Generates Strong Cash Flow

Air Transport Services Group, Inc. (Nasdaq: ATSG), the leading

provider of medium wide-body freighter aircraft leasing, contracted

air transportation, and related services, today reported

consolidated financial results for the third quarter ended

September 30, 2024. Those results, as compared with the same period

in 2023, were as follows:

Third Quarter Results

- Revenues of $471 million, versus $523 million

- GAAP Loss per Share from Continuing Operations of ($0.05),

versus Earnings per Share (diluted) of $0.24

- GAAP Pretax Loss from Continuing Operations of ($5.2) million,

versus Pretax Earnings of $23.5 million

- Adjusted Pretax* Earnings of $10.7 million, versus $31.1

million

- Adjusted EPS* of $0.13, versus $0.32

- Adjusted EBITDA* of $129.5 million, versus $136.6 million

- Free Cash Flow* was $86.4 million, versus negative $51.6

million

As previously announced on November 4, 2024, ATSG entered into a

definitive agreement to be acquired by Stonepeak, a leading

alternative investment firm specializing in infrastructure and real

assets, in an all-cash transaction with an enterprise valuation of

approximately $3.1 billion. Under the terms of the agreement,

holders of ATSG common stock will receive $22.50 per share in cash.

Upon completion of the transaction, ATSG’s shares will no longer

trade on the Nasdaq, and ATSG will become a private company. In

light of the announced transaction, ATSG has canceled the third

quarter 2024 earnings conference call previously scheduled for

Friday, November 8, 2024, and will not provide financial guidance

going forward.

Mike Berger, chief executive officer of ATSG, said, "First off,

we are excited about our future with Stonepeak. Our leasing

business continued to benefit from strong demand for our freighter

aircraft, as we added four Boeing 767-300 freighter leases during

the third quarter. Our third quarter results were affected by fewer

block hours flown than a year ago and higher expenses, including

start-up costs to fly ten more aircraft provided by Amazon. I am

delighted to report that the 10th aircraft entered operations this

week. For the quarter, we once again generated strong free cash

flow, bringing the total to $193 million for the year. Going

forward, certain contractual price increases effective in the

fourth quarter position us for strong improvement in our ACMI

Services segment and we expect to execute three new leases for

CAM-owned freighters by year-end 2024."

* Adjusted EPS (Earnings per Share), Adjusted Pretax Earnings,

Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and

Amortization), Free Cash Flow, and Adjusted Free Cash Flow are

non-GAAP financial measures used in this release, which are defined

and reconciled to the most directly comparable financial measures

calculated and presented in accordance with GAAP at the end of this

release.

Segment Results

Cargo Aircraft Management (CAM)

- Aircraft leasing and related revenues increased 3% for the

third quarter, including the benefit of revenues from eleven

additional freighter leases, including ten additional 767-300s and

one Airbus A321-200 since the end of September 2023. These lease

revenues were more than offset by the scheduled returns of nine

767-200 freighters and six 767-300 freighters over that same

period.

- CAM’s third quarter pretax earnings decreased $5 million, or

22%, to $18 million versus $23 million for the prior-year quarter.

Segment depreciation expense increased by $11 million and interest

expense by $2 million versus the prior-year quarter. The 2024

results were impacted by the reduction in 767-200 freighter leases

and related engine power program revenues, declining $5 million in

total versus a year ago.

- CAM leased four 767s and sold four others to external customers

in the third quarter. One 767-200 freighter was returned by an

external customer upon lease expiration. At the end of the third

quarter, 89 CAM-owned aircraft were leased to external customers,

two fewer than a year ago.

- Nineteen CAM-owned aircraft were in or awaiting conversion to

freighters at the end of the third quarter, one fewer than at the

end of the prior-year quarter. This included eight 767s, six A321s,

and five A330s. One of the A330s is expected to complete conversion

and be leased to an external customer in the fourth quarter of

2024.

ACMI Services

- Pretax loss was $14 million in the third quarter, versus pretax

earnings of $12 million in the third quarter of 2023. Revenue block

hours for ATSG's airlines decreased 13% versus the prior-year

quarter. Cargo block hours decreased 7% for the third quarter,

reflecting the removal of certain 767-200 freighter aircraft from

service and less international flying versus the prior year.

Passenger block hours decreased 34% in the quarter.

