Coterra Energy Inc. (NYSE: CTRA) (“Coterra” or the

“Company”) today announced it has entered into two separate

definitive agreements to acquire certain assets of Franklin

Mountain Energy and Avant Natural Resources and its affiliates for

aggregate consideration of $3.95 billion, consisting of $2.95

billion of cash and $1.0 billion of Coterra common stock, issued to

one of the sellers, subject to certain purchase price adjustments.

The cash portion of the consideration is expected to be funded

through a combination of cash on hand and borrowings. The

transactions are each subject to satisfaction of customary terms

and conditions and are expected to close during the first quarter

of 2025, with effective dates as of October 1, 2024. Neither

acquisition is conditioned on the closing of the other

acquisition.

Tom Jorden, Chairman, CEO, and President of Coterra, noted, “We

are thrilled to announce the pending acquisition of two

high-quality Permian Basin asset packages. These highly accretive

acquisitions create an expanded core area in New Mexico that plays

to Coterra’s organizational strengths. In addition to adding

significant oil volumes in 2025, the acquired assets provide

inventory upside to established and emerging oil-weighted

formations.”

Mr. Jorden continued, “We have been drilling horizontal wells in

Lea County, New Mexico since 2010 and are extremely excited with

the recent results and future opportunity across the area. The

newly scaled platform provides a long runway for capital efficient

development and substantial free cash flow generation. Importantly,

we are maintaining an industry-leading balance sheet.”

Highlights

- Creating an additional oil-weighted focus area in New Mexico,

with acreage adjacent to our existing footprint

- Highly accretive: >15% accretive to estimated 2025-2027 per

share Discretionary Cash Flow and Free Cash Flow, and accretive to

Net Asset Value per share

- Disciplined 2025 framework, with expected pro forma

reinvestment rate of approximately 50%. Pro forma production

expected to be 150-to-170 mbod and 720-to-760 mboed with a total

capital budget anticipated at $2,100-to-$2,400 million

- Deep pro forma inventory, with over 15 years of runway in the

Permian Basin

- Expect to maintain top-tier balance sheet and liquidity, with

estimated year-end 2025 Net Leverage Ratio of 0.6x, which is

expected to remain below 1.0x, even in a $55/bbl and $2.50/MMBtu

commodity price environment

- Estimate corporate breakeven prices, with Free Cash Flow after

the base dividend, to be below $50/bbl WTI and $2.50/MMBtu Henry

Hub

- Remain committed to minimum 50%+ return of annual Free Cash

Flow to shareholders through base dividends and buybacks

Acquisition Details: Adding scale in New Mexico, creating

additional premier core footprint

- Acquisition valued at 3.8x estimated 4Q24 annualized EBITDAX

and approximately 13% estimated 2025 Free Cash Flow yield at

$70/bbl WTI and $3.00/MMBtu Henry Hub price assumptions

- Coring up position in the northern Delaware Basin with

approximately 49,000 net highly contiguous acres concentrated in

Lea County, New Mexico, creating a new approximately 83,000 net

acre focus area within the Coterra portfolio

- Assets to be acquired include 400-550 net Permian locations,

primarily targeting Bone Spring, Harkey, Avalon and the emerging

oily Lower Wolfcamp/Penn Shale. Assets to be acquired are expected

to generate 1.8x PVI10 on average, at $70/bbl WTI and $3.00/MMBtu

NYMEX price assumptions.

- Increases Coterra’s New Mexico net locations by approximately

75%, and Coterra’s Permian net locations by approximately 25%

- Average lateral length of 9,500 feet

- Acquiring approximately 125 miles of pipeline and other

infrastructure, which is expected to enhance netbacks and economics

across existing acreage and the new focus area

- Multiple horizons and contiguous drilling spacing units help

maximize wells per pad, reduce facilities and infrastructure

costs

- Estimate 2025 capital expenditures of $400-to-$500 million,

2025 oil production of 40-to-50 mbopd, and total equivalent

production of 60-to-70 mboed for the acquired assets

2025 Pro Forma Coterra Outlook

- Expect to reinvest approximately 50% of Discretionary Cash Flow

in 2025 assuming $70/bbl WTI and $3.00/MMBtu Henry Hub

- Estimate 2025 oil production of 150-to-170 mbod, an increase of

approximately 49% compared to estimated 2024 mid-point of oil

guidance. Standalone Coterra assets are expected to generate 5-10%

growth in 2025.

- Total equivalent production of 720-760 mboed, an increase of

approximately 11% compared to estimated 2024 mid-point of total

equivalent production guidance.

- Expect oil revenue mix of approximately 55-to-60% based on

estimated 2025 production and assuming $70/bbl WTI and $3.00/MMBtu

Henry Hub

- Estimate $2,100-to-$2,400 million of capital expenditures in

2025, approximately 75% weighted to the Permian Basin

Financing Details

Coterra will fund the acquisitions with $2.95 billion of cash

and the issuance of approximately 40.9 million shares of Coterra

common stock to certain sellers, which is valued at approximately

$1.0 billion. The Company plans to finance the cash portion of the

purchase price through a combination of cash on hand and new

borrowings.

