Mettler-Toledo International Inc. (NYSE: MTD) today announced

third quarter results for 2024. Provided below are the

highlights:

- Reported and local currency sales increased 1% compared with

the prior year.

- Net earnings per diluted share as reported (EPS) were $9.96,

compared with $9.21 in the prior-year period. Adjusted EPS was

$10.21, an increase of 4% over the prior-year amount of $9.80.

Adjusted EPS is a non-GAAP measure, and a reconciliation to EPS is

included on the last page of the attached schedules.

Third Quarter Results

Patrick Kaltenbach, President and Chief Executive Officer,

stated, “We experienced good growth during the third quarter in our

Laboratory business and had particularly strong growth in Service.

While China grew modestly this quarter, market conditions remain

challenging, particularly in the Industrial sector. We are very

pleased with our team’s strong execution of our growth and margin

expansion initiatives, which supported good earnings growth.”

GAAP Results

EPS in the quarter was $9.96, compared with the prior-year

amount of $9.21.

Compared with the prior year, total reported sales rose 1% to

$954.5 million. By region, reported sales increased 2% in Europe

and 4% in Asia/Rest of World and declined 1% in the Americas.

Earnings before taxes amounted to $259.0 million, compared with

$251.2 million in the prior year.

Non-GAAP Results

Adjusted EPS was $10.21, an increase of 4% over the prior-year

amount of $9.80.

Compared with the prior year, total sales in local currency

increased 1%. By region, local currency sales increased 1% in

Europe and 4% in Asia/Rest of World and declined 1% in the

Americas. Adjusted Operating Profit amounted to $296.6 million,

compared with the prior-year amount of $296.0 million.

Adjusted EPS and Adjusted Operating Profit are non-GAAP

measures. Reconciliations to the most comparable GAAP measures are

provided in the attached schedules.

Nine Month Results

GAAP Results

EPS was $28.55, compared with the prior-year amount of $27.37,

and included a non-cash discrete tax benefit of $1.07 per

share.

Compared with the prior year, total reported sales declined 1%

to $2.827 billion. By region, reported sales increased 5% in Europe

and 1% in the Americas and declined 8% in Asia/Rest of World.

Earnings before taxes amounted to $722.7 million, compared with

$741.2 million in the prior year.

Non-GAAP Results

Adjusted EPS was $28.74, compared with the prior-year amount of

$28.63.

Compared with the prior year, total sales in local currency were

flat as currency reduced sales growth by 1%. By region, local

currency sales increased 4% in Europe and 1% in the Americas and

declined 6% in Asia/Rest of World. Excluding the first quarter

benefit from delayed fourth quarter 2023 shipments, year-to-date

local currency sales declined 2%, including flat sales in Europe

and the Americas and a 7% decline in Asia/Rest of World. Adjusted

Operating Profit amounted to $848.0 million, compared with the

prior-year amount of $870.1 million.

Adjusted EPS and Adjusted Operating Profit are non-GAAP

measures. Reconciliations to the most comparable GAAP measures are

provided in the attached schedules.

Outlook

Management cautions that market conditions are uncertain and

could change quickly. Based on today's assessment, management

anticipates local currency sales for the fourth quarter of 2024

will increase approximately 8%, which includes a benefit of

approximately 6% from the previously disclosed shipping delays in

the fourth quarter of 2023. Adjusted EPS is forecast to be $11.63

to $11.78, representing growth of 24% to 25%.

For the full year, management anticipates local currency sales

will increase approximately 2%, which includes a benefit of

approximately 3% from the previously disclosed shipping delays in

the fourth quarter of 2023 that benefited the first quarter of

2024. Adjusted EPS is forecast to be in the range of $40.35 to

$40.50, representing growth of approximately 6%. This compares with

previous local currency sales growth guidance of approximately 2%

and Adjusted EPS guidance of $40.20 to $40.50. Included in the 2024

guidance is an estimated 2% headwind to Adjusted EPS growth due to

adverse currency.

The Company stated that based on its assessment of market

conditions today, management anticipates local currency sales

growth of approximately 3% in 2025, including a headwind to growth

of approximately 1.5% due to the previously mentioned 2023 shipping

delays that benefited 2024. This is expected to result in Adjusted

EPS in the range of $41.85 to $42.50, representing growth of

approximately 4% to 5%.

The Company does not provide GAAP financial measures on a

forward-looking basis because we are unable to predict with

reasonable certainty and without unreasonable effort the timing and

amount of future restructuring and other non-recurring items.

Conclusion

Kaltenbach concluded, “We continue to execute very well and will

benefit from the prior-year shipping delays in the fourth quarter;

however, global market conditions remain soft. We have introduced

many exciting innovations, as well as next generations of our

Spinnaker sales and marketing and SternDrive productivity programs,

over the past year. We also continue to leverage our business

diversity and ability to provide value throughout our customers’

value chain to identify and capture growth opportunities and

believe we are very well positioned to gain market share and

deliver good earnings growth in the future.”