- The pretax loss for the third quarter of 2024 included $4.9

million more for customer incentive costs stemming from warrant

agreements reached with Amazon in May of 2024. In addition to the

reduced flying hours and reduced revenues, ACMI Services

experienced increased expenses for maintenance, travel and ground

services.

- During the third quarter, ACMI Services began operating seven

Amazon-provided Boeing 767-300 aircraft, with three more added

subsequently.

Non-GAAP Financial Measures

This release, including the attached tables, contains financial

measures that are calculated and presented in accordance with

Generally Accepted Accounting Principles ("GAAP") in the United

States, and financial measures that are not calculated and

presented in accordance with GAAP ("non-GAAP financial measures").

Management uses these non-GAAP financial measures to evaluate

historical results and project future results. Management believes

that these non-GAAP financial measures assist in highlighting

operational trends, facilitating period-over-period comparisons,

and providing additional clarity about events and trends affecting

core operating performance. Disclosing these non-GAAP financial

measures provides insight to investors about additional metrics

that management uses to evaluate past performance and prospects for

future performance. Non-GAAP financial measures should not be

considered in isolation or as a substitute for analysis of the

Company's results as reported under GAAP and may be calculated

differently by other companies.

The historical non-GAAP financial measures included in this

release are reconciled to the most directly comparable financial

measure calculated and presented in accordance with GAAP in the

non-GAAP reconciliation tables included later in this release. The

Company does not provide a reconciliation of projected Adjusted

EBITDA or Adjusted EPS, as permitted by Item 10(e)(1)(i)(B) of

Regulation S-K, because it is unable to predict with reasonable

accuracy the value of certain adjustments and as a result, the

comparable GAAP measures are unavailable without unreasonable

efforts. For example, certain adjustments can be significantly

impacted by the re-measurements of financial instruments including

stock warrants issued to a customer. The Company’s earnings on a

GAAP basis, including its earnings per share on a GAAP basis, and

the non-GAAP adjustments for gains and losses resulting from the

re-measurement of stock warrants, will depend on, among other

things, the future prices of ATSG stock, interest rates, and other

assumptions which are highly uncertain. As a result, the Company

believes such reconciliations of forward-looking information would

imply a degree of precision and certainty that could be confusing

to investors.

About ATSG

Air Transport Services Group (ATSG) is a premier provider of

aircraft leasing and cargo and passenger air transportation

solutions for both domestic and international air carriers, as well

as companies seeking outsourced airlift services. ATSG is the

global leader in freighter aircraft leasing with a fleet that

includes Boeing 767, Airbus A321, and soon, Airbus A330 converted

freighters. ATSG's unique Lease+Plus aircraft leasing opportunity

draws upon a diverse portfolio of subsidiaries including three

airlines holding separate and distinct U.S. FAA Part 121 Air

Carrier certificates to provide air cargo lift, and passenger ACMI

and charter services. Complementary services from ATSG's other

subsidiaries allow the integration of aircraft maintenance, airport

ground services, and material handling equipment engineering and

service. ATSG subsidiaries comprise ABX Air, Inc.; Airborne Global

Solutions, Inc.; Airborne Maintenance and Engineering Services,

Inc., including its subsidiary, Pemco World Air Services, Inc.; Air

Transport International, Inc.; Cargo Aircraft Management, Inc.;

LGSTX Services, Inc.; and Omni Air International, LLC. For further

details, please visit www.atsginc.com.

Cautionary Note Regarding Forward-Looking Statements

Throughout this release, Air Transport Services Group, Inc.

(“ATSG") makes “forward-looking statements” within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995, as

amended (the “Act”). Except for historical information contained

herein, the matters discussed in this release contain

forward-looking statements that involve inherent risks and

uncertainties. Such statements are provided under the “safe harbor”

protection of the Act. Forward-looking statements include, but are

not limited to, statements regarding anticipated operating results,

prospects and aircraft in service, technological developments,

economic trends, expected transactions and similar matters. The

words “may,” “believe,” “expect,” “anticipate,” “target,” “goal,”

“project,” “estimate,” “guidance,” “forecast,” “outlook,” “will,”

“continue,” “likely,” “should,” “hope,” “seek,” “plan,” “intend”

and variations of such words and similar expressions identify

forward-looking statements. Similarly, descriptions of ATSG’s

objectives, strategies, plans, goals or targets are also

forward-looking statements. Forward-looking statements are

susceptible to a number of risks, uncertainties and other factors.

