Zuora, Inc. (NYSE: ZUO), a leading monetization suite for modern

business, today announced financial results for its fiscal third

quarter ended October 31, 2024.

Third Quarter Fiscal 2025 Financial Results:

- Revenue: Subscription revenue was $105.3 million, an

increase of 7% year-over-year. Total revenue was $116.9 million, an

increase of 6% year-over-year.

- GAAP Loss from Operations: GAAP loss from operations was

$11.7 million, compared to a loss from operations of $8.8 million

in the third quarter of fiscal 2024.

- Non-GAAP Income from Operations: Non-GAAP income from

operations was $25.1 million, compared to non-GAAP income from

operations of $16.0 million in the third quarter of fiscal

2024.

- GAAP Net Loss: GAAP net loss was $32.2 million, or 28%

of revenue, compared to a net loss of $5.5 million, or 5% of

revenue, in the third quarter of fiscal 2024. GAAP net loss per

share was $0.21 based on 152.3 million weighted-average shares

outstanding, compared to a net loss per share of $0.04 based on

141.5 million weighted-average shares outstanding in the third

quarter of fiscal 2024. The GAAP net loss reflects increased costs

associated with our proposed acquisition, including a debt

redemption liability of $20.2 million as of October 31, 2024

associated with our obligation to repurchase a portion of our 2029

Notes pursuant to our proposed acquisition, and $9.8 million of

legal, consulting, and other transaction related costs. Refer below

for further information on the proposed acquisition.

- Non-GAAP Net Income: Non-GAAP net income was $24.8

million, compared to non-GAAP net income of $12.3 million in the

third quarter of fiscal 2024. Non-GAAP net income per share was

$0.16 based on 152.3 million weighted-average shares outstanding,

compared to non-GAAP net income per share of $0.09 based on 141.5

million weighted-average shares outstanding in the third quarter of

fiscal 2024.

- Cash Flow: Net cash provided by operating activities was

$22.4 million, compared to net cash used in operating activities of

$55.7 million in the third quarter of fiscal 2024.

- Adjusted Free Cash Flow: Adjusted free cash flow was

$25.5 million compared to $12.7 million in the third quarter of

fiscal 2024.

- Cash and Investments: Cash and cash equivalents and

short-term investments were $558.5 million as of October 31,

2024.

Descriptions of our non-GAAP financial measures are contained in

the section titled "Explanation of Non-GAAP Financial Measures"

below and reconciliations of GAAP and non-GAAP financial measures

are contained in the tables below.

Proposed Acquisition; Conference Call and Guidance

On October 17, 2024, we announced that Zuora entered into a

definitive agreement to be acquired by Silver Lake, the global

leader in technology investing, in partnership with an affiliate of

GIC Pte. Ltd. (“GIC”). The transaction is valued at $1.7 billion,

with Silver Lake and GIC to acquire all outstanding shares of Zuora

common stock for $10.00 per share in cash. The acquisition is

expected to close in the first calendar quarter of 2024, subject to

customary closing conditions and approvals, including the receipt

of the required regulatory approvals. Upon completion of the

transaction, Zuora will become a privately held company.

Given the proposed acquisition of Zuora, we will not be holding

a conference call or live webcast to discuss Zuora's third quarter

of fiscal 2025 financial results, we will not be providing any

forward looking guidance, and we are withdrawing all previously

provided goals, outlook, and guidance.

Key Operational and Financial Metrics:

- Customers with annual contract value (ACV) equal to or greater

than $250,000 were 451, compared to 453 as of October 31,

2023.

- Dollar-based retention rate (DBRR) was 103%, compared to 108%

as of October 31, 2023.

- Annual recurring revenue (ARR) was $419.9 million compared to

$396.0 million as of October 31, 2023, representing ARR growth of

6%.

Explanation of Key Operational and Financial Metrics:

Annual Contract Value (ACV). We define ACV as the subscription

revenue we would contractually expect to recognize from a customer

over the next twelve months, assuming no increases or reductions in

their subscriptions. We define the number of customers at the end

of any particular period as the number of parties or organizations

that have entered into a distinct subscription contract with us and

for which the term has not ended. Each party with whom we have

entered into a distinct subscription contract is considered a

unique customer, and in some cases, there may be more than one

customer within a single organization.