Other Matters

The Company will host a conference call to discuss its quarterly

results tomorrow morning (Friday, November 8) at 8:30 a.m. Eastern

Time. To listen to a live webcast or replay of the call, visit the

investor relations page on the Company’s website at

investor.mt.com. The presentation referenced on the conference call

will be located on the website prior to the call.

METTLER TOLEDO (NYSE: MTD) is a leading global supplier of

precision instruments and services. We have strong leadership

positions in all of our businesses and believe we hold global

number-one market positions in most of them. We are recognized as

an innovation leader and our solutions are critical in key R&D,

quality control, and manufacturing processes for customers in a

wide range of industries including life sciences, food, and

chemicals. Our sales and service network is one of the most

extensive in the industry. Our products are sold in more than 140

countries and we have a direct presence in approximately 40

countries. With proven growth strategies and a focus on execution,

we have achieved a long-term track record of strong financial

performance. For more information, please visit www.mt.com.

Forward-Looking Statements Disclaimer

You should not rely on forward-looking statements to predict our

actual results. Our actual results or performance may be materially

different than reflected in forward-looking statements because of

various risks and uncertainties, including statements about

expected revenue growth, inflation, ongoing developments related to

Ukraine, and the Israel-Hamas war. You can identify forward-looking

statements by terminology such as “may,” “will,” “could,” “would,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential,” or “continue.”

We make forward-looking statements about future events or our

future financial performance, including earnings and sales growth,

earnings per share, strategic plans and contingency plans, growth

opportunities or economic downturns, our ability to respond to

changes in market conditions, planned research and development

efforts and product introductions, adequacy of facilities, access

to and the costs of raw materials, shipping and supplier costs,

gross margins, customer demand, our competitive position, pricing,

capital expenditures, cash flow, tax-related matters, the impact of

foreign currencies, compliance with laws, effects of acquisitions,

and the impact of inflation, ongoing developments related to

Ukraine, and the Israel-Hamas war on our business.

Our forward-looking statements may not be accurate or complete,

and we do not intend to update or revise them in light of actual

results. New risks also periodically arise. Please consider the

risks and factors that could cause our results to differ materially

from what is described in our forward-looking statements, including

inflation, ongoing developments related to Ukraine, and the

Israel-Hamas war. See in particular “Factors Affecting Our Future

Operating Results” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.”

METTLER-TOLEDO INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands except

share data)

(unaudited)

Three months ended

Three months ended

September 30, 2024

% of sales

September 30, 2023

% of sales

Net sales

$

954,535

(a)

100.0

$

942,462

100.0

Cost of sales

382,068

40.0

382,923

40.6

Gross profit

572,467

60.0

559,539

59.4

Research and development

47,117

4.9

46,127

4.9

Selling, general and administrative

228,777

24.0

217,447

23.1

Amortization

18,243

1.9

18,314

1.9

Interest expense

18,599

1.9

20,278

2.2

Restructuring charges

2,631

0.3

7,385

0.8

Other charges (income), net

(1,852

)

(0.2

)

(1,171

)

(0.1

)

Earnings before taxes

258,952

27.2

251,159

26.6

Provision for taxes

47,436

5.0

49,528

5.2

Net earnings

$

211,516

22.2

$

201,631

21.4

Basic earnings per common share: Net earnings

$

10.01

$

9.26

Weighted average number of common shares

21,139,674

21,776,944

Diluted earnings per common share: Net earnings

$

9.96

$

9.21

Weighted average number of common and common equivalent shares

21,242,343

21,886,482

Note:

(a) Local currency sales

increased 1% as compared to the same period in 2023.

RECONCILIATION OF EARNINGS

BEFORE TAXES TO ADJUSTED OPERATING PROFIT

Three months ended

Three months ended

September 30, 2024

% of sales

September 30, 2023

% of sales

Earnings before taxes

$

258,952

$

251,159

Amortization

18,243

18,314

Interest expense

18,599

20,278

Restructuring charges

2,631

7,385

Other charges (income), net

(1,852

)

(1,171

)

Adjusted operating profit

$

296,573

(b)

31.1

$

295,965

31.4

Note:

(b) Adjusted operating profit was

flat as compared to the same period in 2023.

