Citi GPS Report Uncovers Untapped Potential of Corporate Treasury and Industry Providers in Driving Growth

03 Dezembro 2024 - 1:00PM

Business Wire

Today, Citi released a new report ‘Treasury 2030: Modernize or

Risk Irrelevance’ which uncovers the challenges and opportunities

for corporate treasury functions to offer true value-add to drive

business growth.

The report depicts how corporate treasurers have a unique

opportunity to create value helping their firms compete in an

increasingly 24/7, real-time world. Citi’s research shows that

treasury is underfunded in technology and resources, yet powerful

new technologies including Artificial Intelligence and Digital

Assets are becoming available to revolutionize processes.

Treasurers need to plan beyond incremental improvement and adopt

novel ways of thinking to drive proactive strategies.

The report also uncovered that corporate treasury cannot unlock

its full potential in isolation. As a function, it is dependent on

numerous stakeholders and counterparties, both internal and

external. To drive the radical yet fundamental changes needed,

corporate treasurers must actively participate in broader

partnership and collaboration to move the dial towards enabling

real-time treasury. The payoff is treasury with an expanded remit

equipping businesses to make better decisions to deliver growth and

returns.

“High-performing treasuries ensure efficient funding of working

capital, identify and mitigate financial risks, and deploy

liquidity to fund the company,” said Stephen Randall, Global Head

of Liquidity Management Services, Citi. “The future, however, holds

so much more for high-performing treasuries. Through astute

investments in technology, talent, and partner collaboration they

can become key contributors to company growth themselves.”

With greater collaboration also comes innovation with the report

envisaging that the technology stack available to treasuries will

evolve, enabling more agile solutions that legacy systems currently

hamper. Companies must invest in real-time solutions to stay

competitive and support digital business models. Those that develop

an "always-on" treasury ecosystem will lead and shape the future of

the industry.

“Technology-based financial services have the potential to

transform how treasurers automate, manage liquidity and risk, and

glean insights to support business growth like never before,”

Stephen Randall went on to say. “It’s time to boldly embrace the

opportunity”.

The GPS report was developed alongside global financial

performance consultancy Zanders and garners insights from clients

and industry participants.

About Citi

Citi is a preeminent banking partner for institutions with

cross-border needs, a global leader in wealth management and a

valued personal bank in its home market of the United States. Citi

does business in more than 180 countries and jurisdictions,

providing corporations, governments, investors, institutions and

individuals with a broad range of financial products and

services.

Additional information may be found at www.citigroup.com | X:

@Citi | LinkedIn: www.linkedin.com/company/citi | YouTube:

www.youtube.com/citi | Facebook: www.facebook.com/citi

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203291748/en/

Richard Bicknell richard.bicknell@citi.com

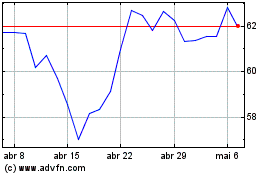

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

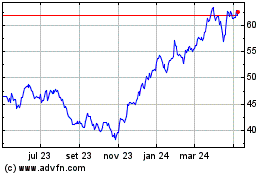

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025