Dollar-based Retention Rate (DBRR). We calculate DBRR as of a

period end by starting with the sum of the ACV from all customers

as of twelve months prior to such period end, or prior period ACV.

We then calculate the sum of the ACV from these same customers as

of the current period end, or current period ACV. Current period

ACV includes any upsells and also reflects contraction or attrition

over the trailing twelve months but excludes revenue from new

customers added in the current period. We then divide the current

period ACV by the prior period ACV to arrive at our dollar-based

retention rate.

Annual Recurring Revenue (ARR). ARR represents the annualized

recurring value at the time of initial booking or contract

modification for all active subscription contracts at the end of a

reporting period. ARR excludes the value of non-recurring revenue

such as professional services revenue as well as contracts with new

customers with a term of less than one year. ARR should be viewed

independently of revenue and deferred revenue, and is not intended

to be a substitute for, or combined with, any of these items. ARR

growth is calculated by dividing the ARR as of a period end by the

ARR for the corresponding period end of the prior fiscal year.

Explanation of Non-GAAP Financial Measures:

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), this press

release and the accompanying tables contain non-GAAP financial

measures including: non-GAAP cost of subscription revenue; non-GAAP

subscription gross margin; non-GAAP cost of professional services

revenue; non-GAAP professional services gross margin; non-GAAP

gross profit; non-GAAP gross margin; non-GAAP income from

operations; non-GAAP operating margin; non-GAAP net income;

non-GAAP net income per share; and adjusted free cash flow. The

presentation of these financial measures is not intended to be

considered in isolation or as a substitute for, or superior to,

financial information prepared and presented in accordance with

GAAP.

We use non-GAAP financial measures in conjunction with GAAP

measures as part of our overall assessment of our performance,

including the preparation of our annual operating budget and

quarterly forecasts, to evaluate the effectiveness of our business

strategies and to communicate with our Board of Directors

concerning our financial performance. We believe these non-GAAP

measures provide investors consistency and comparability with our

past financial performance and facilitate period-to-period

comparisons of our operating results. We also believe these

non-GAAP measures are useful in evaluating our operating

performance compared to that of other companies in our industry, as

they generally eliminate the effects of certain items that may vary

for different companies for reasons unrelated to overall operating

performance.

We exclude the following items from one or more of our non-GAAP

financial measures:

- Stock-based compensation expense. We exclude stock-based

compensation expense, which is a non-cash expense, because we

believe that excluding this item provides meaningful supplemental

information regarding operational performance. In particular,

stock-based compensation expense is not comparable across companies

given it is calculated using a variety of valuation methodologies

and subjective assumptions.

- Amortization of acquired intangible assets. We exclude

amortization of acquired intangible assets, which is a non-cash

expense, because we do not believe it has a direct correlation to

the operation of our business.

- Charitable contributions. We exclude expenses associated with

charitable donations of our common stock. We believe that excluding

these non-cash expenses allows investors to make more meaningful

comparisons between our operating results and those of other

companies.

- Shareholder matters. We exclude non-recurring charges and

benefits, net of insurance recoveries, including litigation

expenses, settlements and other legal, consulting and advisory

fees, related to shareholder matters that are outside of the

ordinary course of our business, including expenses related to a

cooperation agreement. We believe these charges and benefits do not

have a direct correlation to the operations of our business and may

vary in size depending on the timing, results and resolution of

such litigation, settlements, agreements or other shareholder

matters.

- Asset impairment. We exclude non-cash charges for impairment of

assets, including impairments related to internal-use software,

office leases, and acquired intangible assets. Impairment charges

can vary significantly in terms of amount and timing and we do not

consider these charges indicative of our current or past operating

performance. Moreover, we believe that excluding the effects of

these charges allows investors to make more meaningful comparisons

between our operating results and those of other companies.