While ATSG believes that the assumptions underlying its

forward-looking statements are reasonable, investors are cautioned

that any of the assumptions could prove to be inaccurate and,

accordingly, ATSG’s actual results and experiences could differ

materially from the anticipated results or other expectations

expressed in its forward-looking statements. A number of important

factors could cause ATSG's actual results to differ materially from

those indicated by such forward-looking statements. These factors

include, but are not limited to: (i) changes in the market demand

for ATSG's assets and services, including the loss of customers or

a reduction in the level of services it performs for customers;

(ii) its operating airlines' ability to maintain on-time service

and control costs; (iii) the cost and timing with respect to which

it is able to purchase and modify aircraft to a cargo

configuration; (iv) fluctuations in ATSG's traded share price and

in interest rates, which may result in mark-to-market charges on

certain financial instruments; (v) the number, timing, and

scheduled routes of its aircraft deployments to customers; (vi)

ATSG's ability to remain in compliance with key agreements with

customers, lenders and government agencies; (vii) the impact of

current supply chain constraints, which may be more severe or

persist longer than it currently expects; (viii) the impact of the

current competitive labor market; (ix) changes in general economic

and/or industry-specific conditions, including inflation and

regulatory changes; and (x) the impact of geopolitical tensions or

conflicts and human health crises, and other factors that could

cause ATSG’s actual results to differ materially from those

indicated by such forward-looking statements, which are discussed

in “Risk Factors” in Item 1A of Part II of ATSG’s Quarterly Report

on Form 10-Q for the period ended September 30, 2024 and Item 1A of

ATSG's 2023 Form 10-K and may be contained from time to time in its

other filings with the U.S. Securities and Exchange Commission,

including its annual reports on Form 10-K, quarterly reports on

Form 10-Q and current reports on Form 8-K.

ATSG recently entered into an Agreement and Plan of Merger with

Stonepeak Nile Parent LLC and Stonepeak Nile MergerCo Inc. (the

“Merger”). Statements regarding the Merger, including the expected

time period to consummate the Merger, the anticipated benefits

(including synergies) of the Merger and integration and transition

plans, opportunities, anticipated future performance, expected

share buyback programs and expected dividends, are also provided

under the “safe harbor” protection in the Act. Key factors that

could cause actual results to differ materially include, but are

not limited to, the expected timing and likelihood of completion of

the Merger, including the timing, receipt and terms and conditions

of any required governmental and regulatory approvals of the

Merger; the occurrence of any event, change or other circumstances

that could give rise to the termination of the definitive

agreement; the possibility that ATSG’s stockholders may not approve

the Merger; the risk that the anticipated tax treatment of the

transactions contemplated by the Agreement and Plan of Merger (the

“Transaction”) is not obtained; the risk that the parties may not

be able to satisfy the conditions to the Merger in a timely manner

or at all; risks related to disruption of management time from

ongoing business operations due to the Merger; the risk that any

announcements relating to the Merger could have adverse effects on

the market price of ATSG’s common stock; the risk that the Merger

and its announcement could have an adverse effect on the parties’

business relationships and business generally, including the

ability of ATSG to retain customers and retain and hire key

personnel and maintain relationships with their suppliers and

customers, and on their operating results and businesses generally;

the risk of unforeseen or unknown liabilities; customer,

shareholder, regulatory and other stakeholder approvals and

support; the risk of unexpected future capital expenditures; the

risk of potential litigation relating to the Transaction that could

be instituted against ATSG or its directors and/or officers; the

risk associated with third party contracts containing material

consent, anti-assignment, transfer or other provisions that may be

related to the Merger which are not waived or otherwise

satisfactorily resolved; the risk of rating agency actions and

ATSG’s ability to access short- and long-term debt markets on a

timely and affordable basis; and the risks resulting from other

effects of industry, market, economic, legal or legislative,

political or regulatory conditions outside of ATSG’s control.

Readers should carefully review this release and should not

place undue reliance on ATSG's forward-looking statements. These

forward-looking statements were based only on information, plans

and estimates as of the date of this release. New risks and

uncertainties arise from time to time, and factors that ATSG

currently deems immaterial may become material, and it is

impossible for ATSG to predict these events or how they may affect

it. Except as may be required by applicable law, ATSG undertakes no

obligation to update any forward-looking statements to reflect

changes in underlying assumptions or factors, new information,

future events or other changes. ATSG does not endorse any

projections regarding future performance that may be made by third

parties.

