- Ventas intends to convert forty-four select large-scale senior

housing communities in attractive markets to the Company’s SHOP

platform with proven operators and meaningfully expand its SHOP

footprint and expected growth rate; Communities represent a

majority of the units covered by the current Master Lease

- Agreements enable the Company to accelerate conversion of these

communities into its SHOP portfolio in 2025 and apply Ventas

Operational InsightsTM tools and its playbook to drive

performance

- Brookdale has extended the lease on sixty-five senior housing

communities averaging sixty-two units for a 10-year term at a 38%

cash rent increase over current rent

- Eleven communities are intended to be sold in 2025

Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) today

announced that it has reached mutually beneficial agreements with

Brookdale Senior Living (“Brookdale”) regarding all assets under

the current Master Lease (the “Master Lease”) between Ventas and

Brookdale. The agreements provide a comprehensive, clear outcome

for Ventas as it executes its strategy to drive profitable growth

in its senior housing business. The Master Lease was previously set

to expire on December 31, 2025.

“We are pleased to have reached agreements with Brookdale that

give Ventas a meaningful growth opportunity applying our proven

Ventas OITM playbook to forty-four select large-scale senior

housing communities located in favorable markets, while also

providing a 38% cash rent increase on sixty-five communities

averaging sixty-two units with a 10-year lease extension,” said J.

Justin Hutchens, Ventas Executive Vice President, Senior Housing

and Chief Investment Officer. “These mutually beneficial agreements

allow for more certainty and successful execution, benefit

residents and their families and enable Ventas to expand our

participation in the unprecedented opportunity in senior

housing.

“The forty-four SHOP conversion communities will increase our

SHOP footprint and expected growth rate by adding assets in markets

that should support strong net absorption during the next few

years. As we have in previous transitions, we expect to capture

significant occupancy and NOI upside.”

Overview of the

Agreements

1. The agreements enable Ventas to accelerate

the conversion of forty-four select large-scale senior housing

communities with significant upside potential (the “SHOP

Communities”) to its Senior Housing Operating Portfolio (“SHOP”)

starting September 1, 2025, to grow its SHOP footprint in

attractive markets and to increase its expected SHOP growth rate.

Brookdale has agreed to cooperate in the transition process. The

SHOP Communities represent a majority of the units covered by the

current Master Lease.

- The Company intends to leverage Ventas OITM and deploy its

active asset management playbook to reach, and then exceed, market

levels of occupancy and double the NOI over time. The playbook is

expected to include engaging aligned, proven, local market-focused

operators and refreshing the communities.

2. Sixty-five senior housing communities

containing sixty-two units on average (the “Leased Communities”),

which represent approximately 40% of the Master Lease units, will

remain in the Master Lease with Brookdale for an extended 10-year

term commencing January 1, 2026 with initial cash rent of $64

million, a 38% increase above current cash rent. Cash rent for the

Leased Communities will escalate 3% annually over the remaining

term. Brookdale is obligated to pay annual contractual cash rent of

$48 million on these assets in 2025. Brookdale’s obligations under

the Master Lease will continue to be guaranteed by its parent

company through the extended term.

- Ventas has agreed to invest $35 million in capital

expenditures, at an expected return of approximately 8%, in

Ventas’s master lease communities over three years commencing in

2025. These investments are intended to improve performance,

position the communities better in their respective markets and

further enhance the environments for residents and their

families.

3. The remaining eleven senior housing

communities covered by the Master Lease (the “Sale Communities”)

are intended to be sold in 2025. Ventas will retain the proceeds

from the sales. Brookdale will continue to pay full contractual

rent on substantially all of these assets through the end of

2025.

Ventas currently expects that the 2025 cash and GAAP rent/NOI

impacts of the transactions will be materially consistent with the

Company’s previous disclosure of the expected impacts of a

non-renewal of the Ventas-Brookdale Master Lease. The anticipated

cash and GAAP rent/NOI impacts in 2024 are expected to be

immaterial.

About the 44 SHOP

Communities

Key characteristics of the selected SHOP Communities, making

them appropriate for the SHOP conversion, are:

- Current third quarter 2024 annualized NOI (after taking into

account a 5% of revenue management fee) of approximately $54

million

- Favorable market locations, primarily in markets supporting

potential net absorption of approximately 1,000 basis points in the

next few years

- Average size of 129 units

- Average occupancy of ~76%, with a double upside opportunity to

reach and go beyond market level occupancy

- Predominantly combination communities, offering independent

living, assisted living and memory care

- Significant affordability

- Market overlap where Ventas has existing relationships with

experienced, high-performing operators who have successfully

transitioned operations for Ventas previously

Upon transition of each SHOP Community to a new operator, which

is expected to occur beginning September 1, 2025, no further rent

will be payable by Brookdale, and Ventas will receive the NOI from

that community going forward.

About Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate

investment trust enabling exceptional environments that benefit a

large and growing aging population. With approximately 1,350

properties in North America and the United Kingdom, Ventas occupies

an essential role in the longevity economy. The Company’s growth is

fueled by its over 800 senior housing communities, which provide

valuable services to residents and enable them to thrive in

supported environments. The Ventas portfolio also includes

outpatient medical buildings, research centers and healthcare

facilities. The Company aims to deliver outsized performance by

leveraging its unmatched operational expertise, data-driven

insights from its Ventas OI™ platform, extensive relationships and

strong financial position. Ventas’s seasoned team of talented

professionals shares a commitment to excellence, integrity and a

common purpose of helping people live longer, healthier, happier

lives.

Cautionary Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements include, among others,

statements of expectations, beliefs, future plans and strategies,

anticipated results from operations and developments and other

matters that are not historical facts. Forward-looking statements

include, among other things, statements regarding our and our

officers’ intent, belief or expectation as identified by the use of

words such as “assume,” “may,” “will,” “project,” “expect,”

“believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,”

“plan,” “potential,” “opportunity,” “estimate,” “could,” “would,”

“should” and other comparable and derivative terms or the negatives

thereof.

Forward-looking statements are based on management’s beliefs as

well as on a number of assumptions concerning future events. You

should not put undue reliance on these forward-looking statements,

which are not a guarantee of performance and are subject to a

number of uncertainties and other factors that could cause actual

events or results to differ materially from those expressed or

implied by the forward-looking statements. We do not undertake a

duty to update these forward-looking statements, which speak only

as of the date on which they are made. We urge you to carefully

review the disclosures we make concerning risks and uncertainties

that may affect our business and future financial performance,

including those made below and in our filings with the Securities

and Exchange Commission, such as in the sections titled “Cautionary

Statements — Summary Risk Factors,” “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

year ended December 31, 2023 and our subsequent Quarterly Reports

on Form 10-Q.

Certain factors that could affect our future results and our

ability to achieve our stated goals include, but are not limited

to: (a) our ability to achieve the anticipated benefits and

synergies from, and effectively integrate, our completed or

anticipated acquisitions and investments; (b) our exposure and the

exposure of our tenants, managers and borrowers to complex

healthcare and other regulations, including evolving laws and

regulations regarding data privacy, cybersecurity and environmental

matters, and the challenges and expense associated with complying

with such regulation; (c) the potential for significant general and

commercial claims, legal actions, investigations, regulatory

proceedings and enforcement actions that could subject us or our

tenants, managers or borrowers to increased operating costs,

uninsured liabilities, including fines and other penalties,

reputational harm or significant operational limitations, including

the loss or suspension of or moratoriums on accreditations,

licenses or certificates of need, suspension of or nonpayment for

new admissions, denial of reimbursement, suspension,

decertification or exclusion from federal, state or foreign

healthcare programs or the closure of facilities or communities;