- Change in fair value of debt derivative and warrant

liabilities. We exclude fair value adjustments related to the debt

derivative and warrant liabilities, which are non-cash gains or

losses, as they can fluctuate significantly with changes in Zuora's

stock price and market volatility, and do not reflect the

underlying cash flows or operational results of the business.

- Acquisition-related expenses. We exclude acquisition-related

expenses (including integration-related charges) that are not

related to our ongoing operations. These expenses include gains or

losses recognized on contingent consideration related to

acquisitions, including costs associated with our proposed

acquisition. We do not consider these transaction expenses as

reflective of our core business or ongoing operating

performance.

- Workforce reductions. We exclude charges related to workforce

reduction plans, including severance, health care and related

expenses. We believe these charges are not indicative of our

continuing operations.

Additionally, we disclose "adjusted free cash flow", which is a

non-GAAP measure that includes adjustments to operating cash flows

for cash impacts related to Shareholder matters and

Acquisition-related expenses described above, and net purchases of

property and equipment. We include the impact of net purchases of

property and equipment in our adjusted free cash flow calculation

because we consider these capital expenditures to be a necessary

component of our ongoing operations. We believe this measure is

meaningful to investors because management reviews cash flows

generated from operations excluding such expenditures that are not

related to our ongoing operations.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. The non-GAAP measures we use may be different from

non-GAAP financial measures used by other companies, limiting their

usefulness for comparison purposes. We compensate for these

limitations by providing specific information regarding the GAAP

items excluded from these non-GAAP financial measures.

Forward-Looking Statements:

This press release contains forward-looking statements that

involve a number of risks and uncertainties. Words such as

“believes,” “may,” “will,” “determine,” “estimates,” “potential,”

“continues,” “anticipates,” “intends,” “expects,” “could,” “would,”

“projects,” “plans,” “targets,” “strategy,” “likely,” and

variations of such words and similar expressions are intended to

identify forward-looking statements. Forward-looking statements in

this release include statements regarding the proposed acquisition

of Zuora, including the expected timing of the closing of the

acquisition, and expectations for Zuora following the completion of

the acquisition. Forward-looking statements are based on

management's expectations as of the date of this filing and are

subject to a number of risks, uncertainties and assumptions, many

of which involve factors or circumstances that are beyond our

control. Our actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including but not limited to, risks detailed in our Form

10-Q filed with the Securities and Exchange Commission on August

29, 2024 as well as other documents that may be filed by us from

time to time with the Securities and Exchange Commission, including

in our Quarterly Report on Form 10-Q for the quarter ended October

31, 2024. In particular, the following factors, among others, could

cause results to differ materially from those expressed or implied

by such forward-looking statements: the possibility that the

closing conditions to the proposed acquisition are not satisfied

(or waived), including the risk that required approvals from

Zuora’s stockholders for the proposed acquisition or required

regulatory approvals to consummate the acquisition are not obtained

in a timely manner (or at all); the outcome of the current

complaint and any potential litigation relating to the proposed

acquisition; uncertainties as to the timing of the consummation of

the proposed acquisition; the ability of each party to consummate

the proposed acquisition; our ability to attract new customers and

retain and expand sales to existing customers; our ability to

manage our future revenue and profitability plans effectively;

adoption of monetization platform software and related solutions,

as well as consumer adoption of products and services that are

provided through such solutions; our ability to develop and release

new products and services, or successful enhancements, new features

and modifications; challenges related to growing our relationships

with strategic partners; loss of key employees; our ability to

compete in our markets; adverse impacts on our business and

financial condition due to macroeconomic or market conditions; the

impact of actions to improve operational efficiencies and operating

costs; our history of net losses and ability to achieve or sustain

profitability; market acceptance of our products; the success of

our product development efforts; risks associated with currency

exchange rate fluctuations; risks associated with our debt

obligations; successful deployment of our solutions by customers

after entering into a subscription agreement with us; the success

of our sales and product initiatives; our security measures; our

ability to adequately protect our intellectual property;

interruptions or performance problems; litigation and other

shareholder related costs; the anticipated benefits of acquisitions

and ability to integrate operations and technology of any acquired

company; geopolitical conflicts or destabilizing events; other

business effects, including those related to industry, market,

economic, political, regulatory and global health conditions and

other risks and uncertainties. The forward-looking statements

included in this press release represent our views as of the date

of this press release. We anticipate that subsequent events and

developments will cause our views to change. We undertake no

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. These forward-looking statements should not be relied

upon as representing our views as of any date subsequent to the

date of this press release.