Additional Information and Where to Find It

In connection with the Transaction, the Company will file with

the SEC a proxy statement on Schedule 14A (the “Proxy Statement”).

The definitive version of the Proxy Statement will be sent to the

stockholders of the Company seeking their approval of the

Transaction and other related matters.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

PROXY STATEMENT ON SCHEDULE 14A WHEN IT BECOMES AVAILABLE, AS WELL

AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION

WITH THE TRANSACTION OR INCORPORATED BY REFERENCE THEREIN AND ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION REGARDING THE COMPANY, THE

TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free copies of these

documents, including the Proxy Statement, and other documents filed

with the SEC by the Company through the website maintained by the

SEC at

https://www.sec.gov/edgar/browse/?CIK=894081&owner=exclude.

Copies of documents filed with the SEC by the Company will be made

available free of charge by accessing the Company’s website at

https://atsginc.com/investors or by contacting the Company via

email by sending a message to investor.relations@atsginc.com.

Participants in the Solicitation

The Company and its directors and executive officers may be

deemed to be participants in the solicitation of proxies from the

stockholders of the Company in connection with the Transaction

under the rules of the SEC. Information about the interests of the

directors and executive officers of the Company and other persons

who may be deemed to be participants in the solicitation of

stockholders of the Company in connection with the Transaction and

a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the Proxy Statement

related to the Transaction, which will be filed with the SEC.

Information about the directors and executive officers of the

Company and their ownership of the Company common stock is also set

forth in the Company’s definitive proxy statement in connection

with its 2024 Annual Meeting of Stockholders, as filed with the SEC

on April 11, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/894081/000114036124019362/ny20017081x1_def14a.htm)

and in the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/894081/000089408124000016/atsg-20231231.htm).

Information about the directors and executive officers of the

Company, their ownership of the Company common stock, and the

Company’s transactions with related persons is set forth in the

sections entitled “Directors, Executive Officers and Corporate

Governance,” “Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters,” and “Certain

Relationships and Related Stockholder Matters” included in the

Company’s annual report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on February 29,

2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/894081/000089408124000016/atsg-20231231.htm),

and in the sections entitled “Corporate Governance and Board

Matters,” and “Stock Ownership of Management,” included in the

Company’s definitive proxy statement in connection with its 2024

Annual Meeting of Stockholders, as filed with the SEC on April 11,

2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/894081/000089408124000016/atsg-20231231.htm).

Additional information regarding the interests of such participants

in the solicitation of proxies in respect of the Transaction will

be included in the Proxy Statement and other relevant materials to

be filed with the SEC when they become available These documents

can be obtained free of charge from the SEC’s website at

www.sec.gov.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities or the solicitation

of any vote of approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF EARNINGS (UNAUDITED)

(In thousands, except per share

data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

REVENUES

$

471,253

$

523,137

$

1,445,180

$

1,553,571

OPERATING EXPENSES

Salaries, wages and benefits

170,102

165,110

505,663

512,283

Depreciation and amortization

98,995

86,252

281,254

253,671

Maintenance, materials and repairs

46,573

54,569

143,183

148,838

Fuel

52,307

79,020

181,429

213,046

Contracted ground and aviation

services

18,362

18,353

55,794

55,823

Travel

30,633

36,223

93,259

96,998

Landing and ramp

3,732

4,271

12,267

13,139

Rent

8,001

7,811

23,231

24,197

Insurance

3,121

3,055

8,414

8,287

Other operating expenses

17,746

22,443

54,680

64,095

449,572

477,107

1,359,174

1,390,377

OPERATING INCOME

21,681

46,030

86,006

163,194

OTHER INCOME (EXPENSE)

Interest income

352

190

809

585

Non-service component of retiree benefit

costs

(1,085

)

(3,218

)

(3,256

)

(9,654

)

Net (loss) gain on financial

instruments

(5,167

)

1,778

134

1,856

Loss from non-consolidated affiliate

(869

)

(1,885

)

(2,202

)

(4,398

)

Interest expense

(20,103

)

(19,376

)

(63,494

)

(51,753

)

(26,872

)

(22,511

)

(68,009

)

(63,364

)

EARNINGS (LOSS) FROM CONTINUING OPERATIONS

BEFORE INCOME TAXES

(5,191

)

23,519

17,997

99,830

INCOME TAX BENEFIT (EXPENSE)

