CSG Transaction Expected to Close on November 27, 2024

SVP Transaction to Acquire Revelyst on Track to Close by January

2025

Vista Outdoor Inc. (“Vista Outdoor”, the “Company”) (NYSE: VSTO)

today announced that its stockholders voted to approve the sale of

The Kinetic Group to Czechoslovak Group a.s. (“CSG”) (the “CSG

Transaction”) at its special meeting of stockholders held earlier

today.

Vista Outdoor and CSG have received all regulatory approvals

required under the merger agreement for the CSG Transaction and

intend to close the CSG Transaction on November 27, 2024. Under the

terms of the CSG Transaction, Vista Outdoor stockholders will

receive $25.75 in cash and one share of Revelyst common stock for

each share of Vista Outdoor common stock they hold.

“We are thrilled to have received overwhelming support from our

stockholders for the compelling transaction with CSG,” said Michael

Callahan, Chairman of the Vista Outdoor Board of Directors. “The

CSG transaction maximizes value for our stockholders, while also

providing an ideal home for our leading ammunition brands and

significant opportunities for our employees.”

Based on the vote count from the special meeting of

stockholders, approximately 97.89% of votes cast were in favor of

the CSG Transaction, representing approximately 82.57% of all

outstanding shares. The final voting results will be reported in a

Form 8-K filed with the U.S. Securities and Exchange

Commission.

Following the closing of the CSG Transaction, Revelyst will

begin trading on the New York Stock Exchange under the ticker

“GEAR”. Subject to the receipt of necessary regulatory approvals

and satisfaction of other customary closing conditions, funds

managed by Strategic Value Partners, LLC (“SVP”) will subsequently

acquire Revelyst in an all-cash transaction based on an enterprise

value of $1.125 billion (the “SVP Transaction”), subject to a net

cash adjustment. At the closing of the SVP Transaction, Revelyst

stockholders will receive an estimated $19.25 in cash per share of

Revelyst common stock1. The SVP Transaction is on track to close by

January 2025. No separate approval of the SVP Transaction by Vista

Outdoor stockholders is required.

Morgan Stanley & Co. LLC is acting as sole financial adviser

to Vista Outdoor and Cravath, Swaine & Moore LLP is acting as

legal adviser to Vista Outdoor. Moelis & Company LLC is acting

as sole financial adviser to the independent directors of Vista

Outdoor and Gibson, Dunn & Crutcher LLP is acting as legal

adviser to the independent directors of Vista Outdoor.

About Vista Outdoor Inc.

Vista Outdoor (NYSE: VSTO) is the parent company of more than

three dozen renowned brands that design, manufacture and market

sporting and outdoor products. Brands include Bushnell, CamelBak,

Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp

Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal

Ammunition, Remington Ammunition and more. Our reporting segments,

Outdoor Products and Sporting Products, provide consumers with a

wide range of performance-driven, high-quality and innovative

outdoor and sporting products. For news and information, visit our

website at www.vistaoutdoor.com

Forward-Looking Statements

Some of the statements made and information contained in this

press release, excluding historical information, are

“forward-looking statements,” including those that discuss, among

other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or

“our”) plans, objectives, expectations, intentions, strategies,

goals, outlook or other non-historical matters; projections with

respect to future revenues, income, earnings per share or other

financial measures for Vista Outdoor; and the assumptions that

underlie these matters. The words “believe,” “expect,”

“anticipate,” “intend,” “aim,” “should” and similar expressions are

intended to identify such forward-looking statements. To the extent

that any such information is forward-looking, it is intended to fit

within the safe harbor for forward-looking information provided by

the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our

actual results to differ materially from the expectations described

in such forward-looking statements, including the following: risks

related to the previously announced transaction among Vista

Outdoor, Revelyst, Inc., CSG Elevate II Inc., CSG Elevate III Inc.

and CZECHOSLOVAK GROUP a.s. (the “CSG Transaction”) and risks

related to the previously announced transaction among Vista

Outdoor, Revelyst, Olibre LLC and Cabin Ridge, Inc. (the “SVP

Transaction”) including (i) the possibility that any or all of the

various conditions to the consummation of the CSG Transaction or

the SVP Transaction may not be satisfied or waived, including the

failure to receive any required regulatory approvals from any

applicable governmental entities (or any conditions, limitations or

restrictions placed on such approvals), (ii) the possibility that

competing offers or acquisition proposals may be made, (iii) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the merger agreement relating to