Important Information and Where to Find It

In connection with the proposed acquisition, Zuora has filed

with the Securities and Exchange Commission (the “SEC”) a proxy

statement in preliminary form on November 25, 2024, a definitive

version of which will be mailed or otherwise provided to its

stockholders. The Company and affiliates of the Company have

jointly filed a transaction statement on Schedule 13E-3 (the

Schedule 13E-3). Zuora may also file other documents with the SEC

regarding the potential transaction. BEFORE MAKING ANY VOTING

DECISION, ZUORA’S STOCKHOLDERS ARE URGED TO CAREFULLY READ THE

PROXY STATEMENT AND THE SCHEDULE 13E-3 IN THEIR ENTIRETY AND ANY

OTHER DOCUMENTS FILED WITH THE SEC AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS THERETO IN CONNECTION WITH THE PROPOSED TRANSACTION OR

INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE

PARTIES TO THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors

and security holders may obtain free copies of the proxy statement,

the Schedule 13E-3 and other documents that Zuora files with the

SEC from the SEC’s website at www.sec.gov and Zuora’s website at

investor.zuora.com. In addition, the proxy statement, the Schedule

13E-3 and other documents filed by Zuora with the SEC (when

available) may be obtained from Zuora free of charge by directing a

request to Zuora’s Investor Relations at

investorrelations@zuora.com.

Participants in the Solicitation

Zuora and certain of its directors, executive officers and

employees may be deemed to be participants in the solicitation of

proxies from Zuora’s stockholders in connection with the proposed

transaction. Information regarding the persons who may, under the

rules of the SEC, be deemed to be participants in the solicitation

of the stockholders of Zuora in connection with the proposed

transaction, including a description of their respective direct or

indirect interests, by security holdings or otherwise will be set

forth in the proxy statement and Schedule 13E-3 and other materials

to be filed with the SEC. You may also find additional information

about Zuora’s directors and executive officers in Zuora’s proxy

statement for its 2024 Annual Meeting of Stockholders, which was

filed with the SEC on May 16, 2024 (the “Annual Meeting Proxy

Statement”). To the extent holdings of securities by potential

participants (or the identity of such participants) have changed

since the information printed in the Annual Meeting Proxy

Statement, such information has been or will be reflected in

Zuora’s Statements of Change in Ownership on Forms 3 and 4 filed

with the SEC. You can obtain free copies of these documents from

Zuora using the contact information above.

About Zuora, Inc.

Zuora provides a leading monetization suite to build, run and

grow a modern business through a dynamic mix of usage-based models,

subscription bundles and everything in between. From pricing and

packaging, to billing, payments and revenue accounting, Zuora’s

flexible, modular software platform is designed to help companies

evolve monetization strategies with customer demand. More than

1,000 customers around the world, including BMC Software, Box,

Caterpillar, General Motors, The New York Times, Schneider Electric

and Zoom use Zuora’s leading combination of technology and

expertise to turn recurring relationships and recurring revenue

into recurring growth. Zuora is headquartered in Silicon Valley

with offices in the Americas, EMEA and APAC. To learn more, please

visit zuora.com.

© 2024 Zuora, Inc. All Rights Reserved. Zuora, Subscribed,

Subscription Economy, Powering the Subscription Economy,

Subscription Economy Index, Zephr, and Subscription Experience

Platform are trademarks or registered trademarks of Zuora, Inc.

Third party trademarks mentioned above are owned by their

respective companies. Nothing in this press release should be

construed to the contrary, or as an approval, endorsement or

sponsorship by any third parties of Zuora, Inc. or any aspect of

this press release.

SOURCE: ZUORA, INC.