1,864

(6,347

)

(5,277

)

(24,495

)

EARNINGS (LOSS) FROM CONTINUING

OPERATIONS

(3,327

)

17,172

12,720

75,335

EARNINGS FROM DISCONTINUED OPERATIONS, NET

OF TAXES

—

—

—

—

NET EARNINGS (LOSS)

$

(3,327

)

$

17,172

$

12,720

$

75,335

EARNINGS (LOSS) PER SHARE - CONTINUING

OPERATIONS

Basic

$

(0.05

)

$

0.26

$

0.20

$

1.08

Diluted

$

(0.05

)

$

0.24

$

0.20

$

0.98

WEIGHTED AVERAGE SHARES - CONTINUING

OPERATIONS

Basic

65,036

67,253

65,012

69,909

Diluted

65,036

72,672

67,471

78,427

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(In thousands, except share

data)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash, cash equivalents and restricted

cash

$

44,873

$

53,555

Accounts receivable, net of allowance of

$846 in 2024 and $1,065 in 2023

185,251

215,581

Inventory

49,690

49,939

Prepaid supplies and other

31,258

26,626

TOTAL CURRENT ASSETS

311,072

345,701

Property and equipment, net

2,771,568

2,820,769

Customer incentive

133,234

60,961

Goodwill and acquired intangibles

473,425

482,427

Operating lease assets

60,797

54,060

Other assets

134,227

118,172

TOTAL ASSETS

$

3,884,323

$

3,882,090

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

248,647

$

227,652

Accrued salaries, wages and benefits

62,126

56,650

Accrued expenses

11,817

10,784

Current portion of debt obligations

658

54,710

Current portion of lease obligations

20,234

20,167

Unearned revenue

38,431

30,226

TOTAL CURRENT LIABILITIES

381,913

400,189

Long term debt

1,561,874

1,707,572

Stock warrant obligations

18,671

1,729

Post-retirement obligations

14,890

19,368

Long term lease obligations

41,806

34,990

Other liabilities

110,143

64,292

Deferred income taxes

286,787

285,248

STOCKHOLDERS’ EQUITY:

Preferred stock, 20,000,000 shares

authorized, including 75,000 Series A Junior Participating

Preferred Stock

—

—

Common stock, par value $0.01 per share;

150,000,000 shares authorized; 65,759,904 and 65,240,961 shares

issued and outstanding in 2024 and 2023, respectively

658

652

Additional paid-in capital

917,181

836,270

Retained earnings

601,929

589,209

Accumulated other comprehensive loss

(51,529

)

(57,429

)

TOTAL STOCKHOLDERS’ EQUITY

1,468,239

1,368,702

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

3,884,323

$

3,882,090

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED SUMMARY OF

CASH FLOWS (UNAUDITED)

(In thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

OPERATING CASH FLOWS

$

135,555

$

117,517

$

399,076

$

526,093

INVESTING ACTIVITIES:

Aircraft acquisitions and freighter

conversions

(29,979

)

(119,709

)

(145,027

)

(422,873

)

Planned aircraft maintenance, engine

overhauls and other non- aircraft additions to property and

equipment

(18,206

)

(48,706

)

(75,976

)

(158,467

)

Proceeds from property and equipment

9,069

71

35,183

10,516

Acquisitions and investments in

businesses

(10,045

)

(800

)

(19,845

)

(1,600

)

TOTAL INVESTING CASH FLOWS

(49,161

)

(169,144

)

(205,665

)

(572,424

)

FINANCING ACTIVITIES:

Principal payments on secured debt

(155,219

)

(90,217

)

(626,542

)

(180,534

)

Proceeds from revolver borrowings

85,000

80,000

425,000

220,000

Proceeds from convertible note

issuance

—

400,000

—

400,000

Payments for financing costs

—

(10,268

)

—

(10,779

)

Repurchase of convertible notes

—

(203,247

)

—

(203,247

)

Purchase of common stock

—

(118,475

)

—

(155,349

)

Taxes paid for conversion of employee

awards

(16

)

—

(551

)

(1,578

)

Other financing related proceeds

—

1,269

—

1,269

TOTAL FINANCING CASH FLOWS

(70,235

)

59,062

(202,093

)

69,782

NET INCREASE (DECREASE) IN CASH

$

16,159

$

7,435

$

(8,682

)

