Corebridge Financial Announces Pricing of Secondary Offering of Common Stock by AIG

07 Novembro 2024 - 11:24PM

Business Wire

Corebridge Financial, Inc. (NYSE: CRBG) today announced that the

previously announced secondary offering by American International

Group, Inc. (NYSE: AIG) of common stock of Corebridge Financial has

priced at $31.20 per share. The offering is expected to close on

November 12, 2024, subject to customary closing conditions.

AIG, as the selling stockholder, has offered 30 million existing

shares of common stock (out of approximately 568 million total

shares of common stock outstanding) of Corebridge Financial,

corresponding to approximately $936 million of gross proceeds. AIG

has also granted a 30-day option to the underwriters to purchase up

to an additional 4.5 million shares. All of the net proceeds from

the offering will go to AIG.

J.P. Morgan and Morgan Stanley are acting as the underwriters

for the offering. The underwriters may offer the shares of common

stock from time to time for sale in one or more transactions on the

NYSE, in the over-the-counter market, through negotiated

transactions or otherwise at market prices prevailing at the time

of sale, at prices related to prevailing market prices or at

negotiated prices.

The offering of common stock is being made only by means of a

prospectus and an accompanying prospectus supplement. Copies of the

prospectus and accompanying prospectus supplement relating to the

offering may be obtained from: J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by email at prospectus-eq_fi@jpmorganchase.com and

postsalemanualrequests@broadridge.com, or Morgan Stanley & Co.

LLC via mail at 180 Varick Street, 2nd Floor, New York, NY

10014.

A registration statement relating to these securities was filed

with the U.S. Securities and Exchange Commission (“SEC”) on

November 6, 2023, and became effective automatically. The

registration statement may be obtained free of charge at the SEC’s

website at www.sec.gov (EDGAR/Company Filings) under “Corebridge

Financial, Inc.” This press release does not constitute an offer to

sell or the solicitation of an offer to buy these securities, and

shall not constitute an offer, solicitation or sale in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that state or jurisdiction. Any offers,

solicitations or offers to buy, or any sales of securities will be

made in accordance with the registration requirements of the

Securities Act of 1933, as amended.

About Corebridge Financial

Corebridge Financial, Inc. makes it possible for more people to

take action in their financial lives. With more than $410 billion

in assets under management and administration as of September 30,

2024, Corebridge Financial is one of the largest providers of

retirement solutions and insurance products in the United States.

We proudly partner with financial professionals and institutions to

help individuals plan, save for and achieve secure financial

futures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107368739/en/

Işıl Müderrisoğlu (Investors):

investorrelations@corebridgefinancial.com Matt Ward (Media):

media.contact@corebridgefinancial.com

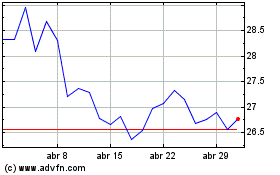

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025