ZUORA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

(in thousands, except per

share data)

(unaudited)

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Revenue:

Subscription

$

105,253

$

98,048

$

308,263

$

283,232

Professional services

11,676

11,801

33,831

37,760

Total revenue

116,929

109,849

342,094

320,992

Cost of revenue:

Subscription1

23,954

20,378

67,207

62,304

Professional services1

14,383

14,650

43,483

47,851

Total cost of revenue

38,337

35,028

110,690

110,155

Gross profit

78,592

74,821

231,404

210,837

Operating expenses:

Research and development1

26,833

27,504

76,853

79,428

Sales and marketing1

36,597

40,245

108,579

124,488

General and administrative1

26,880

15,893

71,351

54,160

Total operating expenses

90,310

83,642

256,783

258,076

Loss from operations

(11,718

)

(8,821

)

(25,379

)

(47,239

)

Change in fair value of debt derivative

and warrant liabilities

(20,174

)

6,997

(29,115

)

2,241

Interest expense

(7,045

)

(5,610

)

(20,781

)

(14,604

)

Interest and other income (expense),

net

6,505

2,272

19,988

13,639

Loss before income taxes

(32,432

)

(5,162

)

(55,287

)

(45,963

)

Income tax (benefit) provision

(226

)

340

(2,152

)

1,396

Net loss

(32,206

)

(5,502

)

(53,135

)

(47,359

)

Comprehensive loss:

Foreign currency translation

adjustment

462

(696

)

386

(1,383

)

Unrealized gain (loss) on

available-for-sale securities

248

(18

)

63

494

Comprehensive loss

$

(31,496

)

$

(6,216

)

$

(52,686

)

$

(48,248

)

Net loss per share, basic and diluted

$

(0.21

)

$

(0.04

)

$

(0.36

)

$

(0.34

)

Weighted-average shares outstanding used

in calculating net loss per share, basic and diluted

152,263

141,488

149,457

138,789

_____________________

(1) Stock-based compensation expense was recorded in the

following cost and expense categories:

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Cost of subscription revenue

$

2,331

$

2,350

$

6,291

$

6,889

Cost of professional services revenue

2,598

2,747

7,359

8,997

Research and development

7,697

7,165

21,680

20,661

Sales and marketing

7,613

8,191

20,609

24,857

General and administrative

4,694

5,648

13,163

16,569

Total stock-based compensation expense

$

24,933

$

26,101

$

69,102

$

77,973

ZUORA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

October 31, 2024

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

277,615

$

256,065

Short-term investments

280,909

258,120

Accounts receivable, net

82,414

124,602

Deferred commissions, current portion

15,995

15,870

Prepaid expenses and other current

assets

25,183

23,261

Total current assets

682,116

677,918

Property and equipment, net

27,403

25,961

Operating lease right-of-use assets

20,591

22,462

Purchased intangibles, net

23,146

10,082

Deferred commissions, net of current

portion

24,941

27,250

Goodwill

73,903

56,657

Other assets

4,972

3,506

Total assets

$

857,072

$

823,836

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

761

$

3,161

Accrued expenses and other current

liabilities

45,167

32,157

Accrued employee liabilities

29,860

37,722

Deferred revenue, current portion

177,436

199,615

Operating lease liabilities, current

portion

7,030

6,760

Total current liabilities

260,254

279,415

Long-term debt

368,348

359,525

Deferred revenue, net of current

portion

860

2,802

Operating lease liabilities, net of

current portion

32,573

37,100

Deferred tax liabilities

4,066

3,725

Other long-term liabilities

6,781

7,582

Total liabilities

672,882

690,149

Stockholders’ equity:

Class A common stock

15

14

Class B common stock

1

1

Additional paid-in capital

1,067,329

964,141

Accumulated other comprehensive loss

(410

)

(859

)

Accumulated deficit

(882,745

)

(829,610

)

Total stockholders’ equity

184,190

133,687

Total liabilities and stockholders’

equity

$

857,072

$

823,836

ZUORA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended

October 31,

2024

2023

Cash flows from operating

activities:

Net loss

$

(53,135

)