Advisors

JPMorgan Chase Bank, N.A., PNC Capital Markets LLC, and TD

Securities (USA) LLC are providing committed financing for the

transaction. Gibson, Dunn & Crutcher LLP is serving as legal

advisor to Coterra. Veriten served as independent advisor.

Jefferies LLC is serving as financial advisor to Franklin

Mountain Energy. Kirkland & Ellis LLP served as legal advisor

to Franklin Mountain Energy.

TPH&Co, the energy business of Perella Weinberg Partners,

and Petrie Partners, LLC are acting as financial advisors to Avant

Natural Resources. Kirkland & Ellis LLP served as legal advisor

to Avant Natural Resources.

Both acquisitions are subject to customary closing conditions

and are expected to close in the first quarter of 2025 with an

effective date of October 1, 2024. A slide deck related to the

acquisitions is available under the “Events & Presentations”

page under the “Investors” section of the Company’s website at

www.coterra.com. Coterra management will host a live conference

call to discuss the acquisitions on Wednesday, November 13, 2024 at

7:30 AM Central Time. Further details are provided at the end of

this press release.

Conference Call Information Management will host a live

conference call to discuss the acquisitions. Date: Wednesday,

November 13, 2024 Time: 7:30 AM CT / 8:30 AM ET USA / International

Toll +1 (646) 307-1963 USA - Toll-Free (800) 715-9871 Canada -

Toronto (647) 932-3411 Canada - Toll-Free (800) 715-9871 Conference

ID: 8994034

To access the live webcast, visit the “Events &

Presentations” page under the “Investors” section of the Company’s

website at www.coterra.com. The replay will be archived and

available at the same location after the conclusion of the live

event.

About Coterra Energy

Coterra is a premier exploration and production company based in

Houston, Texas with focused operations in the Permian Basin,

Marcellus Shale and Anadarko Basin. We strive to be a leading

energy producer, delivering sustainable returns through the

efficient and responsible development of our diversified asset

base. Learn more about us at www.coterra.com.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains certain forward-looking statements

within the meaning of federal securities laws. Forward-looking

statements are not statements of historical fact and reflect

Coterra's current views about future events. Such forward-looking

statements include, but are not limited to, statements about the

closing of the acquisitions, the anticipated indebtedness to be

incurred in connection with the acquisitions, the performance of

the assets to be acquired, returns to shareholders, growth rates,

enhanced shareholder value, reserves estimates (both of Coterra and

for the reserves to be acquired), future financial and operating

performance and goals and commitment to sustainability and ESG

leadership, strategic pursuits and goals, and other statements that

are not historical facts contained in this press release. The words

"expect," "project," "estimate," "believe," "anticipate," "intend,"

"budget," "plan," "predict," "potential," "possible," "may,"

"should," "could," "would," "will," "strategy," "outlook," "guide"

and similar expressions are also intended to identify

forward-looking statements. We can provide no assurance that the

forward-looking statements contained in this press release will

occur as projected and actual results may differ materially from

those projected. Forward-looking statements are based on current

expectations, estimates and assumptions that involve a number of

risks and uncertainties that could cause actual results to differ

materially from those projected. These risks and uncertainties

include, without limitation: our ability to integrate the assets to

be acquired into our operations and to implement our capital plan

with respect to such assets; the volatility in commodity prices for

crude oil and natural gas; cost increases; the effect of future

regulatory or legislative actions; actions by, or disputes among or

between, the Organization of Petroleum Exporting Countries and

other producer countries; market factors; market prices (including

geographic basis differentials) of oil and natural gas; impacts of

inflation; labor shortages and economic disruption (including as a

result of geopolitical disruptions such as the war in Ukraine or

the conflict in the Middle East or further escalation thereof);

determination of reserves estimates, adjustments or revisions,

including factors impacting such determination such as commodity

prices, well performance, operating expenses and completion of

Coterra’s annual PUD reserves process (including for the assets to

be acquired), as well as the impact on our financial statements

resulting therefrom; the presence or recoverability of estimated

reserves; the ability to replace reserves; environmental risks;

drilling and operating risks; exploration and development risks;

competition; the ability of management to execute its plans to meet

its goals; and other risks inherent in Coterra's businesses. In

addition, the declaration and payment of any future dividends,

whether regular base quarterly dividends, variable dividends or

special dividends, will depend on Coterra's financial results, cash

requirements, future prospects and other factors deemed relevant by

Coterra's Board. While the list of factors presented here is

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual outcomes may

vary materially from those indicated. For additional information

about other factors that could cause actual results to differ

materially from those described in the forward-looking statements,

please refer to Coterra's annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K and other filings

with the SEC, which are available on Coterra's website at

www.coterra.com.