$

23,451

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD

$

28,714

$

43,150

$

53,555

$

27,134

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$

44,873

$

50,585

$

44,873

$

50,585

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

PRETAX EARNINGS FROM CONTINUING

OPERATIONS AND ADJUSTED PRETAX EARNINGS SUMMARY

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenues

CAM

Aircraft leasing and related revenues

$

115,565

$

113,145

$

331,776

$

345,500

Customer incentive

(3,096

)

(3,420

)

(9,289

)

(12,353

)

Total CAM

112,469

109,725

322,487

333,147

ACMI Services

ACMI services revenue

327,666

366,064

994,561

1,067,986

Customer incentive

(5,694

)

(816

)

(10,586

)

(2,424

)

Total ACMI Services

321,972

365,248

983,975

1,065,562

Other Activities

93,000

112,841

299,680

334,218

Total Revenues

527,441

587,814

1,606,142

1,732,927

Eliminate internal revenues

(56,188

)

(64,677

)

(160,962

)

(179,356

)

Customer Revenues

$

471,253

$

523,137

$

1,445,180

$

1,553,571

Pretax Earnings (Loss) from Continuing

Operations

CAM, inclusive of interest

expense

18,279

23,306

46,935

88,526

ACMI Services, inclusive of interest

expense

(14,412

)

12,414

(24,973

)

34,057

Other Activities

(1,586

)

(7,968

)

3,694

(8,613

)

Net, unallocated interest

expense

(351

)

(908

)

(2,335

)

(1,944

)

Non-service components of retiree

benefit costs

(1,085

)

(3,218

)

(3,256

)

(9,654

)

Net (loss) gain on financial

instruments

(5,167

)

1,778

134

1,856

Loss from non-consolidated

affiliates

(869

)

(1,885

)

(2,202

)

(4,398

)

Earnings (loss) from Continuing

Operations before Income Taxes (GAAP)

$

(5,191

)

$

23,519

$

17,997

$

99,830

Adjustments to Pretax Earnings from

Continuing Operations

Add contra-revenue from customer

incentive

8,790

4,236

19,875

14,777

Add loss from non-consolidated

affiliates

869

1,885

2,202

4,398

Less net loss (gain) on financial

instruments

5,167

(1,778

)

(134

)

(1,856

)

Less non-service components of retiree

benefit costs

1,085

3,218

3,256

9,654

Add net charges for hangar foam

incident

—

58

—

71

Adjusted Pretax Earnings

(non-GAAP)

$

10,720

$

31,138

$

43,196

$

126,874

Adjusted Pretax Earnings (non-GAAP) excludes certain items

included in GAAP-based Pretax Earnings (Loss) from Continuing

Operations before Income Taxes because these items are distinctly

different in their predictability among periods, or not closely

related to our operations. Presenting this measure provides

investors with a comparative metric of fundamental operations,

while highlighting changes to certain items among periods. Adjusted

Pretax Earnings should not be considered an alternative to Earnings

from Continuing Operations Before Income Taxes or any other

performance measure derived in accordance with GAAP.

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

ADJUSTED EARNINGS FROM CONTINUING

OPERATIONS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATION

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Earnings (Loss) from Continuing

Operations Before Income Taxes

$

(5,191

)

$

23,519

$

17,997

$

99,830

Interest Income

(352

)

(190

)

(809

)

(585

)

Interest Expense

20,103

19,376

63,494

51,753

Depreciation and Amortization

98,995

86,252

281,254

253,671

EBITDA from Continuing Operations

(non-GAAP)

$

113,555

$

128,957

$

361,936

$

404,669

Add contra-revenue from customer

incentive

8,790

4,236

19,875

14,777

Add start-up loss from non-consolidated

affiliates

869

1,885

2,202

4,398

Less net loss (gain) on financial

instruments

5,167

(1,778

)

(134

)

(1,856

)

Less non-service components of retiree

benefit costs

1,085

3,218

3,256

9,654

Add net charges for hangar foam fire

suppression system discharge

—

58

—

71

Adjusted EBITDA (non-GAAP)

$

129,466

$

136,576

$

387,135

$

431,713

Management uses Adjusted EBITDA (non-GAAP, defined below) to

assess the performance of the Company's operating results among

periods. It is a metric that facilitates the comparison of

financial results of underlying operations. Additionally, these

non-GAAP adjustments are similar to the adjustments used by lenders

in the Company’s senior secured credit facility to assess financial

performance and determine the cost of borrowed funds. The

adjustments also remove the non-service cost components of retiree

benefit plans because they are not closely related to ongoing

operating activities. To improve comparability between periods, the

adjustments also exclude from EBITDA from Continuing Operations the

recognition of charges related to the discharge of a foam fire

suppression system in a Company aircraft hangar, net of related

insurance recoveries. Management presents EBITDA from Continuing

Operations (defined below), as a subtotal toward calculating

Adjusted EBITDA.

