UNCLE Credit Union Selects Upstart for Personal Lending

13 Novembro 2024 - 11:00AM

Business Wire

UNCLE Credit Union (UNCLE), a Northern California-based credit

union with over 38,000 members, has announced a new partnership

with Upstart (NASDAQ: UPST), the leading artificial intelligence

(AI) lending marketplace, to provide personal loans to new and

existing members.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241113614042/en/

“At UNCLE Credit Union, we are committed to offering exceptional

financial services to meet all our members’ needs while also

promoting financial wellness throughout our surrounding

communities,” said Dree Johnson, Senior Vice President and Chief

Operating Officer at UNCLE Credit Union. “We partnered with Upstart

to expand inclusive lending and grow our membership across all four

counties we serve in Northern California through an all-digital

lending experience.”

UNCLE Credit Union started lending as a partner on the Upstart

Referral Network in July 2024. With the Upstart Referral Network,

qualified personal loan applicants on Upstart.com who meet UNCLE

Credit Union’s credit policies will receive tailored offers as they

seamlessly transition into an UNCLE-branded experience to complete

the online member application and closing process.

“We are excited to welcome UNCLE Credit Union to the family of

Upstart lending partners,” said Michael Lock, Senior Vice President

of Lending Partnerships at Upstart. “Through the Upstart Referral

Network, UNCLE Credit Union is able to lend to more new and

existing members across Alameda, Contra Costa, San Joaquin, and

Stanislaus counties.”

To learn more about Upstart for Credit Unions and the Upstart

Referral Network, please watch this video.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

About UNCLE Credit Union

Founded in 1957 to offer financial services to the entire

Lawrence Livermore National Laboratory community, UNCLE Credit

Union today offers the benefits of credit union membership to

anyone who lives, works, worships or attends school in Alameda,

Contra Costa, San Joaquin, or Stanislaus counties. With over $750

million in assets and 38,000 members, UNCLE Credit Union provides a

wide range of financial solutions including checking and savings

accounts, consumer and auto loans, mortgage products, credit cards,

business banking, and a full suite of investment and financial

planning services available under its Wealth Management Center.

UNCLE provides its members with access to 5,000+ shared branches

and nearly 30,000 ATMs via the Shared Branching Network. To learn

more, visit unclecu.org.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113614042/en/

Press Contact press@upstart.com

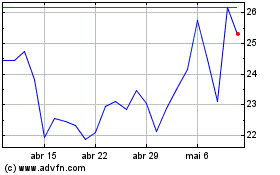

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

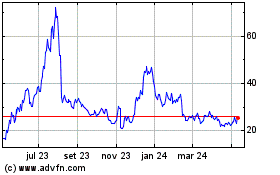

Upstart (NASDAQ:UPST)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024