(d) our reliance on third-party managers and tenants to operate or

exert substantial control over properties they manage for, or rent

from, us, which limits our control and influence over such

properties, their operations and their performance; (e) the impact

of market and general economic conditions on us, our tenants,

managers and borrowers and in areas in which our properties are

geographically concentrated, including macroeconomic trends and

financial market events, such as bank failures and other events

affecting financial institutions, market volatility, increases in

inflation, changes in or elevated interest and exchange rates,

tightening of lending standards and reduced availability of credit

or capital, geopolitical conditions, supply chain pressures, rising

labor costs and historically low unemployment, events that affect

consumer confidence, our occupancy rates and resident fee revenues,

and the actual and perceived state of the real estate markets,

labor markets and public and private capital markets; (f) our

reliance and the reliance of our tenants, managers and borrowers on

the financial, credit and capital markets and the risk that those

markets may be disrupted or become constrained; (g) our ability,

and the ability of our tenants, managers and borrowers, to navigate

the trends impacting our or their businesses and the industries in

which we or they operate, and the financial condition or business

prospect of our tenants, managers and borrowers; (h) the risk of

bankruptcy, inability to obtain benefits from governmental

programs, insolvency or financial deterioration of our tenants,

managers, borrowers and other obligors which may, among other

things, have an adverse impact on the ability of such parties to

make payments or meet their other obligations to us, which could

have an adverse impact on our results of operations and financial

condition; (i) the risk that the borrowers under our loans or other

investments default or that, to the extent we are able to foreclose

or otherwise acquire the collateral securing our loans or other

investments, we will be required to incur additional expense or

indebtedness in connection therewith, that the assets will

underperform expectations or that we may not be able to

subsequently dispose of all or part of such assets on favorable

terms; (j) our current and future amount of outstanding

indebtedness, and our ability to access capital and to incur

additional debt which is subject to our compliance with covenants

in instruments governing our and our subsidiaries’ existing

indebtedness; (k) risks related to the recognition of reserves,

allowances, credit losses or impairment charges which are

inherently uncertain and may increase or decrease in the future and

may not represent or reflect the ultimate value of, or loss that we

ultimately realize with respect to, the relevant assets, which

could have an adverse impact on our results of operations and

financial condition; (l) the risk that our leases or management

agreements are not renewed or are renewed on less favorable terms,

that our tenants or managers default under those agreements or that

we are unable to replace tenants or managers on a timely basis or

on favorable terms, if at all; (m) our ability to identify and

consummate future investments in, or dispositions of, healthcare

assets and effectively manage our portfolio opportunities and our

investments in co-investment vehicles, joint ventures and minority

interests, including our ability to dispose of such assets on

favorable terms as a result of rights of first offer or rights of

first refusal in favor of third parties; (n) risks related to

development, redevelopment and construction projects, including

costs associated with inflation, rising or elevated interest rates,

labor conditions and supply chain pressures, and risks related to

increased construction and development in markets in which our

properties are located, including adverse effect on our future

occupancy rates; (o) our ability to attract and retain talented

employees; (p) the limitations and significant requirements imposed

upon our business as a result of our status as a REIT and the

adverse consequences (including the possible loss of our status as

a REIT) that would result if we are not able to comply with such

requirements; (q) the ownership limits contained in our certificate

of incorporation with respect to our capital stock in order to

preserve our qualification as a REIT, which may delay, defer or

prevent a change of control of our company; (r) the risk of changes

in healthcare law or regulation or in tax laws, guidance and

interpretations, particularly as applied to REITs, that could

adversely affect us or our tenants, managers or borrowers; (s)

increases in our borrowing costs as a result of becoming more

leveraged, including in connection with acquisitions or other

investment activity and rising or elevated interest rates; (t) our

exposure to various operational risks, liabilities and claims from

our operating assets; (u) our dependency on a limited number of

tenants and managers for a significant portion of our revenues and

operating income; (v) our exposure to particular risks due to our

specific asset classes and operating markets, such as adverse

changes affecting our specific asset classes and the real estate

industry, the competitiveness or financial viability of hospitals

on or near the campuses where our outpatient medical buildings are

located, our relationships with universities, the level of expense

and uncertainty of our research tenants, and the limitation of our

uses of some properties we own that are subject to ground lease,

air rights or other restrictive agreements; (w) the risk of damage

to our reputation; (x) the availability, adequacy and pricing of

insurance coverage provided by our policies and policies maintained

by our tenants, managers or other counterparties; (y) the risk of

exposure to unknown liabilities from our investments in properties

or businesses; (z) the occurrence of cybersecurity threats and

incidents that could disrupt our or our tenants’, managers’ or

borrower’s operations, result in the loss of confidential or

personal information or damage our business relationships and

reputation; (aa) the failure to maintain effective internal

controls, which could harm our business, results of operations and

financial condition; (bb) the impact of merger, acquisition and

investment activity in the healthcare industry or otherwise

affecting our tenants, managers or borrowers; (cc) disruptions to

the management and operations of our business and the uncertainties

caused by activist investors; (dd) the risk of catastrophic or

extreme weather and other natural events and the physical effects

of climate change; (ee) the risk of potential dilution resulting

from future sales or issuances of our equity securities; and (ff)

the other factors set forth in our periodic filings with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218780306/en/

BJ Grant (877) 4-VENTAS

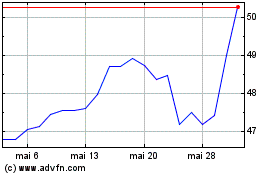

Ventas (NYSE:VTR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ventas (NYSE:VTR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024