EBITDA from Continuing Operations (non-GAAP) is defined as

Earnings (Loss) from Continuing Operations Before Income Taxes plus

net interest expense, depreciation, and amortization expense.

Adjusted EBITDA is defined as EBITDA from Continuing Operations

less financial instrument revaluation gains or losses, non-service

components of retiree benefit costs, amortization of warrant-based

customer incentive costs recorded in revenue, charge off of debt

issuance costs upon refinancing, costs from non-consolidated

affiliates and charges related to the discharge of a foam fire

suppression system, net of insurance recoveries.

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

CASH FLOWS

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

NET CASH FLOWS FROM OPERATING

ACTIVITIES (GAAP)

$

135,555

$

117,517

$

399,076

$

526,093

Sustaining capital expenditures

(18,206

)

(48,706

)

(75,976

)

(158,467

)

ADJUSTED FREE CASH FLOW

(non-GAAP)

$

117,349

$

68,811

$

323,100

$

367,626

Aircraft acquisitions and freighter

conversions

(29,979

)

(119,709

)

(145,027

)

(422,873

)

Proceeds from property and equipment

9,069

71

35,183

10,516

Acquisitions and investments in

businesses

(10,045

)

(800

)

(19,845

)

(1,600

)

FREE CASH FLOW (non-GAAP)

$

86,394

$

(51,627

)

$

193,411

$

(46,331

)

Sustaining capital expenditures includes cash outflows for

planned aircraft maintenance, engine overhauls, information systems

and other non-aircraft additions to property and equipment. It does

not include expenditures for aircraft acquisitions and related

passenger-to-freighter conversion costs.

Adjusted Free Cash Flow (non-GAAP) includes cash flow from

operating activities net of expenditures for planned aircraft

maintenance, engine overhauls and other non-aircraft additions to

property and equipment. Free Cash Flow (non-GAAP) is net cash from

operating activities reduced for net cash flows from investing

activities. Management believes that adjusting GAAP operating cash

flows is useful for investors to evaluate the company's ability to

generate adjusted free cash flow for growth initiatives, debt

service, stock buybacks or other discretionary allocations of

capital.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES ADJUSTED EARNINGS AND ADJUSTED EARNINGS PER SHARE

NON-GAAP RECONCILIATION (In thousands)

Management presents Adjusted Earnings and Adjusted Earnings Per

Share, both non-GAAP financial measures, to provide additional

information regarding earnings per share without the volatility

otherwise caused by the items below among periods.

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

$

$ Per Share

$

$ Per Share

$

$ Per Share

$

$ Per Share

Earnings (loss) from Continuing

Operations - basic (GAAP)

$

(3,327

)

$

17,172

$

12,720

$

75,335

Gain from warrant revaluation, net

tax1

—

—

—

(106

)

Convertible notes interest charges, net of

tax 2

—

443

475

1,999

Earnings (loss) from Continuing

Operations - diluted (GAAP)

(3,327

)

(0.05

)

17,615

$

0.24

13,195

$

0.20

77,228

$

0.98

Adjustments, net of tax

Convertible notes interest charges, net of

tax 2

158

—

—

—

—

—

—

—

Customer incentive 3

6,659

0.10

3,290

0.05

15,086

0.22

11,501

0.15

Non-service component of retiree

benefits4

822

0.01

2,499

0.03

2,475

0.04

7,511

0.10

Derivative and warrant revaluation5

3,914

0.06

(1,380

)

(0.02

)

(120

)

—

(1,327

)

(0.02

)

Loss from affiliates6

658

0.01

1,464

0.02

1,668

0.02

3,417

0.04

Hangar foam incident7

—

—

45

—

—

—

55

—

Adjusted Earnings and Adjusted Earnings

Per Share (non-GAAP)