$

(47,359

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation, amortization and

accretion

14,715

13,684

Stock-based compensation

69,102

77,973

Provision for credit losses

2,117

457

Amortization of deferred commissions

13,946

14,415

Reduction in carrying amount of

right-of-use assets

3,470

4,876

Change in fair value of debt derivative

and warrant liabilities

29,115

(2,241

)

Other

(2,418

)

2,630

Changes in operating assets and

liabilities:

Accounts receivable

40,149

12,476

Prepaid expenses and other assets

(2,657

)

878

Deferred commissions

(12,107

)

(12,013

)

Accounts payable

(2,529

)

(634

)

Accrued expenses and other liabilities

6,843

(82,904

)

Accrued employee liabilities

(7,986

)

509

Deferred revenue

(24,439

)

(7,461

)

Operating lease liabilities

(7,476

)

(10,962

)

Net cash provided by (used in) operating

activities

66,710

(35,676

)

Cash flows from investing

activities:

Purchases of property and equipment

(9,252

)

(6,913

)

Purchases of short-term investments

(240,093

)

(66,665

)

Maturities of short-term investments

222,279

175,128

Cash paid for acquisition, net of cash

acquired

(24,786

)

(4,524

)

Net cash (used in) provided by investing

activities

(51,852

)

97,026

Cash flows from financing

activities:

Proceeds from issuance of common stock

upon exercise of stock options

3,372

1,000

Proceeds from issuance of common stock

under employee stock purchase plan

4,481

4,765

Payment for taxes related to net share

settlement of stock options

(1,547

)

—

Proceeds from issuance of convertible

senior notes, net of issuance costs

—

145,861

Net cash provided by financing

activities

6,306

151,626

Effect of exchange rates on cash and cash

equivalents

386

(1,383

)

Net increase in cash and cash

equivalents

21,550

211,593

Cash and cash equivalents, beginning of

period

256,065

203,239

Cash and cash equivalents, end of

period

$

277,615

$

414,832

ZUORA, INC.

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except

percentages)

(unaudited)

Subscription Gross

Margin

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of cost of subscription

revenue:

GAAP cost of subscription revenue

$

23,954

$

20,378

$

67,207

$

62,304

Less:

Stock-based compensation

(2,331

)

(2,350

)

(6,291

)

(6,889

)

Amortization of acquired intangibles

(1,164

)

(607

)

(2,706

)

(2,083

)

Workforce reductions

(228

)

—

(796

)

(38

)

Acquisition-related expenses

(12

)

—

(103

)

—

Asset impairment

—

(439

)

—

(439

)

Shareholder matters

—

—

(20

)

—

Non-GAAP cost of subscription revenue

$

20,219

$

16,982

$

57,291

$

52,855

GAAP subscription gross margin

77

%

79

%

78

%

78

%

Non-GAAP subscription gross margin

81

%

83

%

81

%

81

%

Professional Services Gross

Margin

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of cost of professional

services revenue:

GAAP cost of professional services

revenue

$

14,383

$

14,650

$

43,483

$

47,851

Less:

Stock-based compensation

(2,598

)

(2,747

)

(7,359

)

(8,997

)

Acquisition-related expenses

(22

)

—

(22

)

—

Shareholder matters

—

—

(28

)

—

Workforce reductions

—

—

(5

)

(46

)

Non-GAAP cost of professional services

revenue

$

11,763

$

11,903

$

36,069

$

38,808

GAAP professional services gross

margin

(23

)%

(24

)%

(29

)%

(27

)%

Non-GAAP professional services gross

margin

(1

)%

(1

)%

(7

)%

(3

)%

ZUORA, INC.