METTLER-TOLEDO INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands except

share data)

(unaudited)

Nine months ended

Nine months ended

September 30, 2024

% of sales

September 30, 2023

% of sales

Net sales

$

2,827,234

(a)

100.0

$

2,853,317

100.0

Cost of sales

1,140,966

40.4

1,163,669

40.8

Gross profit

1,686,268

59.6

1,689,648

59.2

Research and development

139,303

4.9

138,849

4.9

Selling, general and administrative

698,963

24.7

680,679

23.9

Amortization

54,649

1.9

54,135

1.9

Interest expense

56,781

2.0

57,711

2.0

Restructuring charges

17,624

0.6

19,680

0.7

Other charges (income), net

(3,728

)

(0.1

)

(2,578

)

(0.2

)

Earnings before taxes

722,676

25.6

741,172

26.0

Provision for taxes

111,837

4.0

137,188

4.8

Net earnings

$

610,839

21.6

$

603,984

21.2

Basic earnings per common share: Net earnings

$

28.69

$

27.54

Weighted average number of common shares

21,288,202

21,933,889

Diluted earnings per common share: Net earnings

$

28.55

$

27.37

Weighted average number of common and common equivalent shares

21,396,456

22,067,398

Note:

(a) Local currency sales were

flat as compared to the same period in 2023.

RECONCILIATION OF EARNINGS

BEFORE TAXES TO ADJUSTED OPERATING PROFIT

Nine months ended

Nine months ended

September 30, 2024

% of sales

September 30, 2023

% of sales

Earnings before taxes

$

722,676

$

741,172

Amortization

54,649

54,135

Interest expense

56,781

57,711

Restructuring charges

17,624

19,680

Other charges (income), net

(3,728

)

(2,578

)

Adjusted operating profit

$

848,002

(b)

30.0

$

870,120

(b)

30.5

Note:

(b) Adjusted operating profit

decreased 3% as compared to the same period in 2023.

METTLER-TOLEDO INTERNATIONAL

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(amounts in thousands)

(unaudited)

September 30, 2024

December 31, 2023

Cash and cash equivalents

$

71,574

$

69,807

Accounts receivable, net

637,202

663,893

Inventories

375,813

385,865

Other current assets and prepaid expenses

113,643

110,638

Total current assets

1,198,232

1,230,203

Property, plant and equipment, net

790,447

803,374

Goodwill and other intangibles assets, net

934,923

955,537

Other non-current assets

396,226

366,441

Total assets

$

3,319,828

$

3,355,555

Short-term borrowings and maturities of long-term debt

$

185,824

$

192,219

Trade accounts payable

202,859

210,411

Accrued and other current liabilities

796,285

778,452

Total current liabilities

1,184,968

1,181,082

Long-term debt

1,891,661

1,888,620

Other non-current liabilities

397,552

435,791

Total liabilities

3,474,181

3,505,493

Shareholders’ equity

(154,353

)

(149,938

)

Total liabilities and shareholders’ equity

$

3,319,828

$

3,355,555

METTLER-TOLEDO INTERNATIONAL

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(amounts in thousands)

(unaudited)

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Cash flow from operating activities: Net earnings

$

211,516

$

201,631

$

610,839

$

603,984

Adjustments to reconcile net earnings to net cash provided by

operating activities: Depreciation

12,836

12,189

37,709

36,406

Amortization

18,243

18,314

54,649

54,135

Deferred tax benefit

(1,224

)

(2,689

)

(5,061

)

(4,455

)

One-time non-cash discrete tax benefit

-

-

(22,982

)

-

Other

4,359

4,228

13,622

12,450

Increase (decrease) in cash resulting from changes in operating

assets and liabilities

8,936

30,623

13,383

(18,151

)

Net cash provided by operating activities

254,666

264,296

702,159

684,369

Cash flows from investing activities: Proceeds from sale of

property, plant and equipment

65

256

733

668

Purchase of property, plant and equipment

(21,421

)

(20,960

)

(62,622

)

(72,907

)

Proceeds from government funding (a)

-

1,332

-

2,596

Acquisitions

-

-

(2,473

)

(613

)

Other investing activities

(16,287

)

(11,523

)

(4,048

)

(25,937

)

Net cash used in investing activities

(37,643

)

(30,895

)

(68,410

)

(96,193

)

Cash flows from financing activities: Proceeds from borrowings

539,071

489,052

1,561,649

1,569,973

Repayments of borrowings

(559,670

)

(508,497

)

(1,576,862

)

(1,467,228

)

Proceeds from exercise of stock options

14,203

147

22,339

19,234

Repurchases of common stock

(212,499

)

(223,999

)

(637,497

)

(723,998

)

Acquisition contingent consideration payment

-

(2,141

)

-

(7,767

)

Other financing activities

(3

)

(112

)

(1,913

)

(826

)

Net cash used in financing activities

(218,898

)

(245,550

)

(632,284

)

(610,612

)

Effect of exchange rate changes on cash and cash equivalents

2,639

(1,750

)

302

(3,855

)

Net increase (decrease) in cash and cash equivalents

764

(13,899

)

1,767

(26,291

)