$

8,884

$

0.13

$

23,533

$

0.32

$

32,304

$

0.48

$

98,385

$

1.25

Shares

Shares

Shares

Shares

Weighted Average Shares -

diluted1

65,036

72,672

67,471

78,427

Additional shares - stock-based

compensation awards

1,137

—

—

—

Additional shares - convertible notes

2

1,700

—

—

—

Adjusted Shares (non-GAAP)

67,873

72,672

67,471

78,427

Adjusted Earnings and Adjusted Earnings Per Share should not be

considered as alternatives to Earnings (Loss) from Continuing

Operations, Weighted Average Shares - diluted or Earnings (Loss)

Per Share from Continuing Operations or any other performance

measure derived in accordance with GAAP. Adjusted Earnings and

Adjusted Earnings Per Share should not be considered in isolation

or as a substitute for analysis of the Company's results as

reported under GAAP.

- Under U.S. GAAP, certain warrants are reflected as a liability

and unrealized warrant gains are typically removed from diluted

earnings per share (“EPS”) calculations, while unrealized warrant

losses are not removed because they are dilutive to EPS. For each

quarter, additional shares assumes that Amazon net settled its

remaining warrants that were above the strike price. Each year

reflects an average of the quarterly shares.

- Under U.S. GAAP, certain types of convertible debt are treated

under the "if-convert method" if dilutive for EPS. Stock-based

compensation awards are treated under the "treasury stock method"

if dilutive for EPS. The non-GAAP presentation adds the dilutive

effects that were excluded under GAAP.

- Removes the amortization of the warrant-based customer

incentives which are recorded against revenue over the term of the

related aircraft leases and customer contracts.

- Removes the non-service component effects of employee

post-retirement plans.

- Removes gains and losses from financial instruments, including

derivative interest rate instruments and warrant revaluations.

- Removes losses for the Company's non-consolidated

affiliates.

- Removes charges related to the discharge of a foam fire

suppression system in a Company aircraft hangar, net of related

insurance recoveries.

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

AIRCRAFT FLEET

Aircraft Types

September 30, 2023

December 31, 2023

September 30, 2024

December 31, 2024 Projected

1

Freighter

Passenger

Freighter

Passenger

Freighter

Passenger

Freighter

Passenger

Aircraft in service

B767-200 2

22

3

22

3

17

3

17

3

B767-300

88

8

87

8

103

10

108

10

B777-200

—

3

—

3

—

3

—

3

B757 Combi

—

4

—

4

—

4

—

4

A321-200

2

—

3

—

3

—

3

—

A330

—

—

—

—

—

—

1

—

Total Aircraft in Service

112

18

112

18

123

20

129

20

Aircraft available for lease

B767-200

1

—

1

—

—

—

—

—

B767-300

—

—

3

—

2

—

1

—

A321

—

—

—

—

—

—

6

—

A330

—

—

—

—

—

—

—

—

Total Aircraft Available for

Lease

1

—

4

—

2

—

7

—

Aircraft in Cargo Modification

B767-300

13

—

9

—

3

—

2

—

A321

7

—

6

—

6

—

—

—

A330

—

—

2

—

4

—

4

—

Feedstock

B767

—

—

5

—

5

—

5

—

A321

—

—

—

—

—

—

—

—

A330

—

—

1

1

1

Total Aircraft

133

18

139

18

144

20

148

20

Aircraft in Service

September 30,

December 31,

September 30,

December 31,

2023

2023

2024

2024 Projected 1

Dry leased without CMI

44

42

49

52

Dry leased with CMI

47

48

40

40

Customer provided for CMI

15

16

24

27

ACMI/Charter3

24

24

30

30

- Projected aircraft levels for December 31, 2024 include

customer commitments for new leases, management's estimates of

existing lease renewals, aircraft expected to complete the

freighter modification process and scheduled aircraft acquisitions

during 2024.

- As Boeing 767-200 aircraft are retired

from service, management plans to use the engines and related parts

to support the remaining Boeing 767 fleet and part sales.

- ACMI/Charter includes four Boeing 767 passenger aircraft leased

from external companies through December 31, 2023 and six Boeing

767 passenger aircraft leased from external companies after

December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108105077/en/

Quint Turner, ATSG Inc. Chief Financial Officer 937-366-2303

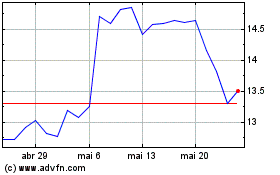

Air Transport Services (NASDAQ:ATSG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Air Transport Services (NASDAQ:ATSG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024