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED)

(in thousands, except

percentages)

(unaudited)

Total Gross Margin

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of gross profit:

GAAP gross profit

$

78,592

$

74,821

$

231,404

$

210,837

Add:

Stock-based compensation

4,929

5,097

13,650

15,886

Amortization of acquired intangibles

1,164

607

2,706

2,083

Workforce reductions

228

—

801

84

Acquisition-related expenses

34

—

125

—

Asset impairment

—

439

—

439

Shareholder matters

—

—

48

—

Non-GAAP gross profit

$

84,947

$

80,964

$

248,734

$

229,329

GAAP gross margin

67

%

68

%

68

%

66

%

Non-GAAP gross margin

73

%

74

%

73

%

71

%

Operating (Loss) Income and Operating

Margin

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of (loss) income from

operations:

GAAP loss from operations

$

(11,718

)

$

(8,821

)

$

(25,379

)

$

(47,239

)

Add:

Stock-based compensation

24,933

26,101

69,102

77,973

Acquisition-related expenses

10,299

19

17,100

211

Amortization of acquired intangibles

1,164

607

2,706

2,083

Workforce reductions

241

—

1,518

265

Shareholder matters

181

(3,508

)

4,240

(3,265

)

Asset impairment

—

1,592

—

1,592

Non-GAAP income from operations

$

25,100

$

15,990

$

69,287

$

31,620

GAAP operating margin

(10

)%

(8

)%

(7

)%

(15

)%

Non-GAAP operating margin

21

%

15

%

20

%

10

%

ZUORA, INC.

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED)

(in thousands, except per

share data)

(unaudited)

Net (Loss) Income and Net

(Loss) Income Per Share

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of net (loss) income:

GAAP net loss

$

(32,206

)

$

(5,502

)

$

(53,135

)

$

(47,359

)

Add:

Stock-based compensation

24,933

26,101

69,102

77,973

Change in fair value of debt derivative

and warrant liabilities

20,174

(6,997

)

29,115

(2,241

)

Acquisition-related expenses

10,299

19

17,100

211

Amortization of acquired intangibles

1,164

607

2,706

2,083

Workforce reductions

241

—

1,518

265

Shareholder matters

181

(3,508

)

4,240

(3,265

)

Asset impairment

—

1,592

—

1,592

Non-GAAP net income

$

24,786

$

12,312

$

70,646

$

29,259

GAAP net loss per share, basic and

diluted1

$

(0.21

)

$

(0.04

)

$

(0.36

)

$

(0.34

)

Non-GAAP net income per share, basic and

diluted1

$

0.16

$

0.09

$

0.47

$

0.21

_________________________________

(1) For the three months ended October 31, 2024 and 2023, GAAP

and Non-GAAP net (loss) income per share are calculated based upon

152.3 million and 141.5 million basic and diluted weighted-average

shares of common stock, respectively. For the nine months ended

October 31, 2024 and 2023, GAAP and Non-GAAP net (loss) income per

share are calculated based upon 149.5 million and 138.8 million

basic and diluted weighted-average shares of common stock,

respectively.

Adjusted Free Cash Flow

Three Months Ended

October 31,

Nine Months Ended

October 31,

2024

2023

2024

2023

Reconciliation of adjusted free cash

flow:

Net cash provided by (used in) operating

activities (GAAP)

$

22,408

$

(55,657

)

$

66,710

$

(35,676

)

Add:

Acquisition-related expenses

5,587

28

7,300

135

Shareholder matters

824

71,377

4,379

72,130

Less:

Purchases of property and equipment

(3,330

)

(3,075

)

(9,252

)

(6,913

)

Adjusted free cash flow (non-GAAP)

$

25,489

$

12,673

$

69,137

$

29,676

Net cash provided by (used in) investing

activities (GAAP)

$

18,999

$

2,005

$

(51,852

)

$

97,026

Net cash (used in) provided by financing

activities (GAAP)

$

(1,295

)

$

145,899

$

6,306

$

151,626

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209614914/en/

Investor Relations Contact: Luana Wolk

investorrelations@zuora.com 650-419-1377

Media Relations Contact: Margaret Juhnke press@zuora.com

619-609-3919

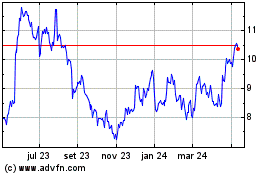

Zuora (NYSE:ZUO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

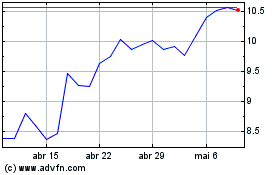

Zuora (NYSE:ZUO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025