Forward-looking statements are based on the estimates and

opinions of management at the time the statements are made. Except

to the extent required by applicable law, Coterra does not

undertake any obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. Readers are cautioned not to place

undue reliance on these forward-looking statements that speak only

as of the date hereof.

Supplemental Non-GAAP Financial Measures (Unaudited)

We report our financial results in accordance with accounting

principles generally accepted in the United States (GAAP). However,

we believe certain non-GAAP performance measures may provide

financial statement users with additional meaningful comparisons

between current results and results of prior periods. In addition,

we believe these measures are used by analysts and others in the

valuation, rating and investment recommendations of companies

within the oil and natural gas exploration and production industry.

See the reconciliations below that compare GAAP financial measures

to non-GAAP financial measures for the periods indicated.

We have also included herein certain forward-looking non-GAAP

financial measures. Due to the forward-looking nature of these

non-GAAP financial measures, we cannot reliably predict certain of

the necessary components of the most directly comparable

forward-looking GAAP measures, such as changes in assets and

liabilities (including future impairments) and cash paid for

certain capital expenditures. Accordingly, we are unable to present

a quantitative reconciliation of such forward-looking non-GAAP

financial measures to their most directly comparable

forward-looking GAAP financial measures. Reconciling items in

future periods could be significant.

Capital expenditures is defined as cash capital expenditures for

drilling, completion and other fixed asset additions less changes

in accrued capital costs.

Discretionary Cash Flow is defined as cash flow from operating

activities excluding changes in assets and liabilities.

Discretionary Cash Flow is widely accepted as a financial indicator

of an oil and gas company’s ability to generate available cash to

internally fund exploration and development activities, return

capital to shareholders through dividends and share repurchases,

and service debt and is used by our management for that purpose.

Discretionary Cash Flow is presented based on our management’s

belief that this non-GAAP measure is useful information to

investors when comparing our cash flows with the cash flows of

other companies that use the full cost method of accounting for oil

and gas produced activities or have different financing and capital

structures or tax rates. Discretionary Cash Flow is not a measure

of financial performance under GAAP and should not be considered as

an alternative to cash flows from operating activities or net

income, as defined by GAAP, or as a measure of liquidity.

Free Cash Flow is defined as Discretionary Cash Flow less cash

paid for capital expenditures Free Cash Flow is an indicator of a

company’s ability to generate cash flow after spending the money

required to maintain or expand its asset base and is used by our

management for that purpose. Free Cash Flow is presented based on

our management’s belief that this non-GAAP measure is useful

information to investors when comparing our cash flows with the

cash flows of other companies. Free Cash Flow is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flow from operating activities or net income,

as defined by GAAP, or as a measure of liquidity.

EBITDAX is defined as net income plus interest expense, other

expense, income tax expense and benefit, depreciation, depletion,

and amortization (including impairments), exploration expense, gain

and loss on sale of assets, non-cash gain and loss on derivative

instruments, earnings and loss on equity method investments, equity

method investment distributions, stock-based compensation expense

and merger-related costs. EBITDAX is presented on our management’s

belief that this non-GAAP measure is useful information to

investors when evaluating our ability to internally fund

exploration and development activities and to service or incur debt

without regard to financial or capital structure. Our management

uses EBITDAX for that purpose. EBITDAX is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating activities or net income,

as defined by GAAP, or as a measure of liquidity.

Net Debt and Net Debt to EBITDAX (or Net Leverage)

Net Debt is calculated by subtracting cash and cash equivalents

from total debt. Net Debt is a non-GAAP measures which our

management believes are also useful to investors when assessing our

leverage since we have the ability to and may decide to use a

portion of our cash and cash equivalents to retire debt. Our

management uses this measure for that purpose.

Other Defined Terms

Present Value Index (PVI10) is often used by management as a

return-on-investment metric and defined as the estimated net

present value (using a 10% discount rate) of the future net cash

flows from such reserves (for which we utilize certain assumptions

regarding future commodity prices and operating costs), adding back

our direct net costs incurred in drilling and adding back our

completing, constructing facilities, and flowing back such wells,

and then dividing that sum by our direct net costs incurred in

drilling, completing, constructing facilities, and flowing back

such wells.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113988998/en/

Investor Contact Daniel Guffey – Vice President of

Finance, Investor Relations, and Treasurer 281.589.4875

Hannah Stuckey – Investor Relations Manager

281.589.4983

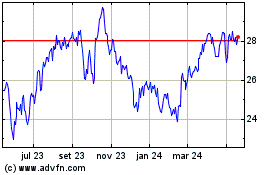

Coterra Energy (NYSE:CTRA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

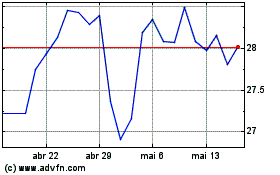

Coterra Energy (NYSE:CTRA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025