain on loan servicing rights, net

(10,432)

(11,448)

Gain on debt extinguishment

—

(33,361)

Depreciation and amortization

15,800

15,850

Non-cash interest expense

2,296

2,156

Other

(2,260)

(10,874)

Net changes in operating assets and

liabilities:

Purchases of loans held-for-sale

(2,076,734)

(2,626,246)

Proceeds from sale of loans

held-for-sale

1,875,358

2,613,039

Principal payments received for loans

held-for-sale

139,582

157,010

Principal payments received for loans held

by consolidated securitization

12,302

36,532

Payments on beneficial interest

liabilities

—

(3,692)

Other assets

27

(2,110)

Operating lease liability and right-of-use

asset

1,563

(600)

Payable to investors for beneficial

interest assets(1)

5,749

—

Accrued expenses and other liabilities

(25,220)

18,646

Net cash provided by operating

activities

33,887

297,257

Cash flows from investing

activities

Purchases and originations of loans

held-for-investment

(121,294)

(196,580)

Proceeds from sale of loans

held-for-investment

774

—

Principal payments received for loans

held-for-investment

78,327

99,768

Principal payments received for notes

receivable and repayments of residual

3,556

4,004

Purchases of property and equipment

(1,285)

(837)

Capitalized software costs

(9,135)

(5,734)

Acquisition of beneficial interest

assets

(39,505)

(63,246)

Proceeds from beneficial interest

assets

—

2,808

Net cash used in investing activities

(88,562)

(159,817)

Cash flows from financing

activities

Proceeds from warehouse borrowings

529,494

297,587

Proceeds from convertible notes issuance,

net of debt issuance costs paid to lender

—

423,002

Payment of debt issuance costs to third

party

—

(1,455)

Repayments of warehouse borrowings

(514,792)

(293,179)

Payments for repurchases of convertible

notes

—

(325,344)

Purchase of capped calls

—

(40,883)

Settlement of capped calls

—

580

Principal payments made on securitization

notes

(10,016)

(42,705)

Payable to investors(1)

(50,668)

12,990

Proceeds from issuance of securitization

notes

165,318

—

Proceeds from issuance of common stock

under employee stock purchase

8,431

7,685

Proceeds from exercise of stock

options

9,475

12,281

Taxes paid related to net share settlement

of equity awards

(6)

(19)

Net cash provided by financing

activities

137,236

50,540

Change in cash and restricted cash

82,561

187,980

Cash and restricted cash

Cash and restricted cash at beginning of

period

532,467

467,787

Cash and restricted cash at end of

period

$

615,028

$

655,767

(1)

During the nine months ended

September 30, 2024, the Company elected to change the presentation

of changes in payable to investors balance on the condensed

consolidated statement of cash flows. Under the new presentation, a

portion of the payable to investors balance related to fiduciary

cash was reclassified from operating to financing activities.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share

and Per Share Data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2024

2023

2024

Revenue from fees, net

$

146,755

$

167,590

$

407,585

$

436,190

Loss from operations

(43,845)

(45,152)

(209,024)

(168,106)

Operating Margin

(30)%

(27)%

(51)%

(39)%

Sales and marketing, net of borrower

acquisition costs(1)

$

9,444

$

10,480

$

26,012

$

30,552

Customer operations, net of borrower

verification and servicing costs(2)

7,911

6,837

26,774

21,624

Engineering and product development

54,941

64,887

222,986

186,431

General, administrative, and other

53,505

59,874

156,616

170,508

Interest income, interest expense, and

fair value adjustments, net

12,198

5,450

34,335

18,626

Contribution Profit

$

94,154

$

102,376

$

257,699

$

259,635

Contribution Margin

64%

61%

63%

60%

(1)

Borrower acquisition costs were

$23.6 million and $32.7 million for the three months ended

September 30, 2023 and 2024, respectively, and $62.4 million and

$80.8 million for nine months ended September 30, 2023 and 2024,

respectively. Borrower acquisition costs consist of our sales and

marketing expenses adjusted to exclude costs not directly

attributable to attracting a new borrower, such as payroll-related

expenses for our business development and marketing teams, as well

as other operational, brand awareness and marketing activities.

These costs do not include reorganization expenses.

(2)

Borrower verification and

servicing costs were $29.0 million and $32.5 million for the three

months ended September 30, 2023 and 2024, respectively, and $87.5

million and $95.8 million for nine months ended September 30, 2023

and 2024. Borrower verification and servicing costs consist of

payroll and other personnel-related expenses for personnel engaged

in loan onboarding, verification and servicing, as well as

servicing system costs. It excludes payroll and personnel-related

expenses and stock-based compensation for certain members of our

customer operations team whose work is not directly attributable to

onboarding and servicing loans. These costs do not include

reorganization expenses.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share

and Per Share Data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2024

2023

2024

Total revenue

$

134,557

$

162,140

$

373,250

$

417,564

Net loss

(40,315)

(6,758)

(197,734)

(125,826)

Net Loss Margin

(30)%

(4)%

(53)%

(30)%

Adjusted to exclude the following:

Stock-based compensation and certain

payroll tax expenses(1)

$

36,446

$

34,794

$

144,991

$

107,639

Depreciation and amortization

4,934

5,390

15,800

15,850

Reorganization expenses

—

—

15,536

3,778

Expense on convertible notes

1,177

1,303

3,527

3,664

Gain on debt extinguishment

—

(33,361)

—

(33,361)

Provision for income taxes

10

45

44

74

Adjusted EBITDA

$

2,252

$

1,413

$

(17,836)

$

(28,182)

Adjusted EBITDA Margin

2%

1%

(5)%

(7)%

(1)

Payroll tax expenses include the

employer payroll tax-related expense on employee stock

transactions, as the amount is dependent on our stock price and

other factors that are beyond our control and do not correlate to

the operation of our business.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share

and Per Share Data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2024

2023

2024

Net loss

$

(40,315)

$

(6,758)

$

(197,734)

$

(125,826)

Adjusted to exclude the following:

Stock-based compensation and certain

payroll tax expenses(1)

36,446

34,794

144,991

107,639

Reorganization expenses

—

—

15,536

3,778

Gain on debt extinguishment

—

(33,361)

—

(33,361)

Adjusted Net Loss

$

(3,869)

$

(5,325)

$

(37,207)

$

(47,770)

Net loss per share:

Basic

$

(0.48)

$

(0.07)

$

(2.38)

$

(1.42)

Diluted

$

(0.48)

$

(0.07)

$

(2.38)

$

(1.42)

Adjusted Net Loss per share:

Basic

$

(0.05)

$

(0.06)

$

(0.45)

$

(0.54)

Diluted

$

(0.05)

$

(0.06)

$

(0.45)

$

(0.54)

Weighted-average common shares

outstanding:

Basic

84,404,966

90,119,481

83,158,146

88,534,495

Diluted

84,404,966

90,119,481

83,158,146

88,534,495

(1)

Payroll tax expenses include the

employer payroll tax-related expense on employee stock

transactions, as the amount is dependent on our stock price and

other factors that are beyond our control and do not correlate to

the operation of our business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107608158/en/

Press press@upstart.com

Investors ir@upstart.com

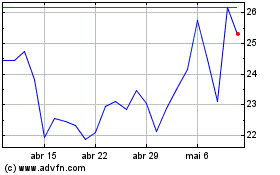

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

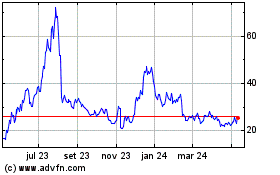

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024