Eagle Point Credit Company Inc. Prices $100 Million Public Offering of Notes

04 Dezembro 2024 - 11:15PM

Business Wire

Eagle Point Credit Company Inc. (the “Company”) (NYSE:ECC, ECCC,

ECC PRD, ECCF, ECCX, ECCW, ECCV) today announced that it has priced

an underwritten public offering of $100 million aggregate principal

amount of its 7.75% notes due 2030 (the “2030 Notes”), which will

result in net proceeds to the Company of approximately $96.5

million after payment of underwriting discounts and commissions and

estimated offering expenses payable by the Company. The 2030 Notes

will mature on June 30, 2030, and may be redeemed in whole or in

part at any time or from time to time at the Company’s option on or

after June 30, 2027. The 2030 Notes will be issued in denominations

of $25 and integral multiples of $25 in excess thereof and will

bear interest at a rate of 7.75% per year, payable quarterly, with

the first interest payment occurring on March 31, 2025. The 2030

Notes are rated ‘BBB+’ by Egan-Jones Ratings Company, an

independent, unaffiliated rating agency. In addition, the Company

has granted the underwriters a 30-day option to purchase up to an

additional $15 million aggregate principal amount of 2030 Notes to

cover overallotments, if any.

The offering is expected to close on December 10, 2024, subject

to customary closing conditions. The Company intends to list the

2030 Notes on the New York Stock Exchange under the symbol

“ECCU”.

Lucid Capital Markets, LLC is acting as the lead bookrunner for

the offering. B. Riley Securities, Inc., Piper Sandler & Co.

and Janney Montgomery Scott LLC are acting as joint bookrunners for

the offering. InspereX LLC and William Blair & Company, L.L.C.

are acting as lead managers for the offering. Clear Street LLC and

Wedbush Securities Inc. are acting as co-managers for the

offering.

Investors should consider the Company’s investment

objectives, risks, charges and expenses carefully before investing.

The preliminary prospectus supplement dated December 3, 2024 and

the accompanying prospectus dated June 9, 2023, which have been

filed with the Securities and Exchange Commission (“SEC”), contain

this and other information about the Company and should be read

carefully before investing. The information in the preliminary

prospectus supplement, the accompanying prospectus and this press

release is not complete and may be changed. The preliminary

prospectus supplement, the accompanying prospectus and this press

release are not offers to sell these securities and are not

soliciting an offer to buy these securities in any state where such

offer or sale is not permitted.

A shelf registration statement relating to these securities is

on file with and has been declared effective by the SEC. The

offering may be made only by means of a prospectus and a related

prospectus supplement, copies of which may be obtained by writing

Lucid Capital Markets, LLC at 570 Lexington Ave., 40th Floor, New

York, NY 10022, by calling toll-free at 646-362-0256 or by sending

an e-mail to: prospectus@lucid.com; copies may also be obtained for

free by visiting EDGAR on the SEC’s website at

http://www.sec.gov.

Egan-Jones Ratings Company is a nationally recognized

statistical rating organization (NRSRO). A security rating is not a

recommendation to buy, sell or hold securities, and any such rating

may be subject to revision or withdrawal at any time by the

applicable rating agency.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management

investment company. The Company’s primary investment objective is

to generate high current income, with a secondary objective to

generate capital appreciation, primarily by investing in equity and

junior debt tranches of collateralized loan obligations. The

Company is externally managed and advised by Eagle Point Credit

Management LLC.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

prospectus and the Company’s other filings with the SEC. The

Company undertakes no duty to update any forward-looking statement

made herein. All forward-looking statements speak only as of the

date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204187628/en/

Investor Relations: ICR 203-340-8510 ir@EaglePointCredit.com

www.eaglepointcreditcompany.com

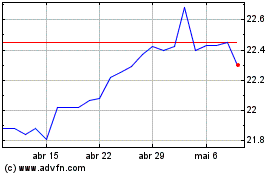

Eagle Point Credit (NYSE:ECCC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

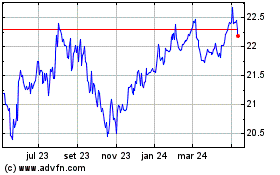

Eagle Point Credit (NYSE:ECCC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025