the CSG Transaction or the SVP Transaction, including in

circumstances which would require Vista Outdoor or Revelyst, as

applicable, to pay a termination fee, (iv) the effect of the

announcement or pendency of the CSG Transaction or the SVP

Transaction on our ability to attract, motivate or retain key

executives and employees, our ability to maintain relationships

with our customers, vendors, service providers and others with whom

we do business, or our operating results and business generally,

(v) risks related to the CSG Transaction or the SVP Transaction

diverting management’s attention from our ongoing business

operations, (vi) that the CSG Transaction or the SVP Transaction

may not achieve some or all of any anticipated benefits with

respect to either business segment and that the CSG Transaction or

the SVP Transaction may not be completed in accordance with our

expected plans or anticipated timelines, or at all, and (vii) that

the consideration paid to Revelyst stockholders in connection with

the SVP Transaction cannot be determined until the consummation of

the SVP Transaction as it is subject to certain adjustments related

to the net cash of Revelyst as of the closing of the SVP

Transaction and the management team’s current estimate of the

consideration may be higher or lower than the actual consideration

paid to Revelyst stockholders in connection with the SVP

Transaction due to the actual cash flows prior to the closing of

the SVP Transaction or other factors; impacts from the COVID-19

pandemic on our operations, the operations of our customers and

suppliers and general economic conditions; supplier capacity

constraints, production or shipping disruptions or quality or price

issues affecting our operating costs; the supply, availability and

costs of raw materials and components; increases in commodity,

energy, and production costs; seasonality and weather conditions;

our ability to complete acquisitions, realize expected benefits

from acquisitions and integrate acquired businesses; reductions in

or unexpected changes in or our inability to accurately forecast

demand for ammunition, accessories, or other outdoor sports and

recreation products; disruption in the service or significant

increase in the cost of our primary delivery and shipping services

for our products and components or a significant disruption at

shipping ports; risks associated with diversification into new

international and commercial markets, including regulatory

compliance; our ability to take advantage of growth opportunities

in international and commercial markets; our ability to obtain and

maintain licenses to third-party technology; our ability to attract

and retain key personnel; disruptions caused by catastrophic

events; risks associated with our sales to significant retail

customers, including unexpected cancellations, delays, and other

changes to purchase orders; our competitive environment; our

ability to adapt our products to changes in technology, the

marketplace and customer preferences, including our ability to

respond to shifting preferences of the end consumer from brick and

mortar retail to online retail; our ability to maintain and enhance

brand recognition and reputation; our association with the firearms

industry, others’ use of social media to disseminate negative

commentary about us, our products, and boycotts; the outcome of

contingencies, including with respect to litigation and other

proceedings relating to intellectual property, product liability,

warranty liability, personal injury, and environmental remediation;

our ability to comply with extensive federal, state and

international laws, rules and regulations; changes in laws, rules

and regulations relating to our business, such as federal and state

ammunition regulations; risks associated with cybersecurity and

other industrial and physical security threats; interest rate risk;

changes in the current tariff structures; changes in tax rules or

pronouncements; capital market volatility and the availability of

financing; our debt covenants may limit our ability to complete

acquisitions, incur debt, make investments, sell assets, merge or

complete other significant transactions; foreign currency exchange

rates and fluctuations in those rates; general economic and

business conditions in the United States and our markets outside

the United States, including as a result of the war in Ukraine and

the imposition of sanctions on Russia, the conflict in the Gaza

strip, the COVID-19 pandemic or another pandemic, conditions

affecting employment levels, consumer confidence and spending,

conditions in the retail environment, and other economic conditions

affecting demand for our products and the financial health of our

customers.

You are cautioned not to place undue reliance on any

forward-looking statements we make, which are based only on

information currently available to us and speak only as of the date

hereof. A more detailed description of risk factors that may affect

our operating results can be found in Part 1, Item 1A, Risk

Factors, of our Annual Report on Form 10-K for fiscal year 2024,

and in the filings we make with the SEC from time to time. We

undertake no obligation to update any forward-looking statements,

except as otherwise required by law.

1 Based on management estimates, including an assumption the SVP

Transaction closes on December 31, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125635762/en/

Investor: Tyler Lindwall Phone: 612-704-0147 Email:

investor.relations@vistaoutdoor.com

Media: Eric Smith Phone: 720-772-0877 Email:

media.relations@vistaoutdoor.com

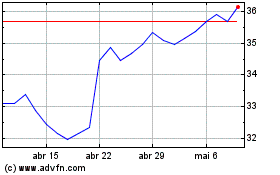

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

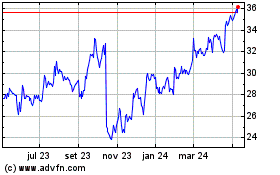

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024