Cash and cash equivalents: Beginning of period

70,810

83,574

69,807

95,966

End of period

$

71,574

$

69,675

$

71,574

$

69,675

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES

TO ADJUSTED FREE CASH FLOW Net cash provided by operating

activities

$

254,666

$

264,296

$

702,159

$

684,369

Payments in respect of restructuring activities

4,086

7,544

19,766

14,942

Transition tax payment

-

-

10,723

8,042

Proceeds from sale of property, plant and equipment

65

255

733

667

Purchase of property, plant and equipment, net (a)

(21,421

)

(20,362

)

(62,622

)

(65,177

)

Acquisition payments (b)

-

-

-

4,775

Adjusted free cash flow

$

237,396

$

251,733

$

670,759

$

647,618

Notes: (a) In September 2021, the Company entered into an

agreement with the U.S. Department of Defense to increase the

domestic production capacity of pipette tips and enhance

manufacturing automation and logistics. The Company received

funding of $35.8 million in prior years, which offset capital

expenditures. During the three and nine months ended September 30,

2023 the Company received funding proceeds of $1.3 million and $2.6

million, respectively. During the three and nine months ended

September 30, 2023 the related purchase of property, plant and

equipment of $0.6 million and $7.7 million, respectively, are

excluded from Adjusted free cash flow. (b) Includes $4.4 million of

the PendoTECH contingent consideration payment that was reported in

net cash provided by operating activities as required by U.S. GAAP

for the nine months ended September 30, 2023.

METTLER-TOLEDO INTERNATIONAL INC. OTHER OPERATING

STATISTICS SALES GROWTH BY DESTINATION

(unaudited) Americas Europe Asia/RoW Total

U.S. Dollar Sales Growth Three Months Ended September 30, 2024

(1

%)

2

%

4

%

1

%

Nine Months Ended September 30, 2024

1

%

5

%

(8

%)

(1

%)

Local Currency Sales Growth Three Months Ended September 30,

2024

(1

%)

1

%

4

%

1

%

Nine Months Ended September 30, 2024

1

%

4

%

(6

%)

0

%

Note: (a) The Company estimates net sales for the nine

months ended September 30, 2024 benefited by 2% from recovering

previously delayed shipments from the fourth quarter of 2023. By

geographic destination, net sales benefited approximately 1% in the

Americas, 4% in Europe and 1% in Asia/Rest of World.

RECONCILIATION OF DILUTED EPS

AS REPORTED TO ADJUSTED DILUTED EPS

(unaudited)

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

% Growth

2024

2023

% Growth

EPS as reported, diluted

$

9.96

$

9.21

8

%

$

28.55

$

27.37

4

%

Purchased intangible amortization, net of tax

0.23

(a)

0.24

(a)

0.71

(a)

0.70

(a) Restructuring charges, net of tax

0.10

(b)

0.27

(b)

0.67

(b)

0.72

(b) Income tax expense

(0.08

)

(c)

0.08

(c)

(1.19

)

(c)

(0.16

)

(c) Adjusted EPS, diluted

$

10.21

$

9.80

4

%

$

28.74

$

28.63

0

%

Notes: (a) Represents the EPS impact of purchased

intangibles amortization of $6.4 million ($5.0 million after tax)

and $6.7 million ($5.2 million after tax) for the three months

ended September 30, 2024 and 2023, and $19.5 million ($15.1 million

after tax) and $20.0 million ($15.4 million after tax) for the nine

months ended September 30, 2024 and 2023, respectively. (b)

Represents the EPS impact of restructuring charges of $2.6 million

($2.1 million after tax) and $7.4 million ($6.0 million after tax)

for the three months ended September 30, 2024 and 2023, and $17.6

million ($14.3 million after tax) and $19.7 million ($15.9 million

after tax) for the nine months ended September 30, 2024 and 2023,

respectively, which primarily include employee related costs. (c)

Represents the EPS impact of the difference between our quarterly

and estimated annual tax rate before non-recurring discrete items

during the three and nine months ended September 30, 2024 and 2023

due to the timing of excess tax benefits associated with stock

option exercises. Also includes a reported EPS reduction of $1.07

for the nine months ended September 30, 2024 for a non-cash

discrete tax benefit resulting from the reduction of uncertain tax

position liabilities related to the settlement of a tax audit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107177327/en/

Adam Uhlman Head of Investor Relations METTLER TOLEDO Direct:

614-438-4794 adam.uhlman@mt.com

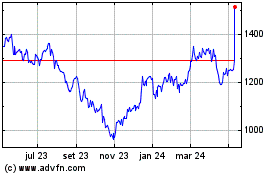

Mettler Toledo (NYSE:MTD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

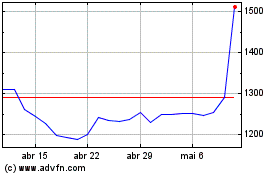

Mettler Toledo (NYSE:MTD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024